Quick Facts About Auto Insurance in Banff

- Banff car insurance is MORE expensive than the Alberta average.

- The average annual car insurance cost in Banff for a driver with comprehensive/collision coverage and a clean record is around $1,222.

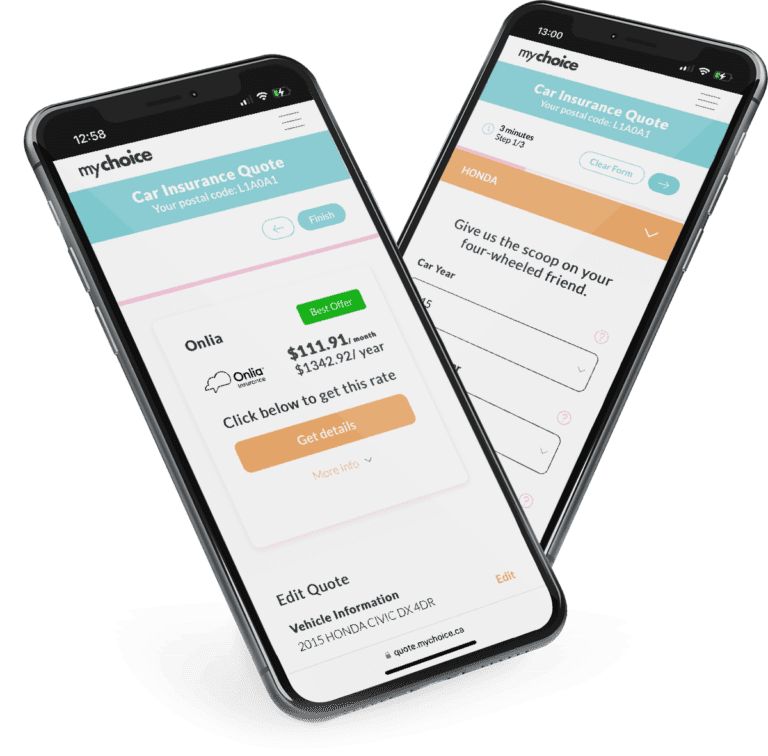

- Comparing Banff auto insurance quotes with MyChoice can save you up to $868 annually.

The Best Car Insurance Brokerages in Banff

A car insurance brokerage can help you find the best auto insurer based on your driving habits, driving record, budget, and vehicle make. Brokerages can compare auto insurance policies between different Banff companies and answer your questions, simplifying your selection process.

Here are some top car insurance brokerages in Banff. Contact them through their details below if you need help looking for affordable car insurance:

| Brokerage | Address | Phone number |

|---|---|---|

| BrokerLink | 220 Bear St #205 Banff, AB T1L 1A8, Canada | +14037622295 |

| BMO Nesbitt Burns | 107 Banff Ave Banff, AB T1L 1B3, Canada | +14037625757 |

Auto Insurance By Postal Code in Banff

At an average auto insurance rate of $1,222 per year, the town of Banff’s rates sit above the average car insurance rate for Alberta. Alberta’s average car insurance rate is $1,211/year, making Banff slighty more expensive to insure a car.

The only postal code in Banff is T1L, which makes it the most expensive area for auto insurance by default. Here’s a detailed look at auto insurance rates there:

| Postal Code | Average Annual Car Insurance Rate |

|---|---|

| T1L | $1,253 |

Car Insurance Cost in Banff by Age

As in any Canadian city or town, your age will have a significant impact on the cost of your car insurance in Banff.

Generally, drivers below the age of 25 have higher car insurance premiums. Because they’re considered less experienced drivers, they’re a bigger risk for insurers to cover – hence, their higher quotes and car insurance premiums.

Once you reach the age of 25, your car insurance premiums in Banff will go down. However, they’ll go back up when you turn 65. Senior citizens are considered to be less reflexive on the road and to have poorer vision due to their age, so auto insurers consider them more likely to get into an accident. They are also more likely to die or be injured in the event of an accident, making them riskier to insure.

Take a look at our table below to see how your age affects the average cost of your Banff car insurance, and how much you can save every year with My Choice:

| Age group | Average Average Annual Car Insurance Rate | Annual savings with MyChoice |

|---|---|---|

| 18-20 | $4,363 | $868 |

| 21-24 | $2,493 | $496 |

| 25-34 | $1,662 | $331 |

| 35-44 | $1,222 | $243 |

| 45-54 | $1,002 | $199 |

| 55-64 | $852 | $169 |

| 65+ | $971 | $193 |

Car Insurance Cost in Banff by Driving History

Your driving history has a significant impact on your car insurance premiums in Banff.

Generally, a driver with a clean driving record will enjoy much lower car insurance quotes. This is because their lack of violations and demerits makes them less risky for auto insurance companies to cover.

But if you have a lot of demerit points, speeding tickets, or other violations on your driving record, you may be considered a high-risk driver by Banff car insurers. A high-risk driver is considered more likely to commit more violations and get into accidents, making them pricier for auto insurers to cover.

