Quick Facts About Auto Insurance in Richmond Hill

- Richmond Hill car insurance is MORE expensive than the Ontario average.

- The average annual car insurance cost in Richmond Hill for a driver with comprehensive/collision coverage and a clean record is around $2,248.

- Comparing Richmond Hill auto insurance quotes with MyChoice can save you up to $1,596 annually.

The Best Car Insurance Brokerages in Richmond Hill

Shopping for car insurance can be easier in Richmond Hill by going through car insurance brokerages. These companies compare policies for you and tell you what you need to know about each insurer’s policies.

Contact these insurance brokerages in Richmond Hill to help you find the best policy:

| Brokerage | Address | Phone number |

|---|---|---|

| Westland Insurance | 110 West Beaver Creek Rd Richmond Hill, ON L4B 1J9, Canada | +19057648061 |

| My Insurance Broker | 50 West Wilmot St #6 Richmond Hill, ON L4B 1M5, Canada | +18554825001 |

| Freedom Insurance Brokers Inc. | 9019 Bayview Ave #214 Richmond Hill, ON L4B 3M6, Canada | +19055976655 |

| All-Risks Insurance Brokers Limited | 11685 Yonge St Richmond Hill, ON L4E 0K7, Canada | +19058841777 |

Most Expensive Postal Codes in Richmond Hill

Richmond Hill has an average annual car insurance rate of $2,248, almost $500 higher than the annual average in Ontario, which is $1,673. There are a couple of postal codes in Richmond Hill that have higher average insurance rates than the rest of the city here are the most expensive postal codes:

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L4E | $2,293 |

| L4C | $2,080 |

Least Expensive Postal Codes in Richmond Hill

Two postal codes in Richmond Hill share the same average annual car insurance premiums as the city average.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L4S, L4B | $1,963 |

Car Insurance Cost in Richmond Hill by Age

How old you are can affect how much you pay in insurance premiums.

Drivers under 25 have higher insurance rates because they’re considered inexperienced drivers. Conversely, drivers over 60 have higher insurance premiums in Richmond Hill because their reaction times are slower and they’re more likely to get injured or killed in an accident.

Here’s the average cost of car insurance in Richmond Hill by age:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $8,025 | $1,596 |

| 21-24 | $4,586 | $912 |

| 25-34 | $3,057 | $608 |

| 35-44 | $2,248 | $447 |

| 45-54 | $1,843 | $367 |

| 55-64 | $1,567 | $312 |

| 65+ | $1,786 | $355 |

Car Insurance Cost in Richmond Hill by Driving History

Insurance companies check your driving history to determine how risky you are as a driver and charge higher premiums if you’re a careless driver.

If you have multiple traffic violations and demerits, insurance companies will consider you a high-risk driver, bumping up your insurance premiums. However, if you have a consistently clean driving record, you’re more likely to get lower auto insurance rates.

Demerits and traffic violations are “reset” every two years in Ontario, though insurance companies can check your records up to ten years back to assess your riskiness as a driver.

These different traffic violations can affect your car insurance rates:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $2,248 |

| Insurance cancellation due to non-payment | $3,687 |

| Licence suspension for alcohol-related offences | $2,698 |

| One accident | $4,946 |

| Speeding ticket | $2,922 |

Driving in Richmond Hill

Richmond Hill was classified as a city in 2019 and is the third-most populated municipality in the York region after the cities of Vaughan and Markham. Out of Richmond Hill’s population of 202,000, over 60% are visible minorities, making this city a diverse melting pot of cultures.

Here are a few facts about the driving experience in Richmond Hill.

- Major highways: 404, 401, 407, 7

- Public transit options: York Region Transit (bus), GO Transit (train)

- Ridesharing services: Uber, Lyft

- Parking space providers: The City of Richmond Hill, private lots

- Top tourist attractions: David Dunlap Observatory, Richmond Hill Centre for the Performing Arts, Wilcox Lake, Mill Pond Park

- Busy intersections: Laverock Avenue and Lucas Street, Highway 144 and Cedar Street, Laburnum Avenue and Hermitage Road

- Airports: None

Main Mode of Commuting in Richmond Hill

Public transportation is relatively popular in Richmond Hill, with 7.9% of the city’s commuters preferring it. Like many other cities, personal vehicles still take the top spot with 86.7% of commuters preferring them. Check the table for a closer look at Richmond Hill’s modes of commuting:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 55,290 | 100.0 |

| Car, truck or van | 47,930 | 86.7% |

| Car, truck or van – as a driver | 43,835 | 79.3% |

| Car, truck or van – as a passenger | 4,090 | 7.4% |

| Public transit | 4,385 | 7.9% |

| Walked | 1,435 | 2.6% |

| Bicycle | 140 | 0.3% |

| Other method | 1,405 | 2.5% |

Commuting Duration in Richmond Hill

Richmond Hill is a rapidly growing city, so traffic may be more congested than other areas of its size. That’s why around 60% of Richmond Hill’s commuters take 15 to 44 minutes to get to work. Here’s a detailed look at the commuting duration in Richmond Hill:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 55,290 | 100.0 |

