Quick Facts About Tenant Insurance in Brampton

- Brampton tenant insurance is LESS expensive than the Ontario average.

- The average cost of tenant insurance in Brampton is $17 per month.

As of May 2023, Brampton is Canada’s ninth-most expensive city for rental properties. However, it still has a relatively low vacancy rate, which shows that most people live in rented homes and apartments.

Landlords are responsible for maintaining rental properties. They must keep the building in a good state, which means they foot the bill if your rental home is damaged in a natural disaster or other hazards. But you should remember that the landlord is only responsible for the property, not its contents.

If your things are damaged in the same disaster or peril, your landlord’s home insurance won’t cover those repair costs. This is where tenant insurance comes in. Tenant insurance pays your belongings’ repair bills when covered perils damage them. Since rent in Brampton is higher than average as it is, having tenant insurance can save you from spending too much money on repairs.

There are many insurers offering tenant insurance, and choosing the right one is challenging. Fortunately, a good grasp of the insurance landscape in the city can help you make informed decisions. That’s why you should understand the ins and outs of tenant insurance in Brampton.

How Much Does Tenant Insurance in Brampton Usually Cost?

The average cost of tenant insurance in Brampton is $204/year. It’s about $60 cheaper than the province’s average tenant insurance rate, which is around $264 annually. When you break the annual cost down, you only need to pay about $17/month for tenant insurance protection in Brampton.

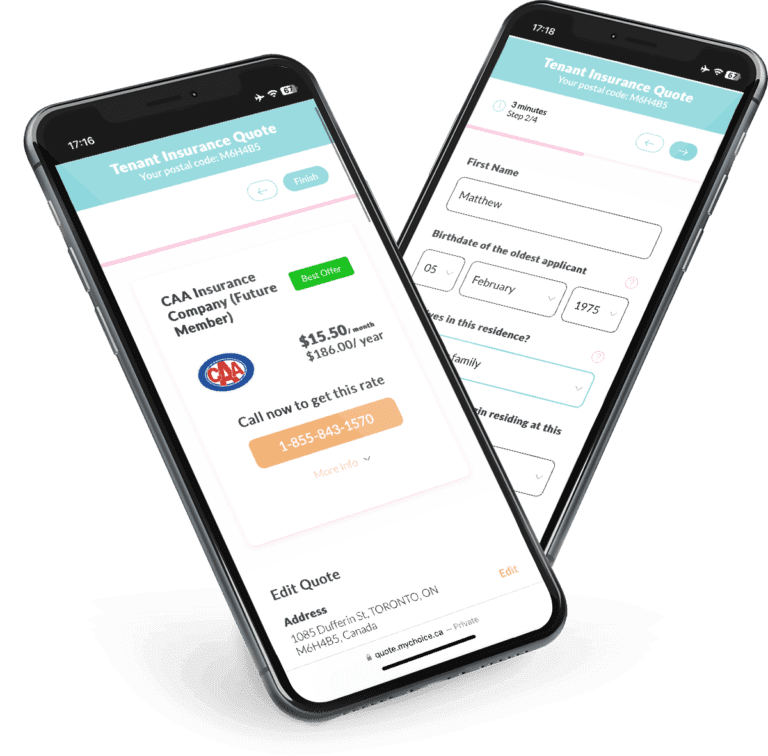

Keep in mind that $204/year is just the average tenant insurance cost. Your actual rate quotes can be lower and higher depending on factors like your insurance company, what kind of belongings you have, and your rental property’s location. Use MyChoice to compare deals from multiple insurers to get the best tenant insurance policy that fits your needs.

A Snapshot of Brampton Renters

Is Brampton a good place to rent a home? Let’s look at the 2021 Census of Population data to get a better idea of the city’s rental landscape.

Out of the 182,475 households surveyed in the census, 21.9% of them rent their homes. That means around one-fifth of Brampton are renters. The dwelling type data also supports this since duplex, low-rise, and high-rise residents make up about 21.2% of the city’s total homes.

Regional statistics show that in 2022, Brampton had a 1.6% rental vacancy rate. Of all the rental property types covered in the data, large townhouses or apartments with three or more bedrooms have the lowest vacancy rate of 1.2%, reflecting their relatively limited supply of 1,567 units. In contrast, two-bedroom properties have the most abundant supply of 5,816 units with a 1.8% vacancy rate.

High demand and low supply generally lead to price surges, which happened in Brampton. Between May 2022 and 2023, rent for a one-bedroom property in Brampton rose by 28.1%, while rent for two-bedroom properties rose by 26.8%.

Brampton Population Growth

The Brampton population has grown a whopping 10.58% in five years since 2016. This is one of the fastest population growth rates in Ontario.

What Is Not Included in a Typical Brampton Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by Brampton insurance companies.

Here are the most common tenant insurance exclusions:

Criminal activities

If your rented home was damaged due to criminal activity, it won’t be covered by your insurance policy.

Earthquakes

Most policies exclude this risk, but you can cover earthquake losses and damage as an add-on to a standard policy.

Failure to maintain your home

Damage or losses caused by poor home upkeep (e.g., water damage from frozen pipes, broken bannisters) won’t be covered.

Flood damage

Flooding is typically not covered by a standard policy, but it may be included as an add-on.

Home business activities

Home businesses will need separate business insurance coverage to protect you from rental property or equipment damage.

Pest damage

Because this is considered a preventable risk, most insurers don’t cover damage or loss caused by insects, vermin, and animals.

Mould

Mould caused by poor home maintenance is typically excluded by insurance policies. Note that this is separate from mould caused by an insured peril, which will be covered by your policy.

Vacant property risks

Many insurers may void your tenant insurance if you leave the property vacant for over 30 days in a row.

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in Brampton. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in Brampton?

If you’re trying to save money on tenant insurance coverage in Brampton, visit our Ontario page for a list of practical tips.