Even if you’re an incredibly safe driver, accidents happen. An at-fault collision might mean a premium hike that can burn a hole in your finances. However, you can prevent this from happening with the OPCF 39, also known as the “accident forgiveness” endorsement. Learn how accident forgiveness works, the conditions for eligibility, and what limitations to know.

What is Accident Forgiveness and What Does it Cover?

In Ontario, accident forgiveness on your car insurance applies explicitly to preventing an increase in your premium after your first at-fault accident. Thus, if you have accident forgiveness and cause an accident, your insurance company won’t increase your rates, allowing you to maintain your current premium.

However, if you have subsequent at-fault accidents, expect your premium to rise, especially for severe violations like impaired driving.

How OPCF 39 Endorsement Works

Ontario Policy Change Forms (OPCFs) are optional provisions that let you modify your car insurance coverage. OPCFs exist for things like replacement vehicles, depreciation waivers, and protection when driving cars you don’t own.

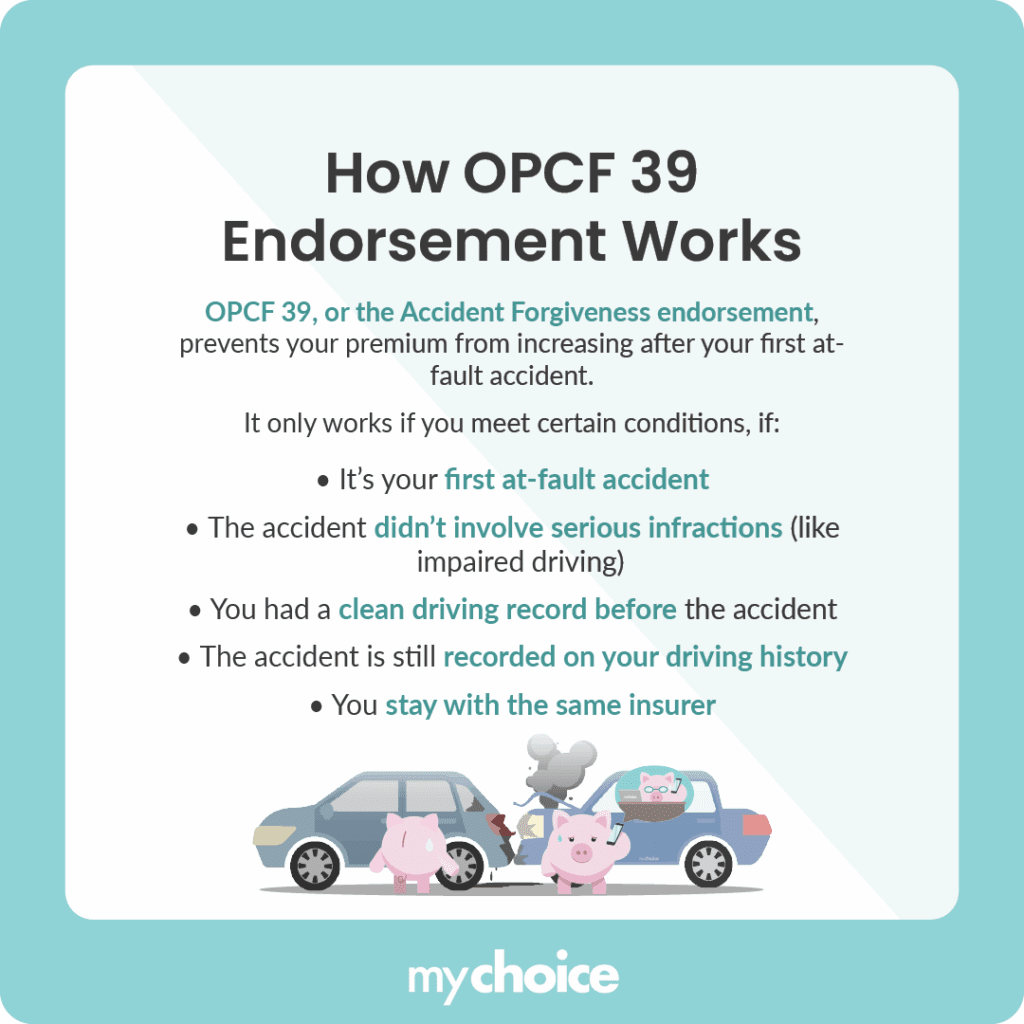

OPCF 39 is explicitly the “accident forgiveness” endorsement, which protects your driving record and prevents a premium increase after your first at-fault accident, essentially giving you a one-time “pass.” However, that doesn’t mean having an OPCF 39 active immediately grants you this pass. There are some conditions and caveats to be fulfilled, which you can see in this table:

Accident forgiveness in Ontario offers some peace of mind, but it’s not a free pass. For instance, accident forgiveness won’t cover the following:

- Subsequent accidents where you are at fault

- Demerit points

- Major violations like DUIs or reckless driving

- Secondary drivers

Do I Need Accident Forgiveness in Ontario?

You’re never legally required to get accident forgiveness in Ontario. However, getting accident forgiveness is a good idea to safeguard your car insurance rates. Let’s take a look at some scenarios where accident forgiveness will be extremely useful:

- You’re a conscientious driver, but acknowledge the possibility of an accidental mishap.

- You’re an inexperienced driver who may be more prone to accidents.

- You participate in activities that occasionally increase your risk profile, such as renting high-performance cars.

- You drive frequently for work and are more statistically likely to experience an accident.

- You live in a dangerous city for driving.

- You drive an accident-prone car model.

The Insurance Benefit of Accident Forgiveness

Adding an OPCF 39 endorsement to your car insurance package is an additional expense on top of your existing Ontario car insurance premiums. However, this additional expense is relatively low, as adding OPCF 39 only raises your annual car insurance premiums by an average of $27. If you compare that with the 15% average premium increase that you’ll be hit with after your first at-fault accident, it’s worth the cost.

To put this into perspective, let’s do the math. The average car insurance premium in Ontario is roughly $1874/year. But if you get into an at-fault accident and get the average 15% premium increase, your annual cost will go up to $2,155, an increase of almost $300. If we look at these numbers, getting accident forgiveness is more than worth it.

How Does Accident Forgiveness Affect Future Insurance Applications?

Accident forgiveness in Ontario has a limited impact on future insurance applications because it doesn’t directly affect how other companies view your driving record. Even with accident forgiveness, you cannot control how long an accident stays on your driving record.

Thus, accident forgiveness will help maintain your current premium, but won’t guarantee the same rate with a new insurer. When determining application eligibility, future insurance companies will still consider your driving history, including forgiven accidents.

How much your rate may increase after a car accident will depend on the following factors:

- The severity of the accident

- Fault determination

- Your driving record

- Your insurance company

Ultimately, the best way to ensure consistently affordable car insurance rates in future applications is to maintain a safe driving record.

Alternative Ways to Protect Your Driving Record and Lower Premiums

Looking for ways to protect your driving record and lower your auto insurance payments? Getting OPCF 39 isn’t your only option. Here are some alternative or complementary options that you can consider to keep your insurance premiums low and your driving record clean.

Key Advice from MyChoice

- Carefully weigh whether accident forgiveness suits your needs. If you’re only planning to keep the car for a short period, already have a heavily discounted insurance rate, or drive a very expensive car, the extra cost of accident forgiveness might not be worthwhile.

- Compare quotes from different insurance companies every few years to ensure you get the best possible rate based on your current driving record and risk profile.

- You can also consider other premium-reducing methods, such as increasing your insurance deductible, installing anti-theft devices, and completing defensive driving courses.