Most people think life insurance is a good idea, especially if you have people who rely on you for income. Leaving them without insurance coverage when you pass away might lead to them making large sacrifices to retain their standard of living.

There are many reasons why buying life insurance is a good idea. But are there any reasons not to buy life insurance?

As it turns out, there are some instances where buying life insurance isn’t the best idea. Read on to learn more about the reasons not to buy life insurance and check out the best alternatives for a life policy.

Is Life Insurance a Good Idea?

Life insurance is generally a good idea. A life insurance policy keeps your loved ones financially healthy when you pass away. Life insurance is very important if you’re the breadwinner or major income contributor since your death might make a big hole in your family’s finances.

Life insurance is also great if you have major debts to cover, like auto loans and mortgages. Your death benefit payout can help repay that debt without forcing your family to sell your things or work extra hard.

Some people also get life insurance because they want a less-risky investment vehicle. You can invest in life insurance through universal or whole life insurance policies.

Is whole life insurance a good investment? Read our article about whole life insurance investments to learn more.

Who Really Needs Life Insurance?

Most people who really need life insurance are those who have dependents or major debts to settle. Here are several of the most common groups of people who need life insurance:

Couples and Spouses

Many couples depend on one another to maintain their lifestyle. Whether they’re working partners or one of them is a stay-at-home spouse, losing half of the couple is a major financial and mental blow. The surviving partner usually needs income replacement as they take time off to recover from the passing.

Life insurance comes in handy because when one partner passes, the surviving partner can take time off to recover, both financially and mentally.

Parents and Children

Life insurance is even more important if a couple has children. Losing one parent might jeopardize the child’s standard of living, meaning they may not get the education and care they deserve. Life insurance ensures the remaining parent can continue the same standard of care as before while they find new income streams or slowly readjust to their new life.

You can also give life insurance policies to your children. Whole life insurance policies for children tend to cost less because children are young and likely haven’t developed any serious medical conditions.

Business Owners or Partners

Business partners are almost like spouses in that if one of them passes, the other partner might struggle to keep things afloat. A life insurance payout can help cover the deceased business partner’s contributions while the remaining ones search for a replacement or find a way to continue operations otherwise.

Mortgage Borrowers

A home mortgage is likely the biggest loan of your life. Dying with an unpaid mortgage usually means your loved ones have to foot the bill. Fortunately, your life insurance coverage can ensure your outstanding mortgage payments are repaid.

Top Reasons Not to Buy Life Insurance

We’ve seen what types of people can best benefit from life insurance. But let’s look at the other side now.

What are the reasons people don’t buy life insurance? Here are the most common reasons:

Lack of Family or Dependents

Life insurance is made to protect your loved ones who may be financially hurt by your passing. If you don’t have any family members or beneficiaries to receive the payout, you may not need life insurance at all. This also applies if you have a financially-stable spouse or grown children who won’t experience financial distress when you pass away.

Budget Concerns

Sometimes, the biggest barrier to buying life insurance is money. You may not make enough money to spare for life insurance. Instead, you prioritize spending money on essential needs like food, utilities, and housing.

Alternative Financial Plans

You might not need life insurance if you have other ways to leave money to your loved ones. There are many alternatives to life insurance, like savings accounts and investments. You can also get other types of insurance policies to cover you from many kinds of incidents.

Lack of Information and Knowledge

People know they may need life insurance but don’t know enough to make decisions about it. Common questions that often go unanswered include:

- How much insurance coverage do I need?

- Do I need extra death benefits if I have children?

- Which one is better, term life insurance or whole life insurance?

- What’s the difference between universal life insurance and whole life insurance?

- Can you invest in life insurance?

Fortunately, the answers are readily available through insurance brokers, online, or through one of our own guides on the matter.

No Trusted Advisors

Life insurance is a complicated and often very personal topic. You can’t just discuss it with anyone – it has to be an experienced advisor you can trust. Not everyone has easy access to a person like that, which makes people hesitant about getting life insurance.

No Time and Procrastination

Sometimes, people don’t get life insurance because they’re just too busy to do it. Talking with brokers, comparing policies, and applying for a policy takes time that people may not have.

Even if they do have time, procrastination might strike. For many people, insurance is something they can put off until later. But sometimes, when “later” comes, they put it off again. The cycle continues for years or until they forget about buying life insurance.

Pros and Cons of Skipping Life Insurance

Like any decision, skipping life insurance has its advantages and disadvantages. Let’s take a look at the pros and cons of not buying life insurance:

Pros of Skipping Life Insurance

- Save money: Life insurance premiums can be costly. Skipping out on life insurance means you have one less expense to pay, helping you save money.

- Lets you make other investments: Not buying life insurance means you have more money to spend on other things. You can then use the money you save to invest and potentially gain higher returns.

Cons of Skipping Life Insurance

- Lose out on protection: Skipping life insurance means you don’t get any insurance coverage. If you die, your loved ones may not receive any money.

- Leave debt to your loved ones: Skipping life insurance is more dangerous if you have a large outstanding debt, like a mortgage. Without insurance, you’re leaving your loved ones to repay the debt.

