When you approach old age, you’ll likely start thinking about getting your affairs in order before you pass away. One of the most important things to consider is ensuring your family and other dependents have financial security, even after you’re not around anymore.

Even at an advanced age, life insurance is well worth it, it ensures your family can cover any debts or expenses you left behind, like your funeral costs or your mortgage.

Is life insurance harder to get as a senior citizen? Yes, but it’s not impossible. While your options are more limited, senior life insurance exists and can help you obtain peace of mind in your golden years.

Keep reading to learn more about how life insurance for people over 50 works, why you should get it, and what affects your rates.

What is Senior Life Insurance for Over 50+?

Senior life insurance is a product specifically designed for older people, generally those over 50. People over 50 aren’t necessarily “seniors”, however, most insurers group them in the “senior” category since there’s a jump in premium costs once you hit 50 years of age due to the higher risk.

Senior life insurance is often more expensive than those for younger people since senior citizens are at higher risk of sickness and death.

Here are several examples of how senior life insurance benefits you:

- Covers your final medical bills, funeral expenses, and any other additional costs arising from settling your estate.

- Replaces the income you would’ve provided in life, ensuring your family’s financial security.

- Pays off any debts you may have left unpaid before passing away.

- Provides your family with inheritance.

- Allows you to make a final donation to a charity or cause you’ve supported all your life.

Read more about why you should consider getting senior life insurance in our article covering why life insurance is important.

What Life Insurance Options Are Available to Senior Canadians & What is the Best?

The types of life insurance available to seniors in Canada are generally similar to the ones available to younger people.

Below we provide an overview of the life insurance types you can choose as a Canadian senior citizen. In terms of the “best” life insurance option, that will depend from person to person since everybody has different needs and circumstances.

- Term life insurance for seniors operates in the same way it would for a younger person, you get a policy for a certain term period, and if you pass away during that period, your family will receive death benefits. Term options are typically cheaper than permanent life insurance, but premiums will still be higher if you’re older.

- The affordability and simplicity of term life insurance are best for people looking to save money and aren’t too concerned with leaving an inheritance through insurance. Generally, these people seek insurance to repay outstanding debts like mortgages when they pass away.

- Term life insurance is flexible, so you can choose when your policy expires. This way, you can stop paying for insurance when you no longer need it, which means saving more money.

- Permanent policies like whole life insurance or universal life insurance can be more expensive to get as an older person, but they provide lifelong protection. Additionally, some of these policies have a cash value that grows with time, meaning you can potentially use permanent life insurance as an investment vehicle.

- Since permanent life insurance offers lifelong protection, you can choose this policy to guarantee your family will receive an inheritance.

- Permanent life insurance is also useful if you have lifelong dependents like disabled children because the financial coverage can provide for their needs even when you’re gone.

- Guaranteed life insurance has higher rates but lower payouts. However, its main advantage is that you don’t need to get a medical exam as long as you’re within a policy’s age limit. This is often the best choice for people with medical conditions that would disqualify them from other insurance types.

- Since a guaranteed policy has no medical exam, this policy is popular among people with pre-existing conditions that would make other types of life insurance unavailable or prohibitively expensive.

- That said, guaranteed life insurance is best used as a “Plan B” since the costs are usually very high and the payouts are smaller. If you’re still in relatively good health and can get good rates with other types of life insurance, you should choose those over guaranteed life insurance.

Is Life Insurance Over 50 Worth It? Evaluating the Benefits and Costs for Seniors

As you become 50 years old or above, the question of whether life insurance is a worthwhile investment becomes increasingly relevant and for many, the answer hinges on a balance of cost versus benefit.

Premiums for life insurance will rise with age, reflecting the increased risk insurers take on. However, the value of peace of mind and financial security for your loved ones can be something worth paying for. Life insurance at this stage can cover critical expenses such as outstanding debts and funeral costs, ensuring your family isn’t burdened financially upon your passing.

