Quick Facts About Auto Insurance in Aurora

- Aurora car insurance is MORE expensive than the Ontario average.

- The average annual car insurance cost in Aurora for a driver with comprehensive/collision coverage and a clean record is around $1,754.

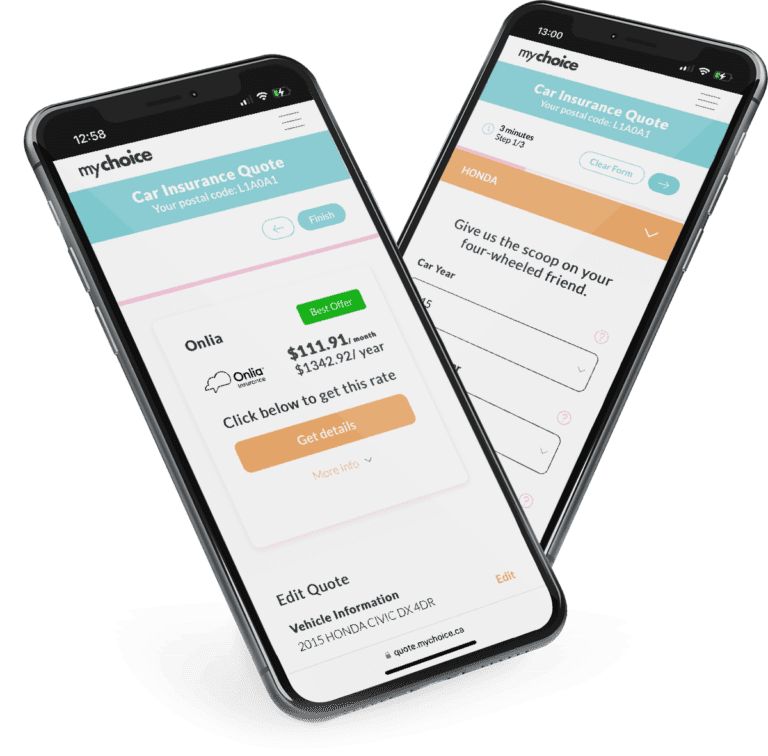

- Comparing Aurora auto insurance quotes with MyChoice can save you up to $1,245 annually.

The Best Car Insurance Brokerages in Aurora

Car insurance brokers can answer your questions and help you find car insurance coverage with the best value in Aurora. With more information about your vehicle make, driving history, and driving habits, they can comb through multiple quotes and simplify your selection process.

Here are some reputable car insurance brokerages in Aurora. Contact them through their details below if you need auto insurance assistance:

| Brokerage | Address | Phone number |

|---|---|---|

| BrokerLink | 238 Wellington St E Suite 400 Aurora, ON L4G 1J5, Canada | +19057274605 |

| McAuley Insurance Brokers | 4 Vata Ct unit 30 Aurora, ON L4G 4B6, Canada | +19057732995 |

| Choice Insurance Brokers Inc | 225 Industrial Pkwy S Aurora, ON L4G 3V5, Canada | +19058413000 |

Auto Insurance by Postal Code in Aurora

The average car insurance rate in Aurora, ON is $1,754/year, slightly above when compared to Ontario’s provincial average of $1,673/year and L4G is Aurora’s only postal code, so it has the highest car insurance premiums by default.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L4G | $1,754 |

Car Insurance Cost in Aurora by Age

Auto insurers in Canada factor in your age as part of your risk assessment.

Generally, older drivers who are 65 years old have higher car insurance premiums. This is because senior citizens are considered more likely to get into an accident due to the poorer vision and slower reflexes associated with old age. They’re also considered more likely to be harmed or to die if they get into a car accident.

However, you don’t necessarily get lower premiums just because you’re young. In fact, younger drivers below the age of 25 also have high car insurance premiums. Auto insurers consider young drivers as less experienced on the road, making them more likely to get into an accident or commit a traffic violation.

Take a look at our table below to see how your age affects the cost of your Aurora car insurance and how much you can save every year with My Choice:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $6,262 | $1,245 |

| 21-24 | $3,578 | $712 |

| 25-34 | $2,385 | $474 |

| 35-44 | $1,754 | $349 |

| 45-54 | $1,438 | $286 |

| 55-64 | $1,223 | $243 |

| 65+ | $1,394 | $277 |

Car Insurance Cost in Aurora by Driving History

Your driving history is used by auto insurers to measure the risk that you’ll get into an accident, so it can have a significant effect on your car insurance premiums.

Generally, drivers who have many speeding tickets and other traffic violations on their records will have the highest car insurance premiums. They’re considered “high-risk” drivers who are more likely to be careless or re-offend, costing car insurers more to cover them. Drivers with a clean record, on the other hand, typically enjoy the lowest car insurance premiums in Aurora.

