Quick Facts About Auto Insurance in Innisfil

- Innisfil car insurance is LESS expensive than the Ontario average.

- The average annual car insurance cost in Innisfil for a driver with comprehensive/collision coverage and a clean record is around $1,561.

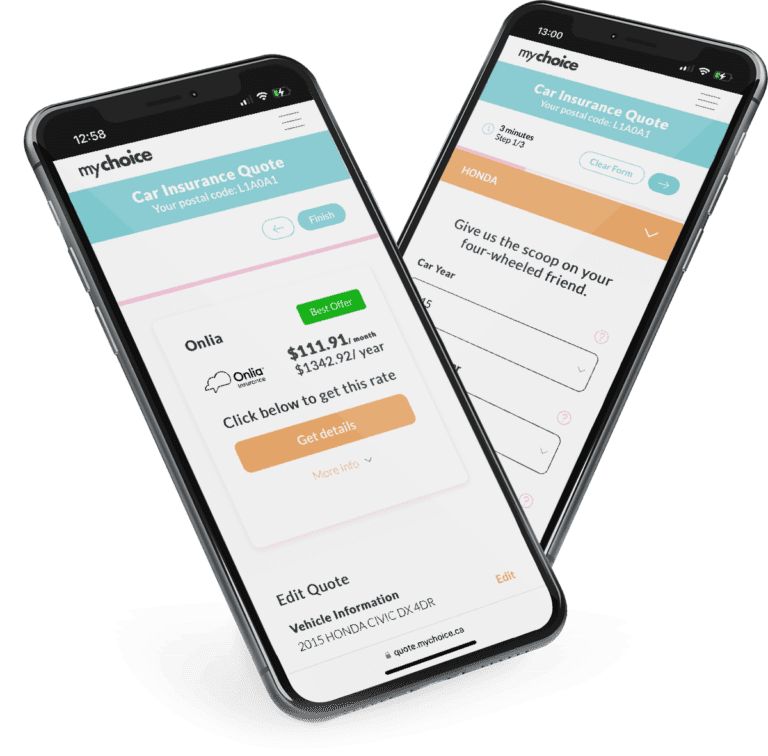

- Comparing Innisfil auto insurance quotes with MyChoice can save you up to $1,108 annually.

The Best Car Insurance Brokerages in Innisfil

An auto insurance brokerage can help you narrow down your car insurance options by comparing offers between different companies and answering your questions.

Here are some top-notch car insurance brokerages in Innisfil. Contact them through their details below to get help with looking for affordable auto insurance:

| Brokerage | Address | Phone Number |

|---|---|---|

| Innisfil Insurance | 2109 Wilson St, Innisfil, ON L9S 0N8, Canada | +16476482537 |

| Odette Novielli Desjardins Insurance Agent | 7869 Yonge St #1, Innisfil ON L9S 1K8, Canada | +17054363276 |

| Hambly Insurance Brokers | 1 King St S, Cookstown ON L0L 1L0, Canada | +17054584709 |

Auto Insurance by Postal Code in Innisfil

The average car insurance rate in Innisfil, ON is $1,561/year, which is cheaper than Ontario’s provincial average of $1,673/year.

The L9S area in Innisfil is the postal code with the most expensive car insurance premium rate in town by default, since it’s the only postal code in the city.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| L9S | $1,561 |

Car Insurance Cost in Innisfil by Age

As in any other Canadian city or town, your age will affect the cost of your car insurance.

Generally, drivers who are 65 years old or older have higher car insurance premiums. This is because senior citizens are considered more likely to be injured or killed if they get into a car accident, posing a higher risk that costs more for car insurers to cover.

However, being younger doesn’t mean your car insurance is cheaper. In fact, drivers younger than 25 also generally get charged higher auto insurance premiums. Younger drivers are seen as less experienced by auto insurers, making them more likely to commit traffic violations, earn demerits, and get into accidents.

Find out more about how your age affects the cost of car insurance in Innisfil through our table below:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $5,573 | $1,108 |

| 21-24 | $3,184 | $633 |

| 25-34 | $2,123 | $422 |

| 35-44 | $1,561 | $310 |

| 45-54 | $1,280 | $255 |

| 55-64 | $1,088 | $216 |

| 65+ | $1,240 | $247 |

Car Insurance Cost in Innisfil by Driving History

Your driving history can also make your car insurance premiums go up or down.

Generally, drivers with a clean record enjoy the lowest car insurance premiums, as they’re deemed less risky to insure. But if you have a lot of speeding tickets, traffic violations, or accidents on your record, auto insurers in Innisfil may consider you a “high-risk” driver.