Additionally, it can serve as a tool for estate planning, potentially providing a significant inheritance to your family or other beneficiaries. The key is to carefully assess your personal financial situation, health status, and family needs. For those with dependents or significant debts, the benefits of a policy might outweigh the costs.

Conversely, senior individuals with substantial savings and fewer financial obligations might find the investment less necessary and choose not to purchase life insurance coverage.

How Much Does Senior Life Insurance Cost?

Insurers calculate your life insurance cost based on your sex, lifestyle, health history, and more. In terms of determining how much senior life insurance costs, it will depend on each individual but generally speaking the older you get the more on average you will be looking to pay. the more likely you are to get sick or pass away, the higher your life insurance premiums cost.

In addition to your circumstances, life insurance premiums can differ depending on what kind of policy you choose. Term life insurance is usually the cheapest, while whole life insurance is more expensive and different companies also charge different rates.

Below is a list of average cost for seniors by age calculated in February 2024, the rates were a senior who was looking to get term 15-year life insurance with $250k coverage, they were also an Ontario resident and a non smoker.

| Age | Male | Savings w/ MyChioce | Female | Savings w/ MyChioce |

|---|---|---|---|---|

| 50-year-old | $53.67 | $3.71 | $39.61 | $2.24 |

| 55-year-old | $84.14 | $9.19 | $61.80 | $5.42 |

| 60-year-old | $141.21 | $12.23 | $101.97 | $10.76 |

| 65-year-old | $226.36 | $15.31 | $162.28 | $20.20 |

| 70-year-old | $368.77 | $36.91 | $271.39 | $19.54 |

What Factors Affect the Price of Senior Life Insurance in Canada?

Most factors that affect the price of senior life insurance in Canada are related to your personal well-being. The less likely you are to get sick or pass away, the lower your insurance price. Here are several examples of factors that may affect your life insurance rates:

Age

Age is one of the primary determinants of your life insurance rates. The older you are, the more likely you are to develop health problems or pass away. Therefore, insurance rates will rise as you age.

Gender

Women generally live longer than men, so insurers may charge men more for life insurance.

Coverage Amount

Raising your death benefit means your beneficiaries get more money if you pass away, but it’ll also raise your rates.

Individual Health

Pre-existing medical conditions like diabetes, heart disease, and cancer mean you’re riskier to insure, leading to higher insurance premiums.

Family Health History

A history of hereditary diseases like diabetes in your family raises your risk of developing the same conditions, so your premiums may be higher.

Smoking

Smoking raises your risk of developing serious health conditions, so smokers are often charged much more on premiums. Some insurers may even deny you coverage altogether.

Pros & Cons When Getting Life Insurance as a 50+ Senior

Life insurance for seniors has many benefits. Here are several examples of how you and your loved ones can get peace of mind and financial stability from senior life insurance:

Pros of Term Life Insurance

Financial Security for Beneficiaries

Provides your loved ones with financial security.

Coverage for Final Expenses

Covers your final expenses, like medical bills and funeral costs.

Settlement of Outstanding Debts

Pays off any outstanding debt you may have left behind.

Estate Planning and Asset Distribution

Helps with estate planning to distribute your assets according to your wishes.

Cons of Term Life Insurance

However, life insurance for seniors also has some drawbacks you should be aware of. Here are some things to watch out for:

Elevated Costs for Health-Compromised Policyholders

High premiums, especially for policyholders with health issues and your coverage amount may not be enough to pay all end-of-life expenses and leave an inheritance.

Challenges in Qualifying Due to Stricter Underwriting for Seniors

Difficulty qualifying since seniors are often subject to stricter underwriting guidelines.

FAQs

Are convertible or renewable life insurance options available for seniors?

Convertible or renewable life insurance options are available for seniors, but they’re usually more limited. Convertible policies for seniors have a hard age limit for conversions, usually at 71 or 75 years old.