Your demerit points, tickets, and driving violations only stay on your Ontario record for two years, but Aurora car insurers may check as far back as 10 years to measure your accident risk. This means even old violations can increase the cost of your car insurance.

Here’s a quick look at how different driving violations affect your Aurora car insurance premiums:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,754 |

| Insurance cancellation due to non-payment | $2,877 |

| Licence suspension for alcohol-related offences | $2,105 |

| One accident | $3,859 |

| Speeding ticket | $2,280 |

Driving in Aurora

Found within the Golden Horseshoe area of Southern Ontario, the town of Aurora is known for preserving its historical architecture, earning it the Prince of Wales Prize for Municipal Heritage Leadership in 2008. Lake Ontario is also just south of this picturesque town, while Lake Simcoe lies to the north.

Its natural beauty, rich history, and proximity to the Greater Toronto Area make it an attractive place to live in. However, residents often complain about the length of their commutes.

What’s it like to drive in Aurora? Here are some key facts about driving in this town:

- Major highways in Aurora: 404, 407, 401

- Public transit options: York Regional Transit (bus), Viva (rapid transit bus; also operated by York Regional Transit)

- Ridesharing services: Uber, Lyft

- Parking space providers: The Town of Aurora, private lots

- Top tourist attractions: Aurora Historical Society & Hillary House, Aurora Arboretum, Aurora Cultural Centre, Sheppard’s Bush Conservation Area, Canadian Moments Mural, Willow Farm, Lakeview & Wimpey Trail

- Busy intersections: Yonge Street and Wellington Street, Highway 48 (from Bloomington Road) and Smith Boulevard, Aurora Heights Drive (from Bathurst Street) and Yonge Street

- Airports: N/A

Main Mode of Commuting in Aurora

The majority of commuters in Aurora prefer travelling by car. However, public transportation is reasonably popular, taking a 4.7% share of all the town’s commuters. Cyclists are in the minority, numbering just 100 people as of the latest census. Here’s a detailed look at the commuting preferences of Aurora residents:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 18,335 | 100.0 |

| Car, truck or van | 16,320 | 89.0% |

| Car, truck or van – as a driver | 15,165 | 82.7% |

| Car, truck or van – as a passenger | 1,160 | 6.3% |

| Public transit | 870 | 4.7% |

| Walked | 545 | 3.0% |

| Bicycle | 100 | 0.5% |

| Other method | 500 | 2.7% |

Commuting Duration in Aurora

There’s a relatively even spread between commuting times in Aurora. Half of the town takes under 30 minutes to get to work, while the other half takes over 30 minutes. Here’s a detailed breakdown of commuting times in Aurora:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 18,335 | 100.0 |

| Less than 15 minutes | 4,615 | 25.2% |

| 15 to 29 minutes | 4,425 | 24.1% |

| 30 to 44 minutes | 4,770 | 26.0% |

| 45 to 59 minutes | 2,430 | 13.3% |

| 60 minutes and over | 2,090 | 11.4% |

Driving Conditions in Aurora

Snowfall, rain, and commute time are just some of the many driving conditions that can affect road safety. Road safety has a significant impact on your driving risk, and, consequently, the cost of your car insurance.

Here’s an overview of the average driving conditions in Aurora:

- Average daily commute time: 2 hours round trip

- Average annual rainfall: 662 mm

- Average annual snowfall: 549 mm

- Rainy days per year: 146.2 days

- Rainiest month in Aurora: June

- Driest months in Aurora: February, December

- Snow days per year: 56.7 days

- Snowfall months in Aurora: January – May, October – December

Traffic in Aurora

Aurora, ON is considered a “bedroom community” for the Greater Toronto Area, with many of its residents commuting to workplaces in Toronto, Barrie, and Vaughan. Though the town has multiple bus routes, many Aurora residents opt to drive to their workplaces, which can lead to heavy traffic during peak hours.

Here’s a quick overview of the key traffic statistics in Aurora:

- Population: 62,057 people live within Aurora’s town limits.

- Town area: Aurora’s town limits span 50 km2.

- Average commute distance: The average Aurora resident travels 25 km every day to their school or workplace.

- Time spent in traffic annually: The average Aurora resident spends 2 hours in traffic daily, totalling roughly 730 hours per year.

- Busiest road: Aurora’s busiest road is Yonge Street.

The Most Common Questions About Car Insurance in Aurora

How much does Aurora car insurance cost?

Aurora car insurance costs $1,754/year.

Is car insurance cheaper in Aurora than in Toronto?

Yes, car insurance is cheaper in Aurora than in Toronto. The average cost of car insurance in Aurora is $1,754/year, while the average cost of car insurance in Toronto is $2,139/year.

How can you get cheaper car insurance in Aurora?

Compare car insurance rates in Aurora with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.