Quick Facts About Auto Insurance in St. Albert

- St. Albert car insurance is MORE expensive than the Alberta average.

- The average annual car insurance cost in St. Albert for a driver with a clean record is around $1,378.

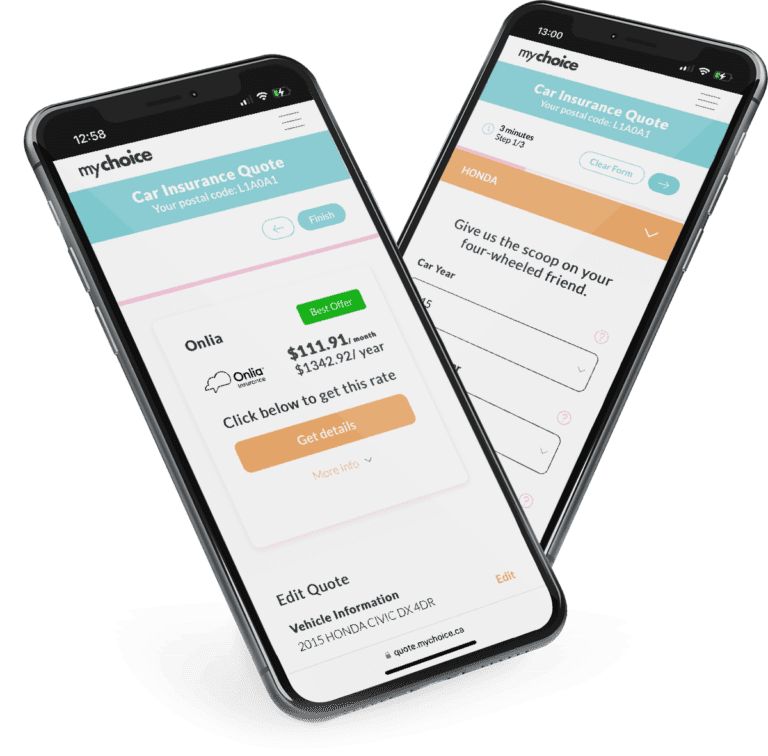

- Comparing St. Albert auto insurance quotes with MyChoice can save you up to $978 annually

The Best Car Insurance Brokerages in St. Albert

Car insurance brokerages are businesses that help drivers find the best car insurance plan for them by comparing car insurance policies between insurance providers in St. Albert. You can ask insurance brokers questions to find out what kind of insurance you’ll need and how much it will cost.

Some of the top car insurance brokerages in St. Albert can provide the best car insurance plans for drivers. If you need assistance shopping for an affordable auto insurance policy, contact these brokerages:

| Brokerage | Address | Phone number |

|---|---|---|

| AMA – Alberta Motor Association | 665 St Albert Trail #200 St. Albert, AB T8N 3L3, Canada | +17804188900 |

| Grandin Agencies | 7 Perron St St. Albert, AB T8N 1E3, Canada | +17804588110 |

| Drayden Insurance & Registries Ltd | 60 Green Grove Dr #100 St. Albert, AB T8N 5H6, Canada | +17804597700 |

Auto Insurance by Postal Code in St. Albert

The city of St. Albert has an average annual car insurance rate of $1,378.

Since T8N is the only postal code in St. Albert, it’s by default the most expensive area for auto insurance in the city.

| Postal Code | Average Annual Car Insurance Rate |

|---|---|

| T8N | $1,378 |

Car Insurance Cost in St. Albert by Age

The cost of your car insurance in St. Albert is affected by your age. Insurance companies assess your level of risk as you gain more experience driving and offer cheaper or more expensive rates at certain age brackets.

A young driver under the age of 25 can expect to pay a lot in insurance because the insurers consider them inexperienced drivers that are prone to accidents. Drivers older than 25 but younger than 55 tend to be given discounts as they’re considered more experienced drivers. After the age of 65, your annual insurance premiums start to go up again as your eyesight and reaction time worsens.

Here’s a table where you can check out the average annual insurance rates per age bracket and how much using MyChoice can save you:

| Age group | Average Annual Car Insurance Rate | Annual savings with My Choice |

|---|---|---|

| 18-20 | $4,919 | $978 |

| 21-24 | $2,811 | $559 |

| 25-34 | $1,874 | $373 |

| 35-44 | $1,378 | $274 |

| 45-54 | $1,130 | $225 |

| 55-64 | $960 | $191 |

| 65+ | $1,095 | $218 |

Car Insurance Cost in St. Albert by Driving History

One of the factors that affect your auto insurance premiums the most is your driving history.

If insurance companies check your record and see a history of traffic violations or accidents, they may profile you as a high-risk driver. This means that you’ll be charged a higher insurance rate in St. Albert. On the other hand, a clean driving record will give insurers confidence, allowing you to get a cheaper rate.

