Generally, you must undergo a medical examination when purchasing life insurance. However, in some cases, you might not want to get a medical exam due to pre-existing conditions or other reasons.

How can you get life insurance coverage without a medical exam? That’s where no medical life insurance comes in. You don’t need a medical examination to qualify for coverage when you apply for no medical life insurance.

Is no medical life insurance right for you? Keep reading to learn more about it to make the best decision for your life insurance coverage.

What is No Medical Life Insurance?

No medical life insurance is a life insurance policy you can get without undergoing medical examinations. In most types of no medical life insurance, your insurer will provide coverage without looking at your pre-existing conditions, health history, and other factors that may otherwise hinder you from getting insurance.

No medical life insurance is especially useful for people who recognize the importance of life insurance but can’t qualify for policies that require a medical examination. The cost of no medical life insurance is often higher than standard policies, but some people can benefit greatly from no medical life insurance policies.

If you’re thinking about getting life insurance, be sure to check our guide on whether life insurance is worth it. You can also read our article on the reasons not to get life insurance to help you make a well-informed decision.

What Types of No Medical Life Insurance Policies Are Available in Canada?

Canada has three types of no medical life insurance available. Here, we’ll take a closer look at each type to learn how it works:

Accelerated Issue Life Insurance

Generally, the average life insurance policy takes six weeks to get approved. In some cases, you don’t want to wait to get insured and don’t want to pay extra to get the policy approved faster. Accelerated issue life insurance promises instant policy approvals while priced similarly to standard life insurance policies.

However, an important condition to remember when getting accelerated life insurance is that you need to be in perfect health. If you’re in perfect health, you only need to answer some health-related questions to qualify for instant life insurance protection.

| Pros | Cons |

|---|---|

| Fast and easy application process. | Requires you to be in perfect health. |

| Generally affordable premiums, not too different from standard insurance policies. | The insurer can deny your coverage if you don’t fulfill health requirements. |

| Higher death benefit amounts. |

Guaranteed Issue Life Insurance

As the name implies, guaranteed issue life insurance provides life insurance coverage regardless of your pre-existing conditions or illnesses. Depending on the insurance company, you may still need to answer some health questions, but you don’t need to take a medical examination.

While getting 100% guaranteed life insurance coverage is a big benefit, this insurance type has some caveats. Guaranteed issue policies are generally much more expensive than other types of life insurance, and the coverage amount is usually limited.

Most guaranteed issue policies also have a two-year waiting period, meaning you need to hold onto the policy for at least two years before it can pay out death benefits. If you pass away before two years are up, the insurer will refund your paid premiums to your beneficiaries.

| Pros | Cons |

|---|---|

| Fast and easy application process. | Lower death benefit. |

| No medical exams. | Two-year waiting period. |

| Approval is guaranteed if you’re within the policy’s age limit. | High premiums. |

Simplified Life Insurance

Simplified life insurance provides lifelong coverage but doesn’t require you to take a medical exam like a permanent life insurance policy. However, you still need to answer medical questions to qualify for a simplified life insurance policy, and you’re not guaranteed qualification.

While simplified life insurance can benefit those who can’t or don’t want to undergo a medical exam, it generally has higher premiums and lower coverage amounts than standard term or permanent policies. Some simplified policies also have a two-year waiting period before death benefits can be paid out, like guaranteed issue life insurance.

| Pros | Cons |

|---|---|

| No medical testing needed, just a health questionnaire. | Has a waiting period. |

| Fast application process. | Coverage qualification isn’t guaranteed. |

| Higher premiums than standard insurance policies. |

What Are Some Pros & Cons of No Medical Life Plans?

Here are some key benefits of no medical life insurance plans:

- Faster approval: Many no medical life insurance policies get approved within 48 hours after application. In contrast, standard insurance policies can take up to 6 weeks to approve.

- No health exams: While you may still need to answer a health questionnaire, getting no medical life insurance means skipping any health examinations.

- Great for people with pre-existing conditions: With no medical life insurance, you can still get insurance coverage with pre-existing conditions or illnesses even when you don’t qualify for other types of insurance.

- Great for people with dangerous occupations: If you have a dangerous or high-risk job, you may have an easier time qualifying for coverage with no medical life insurance.

There are some disadvantages of no medical life insurance plans to be mindful of:

- Higher premiums: No medical insurance policyholders are considered riskier because they don’t offer all the medical information the insurers need. So, your premiums are generally higher.

- Less coverage: No medical life insurance often has lower coverage limits, which means your death benefit amount will be lower.

