Quick Facts About Auto Insurance in Montreal

- Montreal car insurance is MORE expensive than the Quebec average.

- The average annual car insurance cost in Montreal for a driver with a clean record is around $800.

The Best Car Insurance Brokerages in Montreal

It takes a lot of time and money to get quotes and compare policies from different car insurers, especially if you’re unfamiliar with how auto insurance works. Fortunately, a car insurance brokerage can simplify policy shopping for you by getting deals from different insurers.

Car insurance brokerages can compare all available offers from multiple companies for you. They can also answer any questions you may have about car insurance coverage and other related concerns so you can pick the best option for you.

Working with auto insurance brokers will help you find the best policy providers and affordable rates. Here are some recommended Montreal insurance brokerages:

| Brokerage | Address | Phone number |

|---|---|---|

| Clicassure | 625 rue Jacques-Parizeau, QC, G1R 2G5 | 1-855-431-7869 |

| Assurance Simon & Associés | 8490 Rue St-Hubert, Montréal, QC, H2P 1Z5 | 514 881-8885 |

| Gaudreau Assurances | 3737 Boul Crémazie E bureau 1001, Montreal, QC, H1Z 2K4 | 514 374-9944 |

Most Expensive Postal Codes in Montreal

Montreal, Quebec has an annual average auto insurance premium of $800, which is slightly higher than the Quebec average of $718. The most expensive postal code for car insurance in Montreal is the H4W area, which is the district of Cote Saint-Luc.

Here’s a look at some of the priciest postal codes for car insurance in Montreal, which you can see in the table below:

| Postal Code | Average Annual Car Insurance Premium |

|---|---|

| H4W | $845 |

Least Expensive Postal Codes in Montreal

The H1B district located in Montreal East has some of the lowest prices for car insurance in Montreal, with an average premium of around $781. Here’s a look at the least expensive postal codes for car insurance in Montreal:

| Postal Code | Average annual car insurance premium |

|---|---|

| H1B | $781 |

Car Insurance Cost in Montreal by Age

Car insurance rates in Montreal differ depending on your age. Younger drivers typically have higher quotes because they’re less experienced drivers, increasing the risk of collisions or traffic violations. Premiums go down once you reach the age of 21, but they’ll start to go up again when you turn 65. This is because senior drivers have a higher risk of getting into auto accidents.

Here’s a table comparing the average cost of car insurance in Montreal depending on your age:

| Age Group | Average Cost | Annual Savings With MyChoice |

|---|---|---|

| 18-20 | $2,856 | $568 |

| 21-24 | $1,632 | $324 |

| 25-34 | $1,088 | $216 |

| 35-44 | $800 | $159 |

| 45-54 | $656 | $130 |

| 55-64 | $557 | $110 |

| 65+ | $635 | $126 |

Car Insurance Cost in Montreal by Driving History

Your driving history in Montreal affects your car insurance quotes, because auto insurers look at your record to estimate your driving risk. Simply put, if you have a clean driving record with no demerits, you will get cheaper quotes because insurers consider you a safer driver.

If you have multiple at-fault accidents, demerit points, and claims on your record, auto insurers may deem you a high-risk driver. Because high-risk drivers are considered more likely to get into accidents, they usually have higher premiums. Note that while your demerit points are “reset” from your record after two years, auto insurers still look as far back as 10 years into your record for risk assessment.

Here’s a closer look at how driving violations can affect your car insurance rates based on MyChoice’s price quote information:

| Driving violation | Average annual car insurance rate |

|---|---|

| Clean driving record | $800 |

| Insurance cancellation due to non-payment | $1,312 |

| Licence suspension for alcohol-related offences | $960 |

| One accident | $1,760 |

| Speeding ticket | $1,040 |

Driving in Montreal

Montreal is the second most-populated city in Canada. Because of its size, location, and the number of road crossings that go through it, Montreal has traffic congestion issues further compounded by commuters entering the city.

Here are some key facts about driving and commuting in Montreal you should know:

- Major highways in Montreal: A-10 (a.k.a. the Bonaventure Expressway), A-15 (the Decarie Expressway), A-13 (a.k.a. Autoroute Chomedey), and A-40 (a.k.a. The Metropolitan, and part of the Trans-Canada Highway system)

- Public transit options: La société de transport de Montreal (STM; transit bus and rapid transit services), VIA Rail (trains), Exo (commuter bus and commuter rail), the Montreal Metro (subway),

- Ridesharing services: Uber, Lyft, Eva

- Parking space providers: The City of Montreal, private lots

- Top tourist attractions: Notre-Dame Basilica of Montreal, Saint Joseph’s Oratory of Mount Royal, Jean Talon Market, The Montreal Museum of Fine Arts, Old Montreal (Vieux-Montréal)

- Busy intersections: De Maisonneuve and Decarie, Parc Ave. and St-Viateur St., Galeries d’Anjou Blvd. and St-Zotique St., Crémazie Blvd. West and St-Laurent Blvd.

- Airports: Montréal–Pierre Elliott Trudeau International Airport, Montréal–Mirabel International Airport, Montreal Saint-Hubert Longueuil Airport

Main Mode of Commuting in Montreal

According to the 2021 Census of Population, over half of Montrealeans aged 15 years and over with a usual place of work or no fixed workplace address, drive a car, truck, or van as their main mode of commuting (52.5% from 25% sample data). Nearly a third take public transit (28.4%), while 9.6% walk to their workplace.

