Every Canadian owning a vehicle should be prepared for a potential incident or damage. Getting the right auto insurance coverage for your car is the only way to be ready, whether you’re looking for other insurance options or have bought a new car.

How do you know what insurance coverage you should get? Most insurance providers will offer you two types of coverage: collision and comprehensive. In this article, we will show you what each one of these coverage types is, how they differ and what you should take into account when choosing your car insurance.

What Is Collision Car Insurance?

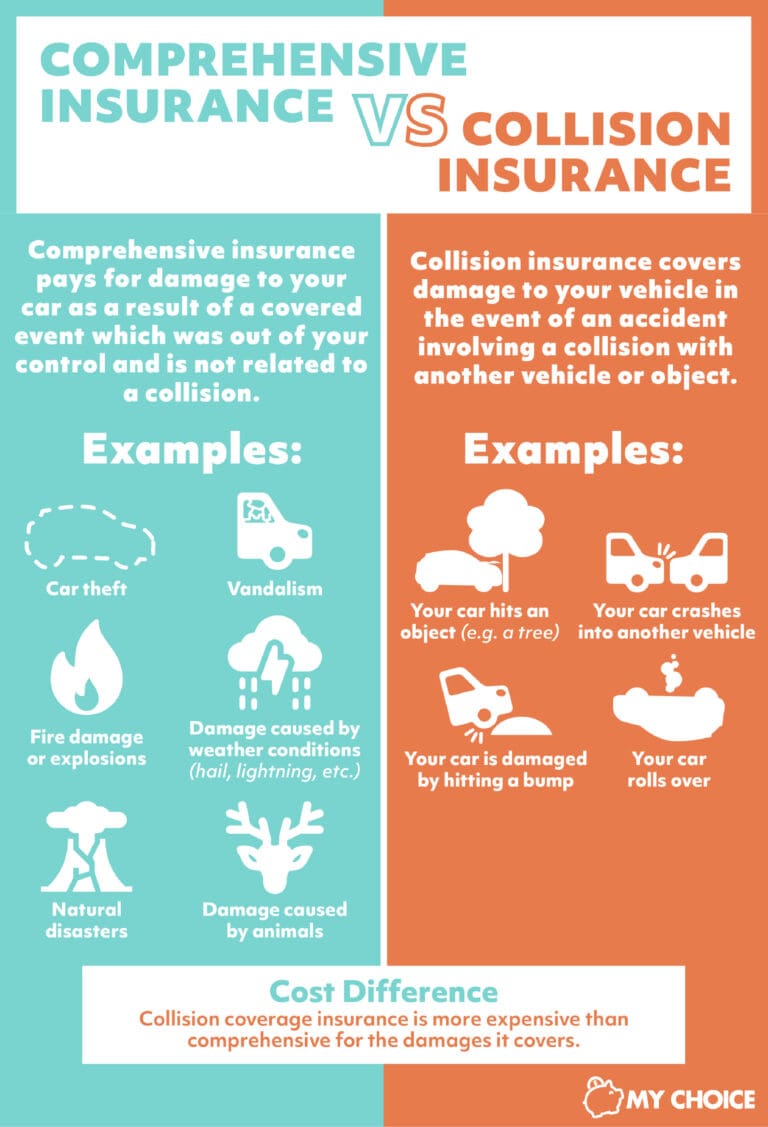

Collision car insurance in Ontario covers damage to your vehicle in the event of an accident involving a collision with another vehicle or object. This may include repairs or a complete replacement of your covered vehicle. Some situations that can cover this insurance are:

- Your car hits an object, like a tree

- Your car crashes into another vehicle

- Your car rolls over

Sometimes the most prudent drivers can be involved in car collisions. Even if you’re an A+ driver who is calm behind the wheel, you still can’t control the vehicles around you. That’s why every driver should be insured with collision insurance. Collision insurance will help pay for the costs of repairing or replacing your vehicle, even if you had an accident with a driver who had no insurance.

What is Comprehensive Car Insurance?

