Having an auto insurance policy is a requirement if you want to drive in Canada. But if you don’t drive a lot, the cost of yearly auto insurance premiums can seem exorbitant, leading many to ask “how much insurance do you really need?” With pay-as-you-go insurance, you can save money by only paying for auto insurance when you drive your car, as opposed to paying for a full coverage policy.

Pay-as-You-Go Car Insurance at a Glance

- Pay-as-you-go car insurance allows you to only pay for car insurance based on the number of kilometres you drive per year.

- This type of insurance allows you to save more on your car insurance the less you drive.

- Typically, pay-as-you-go insurance is only worth it if you drive less than 12,000 kilometres per year.

What are the pros and cons of pay-as-you-go insurance? Who would benefit the most from this kind of coverage? Read on to find out more about pay-as-you-go car insurance and if it’s the right option for you.

How Does Pay-as-You-Go Car Insurance Work?

Pay-as-you-go car insurance, also known as usage-based insurance (UBI) or telematics insurance, is a type of auto coverage that tracks your driving behaviour and mileage to determine your premium. When you take out a pay-as-you-go policy, you pay an initial rate plus the cost of the first 1,000 kilometres and have a small tracker called a telematics device installed on your vehicle. This device tracks your driving habits, collecting data such as distance per drive, the time you drive, acceleration and braking patterns, and the speed of your car, which it then sends to your insurance company.

Your insurer will use the data gathered by the telematics device to calculate your insurance rate based on predetermined thresholds for distance and safety. If you only drive during the day, following speeding laws and driving safely, your rate will be much lower than if you drive recklessly at night.

Insurance companies that offer pay-as-you-go insurance typically have an app that you can download to track your usage. You’ll need to pay an additional rate for every 1,000 km that you drive, making tracking your distance driven essential if you want to save the most money.

Who Should Consider Pay-as-You-Go Car Insurance?

Pay-as-you-go car insurance is most beneficial to people who don’t typically drive as part of their daily routine. In cities like Toronto, it’s common for car owners to take public transit to and from work, but take their car out for groceries, errands, and weekend trips. A full auto insurance policy in Toronto might not be the best for these kinds of commuters, with pay-as-you-go insurance offering much more value for money.

Since the COVID-19 pandemic, many Ontario citizens have eliminated the need to drive to work because of the prevalence of work-from-home situations. However, these workers usually still have their cars around for other reasons. Changing your policy from a traditional auto insurance policy to a pay-as-you-go one can drastically lower the amount you pay for insurance if you work from home.

Pay-as-you-go insurance is an excellent option for drivers renting a car for a short time. Since rental cars need insurance before they can be driven, taking out a full insurance policy can be an unnecessary expense. Taking out a pay-as-you-go policy is a far better option that gives you more flexibility with your insurance premium.

Which Companies Offer Pay-as-You-Go Insurance?

At this time, only CAA offers a pay-as-you-go option for car insurance. While other companies also offer telematics-based insurance policies, they’re mostly focused on lowering your premiums by monitoring driving habits, and not the distance you drive.

CAA’s MyPace program allows drivers to pay a base rate plus a fee for every 1,000 kilometres driven, making it ideal for those who drive less than 12,000 kilometres annually. The program features a telematics device that only tracks mileage and notifies users when they approach the next billing increment. Savings can reach up to 50% compared to traditional insurance, but the benefits decrease as mileage increases, especially beyond 12,000 kilometres.

The MyPace program is also available to drivers in New Brunswick, Nova Scotia, and Prince Edward Island, in addition to Ontario. Take note that the MyPace program has a strict mileage limit of 12,000 kilometres. If you exceed this limit, CAA will automatically switch you to a traditional car insurance policy.

