Life insurance can help you provide for your loved ones’ financial future when you’re gone. There are different types of policies, all offering various levels of coverage at different costs. How do you know what type of coverage is right for your unique needs and budget? Keep reading to learn all about life insurance, what can increase or lower premiums, and how to get the most affordable life insurance coverage in Canada for your needs.

How Life Insurance Works In Canada

Life insurance in Canada requires an insurer to pay out death benefits to your beneficiaries when you die in exchange for regular payment of policy premiums. There are three basic types of life insurance you can get:

Some of Canada’s most trusted life insurance providers include Manulife, Sun Life, and RBC Insurance however there are numerous others with a great reputation. Coverage and policy types offered differ between providers, provinces, and other factors, which we’ll dive into below.

Who Provides Life Insurance Quotes in Canada?

There are a few different ways you can get life insurance quotes from various trusted providers in Canada. Here are four different ways you can use to get a life insurance quote.

Choose from 3 Most Common Life Insurance Options in Canada

Canadians can choose from whole, term, and universal life insurance to provide financial security for their loved ones. Here’s a table comparing the similarities and differences between these life insurance options:

| Whole life insurance | Term life insurance | Universal life insurance |

|---|---|---|

| Lifetime coverage | Temporary coverage (e.g. 10 or 20 years) | Lifetime coverage |

| Fixed premiums from the start of your policy | Fixed premiums for the specified term of the policy | May have flexible premiums |

| Typically more expensive than universal life insurance | Less expensive than whole or universal life insurance | May be more cost-effective than whole life insurance |

| The insurer chooses where to invest your premiums | No investment of premiums | You can choose where to invest your premiums |

| Consistent death benefit and cash value | Death benefit only | Death benefit and potentially higher cash value |

| Coverage continues even after non-payment, as long as the policy’s cash value can pay for the premiums | Coverage lapses after one month of non-payment | Coverage continues even after non-payment, as long as the policy’s cash value can pay for the premiums |

Average Canadian Life Insurance Prices by Age & Type

The cost of life insurance premiums depends on various factors such as age, and the type of policy. Below is a detailed breakdown of average monthly premiums for Term 20, Whole Life, and Universal Life (U/L) policies, tailored to different age groups and genders:

| Age | Gender | Term 20 | Whole Life Guaranteed Life Pay | U/L T100 Minimum Premium |

|---|---|---|---|---|

| 30 | Male | $28.31 | $254.34 | $239.30 |

| Female | $20.84 | $230.94 | $209.28 | |

| 40 | Male | $42.96 | $391.95 | $370.88 |

| Female | $33.31 | $349.65 | $323.44 | |

| 50 | Male | $106.88 | $663.75 | $583.11 |

| Female | $77.22 | $559.44 | $509.28 | |

| 60 | Male | $320.82 | $1,095.75 | $994.27 |

| Female | $223.53 | $933.39 | $849.07 |

Your Life Insurance Quote at a Glance

Several factors impact what goes into life insurance quotes in Canada. Understand these key considerations so you can make an informed decision in selecting a policy and provider:

How to Save Money on Life Insurance in Canada

Early financial planning and smart lifestyle choices can help you save money on life insurance in Canada. Here are some tips to help you lower your life insurance premiums:

- Buy as early as possible: Premiums are typically lower for younger people as they’re considered less risky by insurers.

- Have a healthy lifestyle: Non-smokers who maintain a healthy weight and get regular check-ups enjoy lower rates, as these choices demonstrate a lower likelihood of developing certain diseases.

- Bundle policies: Some insurers offer discounts

- Shop and compare to find cheap life insurance: Use MyChoice to compare quotes and coverage from different insurers without leaving your home.

