What Exactly Does Collision Coverage Include?

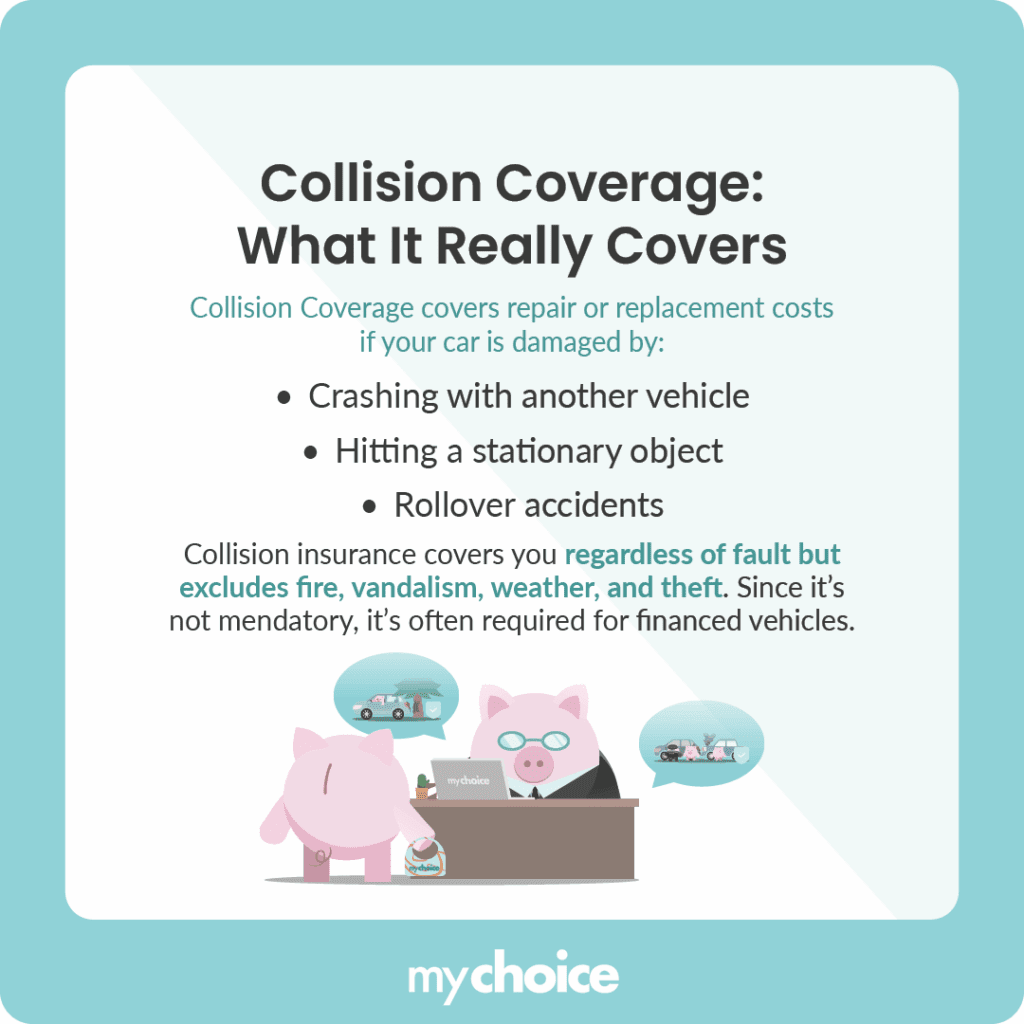

Collision insurance covers repair or replacement costs if the following causes damage your car:

- Crashes with another vehicle

- Crashes with stationary objects

- Rollover accidents

Collision insurance protects you from those damages regardless of whether you’re at fault. However, this coverage doesn’t include damages due to fire, vandalism, weather, or theft.

Note that collision coverage isn’t part of your mandatory auto insurance coverage requirements, but it’s sometimes needed for vehicle loan qualifications.

How Much Does Collision Coverage Actually Cost in Ontario?

The average cost of collision coverage in Ontario is $281/year, though it may be higher or lower depending on the insurer you work with and your risk factors.

Collision Coverage vs. DCPD in Ontario

On the surface, collision coverage and DCPD sound similar since they both provide payouts after a collision or accident. However, there are several key differences to consider. To help you compare collision insurance and DCPD in Ontario, let’s take a look at the table below:

| Coverage Type | Optional or Mandatory? | What’s Covered |

|---|---|---|

| Collision insurance | Optional | Repair costs for crashes with other vehicles or stationary objects and rollover accidents regardless of who’s at fault. |

| DCPD (Direct Compensation for Property Damage) | Optional as of January 2024 | Repair costs for crashes in which you’re not at fault. |

Instead of getting one or the other, collision coverage and DCPD can complement each other. Having both DCPD and collision coverage helps you in the event of an accident, whether you or the other driver is at fault. If you’re at fault, collision coverage can cover your repair costs. If you’re not at fault, DCPD can foot the repair bill.

How to Strengthen Your Protection in Ontario

As a driver in Ontario, you need three types of mandatory auto insurance coverage: Third Party Liability worth $200,000, Accident Benefits, and Uninsured Automobile Coverage. However, that’s just the bare minimum coverage you can get. Getting extra protection can give you more peace of mind and provide your finances with more room to breathe in the event of a car accident.

Beyond increasing the coverage amounts on your policy, you can get optional insurance coverage to round out your protection. Let’s take a look at some recommended optional coverage types:

| Coverage Type | What’s Covered | When This Coverage Helps You |

|---|---|---|

| Collision | Car repair and replacement for damages caused by your car colliding with other cars or objects | If you get into an accident involving other cars or stationary objects. |

| Comprehensive | Damages caused by non collision incidents like theft, vandalism, weather damage, animal attacks, and falling objects | Protecting your car from various non-collision hazards that may happen in everyday life. |

| OPCF 20 (loss of use coverage) | Transport reimbursements or a replacement car while your own car is being repaired or replaced. | If your car is damaged or totaled and can’t be used. |

| OPCF 27 (liability for damage to non-owned automobiles) | Comprehensive and collision car insurance coverage when driving cars you don’t own. | If you rent or borrow somebody else’s car. This coverage works in both Canada and the United States. |

| OPCF 43 (waiver of depreciation) | Removes the insurer’s right to deduct depreciation from your car’s value on total loss or theft claims. | If your car needs to be replaced, the waiver of depreciation ensures you receive a non depreciated cash value for the car. |

When Dropping Collision Coverage Makes Sense

Having collision coverage rounds out your protection, and keeping it is generally a good idea. However, you may need to remove some optional insurance protection to lighten the financial burden.

Dropping collision coverage is one of the ways you can cut back on insurance costs, but it needs to be done with consideration to ensure you don’t end up paying more than you need if you get into a car accident.

Key Advice from MyChoice

- Collision insurance coverage is optional, but it’s still a good idea if you’re accident-prone or you can’t afford car repairs or replacements.

- Collision insurance and DCPD cover similar things, but getting both coverage types can ensure you’re protected in case of accidents, regardless of who’s at fault.

- You can add comprehensive coverage, as well as OPCFs 20, 27, and 43, to enhance your mandatory auto insurance protection.