Quick Facts About Auto Insurance in Gatineau

- Gatineau car insurance is LESS expensive than the Quebec average.

- The average annual car insurance cost in Gatineau for a driver with comprehensive/collision coverage and a clean record is around $552.

The Best Car Insurance Brokerages in Gatineau

Car insurance brokers help you choose the right auto insurance policy by answering your questions and comparing policy offers.

Here are several brokers in Gatineau that you can contact for extra assistance when seeking car insurance:

| Brokerage | Address | Phone number |

|---|---|---|

| Assurances Multipro Inc | 195 Bd Gréber, Gatineau, QC J8T 3R1, Canada | +18197779700 |

| Co-operators | G-1, 325 Bd Gréber, Gatineau, Quebec J8T 8J3, Canada | +18192468189 |

| Assurancia Groupe Tardif / Charlebois Trépanier | 815 Bd de la Carrière bureau 102, Gatineau, QC J8Y 6T4, Canada | +18197775246 |

| Assurances Paul Duval inc | 40 Bd du Mont-Bleu, Gatineau, QC J8Z 1J3, Canada | +18197774565 |

Most Expensive Postal Codes in Gatineau

The average cost of car insurance in Gatineau, Quebec, is $552. It’s about $166 cheaper than the provincial average, so it’s relatively affordable. However, some areas of Gatineau have higher-than-average car insurance rates.

Here’s a breakdown of the most expensive postal codes for auto insurance in Gatineau:

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| J8T | $558 |

Least Expensive Postal Codes in Gatineau

While some areas of the city have higher-than-average car insurance rates, some areas also have lower-than-average rates.

Here’s an overview of the cheapest areas for auto insurance in Gatineau:

| Postal Code | Average annual car insurance premium |

|---|---|

| J8P | $546 |

Driving in Gatineau

Planning to move to or visit Gatineau? It helps to know more about driving in the area. Here are some key facts about driving in Gatineau you should know:

- Major highways in Gatineau: Autoroute 50

- Public transit options: OC Transpo, Société de transport de l’Outaouais

- Ridesharing services: Blacklane, Uber, Talixo

- Parking space providers: The City of Gatineau, private lots

- Top tourist attractions: Canadian Museum of History, Gatineau Park, Canadian Children’s Museum, Jacques Cartier Park, Mackenzie King Estate

- Busy intersections: Gréber and Maloney Boulevards, Maisonneuve and des Allumettières

- Airports: Gatineau-Ottawa Executive Airport

Main Mode of Commuting in Gatineau

Knowing more about the commuting statistics in a city or town helps you get to work on time. Here’s a detailed look at the commuter data in Gatineau:

- Average commute distance: The average Gatineau resident travels x km to their workplace or school.

- Commute duration: 38.1% of Gatineau commuters spend 15 to 29 minutes on the road, which means commute times in the city are relatively short. However, 21.6% of commuters spend 30 to 44 minutes getting to work, meaning quite a sizable part of Gatineau residents take longer getting to work.

- Main mode of commuting: Personal vehicles are by far the most popular commuting method in the city, with 81.4% of commuters going to work by car, truck, or van. Public transit users take second place with a 10.7% share, while pedestrians take third with a 4.4% share.

Driving Conditions in Gatineau

Various weather and driving conditions like snow and rain can affect your auto insurance premiums. Here’s an overview of driving conditions in Gatineau:

- Average annual rainfall: 96.2 mm

- Average annual snowfall: 145 mm

- Rainy days per year: 114

- Rainiest month in Gatineau: August

- Driest months in Gatineau: February

- Snow days per year: 114

Snowfall months in Gatineau: October-April

Traffic in Gatineau

Gatineau is Quebec’s fourth-largest city, and it’s right across the river from Ottawa. This means sometimes you’re dealing with two cities’ worth of traffic when driving in Gatineau.

Here’s a quick look at the key traffic statistics in Gatineau:

- Population: 291,041 people live within Gatineau’s city limits.

- City area: Gatineau’s city area spans 381.30 km2.

- Busiest highways: There’s no major highway on the Gatineau side of the Ottawa River. However, Autoroute 50 passes through the city.

The Most Common Questions About Car Insurance in Gatineau

How much does Gatineau car insurance cost?

Gatineau car insurance costs $552/year, $166 under Quebec’s provincial average.

Why should you compare car insurance rates in Gatineau?

You should compare car insurance rates in Gatineau because different insurers provide different coverage at different prices. Comparing rates help you choose which policy has the best value.

Do I need winter tires in Gatineau?

According to provincial regulations, all motor vehicles must be winter-ready from December 1st to March 15th. Therefore, you need winter tires in Gatineau when winter comes.

How can you get cheaper auto insurance in Gatineau?

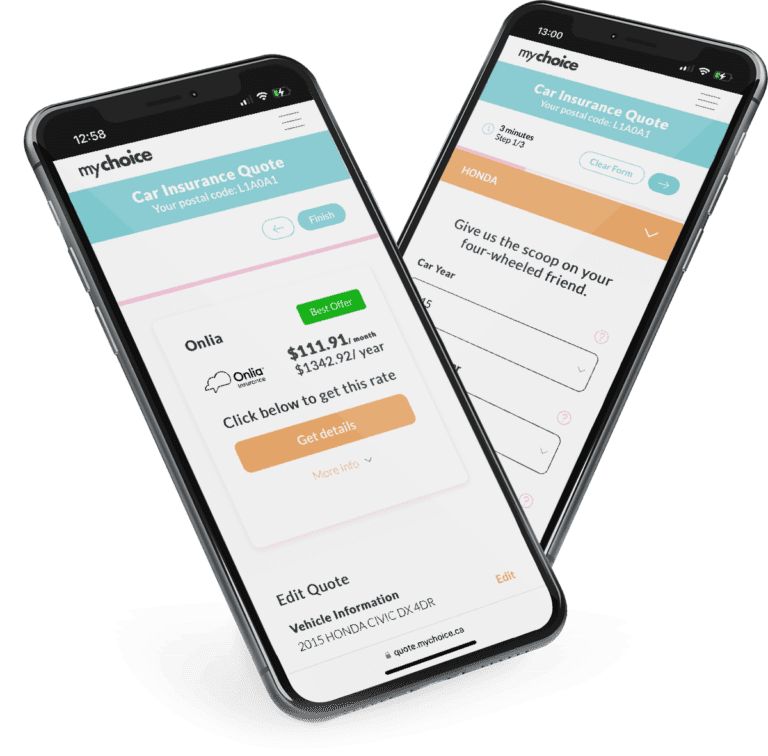

Compare car insurance rates in Gatineau with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.