Quick Facts About Condo Insurance in Canada

- On average, depending on where you live and personal circumstances you can expect to pay somewhere in the region of $25 – $40 per month in Canada for condo insurance.

- Condo insurance is not mandatory but highly recommended.

- Condo insurance is a type of home insurance, they are not the same, condo insurance will cover the interior of the unit whereas home insurance covers the whole building.

Whether you’re a first-time buyer or own multiple properties, navigating the intricacies of condo insurance and finding the best rates can be daunting. Learn the basics of condo insurance in Canada, what factors can affect your premium rates, and how you can get the most affordable condo insurance quotes with MyChoice.

How Condo Insurance Works in Canada

Condo insurance is a type of home insurance policy that protects unit owners from injuries, as well as provides coverage for damages and losses that happen to the unit itself and the owner’s personal belongings.

Condo insurance is similar to homeowner’s insurance, with one of the main differences being the price. Because condos are much smaller than homes, the cost to cover the physical structure is much lower.

What condo insurance covers:

Personal property coverage protects all personal belongings inside a condo, including appliances, furniture, clothing, gadgets, and electronics.

Remember that most insurance providers don’t cover high-value items, such as jewelry or fine art. These items may require special insurance.

Personal liability covers the damages incurred from accidental injuries inside your unit. This ensures you won’t have to pay out of pocket for consultations and hospital bills related to accidents.

Also known as unit improvements or betterments, this coverage protects you in case your condo’s structure or personal property is damaged in the process of making upgrades to your unit. This typically includes damages to light fixtures, faucets, hardwood floors, countertops, and built-in shelving units.

Also called ALE, this covers you in case you have to live somewhere else following damages and repairs to your unit. For example, if a pipe bursts and floods your condo or if a fire breaks out and causes significant damage, ALE will cover the cost of your temporary lodging, storage, laundry, etc.

If your unit becomes unlivable due to the aforementioned incidents, this type of protection can cover the cost of maintenance and repairs. If you’re renting your unit out to a tenant, you can claim the rental value you’ll be missing out on.

Average Condo Insurance Prices in Canada by Province

The below table shows a comparison of the average monthly condo insurance premiums across the Canadian provinces.

| Province | Average Monthly Insurance Premium |

|---|---|

| Ontario | $35 |

| Quebec | $28 |

| British Columbia | $38 |

| Alberta | $39 |

| Manitoba | $31 |

| Saskatchewan | $31 |

| Atlantic Provinces | $28 |

Your Condo Insurance Quote at a Glance

Several factors affect your condo insurance rates. Understanding these factors and how they impact you can help you make a more informed decision when choosing a policy and provider. Some of these factors include:

Property type

Rates change based on the type of condo you’re looking to insure, because some buildings, such as stacked townhouses, are more exposed to the elements than others, like high-rises.

Location

Condos in highly urbanized areas cost more to insure due to higher incidences of crime. Condos located near airports and bodies of water are also more expensive, due to the increased risks of falling objects or flooding.

Internal construction

This includes heating, plumbing, and electrical wiring. Older materials are more costly to insure, due to more expensive parts and higher maintenance requirements.

Upgrades to the unit

Renovations and improvements can raise the value of your condo, resulting in higher premium rates. Security systems, carbon monoxide detectors, and other safety measures, on the other hand, can lower your premium rates.

Rentals

If you’re renting your unit out to tenants, you can expect higher premiums.

Pets

Pet ownership results in higher premium rates due to the risks and liabilities involved, such as damages to the unit and accidental injury from aggressive behaviour.

Is Condo Insurance the Same as Home Insurance?

Condo insurance is relatively similar to homeowner’s insurance, with a few key differences:

The Price

One big difference between condo and home insurance is the price, they are different as condos typically need less coverage than home insurance which requires you to have coverage for the whole building.

Liability Coverage

Condo insurance only insures the interiors of a unit. This means that any accidents that happen outside the unit but within the condo building or coverage won’t be covered by your policy. Homeowner’s insurance, on the other hand, typically covers both the inside and outside of the home — covering the entirety of the property.

Loss Assessment Coverage

If you’re part of a homeowners association (HOA) community, you’ll have to get loss assessment coverage. This policy covers damages to common areas that go beyond the association’s coverage limit. This may apply to homeowners who are part of an HOA as well.

How to Save Money on Condo Insurance in Canada

There are plenty of ways to save money on condo insurance. Follow these tips to find discounts and good deals on your insurance:

Bundle your insurance

Insurers offer discounts for clients who buy their condo and car insurance policies from one place.