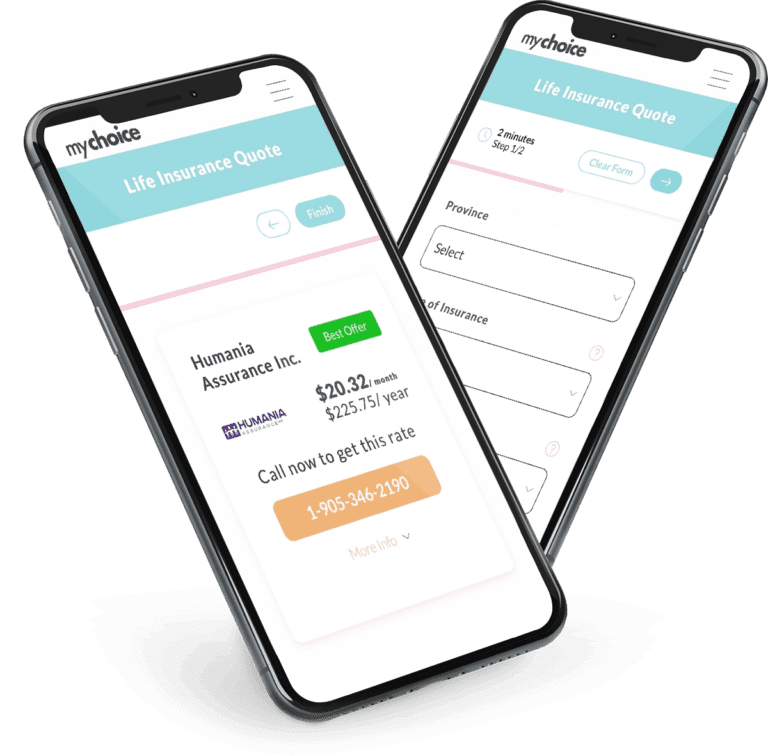

How to Shop for Life Insurance with MyChoice

Shopping for life insurance is a snap with MyChoice’s user-friendly life insurance quoter. Simply share basic details like required coverage, age, and your province to get and compare quotes from trusted insurers in Canada.

It only takes a few minutes to type your applicant information and lock in the lowest rates for your budget on our site. Tell us what you want from your policy and insurer, and we’ll find the best deals available.

Life Insurance FAQs

How much is life insurance in Canada?

The cost of life insurance in Canada depends on factors such as:

– Age

– Gender

– Family history of illnesses

– If you’re getting term or whole life insurance

Your premiums will be different from other applicants. Compare life insurance quotes in Canada from different providers through MyChoice to find the best deal for your needs.

How much life insurance do I need?

The amount of life insurance coverage you need depends on several factors, such as:

– Future income replacement for dependents when you pass away

– Your financial obligations

– Possible funeral and end-of-life expenses

– Assets and savings

Talk to your life insurance provider to determine an amount tailored to these circumstances and your needs.

Who needs life insurance?

If you fall under any of these categories, you may need life insurance to secure your loved ones’ financial future:

– Parents with dependents, especially those with minor or special-needs dependents

– Breadwinners

– Business owners or key employees

– Married couples

– High net-worth individuals

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a set number of years and pays out a benefit only if the insured dies within that period. Whole life insurance provides lifetime coverage with a death benefit and accumulated cash value over time. Because of its longer coverage and potentially larger benefit, whole life insurance is more expensive than term life insurance.

Can I get life insurance with pre-existing conditions?

Yes, you can get life insurance with pre-existing conditions. However, your policy may cost more because your insurer will consider you more likely to file a claim.

What happens after I apply for life insurance?

After you apply for life insurance, the insurer will usually contact you to complete the following steps:

Review of application and submitted documentation: The insurer will contact you to ensure all documents are complete and request any additional documents.

Medical examination: Depending on your policy, insurer, and other factors like age and history of family illness, you may be required to take a medical exam. The insurer may also request access to your medical records.

Underwriting: The insurer evaluates your application, medical records, medical exam results, and other documents to assess your risk profile.

Policy approval or modification: Based on their assessment, the insurer will approve your application or offer one with different terms. In some cases, the insurer may deem you too high-risk and deny your application.

Policy issuance and activation: The insurer sends an offer outlining the policy’s terms. If you accept, you make the first premium payment to activate the policy.

Ongoing coverage and management: By this time, the policy is in place. Make premium payments to keep it active, update beneficiary information when needed, and talk to your insurer if you need to make changes.

At what age should a person get life insurance?

The “best” age differs based on financial capability, health, and other circumstances. Typically, the best age to get life insurance is in your 20s, as you can lock in lower monthly premiums. The earlier you can factor life coverage into your budget, the easier it is to get affordable life insurance in Canada before serious health issues arise.

How do I make a life insurance claim?

The process between insurers may differ, but generally, you will take the following steps to make a life insurance claim:

1. Notify the insurer about the policyholder’s death as soon as possible.

2. Get the necessary documents for filing a claim – usually, you need a certified copy of the death certificate and the insurance policy.

3. Complete the claim form with any required information about beneficiaries.

4. Compile the claim form and documents to submit the claim to the insurer.

5. Wait for the claim to be approved, then receive the payment.