Cars get the job done for everyday driving, but when your work demands off-road capability, towing power, or hauling heavy equipment, nothing matches the capability of a truck. Many industries rely on trucks for both performance and practicality, especially in Canada’s demanding road and weather conditions.

That said, ownership costs, particularly truck insurance, can quickly add up. This guide breaks down which trucks offer the most affordable insurance rates and which deliver the best overall value, helping you choose a vehicle that works just as hard for your budget as it does on the road.

View our comprehensive list of the cheapest cars to insure in Canada if you want to learn more.

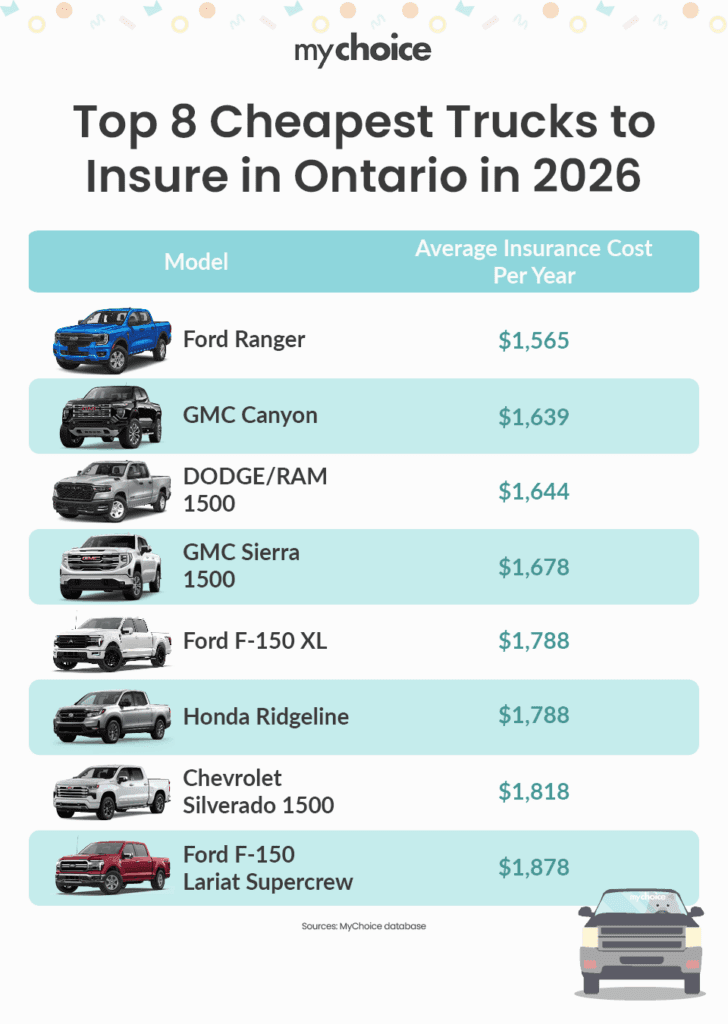

Top 8 Cheapest Trucks to Insure in Ontario in 2026

| Car model | Average Annual Car Insurance Premium | Average Monthly Car Insurance Premium |

|---|---|---|

| Ford Ranger | $1,565 | $130 |

| GMC Canyon | $1,639 | $137 |

| DODGE/RAM 1500 | $1,644 | $137 |

| GMC Sierra 1500 | $1,678 | $139 |

| Ford F-150 XL | $1,788 | $149 |

| Honda Ridgeline | $1,788 | $149 |

| Chevrolet Silverado 1500 | $1,818 | $152 |

| Ford F-150 Lariat Supercrew | $1,878 | $157 |

The insurance premiums in the table above and the infographic below are based on the thousands of quotes we collected through our platform in 2025.

Our Methodology for Choosing the Cheapest Trucks to Insure in Ontario

To build this 2026 ranking of the most affordable pickup trucks to insure, we focused on real insurance data from actual Ontario drivers rather than estimates or manufacturer assumptions. Our goal was to highlight real-world trends that reflect what people are genuinely paying for coverage across the province.

Here’s the process we used:

- We analyzed more than 60,000 Ontario auto insurance quotes submitted through our platform in 2025.

- Each quote was categorized by vehicle make, model, and year, allowing us to calculate the average annual and monthly insurance premiums for each truck.

