Many people assume that you have to be the picture of good health to qualify for a life insurance plan – but the truth is that you can buy a policy even with diabetes. Just like with any other would-be policyholder, there are lots of moving parts that impact how things are going to proceed, however.

Life Insurance for Diabetics at a Glance

- Diabetics can easily qualify for life insurance, but be ready to pay a little bit more monthly

- Well-managed cases are more likely to be given prime rates.

- The premiums you pay are dependent on your age at diagnosis, your overall health, and other lifestyle factors – and that means you can make changes to get lower rates.

Navigating life insurance can seem daunting, especially if you have diabetes. But fear not—being informed can make all the difference. In this guide, we’ll break down everything you need to know about getting the best life insurance for diabetics in Canada.

Life Insurance and Diabetes

Life insurance is a powerful tool used to secure futures and build a sense of confidence that your loved ones will always be provided for – and folks with all sorts of health conditions have qualified. That said, similar to any other disease that has a lasting impact on the quality of your life, diabetes can make things more difficult when trying to get a good monthly rate.

Simply put, this all comes down to a person’s individual life expectancy, which is the statistical probability of a person passing away after each birthday. Beyond just age, these probabilities are weighted against a person’s gender, lifestyle, job, and health conditions.

With something like diabetes in the mix, the probability of passing away increases – therefore making it more expensive to insure a diabetic than someone who doesn’t have the same condition.

Can I Still Get Life Insurance if I Have Diabetes?

Yes, you can still get life insurance with diabetes – but like we mentioned earlier, insurers may just price your plan a little differently.

Many insurance companies in Canada offer coverage to individuals with diabetes, and there are quite a few plans that won’t even require a medical exam, which can help you avoid health concern-related bill bumps. That said, the key lies in understanding how diabetes impacts your application and what steps you can take to secure the best possible rates – regardless of type.

How Insurers Price Your Plan: For Diabetics

The application period for any life insurance plan can be quite confusing for anyone, and that’s because insurers often have a long list of things they check before laying down hard numbers for a potential policyholder. Luckily, the process has been demystified, and it’s easier than ever to get information about how your specific case is appraised.

Here are the factors that come into play when discerning the average cost of life insurance for diabetics:

- Type of diabetes: The kind of diabetes you have can impact insurance rates quite profoundly. Insurers often are very particular about the distinction between Type 1 and Type 2 diabetes, with Type 1 generally considered higher risk due to its earlier onset and dependency on insulin. As a result, folks with Type 2 diabetes are more likely to receive standard rates.

- Age upon diagnosis: Age is already one of the most influential factors when pricing an insurance plan, but that becomes doubly true when dealing with diabetes. The earlier you received your diagnosis, the higher your premiums, and the logic is simple: you become a bigger risk the longer you’ve had diabetes.

- Medication and other maintenance factors: If your care plan includes medications, they can definitely influence your premiums in one of two ways. For example, if you’re on oral medication and it helps manage your symptoms and maintain your overall health, that could be a net positive during the underwriting phase. However, some insurers may weigh the consistent use of insulin against you – but it’s extremely case-to-case.

- Other health complications: If you experience other health complications both related and unrelated to your diabetes, you may receive slightly higher rates. For example, complications like neuropathy, retinopathy, or cardiovascular issues stemming from diabetes can affect your rates.

- General blood sugar management: How well you manage your blood sugar levels (reflected in your HbA1c readings) can demonstrate your commitment to health, potentially lowering your premiums.

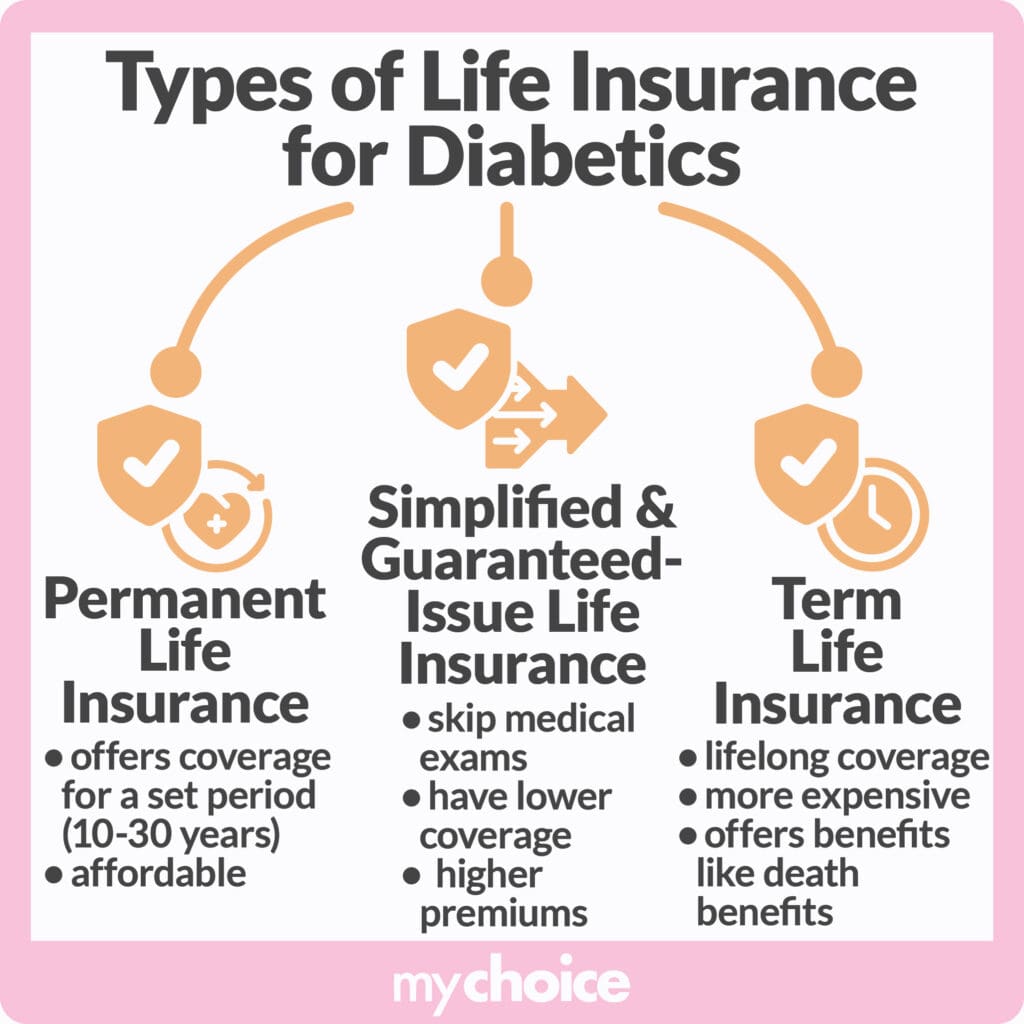

- Type of insurance plan: The kind of policy you’re looking to purchase can influence the overall cost. For example, term life insurance for diabetics may cost less than more permanent options simply because they tend to expire before the end of your life. That said, you may be able to piggyback off term life’s cheaper initial premiums and convert to whole life down the road.

