Quick Facts About Auto Insurance in Orillia

- Orillia car insurance is LESS expensive than the Ontario average.

- The average annual car insurance cost in Orillia for a driver with comprehensive/collision coverage and a clean driving record is around $1,561.

- Comparing Orillia auto insurance quotes with MyChoice can save you up to $1,108 annually.

The Best Car Insurance Brokerages in Orillia

Car insurance brokers help you choose the right auto insurance policy by answering your questions and comparing policy offers.

Here are several brokers in Orillia that you can contact for extra assistance when seeking car insurance:

| Brokerage | Address | Phone number |

|---|---|---|

| Allstate Insurance: Orillia Agency | 10 Peter St N Suite 202, Orillia, ON L3V 4Y7, Canada | +17054181096 |

| McLean & Dickey Insurance | 4 King St, Orillia, ON L3V 1R1, Canada | +17053254461 |

| Ron Johnston Insurance | 448 West Street N, Orillia, ON L3V 5E8, Canada | +17053256200 |

| Murray Hofstetter Desjardins Insurance Agent | 145 West Street N, Orillia, ON L3V 5C4, Canada | +17053263294 |

Auto Insurance by Postal Code in Orillia

On average, an auto insurance policy in Orillia costs $1,561, $110 lower than Ontario’s provincial average of $1,673 and Orillia only has one postal code, L3V.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L3V | $1,561 |

Car Insurance Cost in Orillia by Age

Age is a major driving factor in whether you can expect higher insurance premiums. Generally, the idea is that older drivers have more experience and are thus more likely to be responsible and capable of avoiding accidents.

Drivers under the age of 25 can expect higher insurance premiums, while those in their 50s and 60s can expect the lowest insurance rates. However, once you reach a certain age, your premium rates start to rise again – usually when you reach the age of 65 or become a senior citizen.

Based on studies, 75-year-old male drivers pay 21% more for auto insurance than 55-year-old male drivers. This is because as people get older, they go through physical changes that can affect their driving ability, such as changes in vision, attention, fitness, and reaction time.

Take a look at how much car insurance costs can vary by age in Orillia:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $5,573 | $1,108 |

| 21-24 | $3,184 | $633 |

| 25-34 | $2,123 | $422 |

| 35-44 | $1,561 | $310 |

| 45-54 | $1,280 | $255 |

| 55-64 | $1,088 | $216 |

| 65+ | $1,240 | $247 |

Car Insurance Cost in Orillia by Driving History

Take a look below at how car insurance quotes vary by violation in Orillia:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,561 |

| Insurance cancellation due to non-payment | $2,560 |

| Licence suspension for alcohol-related offences | $1,873 |

| One accident | $3,434 |

| Speeding ticket | $2,029 |

All estimated rates are based on a 35-year-old female driving a 2018 Honda Civic four-door.

Your driving record plays a major role in determining the cost of your insurance premiums. Insurance companies will usually request the following:

- Demerit point total

- Any convictions, suspensions, and reinstatements under the Highway Traffic Act and Criminal Code of Canada

- Records of collisions

- Any driver’s license replacements/renewals

A clean driving record will help you get lower premiums, while a record laden with violations will get you tagged as a high-risk driver and cause insurance companies to charge you more.

In Ontario, driving violations remain on your record for two years, but they can affect your premium rates for far longer.

Driving in Orillia

When you move or travel to a town, it’s important to know more about driving in the area to reduce your risk of getting into an accident. Here are some key facts about driving in Orillia you should know:

- Major highways in Orillia: 11

- Public transit options: Orillia Transit & Simcoe County LINX (bus)

- Ridesharing services: Uber, SuperShuttle

- Parking space providers: The Town of Orillia, private lots

- Top tourist attractions: The OPP Museum, Couchiching Beach Park, Stephen Leacock Museum

- Busy intersections: Westmount Drive South and Rose Avenue, West Street North and Fittons Road

- Airports: Orillia-Ramara Airport

Main Mode of Commuting in Orillia

Knowing more about the commuting statistics in a city or town helps you get to work on time. Here’s a detailed look at the commuter data in Orillia:

- Average commute distance: The average Orillia resident travels x km to their workplace or school.