What is the best life insurance company for a senior in Canada?

Different life insurance companies offer different benefits, so there’s no “best” life insurance company for a senior in Canada. Compare quotes from multiple insurance companies to find the one that best fits your needs.

Check out our comparison of term vs whole life insurance to find the type of protection that works best for you.

How do you buy life insurance for seniors?

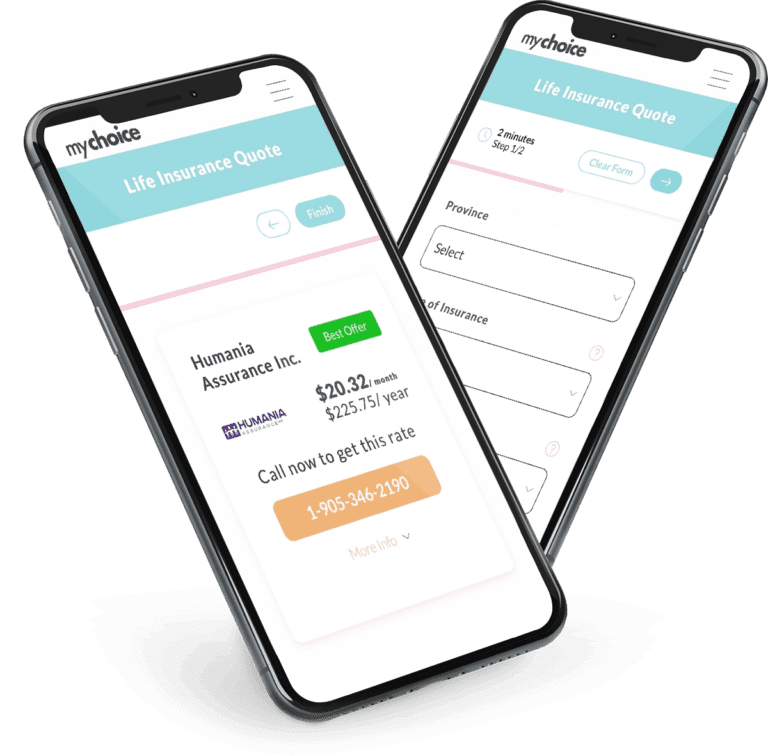

Buying life insurance for seniors works much like buying any other life insurance policy. You can get a quote for senior life insurance here at MyChoice to start the process.

Can seniors get life insurance without a medical exam?

Seniors can get life insurance without a medical exam with a guaranteed life insurance policy. You’ll only have to answer a few medical questions, and you’re guaranteed life insurance coverage.

Is No-Medical insurance a good option for seniors in Canada?

No-medical or guaranteed life insurance is a good option for seniors in Canada only if you can’t qualify for other types of coverage since no-medical insurance is more expensive and provides smaller death benefits.

Is term or whole life insurance better for seniors?

There’s no “better” option between the two because every senior has different needs. Choose whichever type of insurance fits your requirements best.

Is there a maximum age at which you can get life insurance?

There’s no “maximum” age at which you can get life insurance in Canada, but the older you get, the harder and costlier it is to get life insurance.

How much is life insurance for seniors over 60 in Canada?

Life insurance for seniors over 60 in Canada will heavily depend on the senior’s risk factors. If they’re low-risk, they may get more affordable rates. Conversely, high-risk seniors may land higher rates.

As of February 2024, we have checked the rates for a 60 year old senior who is looking for term 15-year insurance with $250k coverage, a non-smoker and an Ontario resident, males averaged at $141.21 per month and females $101.97 per month.

How much is life insurance for seniors over 70 in Canada?

Like life insurance for seniors over 60, it heavily depends on their risk factors.

As of February 2024, we have checked the rates for a 70 year old senior who is looking for term 15-year insurance with $250k coverage, a non-smoker and an Ontario resident, males averaged at $368.77 per month and females $271.39 per month.