Save On Car Insurance With Multi Vehicle Insurance

Car insurance is a major bill for drivers in Canada and there is always an interest in trying to save money when it comes to their insurance. One common way to save is by bundling policies, and families with multiple cars have the option to bundle their cars into multi-vehicle insurance.

When Multi Vehicle Insurance Makes Sense

Multi-car insurance is generally a good option with it being a simple way to get lower rates. Multi-vehicle insurance is good for a single person who owns multiple vehicles and for families where the primary drivers have similar driving histories.

Multi-vehicle insurance is especially useful when insuring non-standard vehicles such as boats or RVs. This is because it can be difficult to find a broker for these vehicles and because most people will only insure these types of vehicles for part of the year. A multi-vehicle policy makes it possible to add a vehicle to a policy within minutes.

Finally, multi-vehicle insurance allows you to make a single payment for multiple vehicles. This adds convenience, especially for people who are insuring a large number of vehicles.

What Is Multi Vehicle Insurance

Multi-vehicle insurance is simply a policy that covers more than one vehicle compared to a standard policy that covers each vehicle. Insurance companies promote multi-vehicle insurance as it brings more business to them.

Numerous Benefits To Customers

Insurers will generally reward their customers with a discount on premiums. In addition, multi-vehicle insurance simplifies the process of paying your premiums.

Bundling Non-Standard Vehicles

Multi car insurance does not require you to bundle your insurance with your typical personal cars and trucks. It is possible to have multi vehicle insurance for such things as:

- Boats

- RVs

- Motorcycles

- Snow Mobiles

When To Avoid Multi Vehicles Insurance

Multi vehicle insurance is generally good when insuring drivers with similar driving histories. However, it may not be good when insuring someone such as an inexperienced driver who will almost always have to pay high insurance premiums. In these cases, it may be cheaper to simply purchase separate insurance for a new driver.

Commonly Asked Questions About Multi Vehicle Insurance

Can I Add Another Vehicle To My Existing Policy?

Most insurers will allow you to simply add another vehicle to your existing insurance policy with them offering you a discount for doing so. This makes it simple for you to receive insurance when you purchase a new vehicle.

Can I Adjust My Multi Vehicle Insurance For Each Vehicle?

You can generally adjust your insurance coverage for each vehicle. This is a good feature as it allows you to have basic coverage for an older vehicle that you want the lowest possible premiums for. You can then have comprehensive coverage for your newer vehicle that you want to protect.

Will A Claim On One Vehicle Affect My Overall Rates?

Insurance premiums are based on driving history. This means that an insurance claim will affect overall rates regardless of you having a single or multi vehicle policy.

Get a Great Quote For Multi Car Insurance With Us!

You should compare your multi vehicle insurance with single vehicle insurance to make sure that you are getting the lowest rates possible.

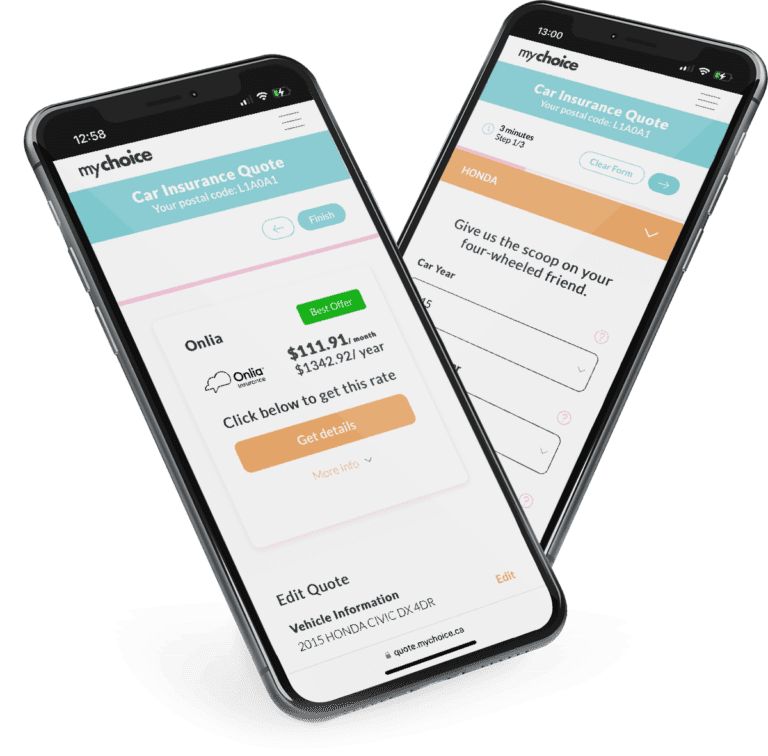

Here at, MyChoice we make it easy for you to compare multi vehicle and single vehicle insurance from all major providers.