- Commute duration: Slightly over half (51.6%) of Orillia’s households spend under 15 minutes on their commutes. The second-largest portion (20.3%) of households spend between 15 to 29 minutes on theirs. Therefore, commutes in Orillia are generally quite short.

- Main mode of commuting: Cars, trucks, and vans are the most popular modes of commuting in the town, with 86.9% of households using them. The second-largest portion of households, at 6.7%, simply walked to their workplaces.

Driving Conditions in Orillia

Various weather and driving conditions like snow and rain can affect your auto insurance premiums. Here’s an overview of driving conditions in Orillia:

- Average annual rainfall: 88 mm

- Average annual snowfall: 105 mm

- Rainy days per year: 122

- Rainiest month in Orillia: June

- Driest months in Orillia: February

- Snow days per year: 122

- Snowfall months in Orillia: October-April

Traffic in Orillia

Orillia is a waterfront town that often gets a lot of tourist activity. Therefore, traffic may fluctuate at certain times of the year.

Here’s a quick look at the key traffic statistics in Orillia:

- Population: 33,411 people live within Orillia’s city limits.

- City area: Orillia’s city area spans 28.53 km2.

- Busiest highways: Highway 11, which connects Highway 400 to the Ontario-Minnesota border, goes through Orillia.

Most Common Questions About Car Insurance in Orillia

Is ridesharing insurance available in Orillia?

Ridesharing insurance for Uber and Lyft drivers is available in Orillia. Ask your insurer for more details.

How much does Orillia car insurance cost?

Orillia car insurance costs $1,561/year.

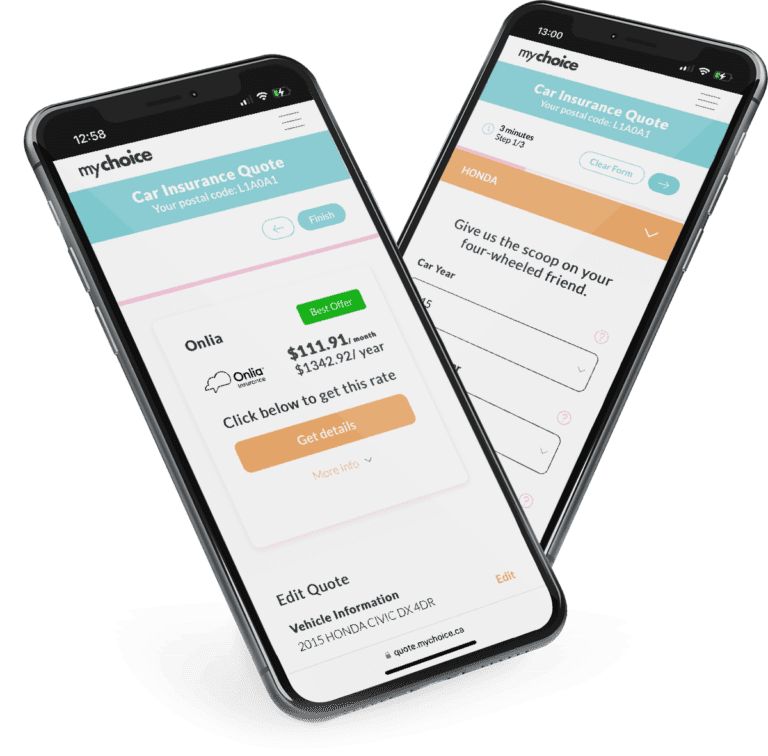

Why should you compare car insurance rates in Orillia?

You should compare car insurance rates in Orillia because different insurers provide different coverage at different prices. Comparing rates help you choose which policy has the best value.

What information do you need for an auto insurance quote in Orillia?

You need to provide basic personal details and vehicle information like production year, make, and model to get a basic auto insurance quote. You can get more accurate quotes by disclosing extra information, like your driving record and past traffic violations.

How can you get cheaper auto insurance in Orillia?

Compare car insurance rates in Orillia with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.