- Waiting period: Some no medical life insurance policies have two-year waiting periods. If you pass away before you’ve had the policy for two years, your death benefit won’t be paid out.

Who Would Be Suitable for Life Insurance With No Medical Exam or Health Questions?

Generally, life insurance with no medical exam or health questions is best suited for people who can’t qualify for standard life insurance. Here are some people who can benefit the most from no medical life insurance:

- People with serious medical conditions like diabetes, heart disease, or cancer.

- People with dangerous occupations like sea fishing and roofing.

- People with a record of impaired driving.

- People unwilling to go through a medical exam.

- People who want to get insurance coverage as soon as possible.

- People who don’t qualify for standard life insurance.

Are you a diabetic looking for life insurance? Check out our article on life insurance for diabetics.

What Insurance Companies Offer No Medical Life Insurance in Canada?

Many insurance companies offer no medical life insurance in Canada. Here’s a list of Canada’s top insurance providers that offer no medical life insurance:

- Assumption Life

- BMO Life

- CAA

- Canada Protection Plan

- Desjardins

- Edge Benefits

- Family Compass

- Foresters

- Gerber Life

- La Capitale

- Manulife

- Specialty Life

- Sun Life

- Wawanesa Life

Commonly Asked Questions About No Medical Life Insurance

How much does no medical life insurance cost?

No medical life insurance costs can vary depending on your risk profile. However, no medical policies generally have higher costs than standard life insurance because the insurer takes on more risk covering people without comprehensive health information.

Different coverage periods also have varying costs. You can check our guide on term insurance vs whole life insurance to learn the differences between these two types of life insurance.

Can I get additional coverage with no medical life insurance?

You can get additional coverage with no medical life insurance. Some common extra protection options include:

– Critical illness coverage

– Accidental death benefits

– Age limits for premium payments

Can you be denied no medical life insurance?

You can still be denied no medical life insurance if you don’t meet the insurer’s requirements. For instance, accelerated issue life insurance still requires you to be in good health to qualify.

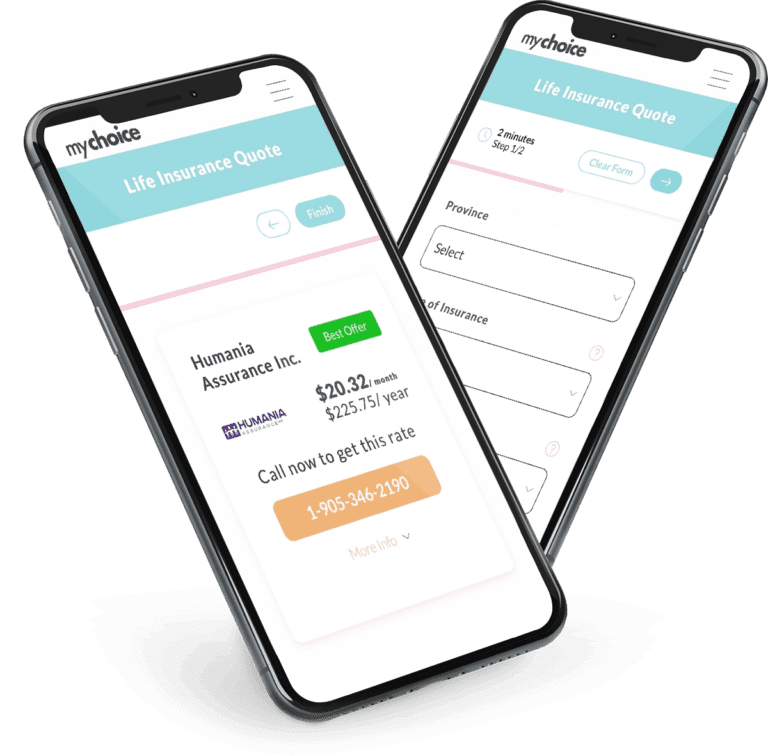

Can you buy no medical life insurance online?

You can buy no medical insurance online from some providers. Ask your insurance company or broker about online applications for more information.

What is the typical amount of coverage for life insurance with no medical exam or questions?

The typical amount of coverage for life insurance with no medical exam or questions can vary. Death benefits can range from $5,000 all the way up to $1,000,000. However, the maximum amount of coverage you can qualify for will depend on your health and other factors determined by the insurer.

How to buy life insurance without a medical exam or health questions?

You can buy life insurance without a medical exam or health questions through a variety of sources:

– Direct underwriters working for specific insurance companies.

– Insurance agents working for a certain company.

– Insurance brokers selling insurance products from multiple companies.

– Online applications through insurance companies.