How Can You Get Cheap Car Insurance in Scarborough?

You can get cheap Scarborough car insurance by finding the best deals. Here are several tips to help you do so:

Compare Rates Between Insurers

Scarborough has a highly competitive auto insurance market, so insurers are constantly vying for your business. When insurers try to give you the best deals, it’s you who wins. Compare rates and shop around to see which insurance provider fits your auto protection needs affordably.

Take Bundled Policies

One of the best ways to save money while shopping is to buy a package deal, and insurance is no different. If you bundle home and auto insurance from the same company, you’re much more likely to get lower rates.

Ask For A Higher Deductible

You must pay a deductible on insurance claims before your carrier covers the remaining expenses. A higher deductible means paying extra if something happens to your car, but it also means you’ll get lower insurance premiums.

Request Group Discounts

Many insurance companies deal in group discounts for companies and other organizations. If you’re shopping for auto insurance in Scarborough for work, ask your agent about group deals and discounts.

Pay Annual Premiums

Paying annual insurance premiums might look expensive initially, but it’s generally cheaper than paying them monthly. Ask your insurers about half-year premiums if you can’t afford annual premiums.

Drive Safely

Motor vehicle offences and accidents stay on your record for years. Unfortunately, any driving violation on your record will considerably increase your insurance rates. However, this also means you’ll get lower auto insurance rates if you have no offences on record.

Consider Taking Usage-Based Insurance

Usage-based insurance (UBI) or pay-as-you-go insurance tracks your driving behaviour to determine how much you must pay for insurance. Taking UBI lets you save up to 30% on your annual premiums, so it’s a good option if you consider yourself a safe driver.

Take Driving Courses

Accredited driving lessons make you a safer driver and let you earn discounts on auto insurance in Scarborough.

Choose the Coverage You Need

Naturally, more insurance protection leads to higher rates. While some auto insurance coverage is mandatory, you have optional insurance coverage like at-fault accident and theft protection. Review your policy and skip unnecessary optional coverage to save on insurance premiums.

Buy Affordable Cars

Cars that are expensive and hard to replace tend to get hit with higher premiums. If possible, buy affordable and reliable cars that are more common and easy to repair or replace if you want lower insurance rates.

Quick Facts About Auto Insurance in Scarborough

- Scarborough car insurance is MORE expensive than the Ontario average.

- The average annual car insurance cost in Scarborough for a driver with comprehensive/collision coverage and a clean record is around $2,710.

- Comparing Scarborough auto insurance quotes with MyChoice can save you up to $1,924 annually.

Who Provides Car Insurance Quotes in Scarborough?

Insurance brokers, agents, aggregators, and direct writers provide car insurance quotes in Scarborough. Here’s an overview of these four insurance quote providers:

Insurance Brokers

Insurance brokers are independent professionals who help you shop for the best rates by comparing deals from multiple insurers. Because they have a bird’s-eye view of the current Scarborough insurance landscape, they can show you which companies offer the best insurance deals and answer any questions you may have.

Brokers take a commission from insurance companies, which could increase your rates. You might spend more money than if you had found an insurer yourself.

Direct Writers

Like insurance agents, direct writers only sell insurance products from one company. Direct writers are typically found online and are cheaper because they don’t have physical offices.

Insurance Agents

Insurance agents work for a certain insurer, so they can only offer their employer’s insurance products. However, they know their insurer like the back of their hands and might even give you discounts that brokers don’t have access to.

Additionally, insurance agents can close insurance sales independently, meaning you can purchase insurance from them right then and there.

