While careless driving is a common violation in Ontario, it can drastically affect your insurance and leave you with a hefty fine. However, only some licenced Ontario drivers know what careless driving entails.

This guide will tell you what to know to avoid pricey driving infractions and stay safe on the road.

Careless Driving vs Reckless Driving: What’s the Difference?

The primary difference between careless and reckless driving is intent. Careless driving is considered a less severe citation and indicates a disregard for driving laws.

On the other hand, reckless driving refers to intentionally driving in a manner that can cause harm to others. According to Canadian law, reckless drivers have a “willful or wanton disregard” for human life and safety.

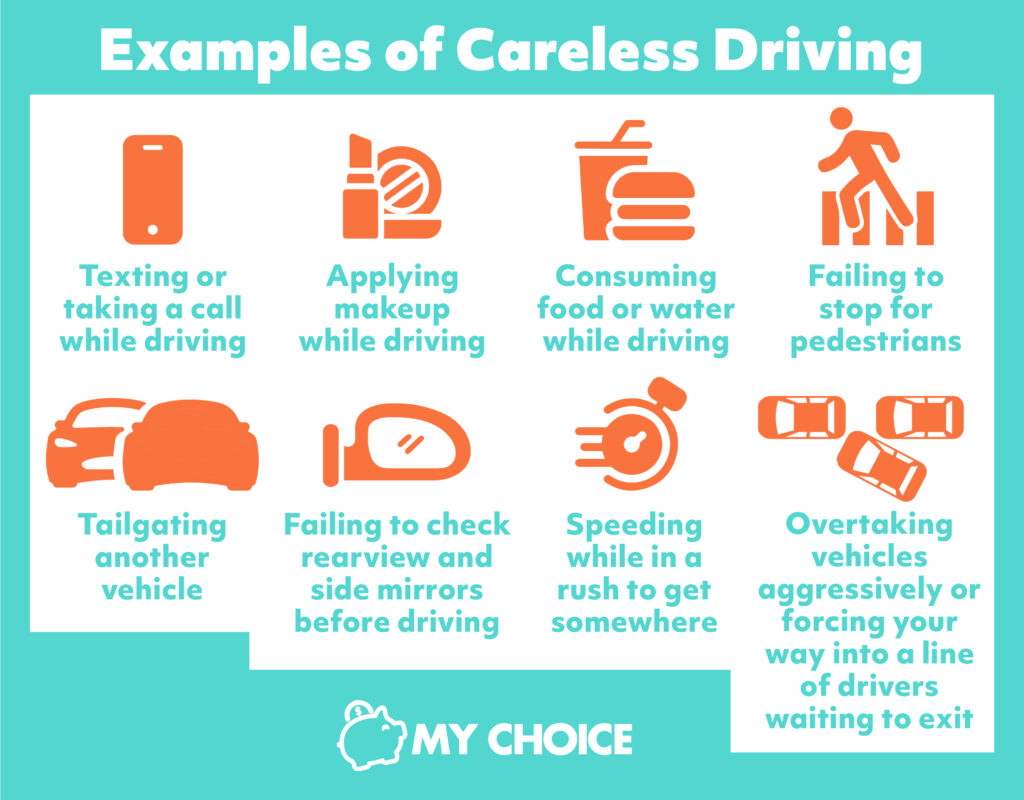

Examples of Careless Driving

As the Highway Traffic Act (HTA) defines it, careless driving occurs when you drive without care or consideration for other drivers. So, what does this entail? Here are a few examples of careless driving that can potentially incur a fine:

- Texting or taking a call while driving

- Applying makeup while driving

- Consuming food or water while driving

- Overtaking vehicles aggressively or forcing your way into a line of drivers waiting to exit

- Failing to stop for pedestrians

- Tailgating another vehicle

- Failing to check rearview and side mirrors before driving

- Speeding while in a rush to get somewhere

In comparison, examples of reckless driving might include:

- Drag racing with other vehicles

- Driving while under the influence of alcohol or another substance

- Driving on the sidewalk

- Intentionally running a red light or stop sign

Types of Careless Driving

According to the Ontario Highway Traffic Act, there are two types of careless driving.