Driving violations in St. Albert stay on your record for two years, but insurance companies can check your driving history as far as 10 years back. DUIs, parking lot accidents, and speeding tickets are some of the marks that insurers will search your record for.

Here’s a table showing how driving violations can increase your car insurance premiums in St. Albert:

| Driving violation | Average Annual Car Insurance Rate |

|---|---|

| Clean driving record | $1,378 |

| Insurance cancellation due to non-payment | $2,260 |

| Licence suspension for alcohol-related offences | $1,654 |

| One accident | $3,032 |

| Speeding ticket | $1,791 |

Driving in St. Albert

St. Albert is a city with a small-town feel. While this city may be smaller than Calgary or Edmonton, it has all the amenities of a major urban center, such as exceptional community services, a thriving cultural scene, and well-planned neighbourhoods.

Here are some key facts about driving in St. Albert:

- Major highways: 2, 216, 633

- Public transit options: St. Albert Transit

- Ridesharing services: Uber, Lyft

- Parking space providers: The City of St. Albert, private lots

- Top tourist attractions: St. Albert Botanic Park, Musee Heritage Museum

- Busy intersections: St. Albert Trail and Giroux Road/Boudreau Road, St. Albert Trail and McKenney Avenue/Bellerose Drive, St. Albert Trail and Hebert Road/Gervais Road

- Airports: N/A

Main Mode of Commuting in St. Albert

92.1% of St. Albert’s commuters prefer travelling by car or other personal vehicle. The second-most popular commuting method is walking, which 3.4% of commuters prefer. Check the table below for more information on the modes of commuting used by St. Albert commuters:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 24,820 | 100.0 |

| Car, truck or van | 22,860 | 92.1% |

| Car, truck or van – as a driver | 21,645 | 87.2% |

| Car, truck or van – as a passenger | 1,215 | 4.9% |

| Public transit | 490 | 2.0% |

| Walked | 840 | 3.4% |

| Bicycle | 130 | 0.5% |

| Other method | 495 | 2.0% |

Commuting Duration in St. Albert

St. Albert’s small-town feel extends to its commute times. Around 70% of its commuters spend less than 29 minutes on the road, which is reasonably fast for a city of St. Albert’s size. Moreover, only 2.7% of its commuters take over an hour to get to work. Here’s a quick look at the commuting times in St. Albert:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 24,820 | 100.0 |

| Less than 15 minutes | 7,765 | 31.3% |

| 15 to 29 minutes | 9,730 | 39.2% |

| 30 to 44 minutes | 5,505 | 22.2% |

| 45 to 59 minutes | 1,150 | 4.6% |

| 60 minutes and over | 665 | 2.7% |

Driving Conditions in St. Albert

Roads in St. Albert often get snowed over, making driving risky. Driving on snowy roads without snow tires can increase your insurance premiums. Consider getting all-perils insurance to insure yourself against most dangers in St. Albert.

Here are a few facts about the driving conditions in St. Albert:

- Average daily commute time: X

- Average annual rainfall: 338 mm

- Average annual snowfall: 539 mm

- Rainy days per year: 123 days

- Rainiest month in St. Albert: July

- Driest months in St. Albert: January, December

- Snow days per year: 73 days

- Snowfall months in St. Albert: September – June

Traffic in St. Albert

Many St. Albert residents work within the city, but many others commute to Edmonton to work. St. Albert Trail is the busiest thoroughfare in St. Albert, and a majority of traffic incidents happen at intersections throughout St. Albert Trail.

Here are some facts about the traffic conditions in St. Albert:

- Population: 63,232 people live within St. Albert’s city limits.

- City area: St. Albert’s city limits span 47.84 km2.

- Average commute distance: The average St. Albert resident travels x km every day to their school or workplace.

- Busiest highways: St. Albert’s busiest road is St. Albert Trail.

- Average number of collisions: St. Albert sees 343 collisions a year.

The Most Common Questions About Car Insurance in St. Albert

How much does St. Albert car insurance cost?

St. Albert car insurance costs an average of $1,378 per year.

Is car insurance cheaper in St. Albert than Calgary?

Yes, car insurance in St. Albert is cheaper than in Calgary. The average annual car insurance rate in St. Albert is $1,378, while in Calgary, it’s $1,512.

What is the grid rating system in St. Albert all about?

The grid rating system in St. Albert determines the maximum insurance rates that companies are allowed to charge drivers. St. Albert car insurance companies are required to compare a driver’s projected insurance rate against the grid rate and charge the lower amount.

How you can get cheaper car insurance in St. Albert?

Compare car insurance rates in St. Albert with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.