Buying a car means higher monthly costs, but at the end of the day, you will end up with something of your own. On the other hand, car leasing offers lower monthly payments, but you will ultimately pay more over time, effectively renting the vehicle rather than owning it.

If you’re unsure about which option is right for you, you’ve come to the right place. We’ll show you how each works and provide an overview of the benefits and drawbacks of each one.

Leasing vs Financing: An Insurer’s Perspective

Whether you’re leasing or financing a car doesn’t matter much for an insurer. When calculating your car insurance rates in Canada, insurers assess your risk profile as a driver and how risky your car’s make and model is to insure.

However, you still need to tell your insurer whether you leased or financed the car because this will come up if your car is stolen or totalled in an accident. If that happens, your insurer will pay your leasing company or loan provider to cover your remaining payments.

Must-Have Endorsements in Ontario: Leasing vs. Financing

On top of your car insurance policy, car insurance endorsements in Ontario (often known as OPCFs) or other insurance coverage round out your protection. Let’s take a look at the common endorsements:

| Endorsement | Leased Car | Financed Car |

|---|---|---|

| OPCF 5 | Required on leased cars. | Inapplicable. |

| OPCF 23A/23B | Inapplicable. | May be required by the financial provider. |

| OPCF 43 | Recommended to get your car’s full value in compensation in the case of theft or a total write-off. | Recommended to get your car’s full value in compensation in the case of theft or a total write-off. |

| Gap Insurance | Recommended for theft/total write-off protection. | Recommended for theft/total write-off protection. |

What Is a Car Lease?

A lease is a rental of a good for payment during a certain period. The lessor buys, for example, a car and rents it to you for a fee during the time established in the contract, which generally goes from 12 to 36 months. At the end of this period, you have three options:

- Renew the lease with a new car

- Buy the car for the residual cost

- Return the vehicle and end the contract.

Car leasing, or leasing, is another way of acquiring a car and has interesting characteristics. At first glance, leasing seems like a non-viable way to buy a car, but as always, everything will depend on the profile of each person, their likes and needs.

What Are The Different Types Of Car Leases?

There are different types of car leases in Canada, the type you choose depends on your short and long-term interests as well as your monthly budget. These are the most common:

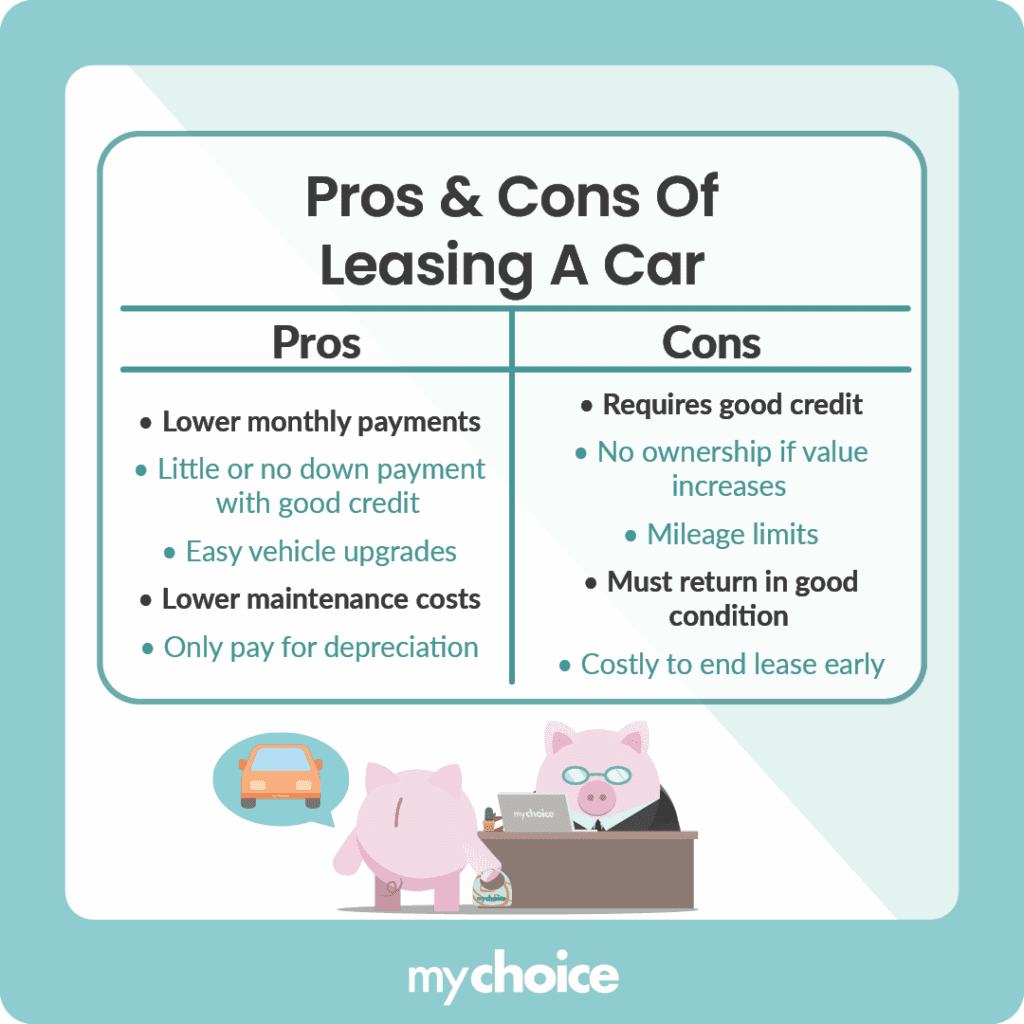

Pros & Cons Of Leasing A Car

Some people find car leasing a solution to their immediate needs that also better fits their budget. Leasing a vehicle can offer you the following advantages:

- Monthly payments are lower than those of owning, and you may receive special offers.

- If you have a good credit history, you likely won’t be required to pay any down payment beyond the first month’s rent.

- You can easily switch vehicles in a short period, which will save you a significant amount of maintenance costs.

- You do not pay the total cost of the vehicle, only the residual value. This amount results from the difference between the current market price and the estimated value it will have at the end of the term.

- The amounts do not change if the car depreciates or increases in value. If it depreciates too much and you are interested in purchasing, it could represent an excellent option to buy at the end of your term.

Leasing a car is ideal for those who don’t need a vehicle for a long time and who are not willing to pay high amounts or monthly payments. If this is not the case for you or if you do not meet some of these characteristics, you will likely find some disadvantages such as:

- If you do not have a good credit history, you may not be able to lease a vehicle.

- If the car increases in value, it is likely that you will not be able to own it at the end of the term.

- If you like to drive a lot, renting a car could frustrate you since the mileage in this type of transaction is limited to a maximum of approximately 12,000 annual miles. If you exceed, you will have to pay additional fees at the end of the contract.

- The integrity of the vehicle is your responsibility, you must deliver it in good condition.

- If you wish to cancel your contract early, you will be required to pay a substantial early termination fee.

What Is Vehicle Financing?

Financing a vehicle means obtaining a loan to buy and paying for it within a certain period of time. When you take out a loan to buy a car, you agree to repay the amount borrowed, plus interest and fees, over a set period. Shopping around and comparing loan interest rates could save you a lot of money.

Currently, you can access auto financing in Canada. There are three types of lenders to which you could go for approval for financing, we recommend consulting with a car sales representative to help you decide which path is best for you.

- The traditional way to borrow money to buy a car is directly from a financial institution or bank, you have to fill out an application form and meet with a branch manager to discuss the loan. Bank agents look at various factors, such as your income, savings, and credit score, before deciding on whether or not to approve you.

- Apply for financing through a car dealership, you usually choose the car you want and then arrange the financing. Your dealer will submit your application to their in-house financing division or to various outside lenders (including banks) in the hope that you will be approved for the car you want.

- Online auto financing is simple and easy to access. This method helps car buyers get pre-approved for car financing before they even start shopping for vehicles. Each customer is then matched with a nearby dealership that has dozens of vehicle options within their price range.

