If you’ve ever been in a car accident in Ontario, you may have noticed that filing your insurance claims can be easier than in other provinces. This is thanks to Ontario’s no-fault insurance system, which allows drivers involved in an accident to process their claims directly with their own insurer, saving them the time and hassle of going to court to sue the other driver for compensation.

However, this does not mean that you can’t be found at fault for an accident. If you are found to be at fault, you will still need to pay the deductible on your insurance before your insurance claim is paid out.

What is no-fault insurance, and why is it important? Does every driver in Ontario get no-fault insurance? Read this guide to learn everything you should know about Ontario’s no-fault insurance.

What Is No-Fault Insurance in Ontario?

No-fault insurance in Ontario is a system put in place by the government to expedite the claims process for all drivers involved in an accident. Under this system, drivers who are involved in car accidents in Ontario are compensated by their own insurance company, regardless of who was at fault for the accident.

Ontario no-fault insurance is designed to streamline the claims process and ensure that injured parties receive compensation as quickly as possible, without having to wait for a lengthy investigation to determine who was at fault for the accident.

However, it also means that drivers cannot sue each other for damages, except in cases of serious injury or death. Read more about how fault is assigned in Ontario.

How Does No-Fault Insurance Work in Ontario?

No-fault insurance works in Ontario when an accident happens, and each person files their claim with their respective insurance companies instead of having to first determine who is at fault and which insurance company will pay out the claims.

The insurance companies will still determine who is partially or fully at fault using Ontario’s Fault Determination Rules, which will affect the parties’ insurance policies going forward. Drivers can be found to be from 0 percent to 100 percent at fault. This doesn’t affect the insurance payout if a driver’s policy covers the damages caused by the accident.

What Does Ontario No-Fault Insurance Cover?

Ontario no-fault insurance covers the claims you make to your insurer after an accident. Since no-fault insurance allows you to deal directly with your insurance company, you can be quickly paid out for:

What Actually Happens After a Crash? A Step-by-Step Claim Timeline

Claiming insurance is important to ensure you’re financially protected after an accident. To make it easier for you, here’s a step-by-step overview of what happens and what to do throughout a post-crash insurance claims process:

- File an accident report with your insurance representative within seven days, providing key details of the incident. If the total damages exceed $5,000, you may need to order a collision report for insurance purposes.

- Wait for a claims adjuster to contact you and answer any questions they may have.

- Get an estimate for your car’s damage and repair costs.

- Find an auto garage and schedule a repair appointment.

- Close the insurance claim.

Throughout this process, the claims adjuster will be your primary contact point for updates from the insurer. You can also ask them questions about the process.

There’s no one-size-fits-all timeline for a car insurance claims process since it varies depending on the case’s complexity. Simple cases can take just a few weeks to pay out, while bigger accidents can take months to resolve, especially if they involve bodily injury.

Why Was No-Fault Insurance Introduced In Ontario?

No-fault insurance was introduced in Ontario in 1990 to reduce the impact of growing liability costs when drivers get into an accident. Before this system was put in place, drivers affected by an accident often had to make multiple insurance claims and wait months after the accident occurred to receive their insurance payouts.

After the introduction of the no-fault policy, it became easier and quicker for drivers in an accident to receive their Ontario car insurance payouts. This made paying for vehicle damages and medical bills incurred by an accident a lot easier for the affected drivers.

Common Misunderstandings About No-Fault Insurance

Because the term “no-fault insurance” can be a bit ambiguous, many people assume some things about the policy that are simply untrue. Here are a few common misconceptions about no-fault insurance in Ontario:

- If you are involved in an accident, you won’t be found at fault.

- If nobody is at fault for an accident, insurance companies won’t investigate who caused it.

- No-fault insurance prevents accidents from going on your driving record if you’re not at fault.

These common interpretations of the term “no-fault” insurance are false. Regardless of who caused an accident, car insurance companies will always investigate an insurance claim to determine who was at fault and by how much.

Depending on your insurer’s findings according to the Fault Determination Rules, you can be found to be partially at fault, fully responsible, or share fault with one or more other drivers. Accidents will also go on your driving record if you’re found to be more than 25% at fault.

Under Ontario’s No-Fault Insurance, Who Pays the Deductible?

Under Ontario’s no-fault insurance, you pay for the car insurance deductible if you are found to be at fault for the accident.

After reporting a car accident, you need to file a claim with your insurance company. Once your insurer determines who is at fault for the accident, you will need to pay your deductible amount if you are found to be more than 25% at fault. If you are not found to be at fault, you don’t need to pay the deductible.

The deductible amount you need to pay depends on the details of your policy and how much you pay in insurance premiums.

Will a No-Fault Claim Affect Insurance Rates?