Not Causing Bodily Harm

Per section 130 (1) of the Highway Traffic Act, incidents not causing bodily harm can incur fines of up to $2,500 and jail time of up to 6 months. Drivers can also get their licences suspended for up to two years.

Causing Bodily Harm

Per section 130 (3)of the Highway Traffic Act, incidents causing bodily harm can incur fines of up to $50,000 and jail time of up to 2 years. Drivers can also get their licences suspended for up to five years.

Penalties and Fines for Careless Driving in Ontario

In Ontario, careless driving has some of the heaviest penalties for breaking road laws. Below is a breakdown of the consequences you can expect for careless driving.

Careless Driving Tickets

Careless driving can incur tickets of two types:

- Without fine: Enforcers typically write tickets without penalties for graver offences. Drivers must appear in court for a potential licence suspension, higher fine, and jail time.

- With fine: Enforcers write tickets with penalties for less serious offences. When a driver pays their fine, it counts as an admission and acceptance of guilt.

Demerit Points

Whether you receive a ticket with or without a fine, you’ll receive six demerit points for careless driving. Six is the highest number of demerits you can receive for a traffic conviction. Fully licenced drivers can receive up to 15 demerit points before getting their licences suspended.

If you incur over nine demerit points, you may have your licence temporarily revoked and must attend a mandatory meeting. Drivers must also pay for the session, which costs $50.

Drivers who incur over 15 demerits will automatically receive a 30-day licence suspension. If you don’t surrender your licence at any Service Ontario Centre, you risk a longer suspension of up to two years.

Below are the demerit points for speeding.

| Points | Speed (over the limit) |

|---|---|

| 3 | 16 – 29 km/h over the limit |

| 4 | 30 – 49 km/h over the limit |

| 6 | > 50 km/h over the limit |

Below are the demerit points for general distracted driving.

| Points | Offence |

|---|---|

| 3 | First offence |

| 4 | Second offence |

| 6 | Third offence |

Ticket Fines

If you receive a ticket with a fine, expect to be charged the following amounts.

| Fee | Offence |

|---|---|

| $400 (minimum) – $2,000 (maximum) | Careless driving not causing bodily harm |

| $2,000 (minimum) – $50,000 (maximum) | Careless driving causing bodily harm or death |

Is Careless Driving a Criminal Offence in Ontario?

Careless driving is not a criminal offence in Ontario, and you won’t receive a criminal record if found guilty. However, a non-criminal charge can still have significant consequences, such as hefty fines, a driver’s licence suspension, and possible jail time.

In addition, a careless driving ticket will stay on your driving record for at least three years.

How Careless Driving Affects Your Insurance

Careless driving tickets can significantly affect your insurance premiums. Even on your first offence, rates can increase by up to 100%.

In some cases, insurers might cancel your policy altogether. These cancellations can make it challenging for you to get insurance from other companies. Should you be lucky enough to find one, expect your premiums to be higher than average.

Take, for example, how speeding tickets can affect your insurance. On average, insurers increase rates between $20 and $60 monthly for speeding roughly 15 km/h over the legal limit. This prices traffic tickets at $3 per kilometre over the speed limit.

One way to prevent rate increases is to apply for a conviction protection endorsement. However, remember that this protection can keep you locked in with your insurer until the ticket is off your driving record.