Insurance Aggregators

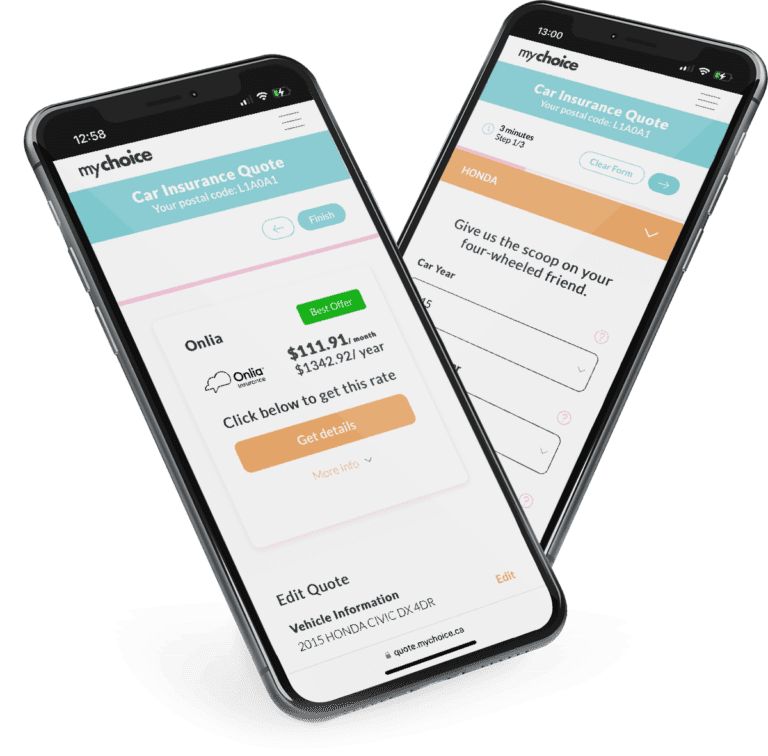

An insurance aggregator website like MyChoice compiles rates from various insurance brokers, companies, and direct writers in one place. You can browse aggregator websites to find the best deals from the top insurance companies and get quotes instantly.

Better yet, insurance aggregators are accessible online and entirely free for customers, so you can look up insurance rates without spending a single penny or leaving the house.

The Best Car Insurance Brokerages in Scarborough

If you find shopping for car insurance overwhelming, working with a brokerage in Scarborough can take some of the weight off your shoulders.

With their help, you can get your fair share of coverage options without having to do the heavy lifting. Below are some of the best brokerages in Scarborough:

| Brokerage | Address | Phone number |

|---|---|---|

| Youngs Insurance Brokers Scarborough | 55 Crockford Blvd Unit 1 Scarborough, ON M1R 3B7, Canada | +14162849470 |

| All-Risks Insurance Brokers Limited | 4465 Sheppard Ave E #201 Scarborough, ON M1S 5H9, Canada | +12898594688 |

| William G. Waters Insurance Brokers Limited | 2596 Midland Ave Scarborough, ON M1S 1R5, Canada | +14162911097 |

| All Seasons Insurance | 4865 Sheppard Ave E #8 Scarborough, ON M1S 3V8, Canada | +14166287754 |

How Does Car Insurance Work in Scarborough?

Car insurance in Scarborough works by providing financial coverage in case something bad happens to you or your car, depending on the protection you choose. Auto insurance in Scarborough is mandatory by local laws, which means you need car insurance to avoid fines or driver’s licence suspensions.

Worse still, if you get convicted of driving without insurance, you’ll get higher premiums from carriers. This makes driving again prohibitively expensive or even nearly impossible after being caught driving without insurance. That’s why getting auto insurance is essential before buying a car or driving in Scarborough.

Here’s a breakdown of the key elements of your auto insurance policy:

The mandatory car insurance requirement for Scarborough drivers are:

Third-Party Liability (TPL) Coverage

This insurance component provides financial compensation if you cause an accident that results in car damage or somebody getting hurt or killed. Per Financial Services Commission of Ontario (FSCO) regulations, you need at least $200,000 in TPL coverage.

Statutory Accident Benefits Coverage

This insurance component pays for your medical bills, rehabilitation, and possible funeral expenses if you get hurt or killed in a car accident, regardless of who’s at fault. Accident benefits coverage also offers income replacement worth 70% of your gross income, capped at $400 per week.

Uninsured Automobile Insurance

Uninsured automobile insurance covers your medical bills and funeral expenses if you’re struck by uninsured vehicles or hit-and-run drivers. Additionally, it compensates for vehicular damage caused by uninsured drivers.