Commuting Duration in Montreal

Nearly half of working Montrealeans spend less than 30 minutes commuting to their workplace. 17.9% take under 15 minutes to commute to work, while 35.5% have a daily commute that lasts from 15 to 29 minutes. Only 9% have a commute duration of 60 minutes or more.

Driving Conditions in Montreal

Road conditions and safety are affected by the weather, so factors like average rainfall and snow days impact your Montreal car insurance premiums. Here’s a quick look at the driving conditions in Montreal:

- Average daily commute time: 27 minutes round trip

- Average annual rainfall: 864 mm

- Average annual snowfall: 1120 mm

- Rainy days per year: 154.5

- Rainiest month in Montreal: May

- Driest month in Montreal: September

- Snow days per year: 74.1

- Snowfall months in Montreal: January through May, then October through December

Traffic in Montreal

Montreal is the most densely-populated city in Quebec, with a city population of 1,762,949. Because Montreal is located on an island and its bridges are frequently congested, traffic is a constant challenge for Montreal drivers.

Montreal also frequently hosts international events and conferences, notably the F1 Canadian Grand Prix and the largest international comedy festival, Just for Laughs. During these events, traffic conditions get even trickier. Here’s a quick look at key Montreal traffic statistics so you can manage your driving risks.

- Population: Montreal has 1,762,949 residents within the city limits, and 4,291,732 as its metropolitan population.

- City area: Montreal’s urban area spans 431.50 km2.

- Average commute distance: Most Montrealeans travel 11.8 km to their workplace or school.

- Time spent in traffic annually: Most Montrealeans spend 164.25 hours every year (or 27 minutes every day) in traffic.

- Busiest highways: The stretch of Highway 40 between Pie IX Blvd. and Highway 520 in Montreal is one of the city’s busiest highways, and it’s widely considered one of the worst traffic bottlenecks in Canada.

The Most Common Questions About Car Insurance in Montreal

How much is car insurance in Montreal?

The average cost of car insurance in Montreal is $800 annually.

Where has cheaper car insurance, Montreal or Toronto?

Montreal has much cheaper car insurance compared to Toronto. The average cost of auto insurance in Montreal is $800, while car insurance in Toronto has an average price of $2,139 annually. This may be attributed to the hybrid insurance system in Quebec, where public insurance is funded by annual driver’s licence fees and covers no-fault insurance for Quebecers.

What are car insurance rates for Montreal students?

The average car insurance quote for Montreal students ranges from $2,000 to $2,200. Students tend to pay higher car insurance rates because they’re young. Their perceived lack of driving experience makes insurers deem them more likely to get into auto accidents or commit traffic violations, making them riskier to insure.

How do Montreal car insurance rates compare to other cities in Quebec?

Montreal car insurance rates are typically higher compared to other cities in Quebec, and Montreal is consistently cited as one of the most expensive cities in the province for auto insurance. This may be because of its high population density, as a higher population means more congested highways and potentially a higher incidence of auto accidents.

How can you get cheaper auto insurance in Montreal?

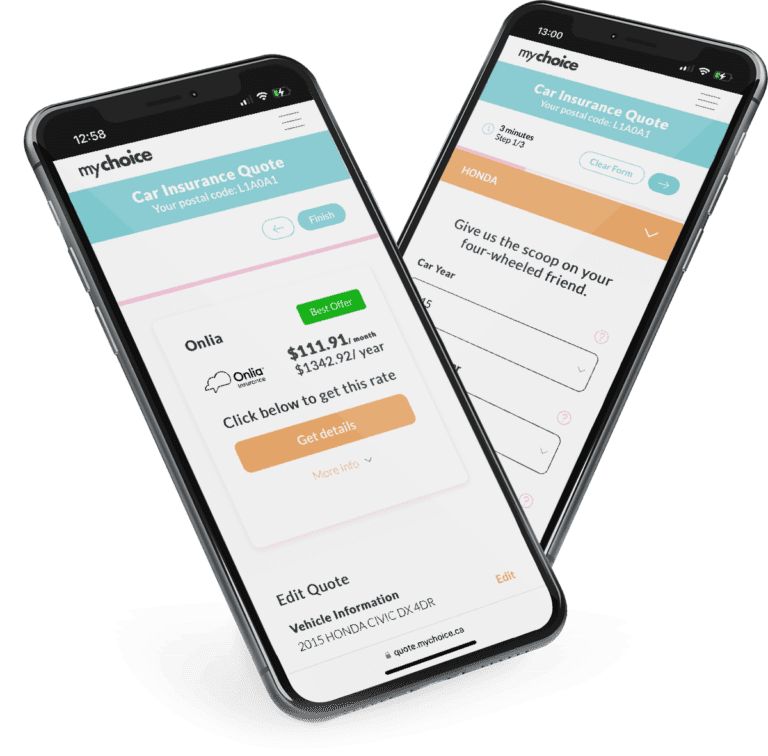

Compare car insurance rates in Montreal with MyChoice, or visit our main car insurance page to learn other ways of getting cheap car insurance quotes.