Quick Facts About Auto Insurance in Kitchener

- Kitchener car insurance is LESS expensive than the Ontario average.

- The average annual car insurance cost in Kitchener for a driver with comprehensive/collision coverage and a clean driving record is around $1,642.

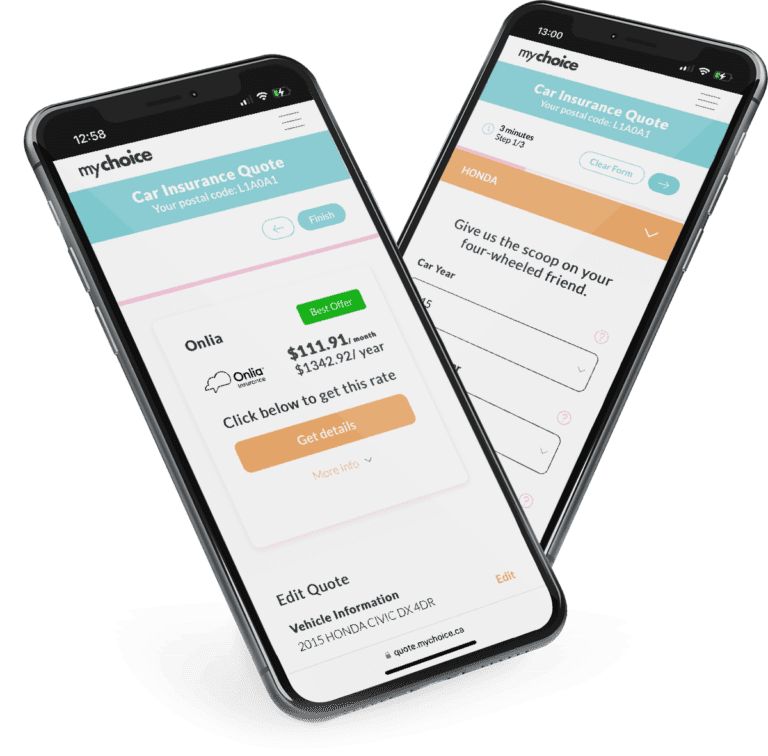

- Comparing Kitchener auto insurance quotes with MyChoice can save you up to $1,166 annually.

The Best Car Insurance Brokerages in Kitchener

Insurance brokers have a deep knowledge of the auto insurance scene in Kitchener. They can make your life easier by comparing policies and deals from different companies so you don’t have to. Plus, if you have any questions about auto insurance, brokers are more than ready to help you out.

You can partner with insurance brokers to ensure you get the policy you need at the price you want. Here are some of the best car insurance brokerages in Kitchener:

| Brokerage | Address | Phone Number |

|---|---|---|

| Regal Insurance Brokers | 428 Gage Ave #2, Kitchener ON N2M 5C9, Canada | +15195787170 |

| BrokerLink | 230 The Boardwalk Mall Ln #1, Kitchener ON N2N 0B1, Canada | +15195765242 |

| KW Insurance Brokers | 501 Krug St Unit 112, Kitchener ON N2B 1L3, Canada | +15197444190 |

| All-Risks Insurance Brokers Limited | 229 Frederick St, Kitchener ON N2H 2M7, Canada | +15192080220 |

Most Expensive Postal Codes in Kitchener

The annual average auto insurance premium for Kitchener, Ontario is $1,642. Kitchener’s three most expensive postal codes can be seen in the table below:

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| N2B, N2H, N2N | $1,671 |

Least Expensive Postal Codes in Kitchener

Other than the three most expensive postal codes, the rest of Kitchener’s postal codes have an average insurance rate of $1,625.

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| N2A, N2C, N2E, N2G, N2M, N2P, N2R | $1,625 |

Car Insurance Cost in Kitchener by Age

Depending on your age, your insurance premiums can be higher or lower. Students and younger drivers are considered higher-risk drivers due to their inexperience, so they can expect to pay higher insurance rates.

When drivers reach the age of 25, insurance premiums start to go down. Premiums start to rise again upon reaching the age of 65 due to senior citizens having an increased accident risk.

Here’s a look at car insurance costs in Kitchener, categorized by age:

| Age | Average Annual Rates | Average Savings with MyChoice |

|---|---|---|

| 18-20 | $5,862 | $1,166 |

| 21-24 | $3,350 | $666 |

| 25-34 | $2,233 | $444 |

| 35-44 | $1,642 | $327 |

| 45-54 | $1,346 | $268 |

| 55-64 | $1,144 | $228 |

| 65+ | $1,305 | $260 |

Car Insurance Cost in Kitchener by Driving History

Having a clean driving record is important if you want to keep your Kitchener auto insurance premiums low. Insurance providers use your driving history to see if you’re a high-risk driver. If you have a clean driving history, you’ll qualify for lower auto insurance rates than drivers with multiple violations and accidents on their records.

