Yes, you can buy life insurance for your parents in Canada. However, you need their consent to do so. You must also meet other conditions like completing health assessments, identifying their financial needs, and defining the policy’s purpose. Whether or not it’s a good idea will depend on you and your parents’ financial condition and needs.

Are you planning to get insurance for your parents? Keep reading to learn whether it’s a good idea and how to do it.

Should I Get My Parents Insured?

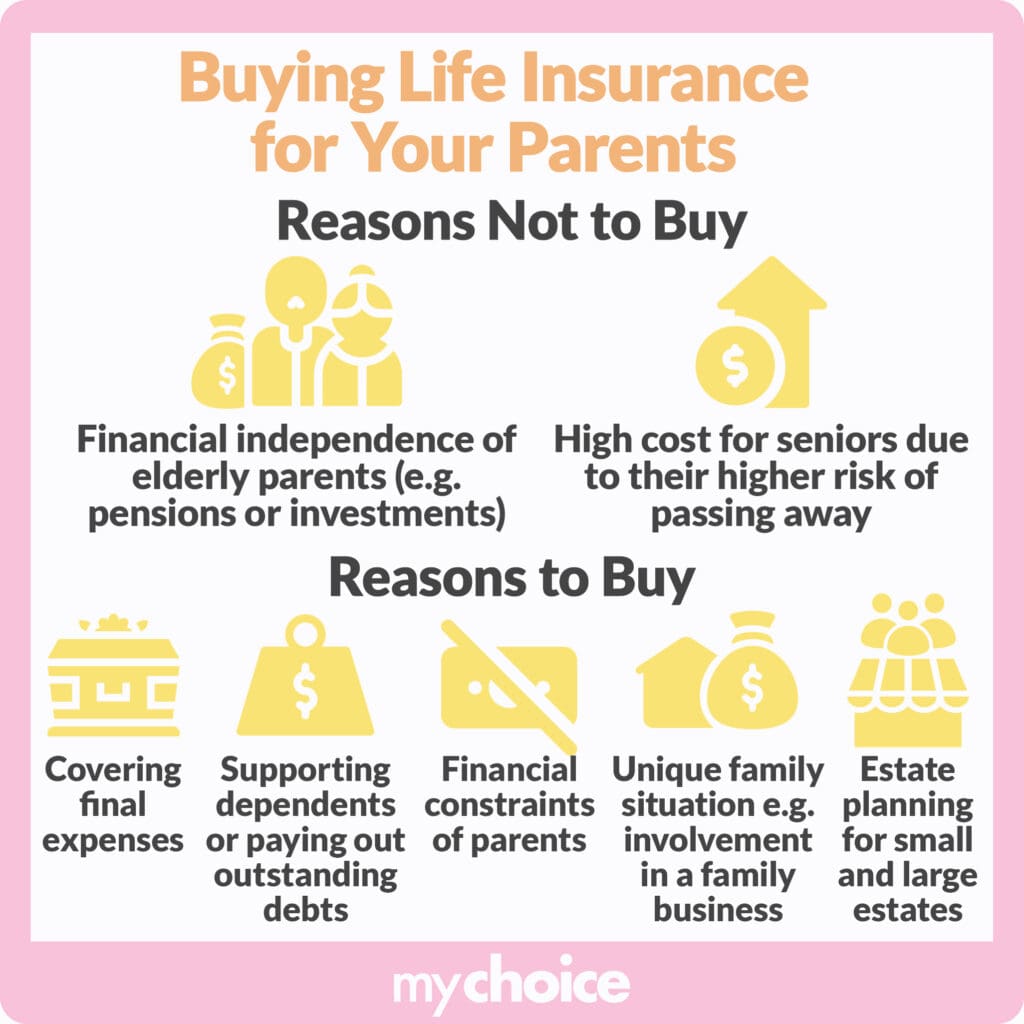

Whether or not you should get your parents insured depends on your needs and theirs. Some people may get life insurance for their parents so the death benefit can cover their final expenses and pay off outstanding debt. However, some people may choose not to do so because the cost of insurance outweighs the potential final expenses when their parents pass.