Comprehensive auto insurance in Ontario pays for damage to your car as a result of a covered event such as theft, vandalism or hail, which is not related to a collision. Comprehensive car insurance protects your car from external factors that are out of your control. Some of the most common claims are:

- Car theft

- Vandalism

- Fire damage or explosions

- Damage caused by weather conditions such as hail, earthquakes, lightning or windstorms

- Natural disasters

- Damage caused by an animal

- Falling objects

Sometimes you have to park outside, and a big storm hits your area out of nowhere. Sometimes you have to drive down a dark country road, and a deer jumps in front of your vehicle. You can’t control these things, but you can prepare for them by buying comprehensive auto insurance. It’s advisable to contact your insurance provider and make sure which perils are included in your policy.

What Type of Car Insurance Coverage Should I Buy?

You may wonder if you need to buy both types of coverage. These two coverages are also optional since buying them is not mandatory if you have paid for your car in full. However, if you’re leasing or financing your car, the lender likely requires you to purchase one or both coverages. To determine if you need collision insurance and comprehensive insurance, consider the following:

Your car’s value

The higher the value of your car, the more expensive it will be to repair or replace it. Buying comprehensive and collision coverage can protect you from paying those costs out of pocket.

Accident risk

If you drive often, especially on roads with a higher traffic volume, you are more likely to have an accident. If your risk is higher, you’ll want to make sure you’re protected with collision insurance.

Your current savings

Do you have enough savings to pay for the cost of repairing or replacing your car out of your pocket? If not, it’s imperative to purchase coverage.

Your Postal Code

Some places are more dangerous than others, and car thefts are more frequent in certain cities. Suppose there is more vehicle damage reported in your area due to fallen branches or animals crossing the road. In that case, it may be a good idea to buy a comprehensive auto insurance policy.

What’s Not Covered by Collision and Comprehensive Insurance?

Comprehensive insurance and mandatory liability coverage are usually combined together by insurance companies in what is known as a complete coverage bundle. There are instances where comprehensive and collision insurance does not apply.

Injuries are usually covered by your own or the other driver’s liability insurance. If you find your vehicle vandalized, your comprehensive insurance will cover the damage. But if there are items that were stolen from the vehicle, they wouldn’t be covered.

What is the Difference Between Comprehensive and Collision Insurance?

Together, these two types of auto insurance offer protection when your vehicle is damaged. However, the kind of damage it covers is quite different. Some insurance companies won’t let you have collision coverage if you don’t have basic mandatory insurance first. Both types of coverage are usually offered together. Here are some of the most important differences:

Cost

Like most things about cars, collision and comprehensive insurance do not have the same price. Collision coverage insurance is more expensive for the damages it covers. You should consider getting both types of coverage to reduce costs.

Damage

You may think that comprehensive coverage will cover all damages but only in certain circumstances. Collision insurance covers collisions, including most accidents in which you are guilty. Both types of coverage are optional unless your lender or leasing company requires it, but it’s always better to be safe than sorry.

What’s Not Covered by Collision and Comprehensive Insurance?

Comprehensive insurance and mandatory liability coverage are usually combined together by insurance companies in what is known as a complete coverage bundle. There are instances where comprehensive and collision insurance does not apply.

Injuries are usually covered by your own or the other driver’s liability insurance. If you find your vehicle vandalized, your comprehensive insurance will cover the damage. But if there are items that were stolen from the vehicle, they wouldn’t be covered.

How Much Does Optional Coverage Cost?

The cost of collision and comprehensive insurance is added to the mandatory insurance. The amount you pay will depend on things like mileage, age, maintenance history and the purchase price of the vehicle. The province where you live and the deductible you are willing to pay will influence your rate as well. The higher the amount you pay for your coverage deductible, the lower the cost of your premium will be. Usually, the cost of comprehensive insurance is between $100 to $300 on top of mandatory insurance.

Visit Billyard Insurance Group to find good rates on optional car insurance. We recommend comparing collision insurance rates with comprehensive insurance rates with MyChoice to find the best and most affordable car insurance.