Driving violations such as speeding tickets and DUIs can stay on your record for two years in Ontario. However, providers will still use them to calculate your insurance premiums for longer than that.

Here’s a look at how traffic violations can influence your insurance rates based on MyChoice’s price quote data:

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,642 |

| Insurance cancellation due to non-payment | $2,693 |

| Licence suspension for alcohol-related offences | $1,970 |

| One accident | $3,612 |

| Speeding ticket | $2,135 |

Driving in Kitchener

Kitchener shares its metropolitan area with its twin city, Waterloo, forming the Kitchener-Waterloo area. Here are some key facts about driving in Kitchener you should know:

- Major highways in Kitchener: 8, 401

- Public transit options: Grand River Transit (bus and trains), GO Transit (bus and trains)

- Ridesharing services: Uber, Lyft

- Parking space providers: The City of Kitchener, private parking lots

- Top tourist attractions: Victoria Park, Doon Heritage Village, Huron Natural Area, Schneider Haus National Historic Site, St. Mary Our Lady of the Seven Sorrows Church

- Busy intersections: Homer Watson Boulevard and Block Line Road, Homer Watson Boulevard and Manitou Drive, Homer Watson Boulevard and Doon Village Road

- Airports: Region of Waterloo International Airport

Main Mode of Commuting in Kitchener

As with many other cities, a large portion of Kitchener’s commuters take a car, truck, or van to work. The lion’s share of car commuters are drivers, with a much smaller percentage of passengers. Here’s a closer look at the main modes of commuting in Kitchener:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 89,925 | 100.0 |

| Car, truck or van | 79,585 | 88.5% |

| Car, truck or van – as a driver | 72,320 | 80.4% |

| Car, truck or van – as a passenger | 7,265 | 8.1% |

| Public transit | 5,090 | 5.7% |

| Walked | 2,890 | 3.2% |

| Bicycle | 455 | 0.6% |

| Other method | 1,815 | 2.0% |

Commuting Duration in Kitchener

Nearly half of Kitchener’s commuters take around 15 to 29 minutes to get to work. A quarter of them take less than 15 minutes. That means most of Kitchener’s commuters spend under half an hour on their commute. Learn more about commuting durations in Kitchener in this table:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% Sample Size | 89,925 | 100.0 |

| Less than 15 minutes | 26,845 | 29.9% |

| 15 to 29 minutes | 40,385 | 44.9% |

| 30 to 44 minutes | 12,435 | 13.8% |

| 45 to 59 minutes | 4,360 | 4.8% |

| 60 minutes and over | 5,895 | 6.6% |

Driving Conditions in Kitchener

Depending on the driving condition in Kitchener, your insurance premiums can go up or down. Here’s a quick look at the driving conditions in Kitchener:

- Average daily commute time: 44 minutes round trip

- Average annual rainfall: 776.8 mm

- Average annual snowfall: 159.7 cm

- Rainy days per year: 119

- Rainiest month in Kitchener: January

- Driest month in Kitchener: September

- Snow days per year: 62

- Snowfall months in Kitchener: October to April

Traffic in Kitchener

The city of Kitchener has around 256,885 residents as of the 2021 census, but the Regional Municipality of Waterloo is home to 575,847 citizens. With such a small number of citizens (and, therefore, cars), Kitchener ranks second in a survey on the best Canadian cities for driving.

Here’s a quick look at what driving in Kitchener is like:

- Population: Kitchener has 256,885 residents within its city limits.

- City area: Kitchener’s urban area spans 136.86 km2.

- Average commute distance: Most Kitchenerites travel 13.7 km to their workplace or school.

- Time spent in traffic annually: Most Kitchenerites spend 44 minutes every day in traffic, totalling almost 268 hours every year.

- Busiest highways: Highway 401, Highway 7

The Most Common Questions About Car Insurance in Kitchener

Can you have two car insurance policies in Kitchener?

Yes, you can have two car insurance policies in Kitchener, but you don’t actually need multiple policies. If you take out multiple policies, you’ll end up paying more premiums for the same coverage. To keep your insurance costs low, take out a single policy that covers only what you need to cover.

What is the cost of car insurance in Kitchener?

The cost of car insurance in Kitchener averages out to $1,642 annually. You can get higher or lower insurance rates depending on your age, driving history, car make and model, and how frequently you drive your car.

How do Kitchener car insurance quotes compare to other cities in Ontario?

Kitchener car insurance quotes are fairly average compared to other cities in Ontario. The average car insurance rate in Kitchener sits solidly in the middle, with half of other Ontario cities having more expensive rates, while the other half of Ontario cities have cheaper rates.

Is auto insurance the same in Kitchener and Waterloo?

Yes, auto insurance is the same in Kitchener and Waterloo because they both fall in the Regional Municipality of Waterloo.

How can you get cheaper car insurance in Kitchener?

Compare car insurance rates in Kitchener with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.