Pros and Cons of Pay-as-You-Go Car Insurance

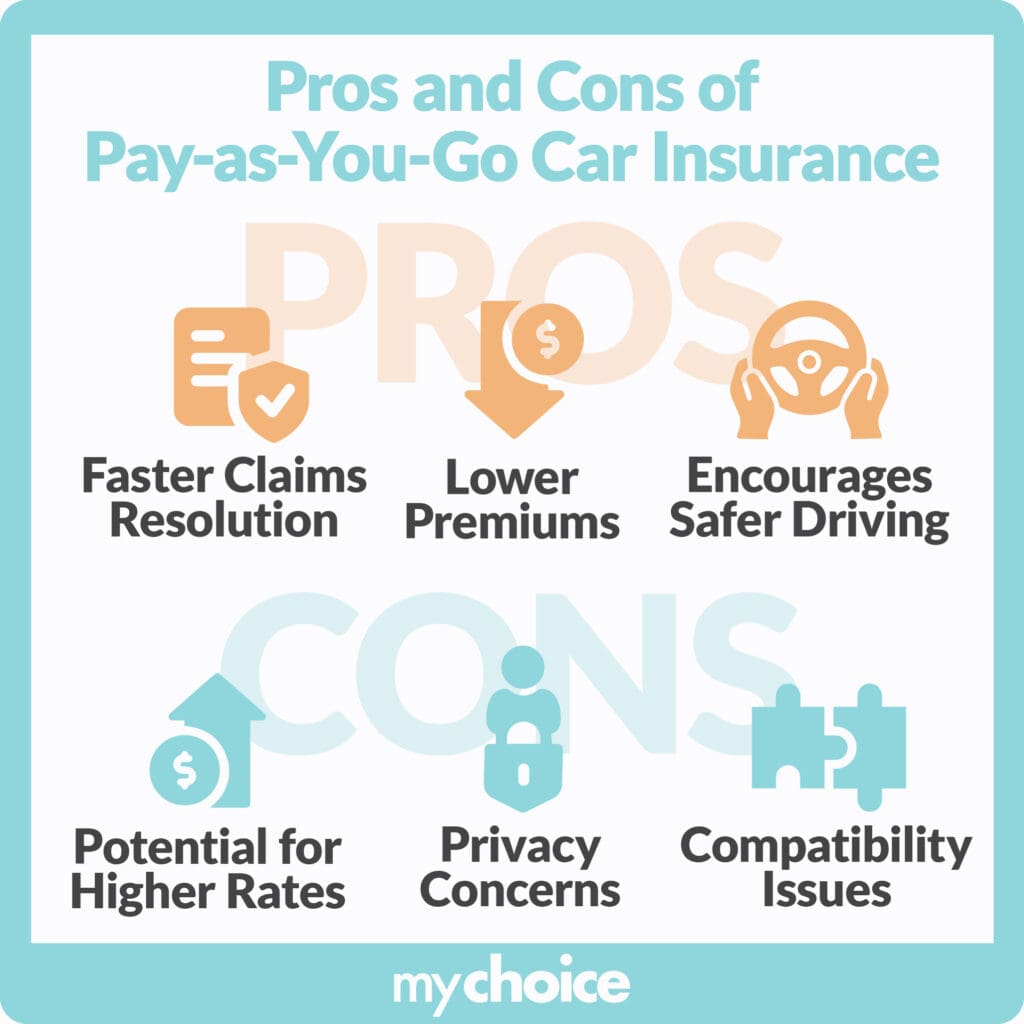

Compared to traditional auto insurance policies, pay-as-you-go insurance offers many benefits, but also has some drawbacks due to the nature of the tracking device placed in your car. Here are some pros and cons of pay-as-you-go car insurance:

- Lower Premiums: The biggest advantage of pay-as-you-go insurance is the potential to save money. Since you’re only paying for kilometres you actually drive, you aren’t wasting any money paying for insurance when not using your car. Additionally, some policies offer discounts based on how little and how safe you drive.

- Encourages Safer Driving: Having a device that monitors your driving can encourage you to drive more safely and avoid risky behaviours like speeding, aggressive acceleration and hard braking. This not only saves you money on your insurance, but it also makes the roads safer for everyone.

- Faster Claims Resolution: If you are involved in an accident, the insurance company has access to detailed driving data that can potentially help resolve claims faster and more accurately.

- Privacy Concerns: Many drivers can be uncomfortable with the idea of having their driving monitored so closely. The telematics device collects a significant amount of data, including your GPS location, which some may view as an invasion of privacy.

- Potential for Higher Rates: While pay-as-you-go insurance is designed to save you money, there is a risk that your rates could be higher if your driving is deemed unsafe or you exceed your mileage limit. As of November 2020, Ontario insurers are now permitted to charge more for risky driving and high mileage.

- Compatibility Issues: Not all vehicles are compatible with the telematics device. Vehicles that are not eligible include electric vehicles, vehicles made earlier than 1997, diesel vehicles made earlier than 2005, and motorcycles.

Key Advice from MyChoice

- With CAA’s MyPace program, you can save as much as 70% compared to traditional insurance policies.

- Not all vehicles are compatible with the MyPace program. Check with CAA to make sure that your car can avail of pay-as-you-go insurance.

- There is a strict 12,000-kilometre limit for CAA’s MyPace program. If you exceed this limit, CAA will switch you over to a traditional car insurance policy.