In Ontario, filing a no-fault claim will not affect your auto insurance rates, as the purpose of no-fault insurance is to ensure that drivers and passengers receive compensation for their injuries and other losses after an accident, regardless of who was at fault.

However, if you were found to be at fault for the accident, your insurance rates may increase upon renewal. This is because your insurance company will consider you a higher-risk driver and adjust your rates accordingly.

It’s important to note that while a no-fault claim won’t affect your insurance rates, making multiple claims or being involved in several accidents may result in higher rates or even non-renewal of your policy. Additionally, if you were driving under the influence of drugs or alcohol or were engaging in illegal activities at the time of the accident, your insurance rates may be affected.

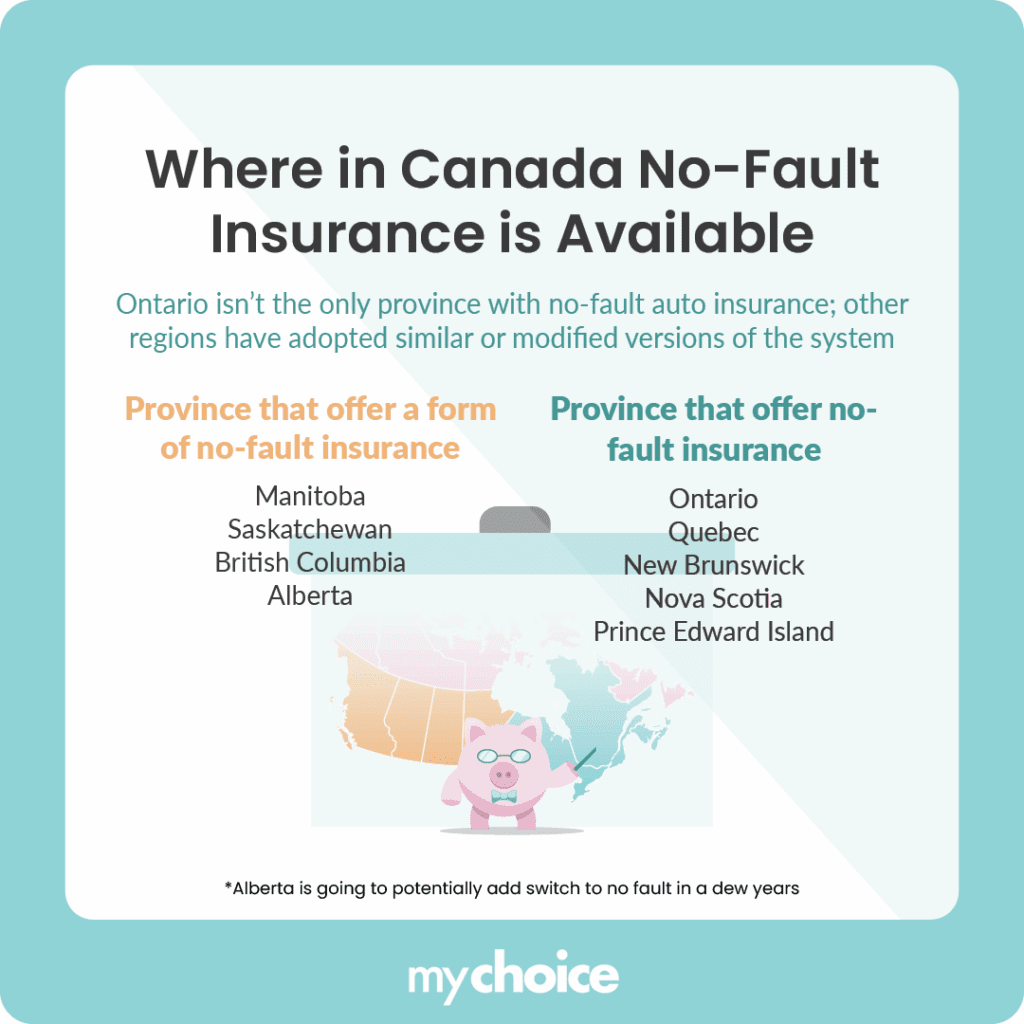

Is No-Fault Insurance Available in Other Provinces?

Yes, no-fault insurance is available in other Canadian provinces besides Ontario. In fact, Quebec was the first province to adopt a no-fault insurance system in 1978. Other than Quebec, three other provinces have adopted the same no-fault insurance system as Ontario: New Brunswick, Nova Scotia, and Prince Edward Island.

Here are some other provinces that offer a form of no-fault insurance:

Key Advice from MyChoice

- Under the no-fault system, you won’t have to pay the deductible if you’re not at fault.

- Filing a no-fault claim won’t affect your rates if you’re innocent, but your rates may increase if you’re found to be at fault.

- Once you’re assigned a claims adjuster, you can ask them for updates on your insurance claim process.