Alternatives to Life Insurance

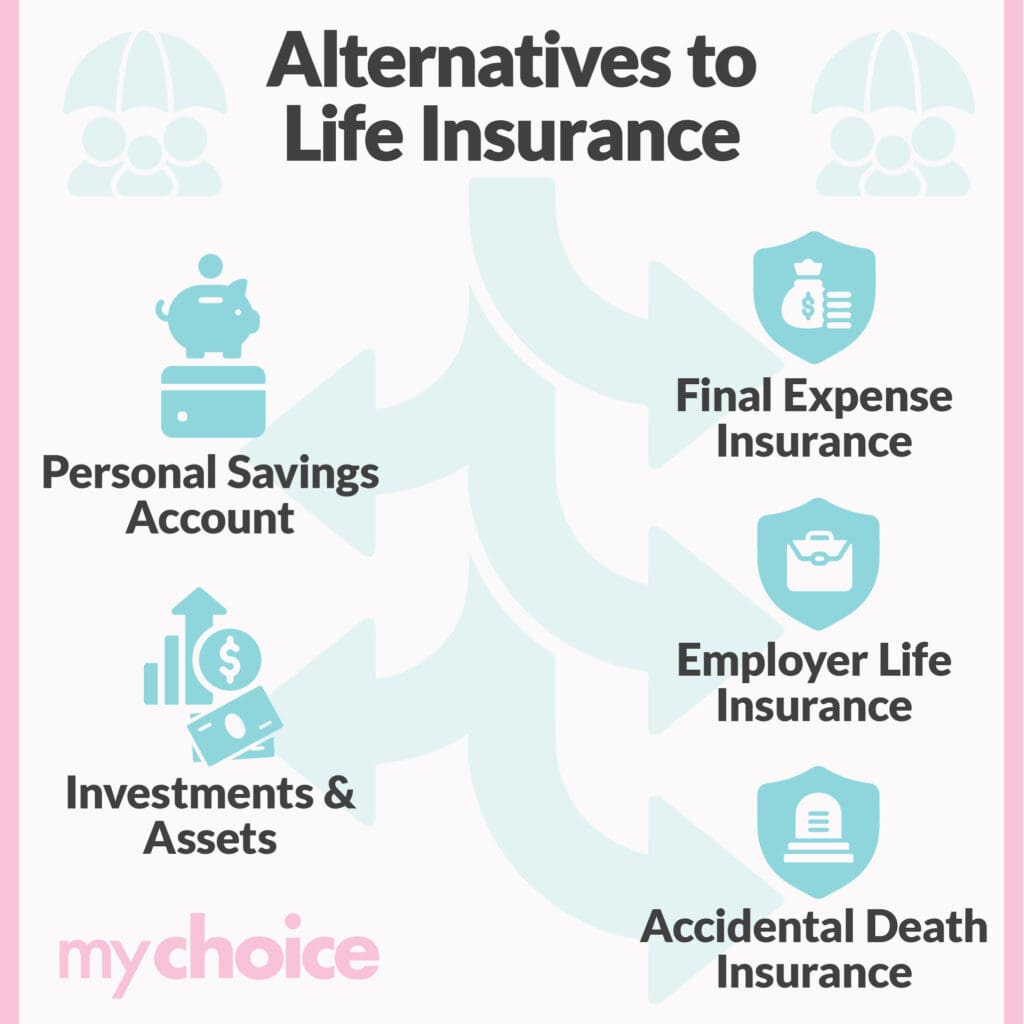

Fortunately, life insurance isn’t the only way you can financially safeguard your loved ones. Here are other methods to protect your beneficiaries and leave a financial legacy:

Personal Savings Account

Putting money into a savings account regularly helps you leave a nest egg for your family. You can give them access to the account and tell them to withdraw the money when you pass.

A personal savings account is more flexible than life insurance because you don’t have predetermined premiums. You can put as much or as little into it based on your financial capabilities.

Investments and Assets

Investing in financial instruments like stocks and real estate is a way to leave a financial legacy for your family. When you pass, they can either sell those assets to get money immediately or take over management to grow their value over time.

However, these assets aren’t a foolproof way to leave money to your family. Some assets grow in value over time, but some might drop in value, which means you end up losing money.

Employer Life Insurance

You can get life insurance without paying for it. Some workplaces offer life insurance for their employees as part of their benefits package. Employer life insurance coverage is usually smaller than self-paid life insurance, but the upside is that you don’t have to spend extra money to get it.

Final Expense Insurance

Funeral costs can be expensive. Fortunately, you can take out an insurance policy called final expense insurance. Final expense insurance is a whole-life policy with a smaller death benefit designed to help with your funeral expenses.

Accidental Death Insurance

Accidents are one of Canada’s leading causes of death, so it’s normal to worry about them. You can get accidental death insurance that will pay out if you pass away in an accident.

The Bottom Line

Getting life insurance is generally a good idea. However, there are some reasons people don’t get life insurance, like a lack of dependents or budgetary reasons.

Even if you can’t or don’t want to buy life insurance, you can still take steps to leave a financial legacy for your loved ones. You can opt for alternatives like savings accounts, investments, and other forms of insurance.