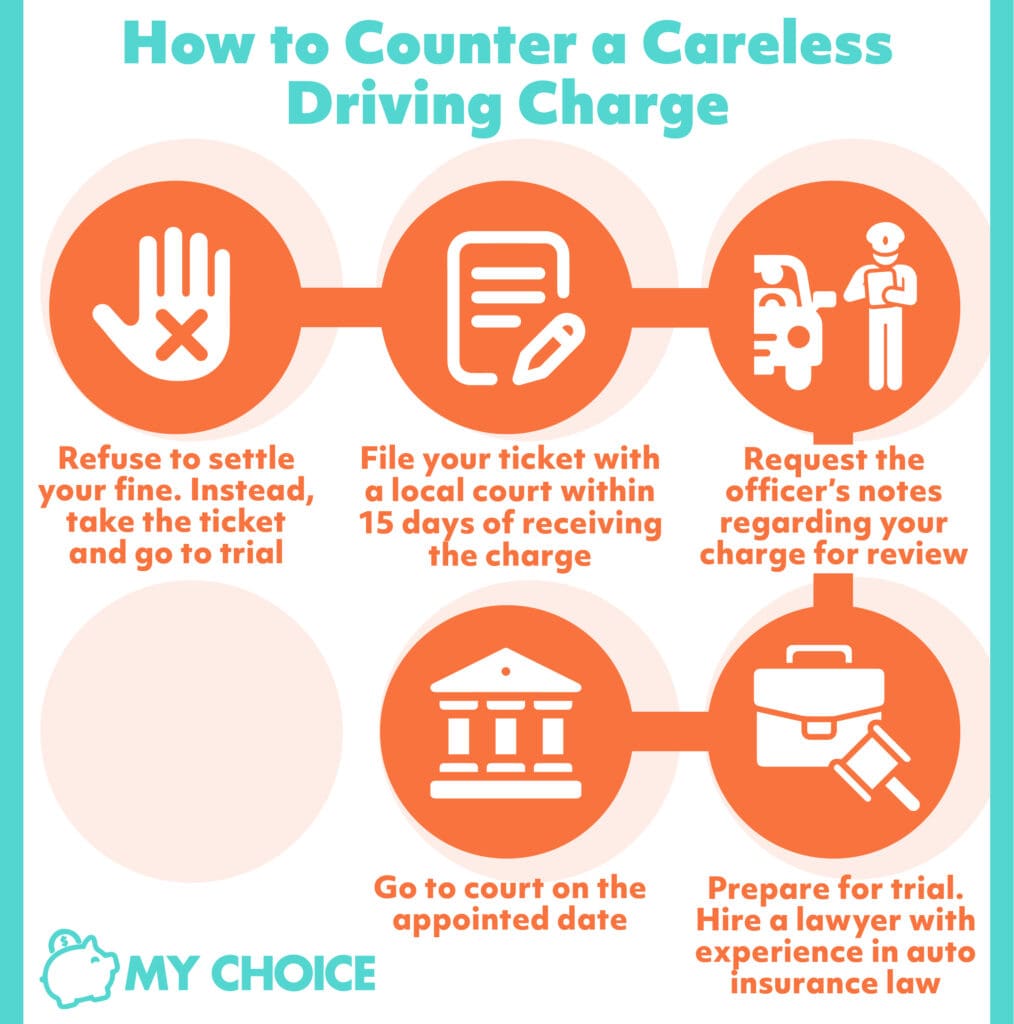

How to Counter a Careless Driving Charge

While it’s possible to get your careless driving charge withdrawn or your ticket dismissed, the process can be complex. However, you have the legal right to go to trial, review the evidence, and plead your case.

To counter a careless driving charge, follow these steps.

- Refuse to settle your fine. Instead, take the ticket and go to trial.

- File your ticket with a local court within 15 days of receiving the charge.

- Request the officer’s notes regarding your charge for review.

- Prepare for trial. Hire a lawyer with experience in auto insurance law.

- Go to court on the appointed date.

Closing Thoughts

While careless driving charges in Ontario won’t go on your criminal record, you’re better off staying safe on the road. The best ways to avoid a careless driving charge are to be mindful of your surroundings, avoid distractions, and stay sober behind the wheel.

If you’re looking for the best insurance deal from Canada’s top providers, you can get tailored solutions in just three minutes with MyChoice.