- To ensure a fair and consistent comparison, we focused on a standard driver profile across all vehicles: a 35-year-old married driver (male or female), fully licensed, with a clean driving record.

- Finally, we ranked each truck from lowest to highest average premium, identifying which models consistently deliver the best value when it comes to insurance affordability.

1. Ford Ranger

Among the lowest in cost to insure, the Ford Ranger stands out. It’s a solid mid-sized truck that brings a lot of capability without going overboard. The 2025 Ranger features (depending on trim) a powerful twin-turbocharged 3.0 L EcoBoost V6 with good off-road cred.

It delivers towing capacity and practical utility, yet isn’t massive in size compared to full-sized trucks. On the road it’s comfortable, manoeuvrable, and a good choice if you need that truck utility but don’t want the insurance jump that often comes with a bigger vehicle.

Estimated Average Insurance Cost: $1,565/year

2. GMC Canyon

Among cheap trucks, the GMC Canyon is an excellent midsize truck for the price. The Canadian 2025 version features a 310 hp TurboMax engine, and it comes with a 2.5 L inline-4 (in some trims), but you can upgrade to a 3.6 L V6 (in older models).

The Canyon is manoeuvrable, and the steering and handling are responsive for the class. Inside, the ride quality is good over most surfaces, and the only downside is that the front seats can be a touch cramped. Though it can go off-road and several trims are made for it, the Canyon hangs just too low for serious off-roading. It’s built for roads and cities, so keep this in mind if off-road capability is a concern.

Estimated Average Insurance Cost: $1,639/year

3. DODGE/RAM 1500

The Ram 1500 is a full-size truck, which normally means higher costs. However, our data shows that some trims (especially those with standard equipment, lower power, and less “luxury” bells) bring down insurance costs. It offers strong capability, good comfort, and if you shop smart, you’ll get full-size utility without the highest insurance hit.

Estimated Average Insurance Cost: $1,644/year

4. GMC Sierra 1500

The Sierra 1500 is similar in many respects to the Ram 1500 in class, with full-size truck capability. What helps its insurance affordability are basic trims, mature design, and nameplate reputation. If you go for ultra-premium trims, you might see higher premiums, but the baseline versions are among those that can be insured relatively cheaply.

Estimated Average Insurance Cost: $1,678/year

5. Ford F-150 XL

The F-150 is one of the most common trucks on Canadian roads, which has pros and cons when it comes to insurance. Its replacement parts are plentiful, and repair networks are strong, but its theft rates and crash exposure are also higher.

The “XL” trim is the basic work-oriented version, which helps with insurance costs. Compared to many other full-size trucks, this model version offers very affordable annual premiums.

Estimated Average Insurance Cost: $1,788/year

6. Honda Ridgeline

The Ridgeline is a bit of a different animal as it’s technically a truck but built on a unibody platform, which is more like an SUV with a bed. The plus side is this often translates into lower insurance risk and repair costs tend to be more in line with lighter vehicles. The usage profile is often less “work-truck” and more “general utility”, which fits nicely with low insurance premiums.

Estimated Average Insurance Cost: $1,788/year

7. Chevrolet Silverado 1500

The Silverado 1500 is another full-size truck that’s very capable and widely used in Canada. That means lots of parts, strong service networks, which helps insurance costs. Note that because it’s full-size, you’ll see higher premiums for this compared to midsize trucks. Despite this, it’s one of the more affordable full-size trucks to insure in Ontario.

Estimated Average Insurance Cost: $1,818/year

8. Ford F-150 Lariat Supercrew

The Ford F-150 Lariat SuperCrew is one of the most popular full-size pickup trucks on Canadian roads. This truck combines serious power with everyday comfort, offering a a well-appointed interior with driver-assist features for safety and convenience.

Under the hood, you’ll find a choice of capable engines, from the efficient 2.7L EcoBoost V6 to the robust 5.0L V8, giving it strong towing and hauling while still offering a smooth ride. While insurance costs for the Lariat are higher than for smaller or more basic trucks, its strong safety ratings, wide availability of parts, and proven reliability help keep premiums manageable.

Estimated Average Insurance Cost: $1,878/year

What Factors Determine How Cheap It Is to Insure Your Truck?

When you pick a truck and try to budget for insurance in Ontario, a number of variables will affect the quotes you get from your preferred car insurer. Here’s a breakdown of key factors that determine how cheap or how expensive it’ll be to insure your truck: