Quick Facts About Tenant Insurance in Toronto

- Toronto tenant insurance is LESS expensive than the Ontario average.

- The average cost of tenant insurance in Toronto is $19 per month.

- On average a one-bedroom apartment costs $1,691 per month in Toronto.

Primarily due to the high cost of homeownership, almost half of those who live in Toronto rent their homes. The rental market is competitive, with a low vacancy rate of 1.7% for purpose-built buildings and just 1.1% for apartments.

Despite the challenges of renting in Toronto, plenty do. And the main reason for this is that renting can be convenient and affordable. Also, since you don’t own the property, you don’t have to worry about maintenance and repairs, even in the worst-case scenario.

With that said, your landlord’s insurance only extends so far. If your belongings are damaged (or if you damage someone else’s) you’ll be out of pocket.

Fortunately, tenant insurance can help you cover the cost of replacing or repairing your assets and shield you from the financial blow of an insured peril. Learn more about how renters insurance in Toronto works, what it can do for you, and how you can get the best policy for your budget.

How Much Does Tenant Insurance in Toronto Usually Cost?

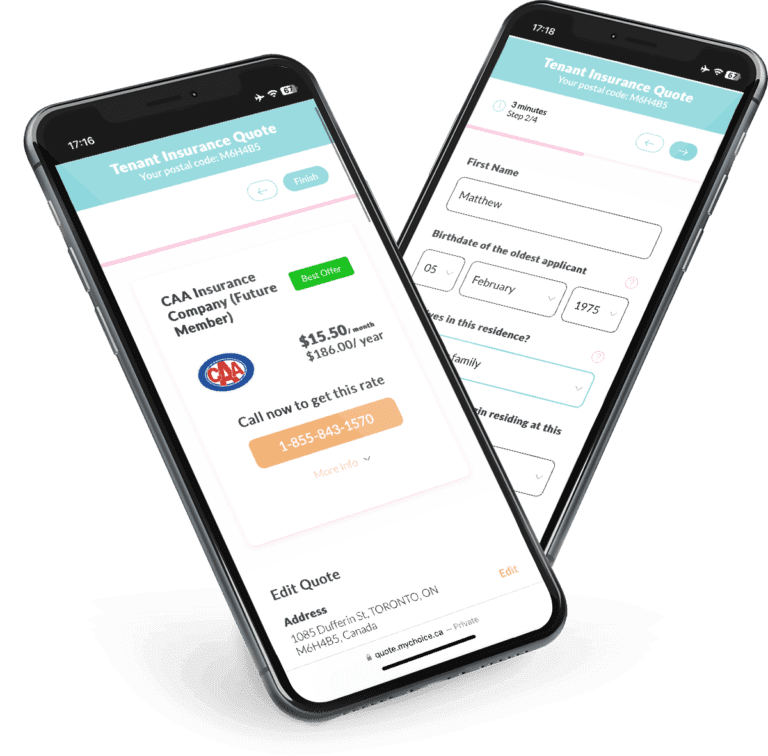

Tenant insurance in Toronto usually costs $228/year, which translates to monthly premiums of $19. This is lower than the average Ontario rate of $264/year or $22/month. For a pretty affordable rate, you can get a Toronto tenant policy that protects your personal belongings.

With that said, it’s important to remember that these are just average figures. How much insurers will actually charge you depends on a variety of factors, such as where in Toronto you live, what kind of dwelling you rent, and what kind of items you need to insure. Get personalized quotes and compare offers with MyChoice to find the best tenant policy in Toronto for your needs.

A Snapshot of Toronto Renters

According to the 2021 Census of Population, almost half (48.1%) of Toronto residents, translating to 557,970 households, are renters. High-rise apartments are the second-most popular housing structure, comprising a massive 46.7% of all dwellings. The 2023 rental report by the Canada Mortgage and Housing Corporation found that the ratio of completions to rentals for apartments has maintained at around 36%.

The vacancy rate of both purpose-built buildings and apartments both fell in 2023 to 1.7% and 1.1% respectively, despite a record number of apartments being added to the market. Meanwhile, the average rent for two-bedroom homes rose 6.5% to $1,765, while two-bedroom condos cost $2,671.

The CMHC attributes this to an increase in interprovincial migration, post-pandemic rental demand (especially as students return to school), and employment recovery for the youth – a group that accounts for most of the rental households in the GTA.

A lack of supply combined with rising mortgage costs are turning many away from homeownership. As more people rent for longer, we’ll likely see more pressure on the rental market in Toronto.

Average Monthly Rent in Toronto

The average monthly rent in Toronto varies by apartment type, with bachelor apartments at $1,414, one-bedroom at $1,691, two-bedroom at $1,958, and three-bedroom or larger at $2,168.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $1,414 |

| 1 Bedroom | $1,691 |

| 2 Bedroom | $1,958 |

| 3 Bedroom + | $2,168 |

Toronto Rent Price Over The Years

Toronto rent for one-bedroom apartments increased significantly from $1,261 in 2018 to $1,691 in 2023, a growth of about 34.1% in five years. Meanwhile, the rent price for two-bedroom units increased from $1,468 in 2018 to $1,958 in 2023, a 33.4% increase.

Toronto Vacancy Rate Over the Years

The vacancy rate for one-bedroom apartments increased from 1.2% in 2018 to 5.8% in 2021 and then decreased to 1.7% by 2023.

Toronto Population Growth

Toronto’s population continued to increase from 2,731,571 to 2,794,356 people between 2016 and 2021, a growth rate of roughly 2.29% over 5 years.

What Is Not Included in a Typical Toronto Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Toronto insurance companies.

Here are the most common tenant insurance exclusions:

Criminal activities

If your rented home was damaged due to criminal activity, it won’t be covered by your insurance policy.

Earthquakes

Most policies exclude this risk, but you can cover earthquake losses and damage as an add-on to a standard policy.

Failure to maintain your home

Damage or losses caused by poor home upkeep (e.g., water damage from frozen pipes, broken bannisters) won’t be covered.

Flood damage

Flooding is typically not covered by a standard policy, but it may be included as an add-on.

Home business activities

Home businesses will need separate business insurance coverage to protect you from rental property or equipment damage.

Pest damage

Because this is considered a preventable risk, most insurers don’t cover damage or loss caused by insects, vermin, and animals.

Mould

Mould caused by poor home maintenance is typically excluded by insurance policies. Note that this is separate from mould caused by an insured peril, which will be covered by your policy.

Vacant property risks

Many insurers may void your tenant insurance if you leave the property vacant for over 30 days in a row.

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Toronto. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Toronto?

Visit our main province page for a list of practical tips if you’re trying to save money on your tenant insurance coverage in Toronto.