Quick Facts About Auto Insurance in Guelph

- Guelph car insurance is LESS expensive than the Ontario average.

- The average annual car insurance cost in Guelph for a driver with comprehensive/collision coverage and a clean record is around $1,642.

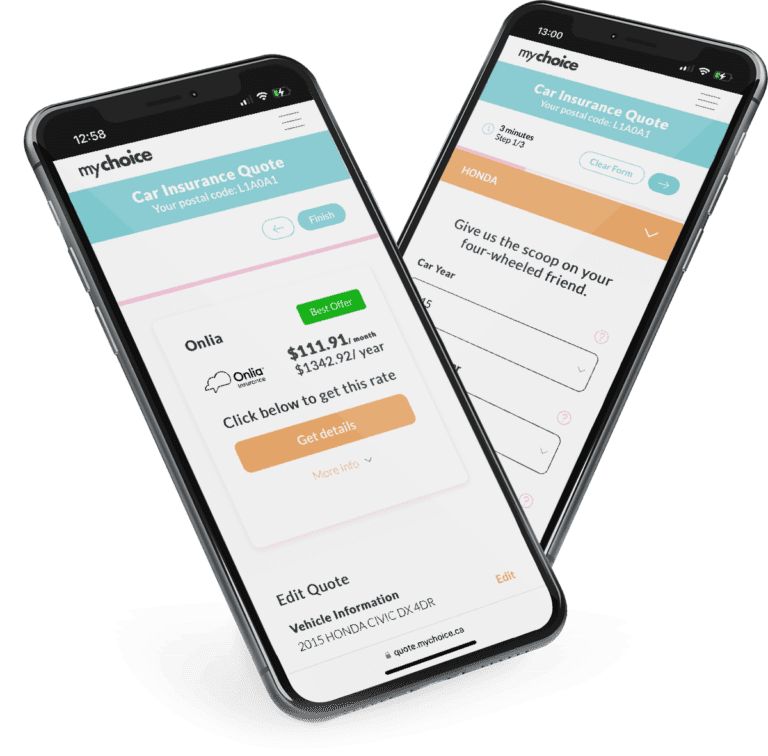

- Comparing Guelph auto insurance quotes with MyChoice can save you up to $909 annually.

The Best Car Insurance Brokerages in Guelph

Shopping for insurance alone can be frustrating, especially when you don’t know much about it. Fortunately, car insurance brokers can make the process easier. Auto insurance brokers can compare deals from several companies and answer your questions to ensure you get the best policy offer.

You can work with insurance brokers to find you the best-rated policies. Here are some great car insurance brokerage options in Guelph:

| Brokerage | Address | Phone Number |

|---|---|---|

| Jeffery & Spence Insurance Brokers | 130 Paisley St, Guelph ON N1H 2P1, Canada | +12262425217 |

| National General | 150 Research Ln #104, Guelph ON N1G 4T2, Canada | +15198243630 |

| Kemper | 86 Woodlawn Rd W, Guelph ON N1H 1B2, Canada | +15198366100 |

| Clearcover | 7-3 Watson Rd S, Guelph ON N1L 1E3, Canada | +12267800802 |

Most Expensive Postal Codes in Guelph

Guelph, Ontario has an annual average auto insurance premium of $1,642, slightly less than the Ontario average of $1,673 with N1C (South Guelph) seeing the highest average auto insurance rates in the city.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| N1C | $1,671 |

| N1E | $1,666 |

| N1G | $1,663 |

Least Expensive Postal Codes in Guelph

Three postal codes in Guelph boast below-average annual auto insurance rates, with N1L (East Guelph) being the cheapest.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| N1H | $1,637 |

| N1K | $1,637 |

| N1L | $1,632 |

Car Insurance Cost in Guelph by Age

Car insurance rates in Guelph change depending on your age. Younger people pay higher premiums due to inexperience, but rates lower as they age. Once you hit 65, your premiums will rise again due to senior citizens having an increased accident risk.

Here’s a look at car insurance costs in Guelph, categorized by age:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $5,862 | $1,166 |

| 21-24 | $3,350 | $666 |

| 25-34 | $2,233 | $444 |

| 35-44 | $1,642 | $327 |

| 45-54 | $1,346 | $268 |

| 55-64 | $1,144 | $228 |

| 65+ | $1,305 | $260 |

Car Insurance Cost in Guelph by Driving History

Your driving history determines your auto insurance premiums in Guelph because insurers use it to gauge your overall driving risk. You’ll get lower premiums with a clean driving record because insurers think you’re a safe driver. Conversely, having lots of violations on your record marks you as a high-risk driver, raising your premiums.

