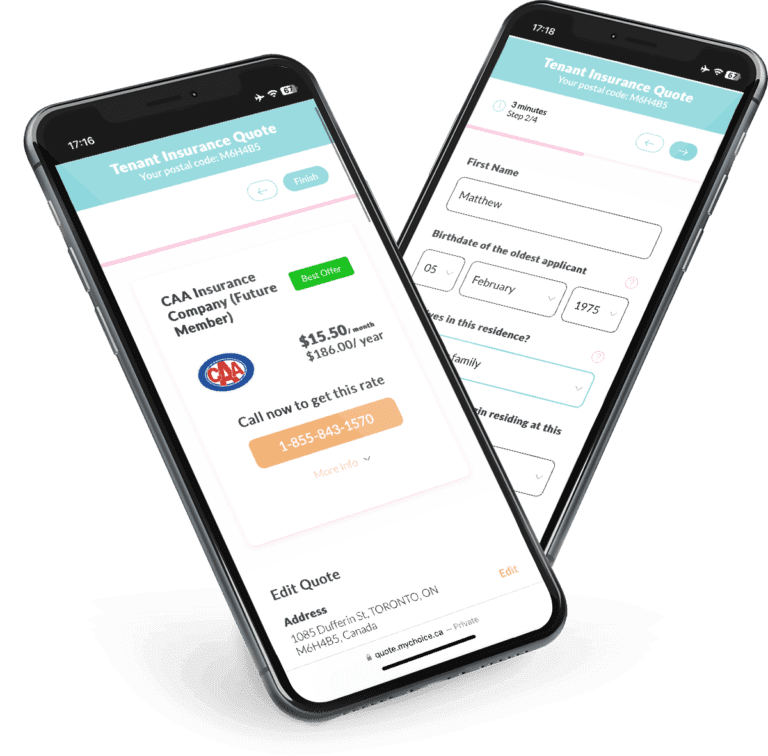

Quote data from MyChoice.ca, June 2025

St. Catharines Tenant Insurance Overview

St. Catharines’ rental market is seeing market supply increase to some of the city’s highest average rates in the past 30 years, with a 2.8% vacancy rate for purpose-built rental apartments. But despite this increased rental supply, stronger employment and an influx of international workers have driven up demand, resulting in fewer affordable rental options.

Convenience is one of the main reasons why rentals are in high demand. By renting your home instead of outright owning it, you leave maintenance and repairs in your landlord’s hands. But while your landlord is responsible for maintaining the property, they have no responsibility if your possessions are lost or damaged.

Tenant insurance can give you peace of mind by covering your belongings from unforeseen events like theft or fires. Learn how tenant insurance works, what its standard coverage is and what add-ons you can get, and where to get quotes for a St. Catharines tenant insurance policy.

How Much Does Tenant Insurance in St. Catharines Usually Cost?

The average cost of tenant insurance in St. Catharines is $237.81/year, making it slightly more expensive than the Ontario average of $275.36 per year. At around $19.82/month, tenant insurance is an affordable way to cover the cost of replacing or repairing your belongings if they’re damaged or destroyed by certain perils.

Quote data from MyChoice.ca, June 2025

A Snapshot of St. Catharines Renters

Based on a 25% sample pool taken by the 2021 Census of Population, over a third of people living in St. Catharines (35.6%, or 20,960 households) are renting their homes. 64.4% of those surveyed (37,945 households) owned their private dwellings. The vast majority of St. Catharines residents live in non-condominium homes (89.3%), with only 10.7% living in condominiums.

A January 2023 rental report from the Canada Mortgage and Housing Corporation found that there was a slower transition to homeownership due to higher mortgage rates.

This left fewer affordable rentals at a time when more students and immigrant workers were moving to the city. As a result, the average rent for purpose-built rentals in St. Catharines went up by 6.3% to $1,260, which is the fastest rent growth rate change the city’s had in over three decades.

St. Catharines’ vacancy rate for purpose-built rentals grew to 2.8%, a 0.9% increase from 2021. This can likely be attributed to the completion of 321 new purpose-built rental apartments as of June 2022.

With more tenants staying in their current rentals and avoiding homeownership, expect St. Catharines rental prices to keep going up in the next few years.

Average Monthly Rent in St. Catharines

Below are the average monthly rent prices in St Catharines categorized by apartment size.

| Apartment Type | Average Monthly Rent |

|---|---|

| Bachelor | $951 |

| 1 Bedroom | $1,224 |

| 2 Bedroom | $1,389 |

| 3 Bedroom + | $1,419 |

St. Catharines Rent Price Over The Years

The rent for all apartment types in St Catharines has shown a steady increase from 2018 to 2023. For instance, Bachelor apartments rose from $658 in 2018 to $951 in 2023, a 44.5% increase. One-bedroom apartments saw a significant increase as well, going from $871 in 2018 to $1224 in 2023, a 40.5% overall increase.

St. Catharines Vacancy Rate Over the Years

The vacancy rate for one-bedroom apartments in St. Catharines saw fluctuations over the years, peaking at 3.4% in 2023, an increase from 2.9% in 2022.

St. Catharines Population Growth

Since 2016, St. Catharines’ population has grown from 133,113 to 136,803 people, a growth rate of 2.8% over the five-year period.

What Is Not Included in a Typical St. Catharines Renters Insurance Policy?

Even if you’ve opted for a highly comprehensive tenant insurance policy, there are some risks that insurers explicitly don’t include as a covered peril. These are called “exclusions” by St. Catharines insurance companies.

Here are the most common tenant insurance exclusions:

Note that a tenant insurance policy doesn’t cover loss or damage to items that aren’t yours, so it won’t cover a roommate’s belongings or your landlord’s possessions. Also, the list above is by no means an exclusive enumeration of risks typically excluded from a tenant insurance policy in St. Catharines. Talk to your tenant insurance provider to see what’s covered by your policy in case of loss or damage.

How You Can Get Cheap Tenant Insurance in St. Catharines?

Looking to save money on your tenant insurance coverage? Visit our Ontario tenant insurance page for a list of practical tips.