Direct Compensation – Property Damage (DC-PD) Insurance

DC-PD insurance compensates you for the damage other drivers cause in an accident. However, DC-PD only kicks in if the other person is at fault, they’re also insured, and the accident takes place in Scarborough.

Once you meet the minimum car insurance coverage requirements, you can legally drive in Scarborough. However, it pays to have extra protection beyond the basics in case you get in an accident.

Since minimum car insurance only goes so far, we’ve got some extra Scarborough car insurance recommendations for you:

Extra TPL Coverage

The mandatory $200,000 insurance minimum can be too small, so many drivers choose to get coverage up to $2 million if they cause property damage or hurt somebody in an accident.

Additional Statutory Accident Benefits

Many people get additional coverage for medical bills and funeral expenses in their statutory accident coverage. You can also get extra income replacement protection if 70% income capped at $400 a week seems too limited.

More Comprehensive Property Damage Protection

DC-PD coverage has very specific coverage terms like the other driver also needs to be insured, and the accident must occur in Scarborough. To cover their bases, many people purchase extra insurance that still protects them even when the other driver is uninsured, and the accident happens in other provinces.

In addition to mandatory insurance coverage outlined by the FSCO, you can take optional insurance coverage like:

Specified Perils Protection

Specified perils insurance coverage protects you from loss or damage due to a specific cause. The most common perils insured are:

- Car theft

- Fire, earthquake, and explosion

- Weather, which includes windstorms, hail, and lightning

Many insurers also offer comprehensive auto insurance in Scarborough if you want protection from all these perils.

Accident Forgiveness

Insurers usually raise your premiums if you’re at fault for causing an accident. If you’ve been a safe driver for several years, you can take extra accident forgiveness coverage so you won’t get higher premiums if you cause an accident. Note that accident forgiveness only works on your first accident, and subsequent violations will still raise your rates.

Limited Depreciation Waiver

If you take a limited waiver of depreciation, you can receive your car’s purchase price as compensation if it’s been stolen or deemed a total loss after an accident.

How Your Car Insurance Quotes Are Calculated in Scarborough

Your car insurance rates are calculated based on how risky you are to insure. Naturally, drivers more likely to get into accidents will have higher premiums than those less likely to be in an accident.

Here are seven factors that influence your Scarborough car insurance quotes:

Age, Gender, and Marital Status

Your personal demographics influence auto insurance premiums in Scarborough because different people have varying accident risks.

Younger people tend to get higher premiums because insurance companies see them as more accident-prone than older people. Generally, your car insurance rates start decreasing when you hit 25 years old as long as you keep a safe driving record. However, insurance premiums increase again for people aged 65 and older because they’re more likely to be injured or killed in traffic accidents.

Women often get lower insurance rates because they’re seen as more careful drivers and don’t take as many risks as men.

Marital status also determines your rates because most insurance companies see married people as more financially stable and less-risky drivers. Married couples also tend to bundle home and auto insurance, saving more on premiums.

Location

People who live in urban areas often see higher insurance premiums because they’re more prone to car accidents and theft.

Car Make and Model

Expensive cars are more costly to repair or replace, so insurance premiums are usually higher than more common vehicles. You can install security features like anti-theft devices if you have an expensive car and want to save on insurance premiums.

Driving History

People who drive safely are rewarded with lower premiums because they’re usually less likely to get into a traffic accident. Conversely, people who have gotten into multiple accidents get higher premiums because they’re more likely to be involved in another accident down the line.

Driving Activity

Logic dictates that people who drive frequently are more likely to get in an accident. Therefore, kilometres driven is one of the determining factors that set your Scarborough auto insurance rates.

Insurance Coverage Chosen

Your coverage options influence your insurance rates because taking more coverage gives you more protection. Naturally, the more coverage you choose, the higher your rates.

Policy Discounts

Getting discounts can lower your auto insurance rates and make them more affordable. You can typically get discounts by bundling home and auto insurance or asking for a group discount for your workplace or organization.

