Auto insurance can be filled with complicated terminology, so it’s no surprise that acronyms like PLPD might confuse some drivers. If you’ve ever been told that you “only need PLPD,” or have seen it as the cheapest insurance option, you might be wondering what exactly PLPD insurance includes and what it doesn’t.

What does PLDPD mean? Do you need it to drive in Ontario? Are there benefits to getting more coverage beyond PLPD? Read on to learn about it, how much it protects you, and whether it’s worth it to have only PLPD coverage on your policy.

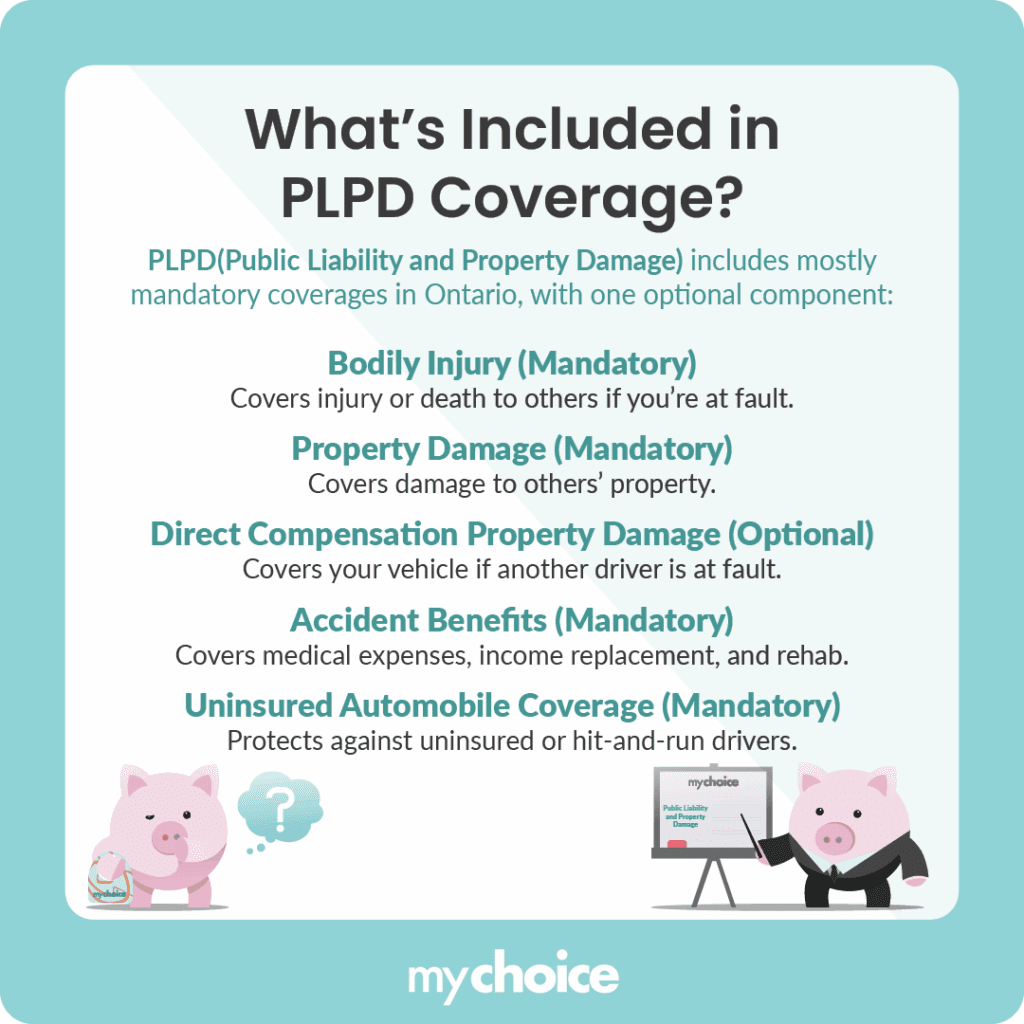

What’s Included in PLPD Coverage?

PLPD coverage includes several components, most of which are mandatory under Ontario law. One notable exception is the optional status of Direct Compensation-Property Damage (DCPD), which was previously mandatory but can now be removed under specific conditions using Ontario Policy Change Form (OPCF) 49.