Driving violations in Ontario stay on your record for two years, but they’ll influence your premiums for longer. Here’s a look at how traffic violations can influence your insurance rates based on MyChoice’s price quote data:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,642 |

| Insurance cancellation due to non-payment | $2,693 |

| Licence suspension for alcohol-related offences | $1,970 |

| One accident | $3,613 |

| Speeding ticket | $2,135 |

Driving in Guelph

Guelph is a medium-sized city where many people live near their workplaces, so long commutes are relatively rare. Here are some key facts about driving in Guelph you should know:

- Major highways in Guelph: 401, Hanlon Expressway

- Public transit options: Guelph Transit (bus), GO Transit (bus and trains), Via Rail (trains)

- Ridesharing services: Uber, Lyft

- Parking space providers: The City of Guelph, private lots

- Top tourist attractions: Church of Our Lady Immaculate, Riverside Park, University of Guelph Arboretum, Donkey Sanctuary of Canada, Guelph Civic Museum

- Busy intersections: Speedvale Ave. West and Silvercreek Parkway, Stone Road West and Edinburgh Rd. South, Edinburgh Rd. South and Gordon Street, Wellington St. West and Edinburgh Rd. South

- Airports: Guelph Airport

Main Mode of Commuting in Guelph

Most Guelphites ride personal vehicles to work, making up about 87% of commuters. The two other most common ways to commute in Guelph are public transit and walking, making up 4.5% and 5.1% of commuters respectively. Here’s a detailed look at how people commute in Guelph:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 52,230 | 100.0 |

| Car, truck or van | 45,645 | 87.4% |

| Car, truck or van – as a driver | 41,495 | 79.4% |

| Car, truck or van – as a passenger | 4,150 | 7.9% |

| Public transit | 2,335 | 4.5% |

| Walked | 2,685 | 5.1% |

| Bicycle | 585 | 1.1% |

| Other method | 975 | 1.9% |

Commuting Duration in Guelph

Guelph’s commute times are relatively short. Over 20,000 Guelphites take less than 15 minutes to get to work. In fact, over 70% of them spend less than 30 minutes on their commutes. Here’s a detailed look at commuting times in Guelph:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 52,230 | 100.0 |

| Less than 15 minutes | 21,215 | 40.6% |

| 15 to 29 minutes | 16,520 | 31.6% |

| 30 to 44 minutes | 7,335 | 14.0% |

| 45 to 59 minutes | 3,455 | 6.6% |

| 60 minutes and over | 3,700 | 7.1% |

Driving Conditions in Guelph

Your insurance premiums may fluctuate depending on Guelph’s driving conditions. Here’s a quick look at the driving conditions in Guelph:

- Average daily commute time: 46 minutes round trip

- Average annual rainfall: 36.56 mm

- Average annual snowfall: 703 mm

- Rainy days per year: 49

- Rainiest month in Guelph: September

- Driest month in Guelph: February

- Snow days per year: 92

- Snowfall months in Guelph: December to March

Traffic in Guelph

Guelph has around 140,000 residents, a very small number compared to the 2.7 million people living in the City of Toronto. This means traffic in Guelph won’t be as heavy or intense as in Toronto. However, it’s still a good idea to learn the key facts about traffic in Guelph to help regulate risk and avoid overpaying for insurance.

Here’s a quick look at what driving in Guelph is like:

- Population: Guelph has 143,740 residents within its city limits.

- City area: Guelph’s urban area spans 87.22 km2.

- Average commute distance: Most Guelphites travel 11.8 km to their workplace or school.

- Time spent in traffic annually: Most Guelphites spend roughly 280 hours in traffic every year or 46 minutes every day.

- Busiest highways: Guelph is one of the stops on Highway 401, the busiest highway in North America. Traffic data shows over 400,000 vehicles pass through Highway 401 daily.

The Most Common Questions About Car Insurance in Guelph

How much is car insurance in Guelph?

On average, car insurance in Guelph costs $1,642 annually.

Which city has cheaper car insurance: Guelph or Mississauga?

Guelph has cheaper car insurance than Mississauga, Guelph drivers pay an average of $1,642/year for their auto insurance, while Mississauga drivers pay $2,315/year.

How do Guelph’s car insurance rates compare to other cities in Ontario?

Among other cities in Ontario, Guelph’s car insurance is more or less on par.

How can you get cheap car insurance in Guelph?

Compare car insurance rates in Guelph with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.