High-risk or careless drivers have higher car insurance premiums. The more violations you have on your record, the more expensive your car insurance will be. While demerits and violations only stay on your Ontario driving record for two years, note that insurers might check your driving history as far back as 10 years. This means even old tickets or violations can increase the cost of your car insurance in Innisfil.

Here’s a quick look at how different driving violations can affect your car insurance quotes in Innisfil, according to our research:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,561 |

| Insurance cancellation due to non-payment | $2,560 |

| Licence suspension for alcohol-related offences | $1,873 |

| One accident | $3,434 |

| Speeding ticket | $2,029 |

Driving in Innisfil

Innisfil is located near Lake Simcoe’s western shore, just south of Barrie, Ontario. Known for being a rural town, it’s recently grown into a bustling commuter hub and increased its residential development. Many employees going to Toronto workplaces pass through this quiet community, causing longer commutes and more congested roads.

Is Innisfil a good place to drive or commute? Here are some key facts about driving and commuting in this town:

- Major highways in Innisfil: King’s Highway 11, 89, 400

- Public transit options: Innisfil Transit (subsidized partnership with Uber)

- Ridesharing services: Uber, Lyft

- Parking space providers: The Town of Innisfil, private lots

- Top tourist attractions: Innisfil Beach Park, Kempenfelt Bay, Cook’s Bay, Tanger Outlet Cookstown, Innisfil Indy Karting, Georgian Downs, Big Cedar Point Golf and Country Club

- Busy intersections: Lockhart Road and 20th Sideroad, Yonge Street and Innisfil Beach Road, Innisfil Beach Road and Sideroad 10

- Airports: N/A

Main Mode of Commuting in Innisfil

An overwhelming majority of Innisfil’s 16,050 commuters travel by car, truck, van or other personal vehicle. That means there are less than 1,000 people commuting with different methods. Here’s a detailed look at the modes of commuting in Innisfil:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 16,050 | 100.0 |

| Car, truck or van | 15,220 | 94.8% |

| Car, truck or van – as a driver | 14,290 | 89.0% |

| Car, truck or van – as a passenger | 925 | 5.8% |

| Public transit | 125 | 0.8% |

| Walked | 345 | 2.1% |

| Bicycle | 35 | 0.2% |

| Other method | 325 | 2.0% |

Commuting Duration in Innisfil

Despite being a relatively small town, Innisfil is a bustling commuter hub with many workers coming through it every day. The impact to Innisfil’s commute times speaks for itself. Around 25% of Innisfil’s commuters spend over an hour on the road getting to work. Here’s a look at the commute times in Innisfil:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 16,050 | 100.0 |

| Less than 15 minutes | 2,755 | 17.2% |

| 15 to 29 minutes | 4,060 | 25.3% |

| 30 to 44 minutes | 2,785 | 17.4% |

| 45 to 59 minutes | 2,355 | 14.7% |

| 60 minutes and over | 4,095 | 25.5% |

Driving Conditions in Innisfil

Driving conditions like rain, average commute time, and snow affect road safety, so they also have a significant impact on the cost of car insurance in a city or town.

Here’s a guide to the average driving conditions in Innisfil:

- Average daily commute time: 62 minutes round trip

- Average annual rainfall: 621 mm

- Average annual snowfall: 553 mm

- Rainy days per year: 145 days

- Rainiest month in Innisfil: September

- Driest month in Innisfil: February

- Snow days per year: 66.4 days

- Snowfall months in Innisfil: January – May, October – December.

Traffic in Innisfil

Innisfil was initially known for being a community that provided seasonal homes for Toronto residents, particularly for its picturesque cottages by Lake Simcoe.

However, the town is now booming with permanent residents, and many seasonal lake houses have now become year-round homes, particularly for families and “empty nesters”. The increase of residents in this sleepy Ontario town has affected traffic conditions in Innisfil.

Here, we break down important traffic information about Innisfil:

- Population: 43,326 people live within Innisfil’s town limits.

- Town area: Innisfil’s town limits span 262.39 km2.

- Time spent in traffic annually: The average Innisfil resident spends 62 minutes in traffic daily, totalling roughly 377 hours per year.

Busiest highway: Innisfil’s busiest highway is Highway 400.

The Most Common Questions About Car Insurance in Innisfil

How much does Innisfil car insurance cost?

Innisfil car insurance costs an average of $1,561/year.

Is car insurance cheaper in Innisfil than in Toronto?

Yes, car insurance is cheaper in Innisfil than in Toronto. Innisfil car insurance costs $1,561/year while Toronto car insurance costs $2,139/year.

How can you get cheaper car insurance in Innisfil?

Compare car insurance rates in Innisfil with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.