| Less than 15 minutes | 9,145 | 16.5% |

| 15 to 29 minutes | 17,865 | 32.3% |

| 30 to 44 minutes | 16,055 | 29.0% |

| 45 to 59 minutes | 5,975 | 10.8% |

| 60 minutes and over | 6,250 | 11.3% |

Driving Conditions in Richmond Hill

Driving in an area with frequent rain and snowfall can raise your insurance premiums. Take a look at these facts about the driving conditions in Richmond Hill:

- Average daily commute time: 37 minutes round trip

- Average annual rainfall: 744.6 mm

- Average annual snowfall: 150.6 cm

- Rainy days per year: 120 days

- Rainiest month in Richmond Hill: May, October

- Driest months in Richmond Hill: February

- Snow days per year: 56 days

- Snowfall months in Richmond Hill: November – April

Traffic in Richmond Hill

Richmond Hill is a rapidly growing city, with over 200,000 residents. This concentrated population means more cars on the road and a longer commute for people living in the city.

Here are some important traffic statistics for Richmond Hill:

- Population: 202,022 people live within Richmond Hill’s city limits.

- City area: Richmond Hill’s city area spans 100.79 km2.

- Average commute distance: The average Richmond Hill resident travels x km to their workplace or school.

- Time spent in traffic annually: The average North Bay resident spends 37 minutes in traffic daily, totalling roughly 226 hours per year.

- Busiest highways: Highway 404 borders Richmond Hill to the east and connects to Highway 401, one of the busiest highways in the world. Highway 7 and Highway 407 border the city to the south.

The Most Common Questions About Car Insurance in Richmond Hill

How much does Richmond Hill car insurance cost?

In Richmond Hill, car insurance costs an average of $2,248, almost $500 more than the average car insurance rate in Ontario.

Is car insurance cheaper in Richmond Hill than in Toronto?

No, car insurance is not cheaper in Richmond Hill than in Toronto. Richmond Hill’s average insurance rates are about $100 more expensive than the average rates in Toronto.

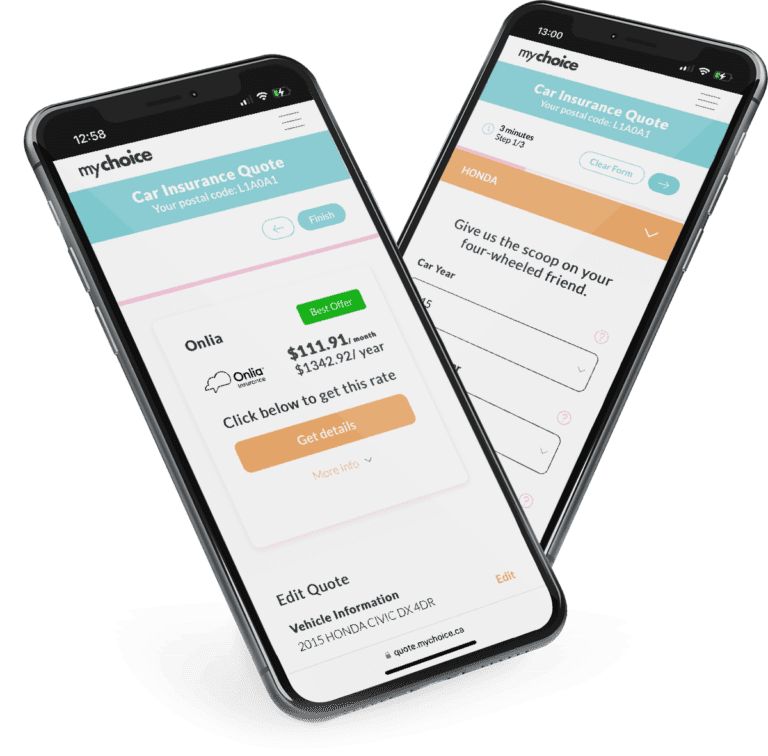

Why should you compare car insurance rates in Richmond Hill?

You should compare car insurance rates in Richmond Hill to find the best price for the coverage that you need. Different insurance companies price their policies according to different metrics, and comparing policies may get you a better rate for the amount of coverage that you want to have.

What information do you need for an auto insurance quote in Richmond Hill?

To get a basic auto insurance quote in Richmond Hill, you need to provide the details of your vehicle, such as the make, model, year, and engine type. If you provide other details like your age, driving history, and past traffic violations, you can get a more accurate quote.

How can you get cheaper car insurance in Richmond Hill?

Compare car insurance rates in Richmond Hill with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.