Here’s a breakdown of PLPD coverage:

| Coverage | Mandatory or Optional | Coverage Details |

|---|---|---|

| Third Party Liability – Bodily Injury | Mandatory | Covers injury or death to other people if you’re at fault in an accident. |

| Third Party Liability – Property Damage | Mandatory | Pays for damage to someone else’s property that you caused in an accident. |

| Direct Compensation – Property Damage | Optional (via OPCF 49) | Covers damage to your vehicle when another driver is at fault. |

| Accident Benefits | Mandatory | Provides benefits such as medical expenses, income replacement, and rehabilitation. |

| Uninsured Automobile Coverage | Mandatory | Protects you if an uninsured or hit-and-run driver hits you. |

What PLPD Does Not Cover

PLPD only covers your liability and basic accident-related expenses. It doesn’t cover damage to your car in most situations, unless another at-fault driver is involved and you have DCPD coverage in place.

Here are some situations not covered under PLPD and the specific policies and endorsements you may need to be covered in these scenarios:

| Scenario | Recommended Coverage | Coverage Details |

|---|---|---|

| Your vehicle is damaged in an accident where you’re found at fault. | Collision Coverage | Pays for damage to your car if you’re at fault or involved in a single-vehicle crash. |

| Your vehicle is stolen, vandalized, or damaged by weather. | Comprehensive Coverage | Covers non-collision incidents like theft, vandalism, fire, hail, and falling objects. |

| Injuries or death exceed the third-party liability limit. | OPCF 44 (Family Protection) | Covers shortfalls if the at-fault driver has insufficient coverage. |

| You want to extend your regular coverage to a rental car. | OPCF 27 (Legal Liability for Damage to Non-Owned Vehicles) | Extends your coverage to rental or borrowed vehicles. |

| You need to rent a car after your vehicle is considered a total loss. | OPCF 20 (Coverage for Transportation Replacement) | Pays for rental while your car is being repaired or replaced. |

| You want to protect your car’s replacement value from depreciation. | OPCF 43 (Removing Depreciation Deduction) | Ensures a new car is valued at the purchase price for claims. |

| You need extra coverage for yourself or your family members. | OPCF 29 (Additional Coverage For Named Person(s)) | Increases standard accident benefits only when the specified person or persons are driving the car. |

Why It’s Not Recommended to Remove Direct Compensation Coverage

As of January 1, 2024, drivers in Ontario have had the option to opt out of Direct Compensation-Property Damage (DCPD) coverage by using OPCF 49. However, most insurance brokers strongly advise against it.

Here are some compelling reasons why you should keep DCPD on your policy:

- Without DCPD, you’re fully responsible for your own vehicle damage, even when someone else is at fault in a not-at-fault accident.

- You won’t receive compensation for towing, storage, or loss of use of your vehicle after a not-at-fault accident.

- Claims can become complicated and costly, especially if you mistakenly assume you’re covered.

In general, it’s not worth it to use OPCF 49 to remove DCPD from your auto insurance policy. Yes, your premiums will be slightly lower, but your out-of-pocket expenses will skyrocket if you get involved in even a minor accident.

Who Should Avoid PLPD-Only Coverage?

While PLPD might seem appealing due to its lower premiums, it’s not for everyone. PLPD-only coverage is best suited for:

- Drivers of older vehicles with low market value, where paying for full coverage may not be worth it.

- Drivers who can afford to repair or replace their vehicle out of pocket.

- Secondary vehicles that are rarely driven.

You should avoid PLPD-only coverage if:

- You rely heavily on your vehicle for daily life or work.

- You can’t afford a surprise repair or replacement.

- You live in an area with higher rates of accidents or theft.

- You drive a new or financed vehicle (lenders often require full coverage).

In these cases, you should consider getting collision coverage, comprehensive coverage, or full coverage for your vehicle.

PLPD Insurance vs. Full Coverage

While PLPD coverage is the minimum required to legally drive in Ontario, full coverage insurance offers maximum protection for you and your vehicle in the majority of situations. Here’s a comparison of the features of each coverage package:

| Features | PLPD Insurance | Full Coverage Insurance |

|---|---|---|

| Third-party liability | Included | Included |

| Accident benefits | Included | Included |

| Uninsured automobile coverage | Included | Included |

| Direct compensation property damage (DCPD) | Optional (can be removed through OPCF49) | Included (recommended) |

| Collision coverage | Not included | Included |

| Comprehensive coverage | Not included | Included |

| Vehicle protection from damage caused by you | No | Yes |

| Cost | Lower premium | Higher premium |

| Ideal for | Older or low-value vehicles | Newer vehicles, financed cars, or drivers needing complete protection |

Key Advice from MyChoice

- Minimum coverage does not equate to adequate coverage. PLPD coverage meets the legal requirements for driving in Ontario, but it may not provide the protection you need.

- Consult your insurance agent or company before asking to remove DCPD from your policy. Unless you’re confident in your ability to pay for damages out of pocket, it’s recommended to keep DCPD.

- Review your auto insurance policy annually. As your car ages or your financial situation changes, your insurance requirements will also need to adapt.