Quick Facts About Auto Insurance in Ottawa

- Ottawa car insurance is LESS expensive than the Ontario average.

- The average annual car insurance cost in Ottawa for a driver with a clean record and comprehensive/collision coverage is around $1,439.

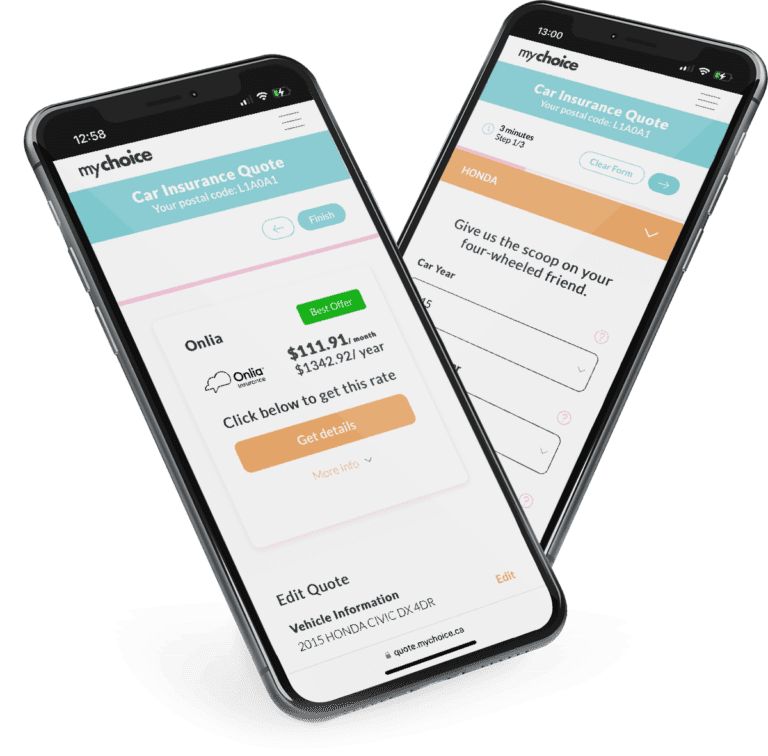

- Comparing Ottawa auto insurance quotes with MyChoice can save you up to $1,022 annually

The Best Car Insurance Brokerages in Ottawa

Auto insurance brokers help car owners by finding the right companies that meet their needs. In a sense, they become a buffer between car owners and insurance companies and do the nitty-gritty work of scouring for the best deals.

Consider working with following insurance brokers to help you find the best-rated policies in Ottawa:

| Brokerage | Address | Phone number |

|---|---|---|

| Tanner Insurance | 200-2435 Holly Ln Ottawa, ON K1V 7P2, Canada | +16132325704 |

| Gifford Carr Insurance Group | 2781 Lancaster Rd Unit 201 Ottawa, ON K1B 1A7, Canada | +16137474700 |

| Smith Petrie Carr & Scott Insurance Brokers Ltd | 359 Kent St #600 Ottawa, ON K2P 0R6, Canada | +16132372871 |

Most Expensive Postal Codes in Ottawa

Ottawa’s average auto insurance rate is a little over $1,439, with the provincial average for Ontario being around $1,673. There are 10 postal codes in Ottawa have higher-than-average auto insurance rates, including:

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| K1G, K1K, K1L | $1,468 |

| K1S, K2C, K2G, K2H, K2J, K2R, K1M | $1,458 |

Least Expensive Postal Codes in Ottawa

Average auto insurance rates are lowest in the suburban and semi-rural areas of Stittsville, Orleans, Greely, and Cumberland, making these the most affordable postal codes for car insurance in Ottawa:

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| K4C, K4P, K1C, K1E, K1W, K4A, K2S | $1,410 |

Car Insurance Cost in Ottawa by Age

Car insurance companies factor in age when computing premiums.

Younger people are charged more because they’re inexperienced and don’t have a long enough track record to prove whether or not they’re safe drivers. However, premiums also go up as people reach a certain age. Senior citizens are charged higher rates because they’re at a greater risk of being involved in an accident.

Let’s take a look at how auto insurance premiums vary across different age groups:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $5,137 | $1,022 |

| 21-24 | $2,936 | $584 |

| 25-34 | $1,957 | $389 |

| 35-44 | $1,439 | $286 |

| 45-54 | $1,179 | $235 |

| 55-64 | $1,003 | $199 |

| 65+ | $1,143 | $227 |

Car Insurance Cost in Ottawa by Driving History

Auto insurance premiums in Ottawa (like in any other city in Canada) are impacted by the driver’s driving history. The more traffic violations you have on your record, the higher your chances are of being labelled a high-risk driver, which raises your premiums. If you can maintain a clean record, you have a better shot at getting lower insurance premiums.

Take note that driving violations and accidents remain on your record for at least two years (sometimes even more), and they can influence your premiums for far longer.