While your tickets, demerit points, and violations only stay on your Alberta driving record for two years, insurers might look as far back into your driving history as 10 years ago to assess the risk of covering you. This means even old violations can increase your car insurance quotes.

Here’s a quick look at how different driving violations can affect your car insurance rates in Banff, based on our research:

| Driving violation | Average Annual Car Insurance Rate |

|---|---|

| Clean driving record | $1,222 |

| Insurance cancellation due to non-payment | $2,004 |

| Licence suspension for alcohol-related offences | $1,466 |

| One accident | $2,688 |

| Speeding ticket | $1,589 |

Driving in Banff

Located within the Alberta Rockies and Banff National Park, the resort town of Banff is a popular tourist destination in Alberta for outdoor sports like skiing and hiking. Over 4 million people visit Banff every year to marvel at the Rocky Mountains and enjoy the hot springs. Banff can get a little crowded during the summer rush, so expect congested roads during peak season.

Here are some fast facts about driving in Banff:

- Major highways in Banff: Trans-Canada Highway, Highway 93 (a.k.a. Icefields Parkway)

- Public transit options: Roam (bus), Banff Railway Station (used by the Rocky Mountaineer and Royal Canadian Pacific tour trains)

- Ridesharing services: N/A

- Parking space providers: The Town of Banff, private lots

- Top tourist attractions: Banff National Park, Banff Gondola, Bow Falls, Lake Minnewanka, Mount Norquay, Whyte Museum of the Canadian Rockies, Lake Louise Ski Resort, Sunshine Village

- Busy intersections: Banff Avenue and Caribou Street, Norquay Road and the Trans-Canada Highway, Norquay and Banff Avenue

- Airports: N/A

Main Mode of Commuting in Banff

Banff only has 3,715 commuters because most people working within the town commute from surrounding communities. This might be why under half of the town’s commuters travel by car, making up only 43.6% of its total commuters. Pedestrian commuters are also very common in Banff, making up 38.6% of all commuters. Here’s a closer look at the commuting preferences of Banff residents:

| Main mode of commuting | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 3,715 | 100.0 |

| Car, truck or van | 1,620 | 43.6% |

| Car, truck or van – as a driver | 1,470 | 39.6% |

| Car, truck or van – as a passenger | 150 | 4.0% |

| Public transit | 290 | 7.8% |

| Walked | 1,435 | 38.6% |

| Bicycle | 275 | 7.4% |

| Other method | 85 | 2.3% |

Commuting Duration in Banff

Commute times in Banff are generally very short. Nearly two-thirds of the community spend under 15 minutes on the road, while people who travel over 30 minutes to get to work are few and far between. Here’s an in-depth look at commute times in Banff:

| Commuting duration | Counts | Rates |

|---|---|---|

| Total – 25% sample data | 3,715 | 100.0 |

| Less than 15 minutes | 2,315 | 62.3% |

| 15 to 29 minutes | 1,015 | 27.3% |

| 30 to 44 minutes | 245 | 6.6% |

| 45 to 59 minutes | 75 | 2.0% |

| 60 minutes and over | 70 | 1.9% |

Driving Conditions in Banff

Snow, rain, and other driving conditions all affect the safety of Banff’s roads. Notably, Banff has subarctic weather, so many Banff drivers get snow tires to make it easier to drive through heavy snow and slush.

Here’s a quick look at the overall driving conditions in Banff:

- Average daily commute time: 28 minutes round trip

- Average annual rainfall: 322.5 mm

- Average annual snowfall: 191 cm

- Rainy days per year: 86.8 days

- Rainiest month in Banff: June

- Driest months in Banff: January

- Snow days per year: 64 days

- Snowfall months in Banff: January – June, September – December

Traffic in Banff

Though many Banff residents work within the town and its hospitality industry, this hasn’t reduced commute times or traffic significantly. One significant factor is the scarcity of affordable housing in this popular resort town, making many Banff workers commute in and out of town every day.

Learn more about the traffic conditions in Banff below:

- Population: 8,305 people live within Banff’s town limits.

- Town area: Banff’s town limits span 4.77 km2.

- Time spent in traffic annually: The average Banff resident spends 28 minutes in traffic daily, totalling roughly 170 hours per year.

- Busiest road: Banff’s busiest road is Banff Avenue.

The Most Common Questions About Car Insurance in Banff

How much does Banff insurance cost?

Banff car insurance costs an average of $1,222/year or approximately $102/month.

Is car insurance cheaper in Banff than in Calgary?

Yes, car insurance is cheaper in Banff than in Calgary. The average cost of car insurance in Banff is $1,222/year, while car insurance in Calgary costs $1,512/year.

What is the grid rating system in Banff all about?

The grid rating system in Banff and other parts of Alberta is a program that sets the maximum premium for basic coverage for all kinds of driving records. However, this only applies to basic coverage prices and does not apply to the cost of increased insurance, such as all-perils insurance.

How can you get cheap car insurance in Banff?

Compare car insurance rates in Banff with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.