Increase your deductible

You’ll pay more upfront but save on your monthly or yearly premiums.

Maintain a good insurance score

This score is based on how often you make claims. More claims make you riskier to insure, which results in higher premiums.

Shop and compare condo insurance quotes

Use MyChoice to compare quotes and coverage from different insurance providers without leaving the comfort of your home!

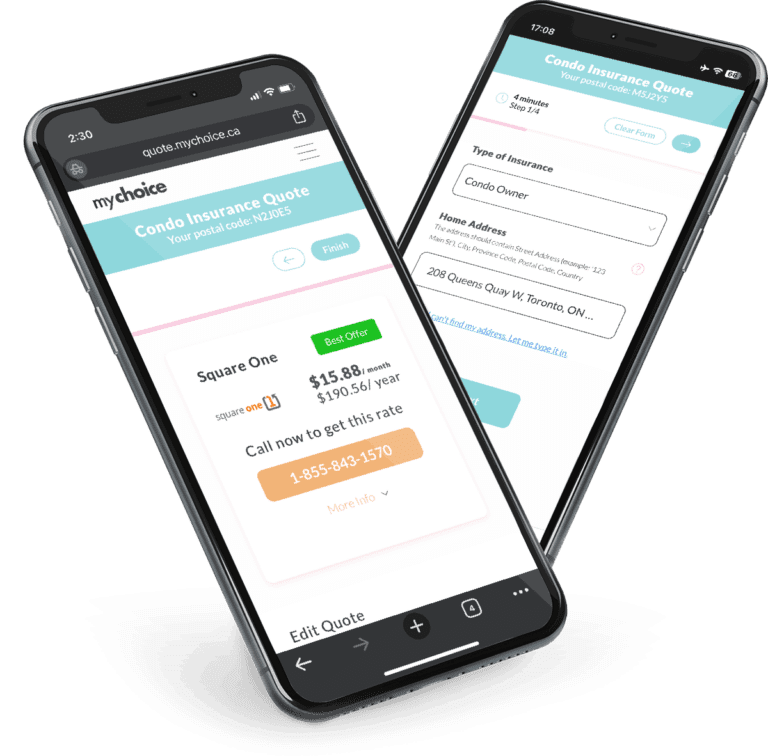

Shopping for Condo Insurance with MyChoice

Ready to find the best rates for condo owners’ insurance? Try MyChoice’s easy-to-use condo insurance quoter. Just input the type of insurance you need and your address, and provide some personal information. In minutes, you can shop around for the lowest rates for your budget and lock down the best policy for you.

Condo Insurance FAQs

What does the average condo insurance typically cost?

The cost of condo insurance depends on several factors, including:

– The condo’s location

– Its value

– The value of the property inside the condo

– The type of policy you choose

In Canada, most people pay around $25 to $40 per month for condo insurance. The rate changes depending on how much coverage is included in the pro

Is having condo insurance in Canada mandatory?

Condo insurance is not mandatory in Canada. However, some condo corporations may require unit owners to have condo insurance before signing their contracts. Many banks and lenders require their clients to have condo insurance before issuing a mortgage.

Is condo insurance the same as renters insurance?

No, condo insurance is not the same as renters insurance. Renters insurance is for people who rent, while condo insurance is offered to condo owners. Condo insurance covers the structural components of the condo itself plus personal property; renters insurance only covers personal property.

Does condo insurance cover appliances?

Most condo insurance policies cover personal property such as fixtures within the unit, appliances, plumbing, wiring, and flooring.

Do condo fees cover insurance?

Some condo fees go to an insurance fund set for paying the building’s insurance premiums. Typically called condominium corporation insurance, this covers the common areas and the furniture and equipment within the property.

Is condo insurance more expensive in big cities like Toronto or Vancouver?

Condo insurance is more expensive in big cities like Toronto and Vancouver. This is because of certain risk factors that increase when living in a big city, such as fires, theft, and vandalism.

How to submit a condo insurance claim in Canada?

To submit a condo insurance claim, call the hotline or go on your insurer’s app to start the process.

Before making a claim, it’s important to document the damage done to your condo. Take photos and write a short report so you have enough evidence for your insurance provider. Upon calling, your insurer will walk you through the process of submitting a claim, which will involve everything from submitting initial documents to finding people to make repairs.

Do I need sewer backup insurance for my condo?

Given the health risks posed by sewer waste, it’s a good idea to get sewer backup insurance for your condo. Sewer backup insurance is an optional policy add-on that covers damages caused by sewage that seeps into your unit from floor drains (this is most common in basement and ground floor apartments) and plumbing and sewage system blockages.