Quick Facts About Tenant Insurance in Sudbury

- Sudbury tenant insurance is MORE expensive than the Ontario average.

- The average cost of tenant insurance in Sudbury is $27 per month.

- On average a one-bedroom apartment costs $1,043 per month in Sudbury.

Sudbury’s rental prices are relatively stable, but that doesn’t mean there isn’t demand for rental properties. Home sales in most of 2022 were lower than in 2021 because people still chose to rent instead of buying a home. People have different reasons to live in rentals, from flexibility to relative affordability.

Your landlord is responsible for maintaining and insuring your rental property. You don’t have to worry about repairing the building if it catches fire or gets damaged in a windstorm. However, your landlord’s home insurance doesn’t cover your belongings – fortunately, tenant insurance does.

Tenant insurance gives you peace of mind by covering the costs of repairs and replacements if your belongings get damaged by covered perils. Having tenant insurance is a good idea, but it can be challenging to pick the right insurance provider and policy. Here, learn more about tenant insurance for renters in Sudbury and ensure you choose the best policy for your protection.

How Much Does Tenant Insurance in Sudbury Usually Cost?

On average, Sudbury tenant insurance costs $322/year. This means tenant insurance in Sudbury is higher than the Ontario average renters insurance rate, which is around $264/year. If we break it down, you’ll need to pay around $27/month for your insurance protection.

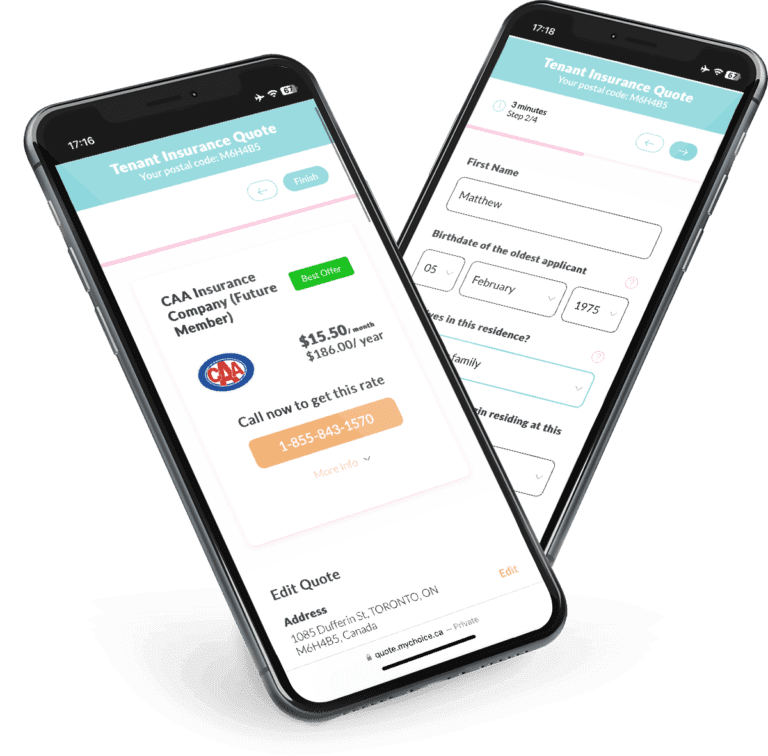

That being said your actual tenant insurance can be higher or lower depending on various factors like your insurance company and other living circumstances. If you want to find the best deals, use MyChoice to compare policy offers from multiple insurers and find the one that fits your insurance needs at a reasonable price.

A Snapshot of Sudbury Renters

How popular are rental properties in Sudbury? Checking the rental landscape in a city can be a great way to research the rental market’s competitiveness, so here’s a snapshot of Sudbury renters from the 2021 Census of Population.

Apartments in buildings under five storeys are the second-most popular type of dwelling in Sudbury, with 16.9% of residents living there. High-rise apartments above five storeys and duplex apartments take third and fourth place with 6.7% and 6.3%, respectively.

Around one-third of households in Sudbury rent their homes, taking up a 35.5% share of the city’s total residents.

The Canada Mortgage and Housing Corporation’s January 2023 rental report states that Sudbury has a 2.3% vacancy rate, a 10-year low for the city. However, the average rent remained stable throughout 2022 at $1,254. Rent price fluctuations were low because increasing population growth was tempered by the lower influx of students and academic staff.

That said, rental properties still aren’t affordable enough for many low-income households, and they often need to compete with high-income families to get affordable vacant units.

Average Monthly Rent in Sudbury

Below are the average rent prices in Sudbury categorised by apartment types:

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $877 |

| 1 Bedroom | $1,043 |

| 2 Bedroom | $1,367 |

| 3 Bedroom + | $1,471 |

Sudbury Rent Price Over The Years

Rent prices for all apartment types in Sudbury have significantly increased over the past six years. This might be due to the rising cost of living and it emphasizes the importance of budgeting for higher rental expenses. In addition, 3-bedroom apartments experienced the highest overall rent increase of 30.6% from 2018 to 2023. Tenants looking for these units should prepare for higher rent costs.

Sudbury Vacancy Rate Over the Years

The significant decreases in vacancy rates for one—and two-bedroom apartments suggest increased demand. Tenants looking to rent these units in Sudbury will face more competition.

Sudbury Population Growth

Sudbury’s population increased steadily from 21,546 to 22,368 between 2016 and 2021, a growth rate of roughly 3.8% over the five years.

What Is Not Included in a Typical Sudbury Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Sudbury insurance companies.

Here are the most common tenant insurance exclusions:

Criminal activities

If your rented home was damaged due to criminal activity, it won’t be covered by your insurance policy.

Earthquakes

Most policies exclude this risk, but you can cover earthquake losses and damage as an add-on to a standard policy.

Failure to maintain your home

Damage or losses caused by poor home upkeep (e.g., water damage from frozen pipes, broken bannisters) won’t be covered.

Flood damage

Flooding is typically not covered by a standard policy, but it may be included as an add-on.

Home business activities

Home businesses will need separate business insurance coverage to protect you from rental property or equipment damage.

Pest damage

Because this is considered a preventable risk, most insurers don’t cover damage or loss caused by insects, vermin, and animals.

Mould

Mould caused by poor home maintenance is typically excluded by insurance policies. Note that this is separate from mould caused by an insured peril, which will be covered by your policy.

Vacant property risks

Many insurers may void your tenant insurance if you leave the property vacant for over 30 days in a row.

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Sudbury. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Sudbury?

If you’re trying to save money on your tenant insurance in Sudbury, compare insurance rates with MyChoice, or visit our Ontario page for practical tips.