Why You Might Need Life Insurance for Your Parents

You may need or want to get your parents insured for various reasons. Here are some common reasons why people buy insurance for their parents:

- Covering final expenses like medical bills and funeral expenses

- Paying out remaining debts

- Estate planning

- Providing income replacement in place of a working parent

- Protecting shared interests like a family business

Types of Life Insurance Coverage for Parents

Generally, life insurance types available to parents are similar to those available to other people. Let’s take a look at the four common types of life insurance bought for parents:

Things to Consider When Buying Life Insurance for Parents

Just like buying life insurance for yourself, there are considerations when buying insurance for your parents. Here are some important considerations that you should think about before making the decision:

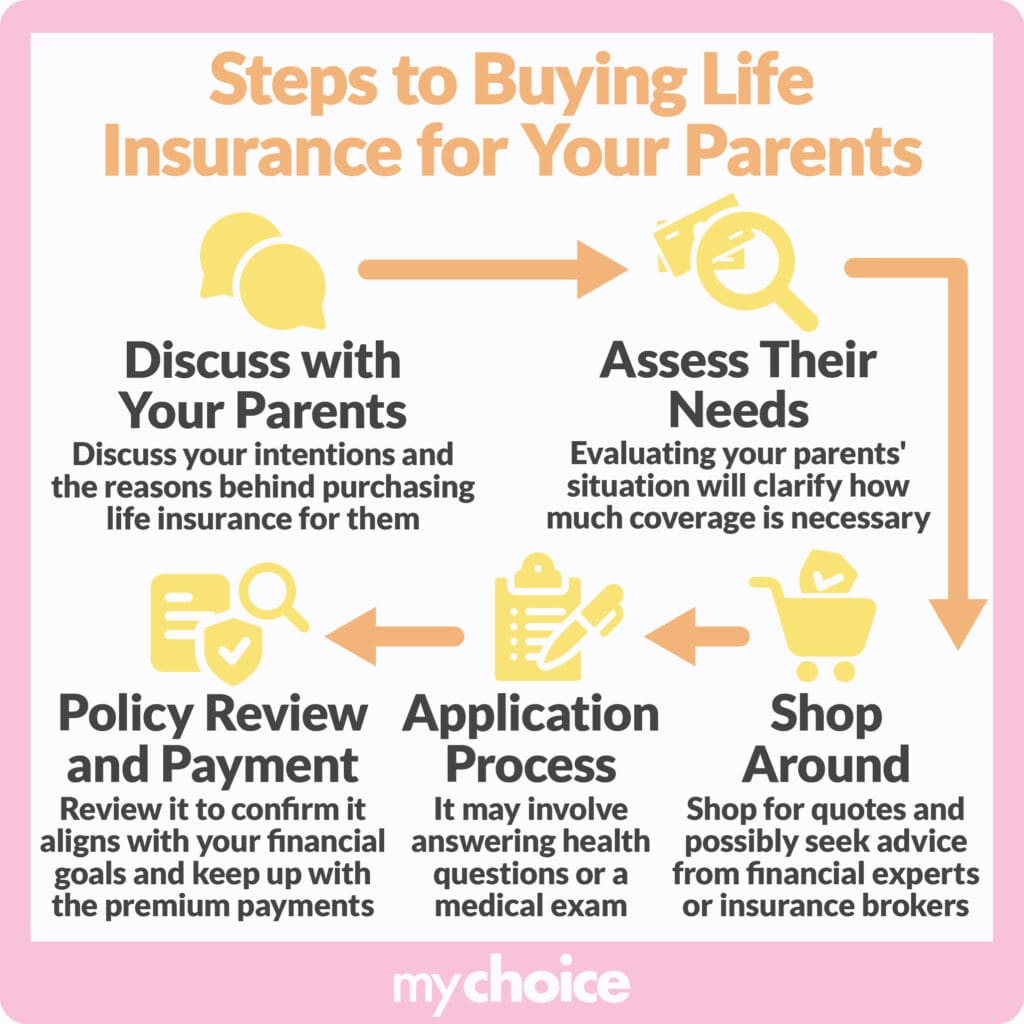

One of the most important things to do before getting insurance for your parents is to discuss this beforehand. Agree on what kind of insurance to get and who pays the premiums. This way, you’ll prevent disputes and ensure that their life insurance policy can provide you and your parents peace of mind.

The below infographic shows the main reasons for and against buying life insurance for your parents.

Tips When Getting Life Insurance for Your Parents

Buying life insurance with your parents is similar to buying one for yourself. However, there may be some differences along the process, and it’s best to bring your parents into the conversation instead of making a one-sided decision. Here’s how you can bring them into the discussion:

Below is the infographic explaining the best course of action if you decide to get life insurance for your parents.

Key Advice From MyChoice

- You can buy life insurance for your parents as long as you have their consent. You also need to prove insurable interest in your parents and have them meet the usual life insurance qualification criteria.

- Life insurance for your parents can replace their income, pay for final expenses, repay debts, and protect your family business, among other uses.

- You have multiple options for your parents’ life insurance policies like term, whole life, guaranteed issue, simplified issue, and final expense coverage.

- You should discuss with your parents what type of life insurance is right for them and whether they need or want it.