Most Expensive Postal Codes in Scarborough

While the city’s average is $2,710, you can expect car insurance rates to vary depending on where in Scarborough you’re located, the most expensive postal codes in the area are M1B and M4C.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| M1B, M4C | $2,823 |

| M1N | $2,821 |

| M4E, M1C | $2,818 |

Least Expensive Postal Codes in Scarborough

Some of the cheapest postal codes in Scarborough for auto insurance are M1H and M1T.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| M1H, M1T | $2,605 |

| M1J | $2,609 |

| M1V | $2,610 |

Car Insurance Cost in Scarborough by Age

As with any region in Canada, younger drivers in Scarborough can expect to pay higher insurance rates because of their lack of experience on the road. Fortunately, there are ways to keep your premiums low as a student driver. For instance, you can attend regular driving school, apply for a student discount, or list yourself as a secondary driver on a parent’s existing plan.

On the other end of the spectrum are senior drivers, who also pay higher insurance rates because of their likelihood of being critically injured in an accident.

Take a closer look below at how age can impact your insurance rates:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $9,675 | $1,924 |

| 21-24 | $5,529 | $1,091 |

| 25-34 | $3,686 | $733 |

| 35-44 | $2,710 | $539 |

| 45-54 | $2,222 | $442 |

| 55-64 | $1,889 | $376 |

| 65+ | $2,153 | $428 |

Car Insurance Cost in Scarborough by Driving History

Like age, a history of claims and traffic tickets can affect your insurance rates. Drivers with a poor driving record can expect to pay higher rates, as insurers consider them high-risk drivers.

Not all driving violations have the same effect on your premiums. More severe accidents will increase your rates more than minor convictions, such as speeding tickets.

How long a conviction stays on your record also depends on where you’re from. Generally, minor violations like speeding tickets stay on your record for three years.

Below is a general estimate of how certain driving violations can affect your insurance rates:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $2,710 |

| Insurance cancellation due to non-payment | $4,444 |

| Licence suspension for alcohol-related offences | $3,252 |

| One accident | $5,962 |

| Speeding ticket | $3,523 |

Other Factors That Affect Car Insurance Prices in Scarborough

We’ve covered several factors that influence car insurance rates in Scarborough. Aside from those, several extra factors play a part in determining your Scarborough auto insurance premiums:

Vehicle Model Accident Rates

Some cars are just more accident-prone than others. Even if you have a spotless driving record, owning a car model infamous for having high accident rates will increase your insurance premiums.

Vehicle Age

Naturally, older cars are more expensive to insure because they may not have all the safety features of newer vehicles. If you insist on driving a vintage car everywhere, make sure you can pay the insurance premiums.

Vehicle Repair Costs

The harder it is to repair a car, the more expensive it is to insure. You can expect high insurance premiums on luxury cars and foreign cars that don’t have a large dealership or service centre presence in Canada.

Vehicle Primary Usage and Annual Mileage

You may spend more or less time on the road depending on what you use the car for. Car usage influences insurance rates – generally, the more you use it, the higher your premiums. For instance, insurance premiums on a car you use as an Uber will be higher than on a car you almost exclusively take on weekend cruises.

A good way to measure how much somebody uses a car is by its annual mileage. If your car has low annual mileage, insurers may determine that this car is low-risk and thus grant you more affordable insurance rates.

Local Crime Rates

Living in high-crime areas means your car is at higher risk of being stolen or vandalized. If you live in an area where theft or vandalism often occurs, you may get higher car insurance rates.

Past Insurance Claims

Any auto insurance claims will drive your premiums up, regardless of who’s at fault. If you make many insurance claims, the insurer will see you as a high-risk policyholder and give you higher rates.

Loyalty Bonuses

Many insurance companies reward long-term customers with discounted rates. If you’ve been a policyholder at the same insurance company for several years, ask for a rate reduction or discount when you renew your policy.

Driving in Scarborough

Driving in Scarborough can be challenging, thanks to frequent storms and traffic within the Greater Toronto Area. In addition, the city attracts many immigrants and students, so expect to see many new drivers on the road. Make sure you drive extra carefully around campuses, and be patient with learning drivers!

