Having a car stolen or totalled in an accident is a stressful event that comes with a lot of financial implications. While an auto insurance policy will ensure you get a payout to recoup some of your loss, your car’s value might have depreciated in the time between purchasing it and making a claim, which will significantly reduce your potential payout.

OPCF 43 is an endorsement that ensures your car’s depreciated value won’t be a factor when it comes to insurance payouts due to a total loss. How does OPCF 43 work? How much does it cost? Read on to find out what you need to know about this insurance policy add-on.

How OPCF 43 Works

You can only take out the Ontario Policy Change Form (OPCF) 43 as an endorsement on your auto insurance policy if you’re buying or leasing a brand-new car. Depending on your policy and insurance company, you can secure the value of your vehicle against depreciation for 24 to 36 months.

Since most vehicles depreciate in value, totalling a car within two or three years can mean that your claim amount will be significantly smaller than the initial price of your vehicle, putting you under financial stress after losing your car. With OPCF 43, you can have peace of mind knowing that if anything happens, you’ll be able to recoup the whole cost of your initial vehicle purchase.

How Does Car Depreciation Work?

When you buy a new car, you’re buying it at full market value. But once you start driving it off of the lot, it typically starts losing its value. Your car can lose up to 30% of its value in the first year that you own it, and its value can decrease even more with each year that passes. After five years, your car might only retain 40% of its original value, meaning that if you face a total loss, the insurance company might only pay a fraction of what you initially paid for it without OPCF 43.

Why Do I Need OPCF 43?

You need OPCF 43 as a way to protect yourself from financial loss in case of a theft or total loss of your vehicle. With this specific endorsement, you can be assured that you’ll be able to get good value from your insurance claim. For example, say you initially bought your vehicle at $25,000 and had a crash that totalled it after a year. A typical insurance claim might only give you $17,000 after your insurer factors in the car’s depreciated value. With OPCF 43 applied to your insurance policy, you would retain the full value of your vehicle in a claim and save thousands of dollars, giving you a lot of financial security and the option to buy a similar model as a replacement.

How Much Does OPCF 43 Cost and Is it Worth it?

Adding OPCF 43 to your auto insurance policy adds anywhere between $50 and $100 to your annual premiums. Depending on your insurance broker or company, you might save some money by bundling OPCF 43 with your base car insurance policy or other endorsements such as OPCF 20.

If you want to drive your car with the certainty that you’ll be able to retain its value in the event of a total loss, then OPCF 43 is definitely worth adding to your auto insurance policy. Losing your car to a theft or a bad accident can cause a lot of stress, and having the option to claim the full value of your vehicle will significantly reduce the financial impact of such an event.

Mechanics of OPCF 43

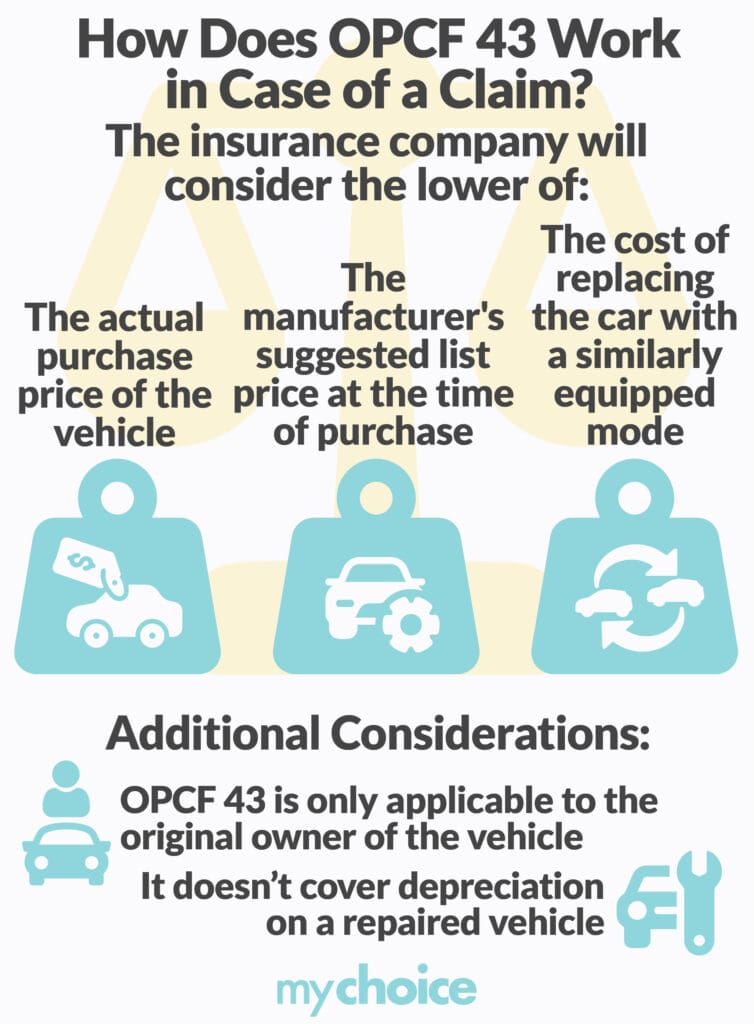

When your car is declared a total loss by your insurance company, your claim will be reviewed by the insurance company. If you have the OPCF 43 endorsement on your insurance policy, your insurer will pay out the lowest of the following amounts:

- The initial purchase price of your vehicle.

- The list price that was suggested by the manufacturer at the time you purchased your vehicle.

- The price of a similarly equipped replacement car model.

Take note that these may be lower than the actual market value of your car at the time of the claim, but only if your car appreciated in value instead of depreciating. However, this is not typical and usually only happens for rare car models or

Limitations of OPCF 43

While OPCF 43 does protect your car’s value from depreciating over time, there are a few limitations that you should be aware of.

Sometimes, a car’s value can appreciate instead of depreciating, meaning that it actually becomes more valuable over time. Car value appreciation is not typical, but it can happen if your vehicle is a rare or limited model, or sees an increase in demand after you buy it. When this happens, having OPCF 43 as an endorsement on your insurance policy can work against you since it allows the insurance company to pay out a lower amount than your car is currently worth.

OPCF 43 also only applies to the original owner of the vehicle, meaning that you aren’t eligible for this endorsement if you buy a used car. This endorsement also doesn’t cover depreciation for repaired vehicles, which means that if you previously got in an accident and had your car repaired, you won’t be able to rely on OPCF 43 to maintain your vehicle’s value. Also, OPCF 43 only covers the vehicle itself and not individual vehicle parts such as the car battery, tires, or other replacement parts.

Key Advice from MyChoice

- Insurers will not consider your vehicle’s fair market value for your insurance claim if it appreciates while you have OPCF 43 on your policy.

- You can’t add OPCF 43 onto your policy if you’re buying a used car, and you can no longer have it as an option if your car suffers damage from an accident and is subsequently repaired.

- In case of a claim, insurance companies will choose the lowest out of three possible values, though the payout will usually be higher than your car’s depreciated value.