Here’s a quick overview of how traffic violations can affect auto insurance rates for Ottawa drivers based on MyChoice’s price quote data:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,439 |

| Insurance cancellation due to non-payment | $2,360 |

| Licence suspension for alcohol-related offences | $1,727 |

| One accident | $3,166 |

| Speeding ticket | $1,871 |

Driving in Ottawa

Ottawa is the capital and fourth-largest city in Canada. It is located between two major cities, Toronto and Montreal, and surrounded by many other commuter towns that connect to the city via highways 417, 416, and 401. As such, highway driving is something that most people who live in and around Ottawa are used to.

Here are some key facts about driving in Ottawa:

- Major highways in Ottawa: Highway 417 (Trans-Canada Highway), Highway 416, Highway 401

- Public transit options: OC Transpo (bus and light rail train)

- Ridesharing services: Uber, Lyft, Facedrive

- Parking space providers: The City of Ottawa, private lots

- Top tourist attractions: Parliament Hill, Rideau Canal, Canadian War Museum, National Gallery of Canada, Peace Tower, Canadian Museum of Nature, National War Memorial, Diefenbunker or Canada’s Cold War Museum, Notre-Dame Cathedral Basilica, Canadian Tulip Festival, Byward Market

- Busy intersections: Hunt Club Road and Riverside Drive, Catherine Street and Kent Street, Innes Road and Tenth Line Road, Riverside Drive and Heron Road, Carling Avenue and Kirkwood Avenue N., Greenbank Road and Iris Street/417 East

- Airports: Ottawa International Airport

Main Mode of Commuting in Ottawa

Ottawa boasts 211,755 car, truck, or van users, making up over three-quarters of the city’s commuters. However, it also has a strong public transit user base with 31,015 commuters. Check the table below to learn what modes of commuting do Ottawans use:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 275,700 | 100.0 |

| Car, truck or van | 211,755 | 76.8% |

| Car, truck or van – as a driver | 190,190 | 69.0% |

| Car, truck or van – as a passenger | 21,565 | 7.8% |

| Public transit | 31,015 | 11.2% |

| Walked | 19,395 | 7.0% |

| Bicycle | 4,260 | 1.5% |

| Other method | 9,265 | 3.4% |

Commuting Duration in Ottawa

Ottawa has nearly 300,000 commuters, but the commute times aren’t as long as you might have assumed. Nearly 70% of Ottawa’s commuters spend less than 30 minutes on the road, with only 10% of them spending more than 45 minutes. Here’s a detailed look at commuting times in Ottawa:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 275,700 | 100.0 |

| Less than 15 minutes | 74,060 | 26.9% |

| 15 to 29 minutes | 116,260 | 42.2% |

| 30 to 44 minutes | 55,365 | 20.1% |

| 45 to 59 minutes | 15,975 | 5.8% |

| 60 minutes and over | 14,030 | 5.1% |

Driving Conditions in Ottawa

In 2019, Ottawa ranked third on the 2019 Driving Cities Index of the best cities for drivers in a survey by Mister Auto. The cities were ranked on factors like road quality, parking costs, gas prices, and congestion. However, winters in Ottawa can be quite severe, creating difficult and dangerous road conditions.

Here’s a quick look at the overall driving conditions in the city of Ottawa:

- Average daily commute time: 84 minutes round trip

- Average annual rainfall: 1068 mm

- Average annual snowfall: 11135 mm

- Rainy days per year: 149.6 days

- Rainiest month in Ottawa: October

- Driest month in Ottawa: September

- Snow days per year: 83.3 days

- Snowfall months in Ottawa: October – May

Traffic in Ottawa

In a recent report, Ottawa was ranked the fourth most congested city in Canada and 139th worldwide. This may be attributed to the fact that 62.65% of Ottawans drive to work.

As expected, congestion becomes particularly bad during rush hour or weekday mornings from 6:30 am to 9 am and afternoons from 3 pm to 6 pm. This is most notable in major roads connecting suburbs to the downtown core.

Here’s a snapshot of what driving is like in Ottawa:

- Population: The Ottawa-Gatineau metropolitan area is home to 1,017,449 people.

- City area: The whole Ottawa-Gatineau metropolitan area measures roughly 2,790 km².

- Average commute distance: The average Ottawan commutes 7.8 km daily.

- Time spent in traffic annually: Most Ottawans waste about 31 hours stuck in traffic over 240 commuting days annually.

- Busiest roads: Carling Avenue, Hunt Club Road, and Innes Road are among the busiest roads in Ottawa.

The Most Common Questions About Car Insurance in Ottawa

How much does Ottawa car insurance cost?

Auto insurance in Ottawa costs roughly $1,439 on average.

Is car insurance cheaper in Ottawa than in Toronto?

Car insurance in Ottawa is significantly cheaper than insurance in Toronto. The average rate of insurance premiums in Toronto is around $2,139.

Why should you compare car insurance rates in Ottawa?

You should compare car insurance rates because rates vary wildly from company to company. While insurers consider similar factors when evaluating clients, they each have their own way of calculating quotes.

How can you get cheaper auto insurance in Ottawa?

Compare car insurance rates in Ottawa with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.