Keep these other vital facts in mind when driving in Scarborough:

- Major highways: Highway 401

- Public transit options: Scarborough Centre Station, Scarborough Rapid Transit

- Ridesharing services: Uber, Lyft, Ola, Didi

- Parking space providers: City of Scarborough, private lots

- Top tourist attractions: Toronto Zoo, Scarborough Bluffs Park, CN Tower, Casa Loma, Rouge Park, Guild Park, Scarborough Museum

- Busy intersections: Lawrence Avenue East to Scarborough Golf Club Road, Steeles Avenue East and Pharmacy Avenue to Esna Park Drive

- Airports: Billy Bishop Toronto City Airport

Main Mode of Commuting in Scarborough

Scarborough has a sizable public transit user base, being used by a quarter of the city’s commuters. While a lion’s share of commuters still use cars, the percentage is much lower at 69.5%. Here’s a closer look at the main modes of commuting in Scarborough:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 188,895 | 100 |

| Car, truck or van | 131,320 | 69.5% |

| Car, truck or van – as a driver | 114,550 | 60.6% |

| Car, truck or van – as a passenger | 16,765 | 8.9% |

| Public transit | 46,770 | 24.8% |

| Walked | 5,465 | 2.9% |

| Bicycle | 745 | 0.4% |

| Other method | 4595 | 2.4% |

Commuting Duration in Scarborough

Scarborough is located in the busy Greater Toronto Area, so commute times can be rough at times. About a quarter of Scarborough’s commuters spend 30 to 44 minutes getting to work, while another quarter spend 15 to 29 minutes. Here’s a detailed look at Scarborough’s commuting duration:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 188,895 | 100.0 |

| Less than 15 minutes | 29,865 | 15.8% |

| 15 to 29 minutes | 54,750 | 29.0% |

| 30 to 44 minutes | 50,955 | 27.0% |

| 45 to 59 minutes | 23,195 | 12.3% |

| 60 minutes and over | 30,125 | 15.9% |

Driving Conditions in Scarborough

Scarborough tends to experience long and cold winters that can make driving tricky without winter tires. In addition, Scarborough gets its fair share of storms, so you’ll want to be prepared year-round.

Here are a few other facts about driving conditions in Scarborough that you should know:

- Average daily commute time: 90 minutes round trip

- Average annual rainfall: 33.25 mm

- Average annual snowfall: 790 mm

- Rainy days per year: 46 days

- Rainiest month in Scarborough: June

- Driest months in Scarborough: February

- Snow days per year: 61 days

- Snowfall months in Scarborough: January – May, November – December

Traffic in Scarborough

While commute times in the Greater Toronto Area have decreased over the years, getting around Scarborough still takes significant time. Traffic within the area can get extreme, especially around Highway 401.

Here are a few other facts about traffic conditions in Scarborough:

- Population: Roughly 629,941 people live in Scarborough.

- City area: The Scarborough city limits span 187.7 km2.

- Busiest highways: The busiest highway in the Scarborough area is Highway 401.

The Most Common Questions About Car Insurance in Scarborough

Can car insurance brokers in Scarborough help you save on car insurance?

Yes, car insurance brokers in Scarborough can help you save on car insurance by shopping around for the best rates.

Is ridesharing insurance available in Scarborough?

Yes, ridesharing insurance is available in Scarborough for Uber and Lyft.

How much does Scarborough car insurance cost?

Scarborough car insurance costs $2,710/year on average.

Is car insurance cheaper in Scarborough than in Toronto?

No, car insurance isn’t cheaper in Scarborough than in Toronto. By comparison, the average car insurance rate in Toronto is $2,139.

Why should you compare car insurance rates in Scarborough?

You should compare car insurance rates in Scarborough to avoid paying more than you can afford. Rates are generally higher in this area, so you should shop for a plan with the best value.

What is the best car insurance for new immigrants in Scarborough?

The best car insurance for new immigrants in Scarborough will vary depending on your driving history. You can save money on car insurance for new immigrants by increasing your deductible, enrolling in driving classes, and using an insurance broker.