Quick Facts About Tenant Insurance in Guelph

- Guelph tenant insurance is LESS expensive than the Ontario average.

- The average cost of tenant insurance in Guelph is $21 per month.

- On average a one-bedroom apartment costs $1,508 per month in Barrie.

Guelph is one of the most expensive cities in the country for rentals, but many of its residents still rent homes. The popularity of rentals may come from expensive homeownership, the desire for flexibility, and a host of other reasons.

One of the biggest perks of renting a home is that the landlord is responsible for maintaining the property. You can rest assured knowing they’ll cover all expenses if a fire or other perils damage the home. But your landlord’s home insurance only covers the building, so you have no protection for your belongings. That’s where tenant insurance comes in.

Tenant insurance covers the costs of fixing your belongings if they’re damaged by covered perils. With the expensive rent in Guelph, this means you don’t have to shell out a lot of money and potentially stretch your finances thin.

Getting a tenant insurance policy is a good idea, but choosing the right insurer can be challenging. Discover more about tenant insurance for Guelph renters to ensure you make the right decision for your protection needs.

How Much Does Tenant Insurance in Guelph Usually Cost?

The average cost of tenant insurance in Guelph is $252 annually. This means the average tenant insurance rate in Guelph is about $10 below the Ontario average renters insurance rate, which is around $264/year. If we’re going by the average rate, that means you’re paying around $13.27/month for tenant insurance protection in Guelph.

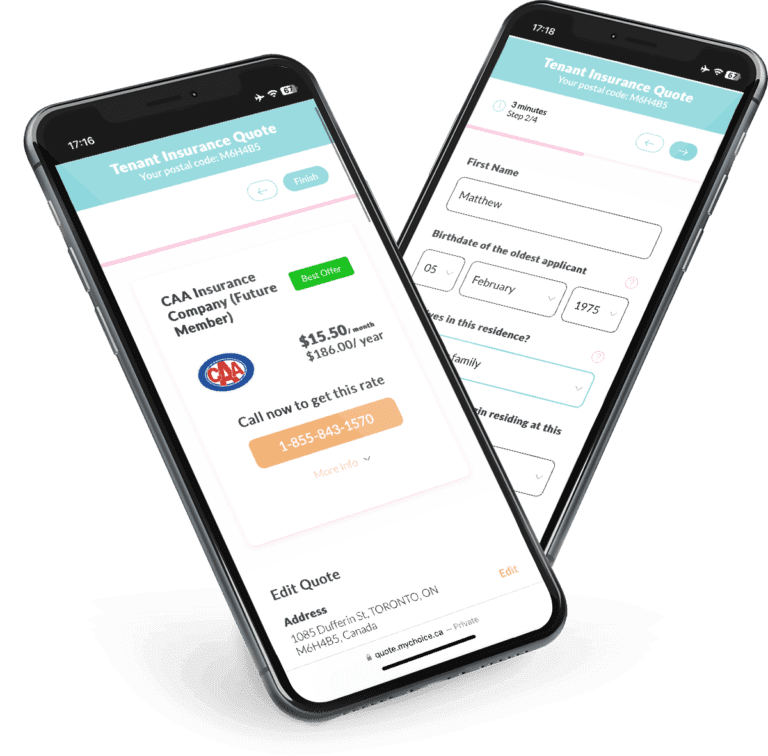

However, $252/year is just the average tenant insurance rate. Your rates can rise or fall depending on various factors like your insurance company, what belongings you have, and your rental property’s location. Use MyChoice to compare deals from multiple insurers and find the best tenant insurance policy that fits your needs and budget.

A Snapshot of Guelph Renters

Checking a city’s rental landscape is a good way to learn the rental market’s competitiveness. Competitive rental markets usually lead to high rental prices. Here’s a look at Guelph renters from the 2021 Census of Population.

The 25% data from the census shows that a little over one-third, or 34.3%, of Guelph’s 56,480 residents rent their homes.

Together, apartments in duplexes, low-rises, and high-rises make up the second-most popular type of dwelling with a 31.6% share.

Guelph is a highly competitive city for renters, with a 2022 vacancy rate of 1.5%, nearly half the national average of 2.4%. 2022’s vacancy rate also represented a 0.5% drop from 2021’s rate of 2%. Large apartments with three or more bedrooms, in particular, had the lowest vacancy rate at 0.9%, while bachelor apartments had the highest vacancy rate at 5.3%.

A declining vacancy rate also led to an increase in prices. The average rent in Guelph for one-bedroom units rose 22.4% in 2022, while two-bedroom units rose 11.1%.

Average Monthly Rent in Guelph

According to CMHC, the average monthly rent in Guelph for a bachelor’s apartment is $1,159, for a one-bedroom apartment, $1,508, for a two-bedroom apartment, $1,652, and for a three-bedroom or larger apartment, $1,958.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,159 |

| 1 Bedroom | $1,508 |

| 2 Bedroom | $1,652 |

| 3 Bedroom + | $1,958 |

Guelph Rent Price Over The Years

The biggest rent increase in 6 years was seen among the bachelor apartments in Guelph. The rent price for these units increased from $773 in 2018 to $1,159 in 2023, an overall increase of 49.9%.

Guelph Vacancy Rate Over the Years

The consistently low vacancy rates for 3-bedroom apartments suggest high demand and limited availability for these units. Below is are the vacancy rates in Gulph since 2018, categorised by apartment types.

Guelph Population Growth

Guelph’s population grew from 131,794 to 144,740 from 2016 to 2021, a 9.06% in 5 years.

What Is Not Included in a Typical Guelph Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Guelph insurance companies.

Here are the most common tenant insurance exclusions:

Criminal activities

If your rented home was damaged due to criminal activity, it won’t be covered by your insurance policy.

Earthquakes

Most policies exclude this risk, but you can cover earthquake losses and damage as an add-on to a standard policy.

Failure to maintain your home

Damage or losses caused by poor home upkeep (e.g., water damage from frozen pipes, broken bannisters) won’t be covered.

Flood damage

Flooding is typically not covered by a standard policy, but it may be included as an add-on.

Home business activities

Home businesses will need separate business insurance coverage to protect you from rental property or equipment damage.

Pest damage

Because this is considered a preventable risk, most insurers don’t cover damage or loss caused by insects, vermin, and animals.

Mould

Mould caused by poor home maintenance is typically excluded by insurance policies. Note that this is separate from mould caused by an insured peril, which will be covered by your policy.

Vacant property risks

Many insurers may void your tenant insurance if you leave the property vacant for over 30 days in a row.

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Guelph. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Guelph?

Compare Guelph tenant insurance rates with MyChoice, or visit our provincial page for practical tips on getting cheap tenant insurance.