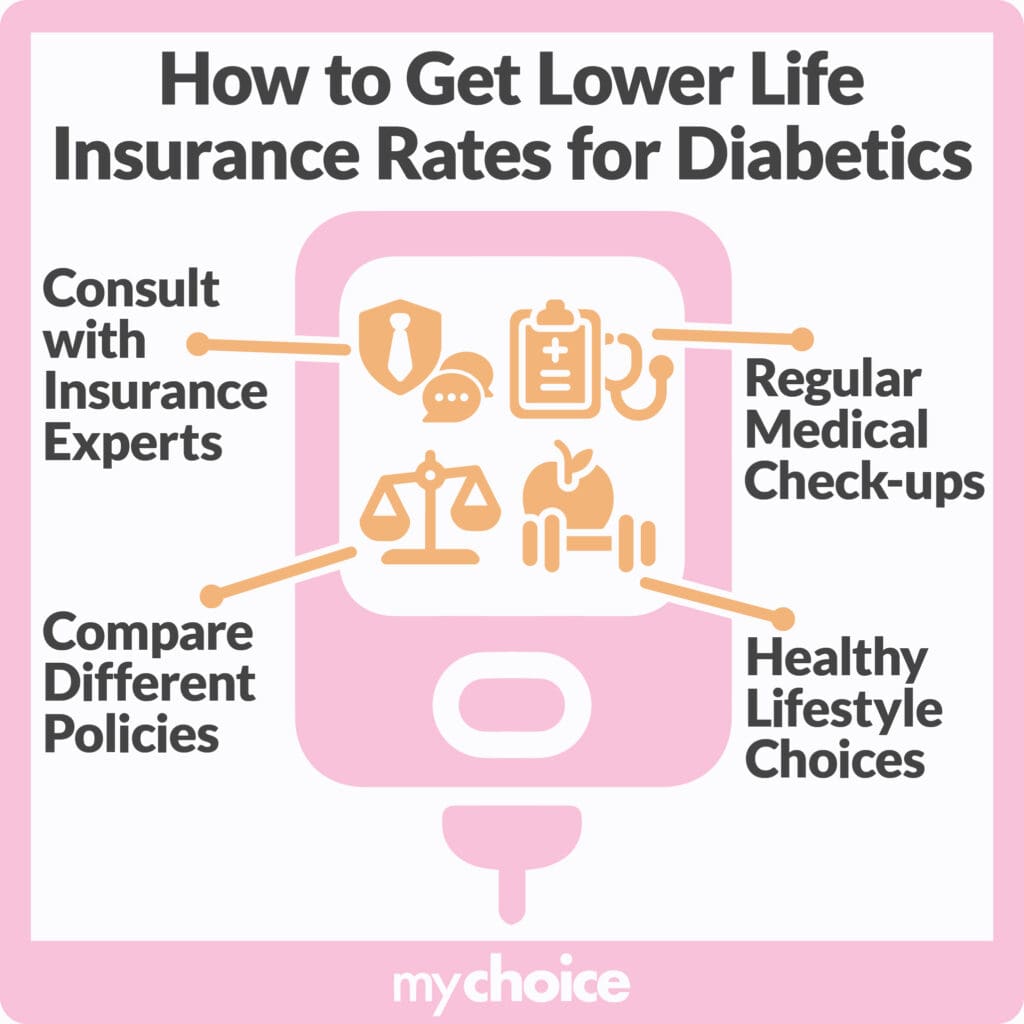

All of that said, insurers price your plan based on your overall health, so well-managed cases of diabetes are treated more favorably. Here are a few proactive steps can help you secure more favorable rates:

- Manage your blood sugar: Naturally, the first thing you’d want to do is consistently monitor and manage your blood sugar levels. A demonstrated stability over time can positively impact your insurance rates.

- Maintain a healthy weight: Obesity on its own can be quite an influential factor during the underwriting process, so maintaining a healthy weight can slide your appraisal closer to prime rates.

- Eliminate smoking and alcohol use (if possible): We know it’s easier said than done, but making moves to eliminate cigarette and alcohol use can be one of the biggest decisive factors during the application phase.

- Exercise regularly: Doctors and medical professionals are constantly advising people to get the daily exercise in – and this is because of the myriad health benefits that come with it. By exercising regularly, your overall physical condition improves, making you easier and cheaper to insure.

What Happens if You Take Out a Term Life Insurance Policy and Then Develop Diabetes?

Once you’ve purchased a life insurance policy, you’re bound to the terms of the contract until its coverage expires. The logic is that all applicants are subject to multiple rounds of screening and health testing, so insurance companies usually know exactly how much it’ll cost to insure you – and developing any diseases after the fact will have no bearing on how your policy is priced.

In fact, you probably won’t even need to inform your insurer about newly diagnosed diabetes unless your plan is up for renewal or you’re looking to upgrade your term insurance into something a little more permanent.

My Life Insurance Application Has Been Denied Due to Diabetes. What Are My Options?

Generally speaking, having an application denied by one insurer won’t impact your chances with another company – though it’s important to note the exact reasons you were denied coverage so you can prepare for the next round of applications.

That said, you have three options in case you’re denied coverage because of your diabetes:

- Apply for diabetes-specific insurance: Many organizations recognize how difficult it can be to qualify for decent coverage with a diabetes diagnosis, so some offer policies tailored to folks with the condition. This usually is a combination of the regular life insurance benefits alongside access to a care program specific to diabetes.

- Try again with another insurer: If you’re given specific reasons why your application was denied, you may be able to work through things and apply with another company. We recommend shopping around and putting in a few applications to save time and energy.

- Work with an experienced broker: The life insurance application process can be quite arduous, but life insurance brokers may be able to find you coverage in even the most difficult situations. The policies you do end up finding may be a little pricier, but they still offer the protection you need.

Key Advice From MyChoice

When choosing a life insurance policy as a diabetic in Canada, consider the following tips:

- Shop around: Different insurers have varying underwriting guidelines. Compare quotes to find the best rates.

- Work with a broker: A knowledgeable insurance broker can help navigate the complexities of diabetes and insurance underwriting.

- Be Honest and Transparent: If a health exam or interview is required by your insurer (such as in non-group insurance contexts) disclose all relevant information about your health. Honesty is crucial for securing the right coverage.

- Understand Policy Options: Look into policies that offer flexibility, such as guaranteed issue or simplified issue plans, which may be more accessible for individuals with pre-existing conditions. However, you should do this alongside looking at more common types of life plans – you may find that they’re cheaper and more comprehensive in some cases.

In summary, securing life insurance as a diabetic in Canada is possible with the right approach. By understanding how insurers assess risk, managing your health proactively, exploring new treatment options, and seeking guidance from experts, you can find a policy that meets your needs.