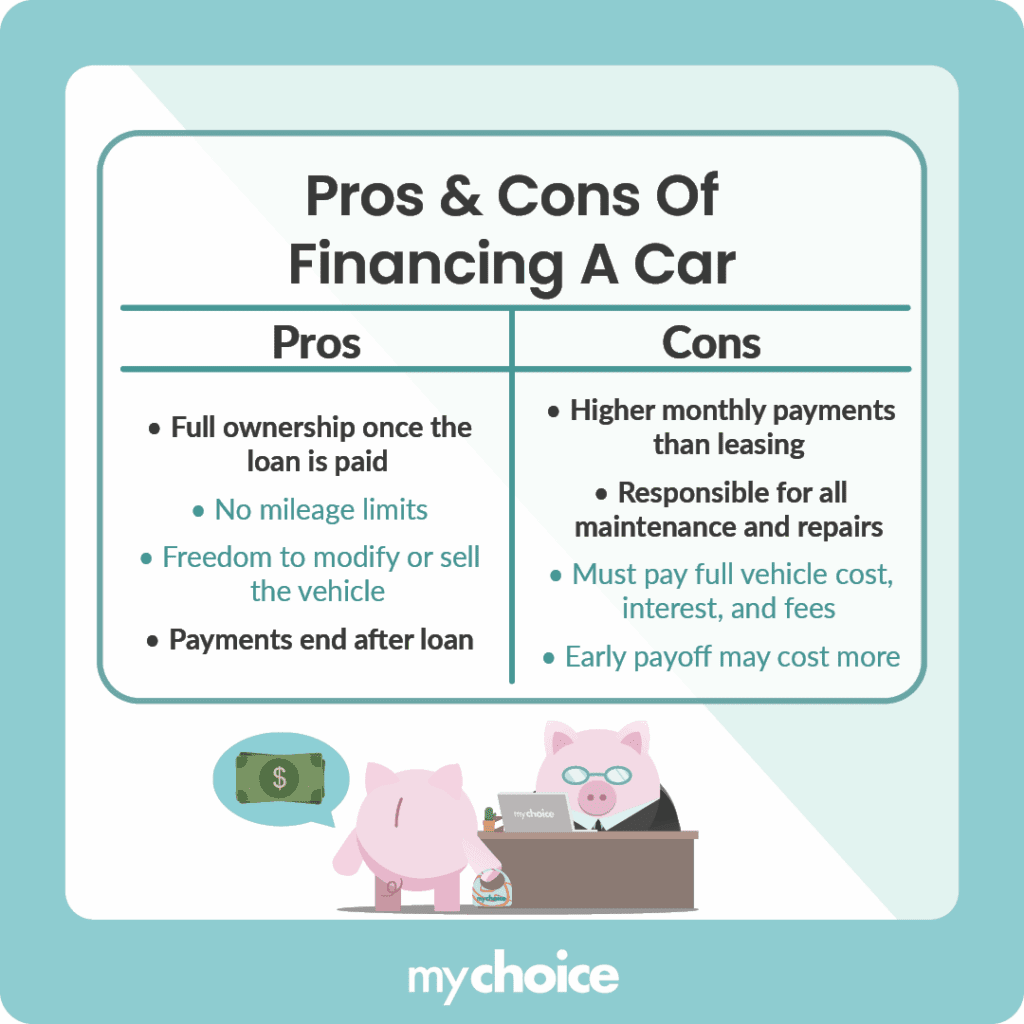

Pros & Cons Of Financing A Car

Consider the following when purchasing a vehicle through financing:

- You can enjoy the benefits of owning a car that you can hold onto until you decide to sell or trade.

- You can drive as many kilometres as you want. However, higher mileage will impact the vehicle’s value and may lead to more frequent repairs and maintenance.

- You can make any updates or changes you want, but you’ll have to pay for any major repairs.

- At the end of the loan, you will no longer have to make payments. If you pay off the loan early, you will be responsible for any additional fees or costs associated with the payoff. When buying a new car, you can either sell or trade in the one you currently have.

- You will be paying the total cost of the vehicle, so it is necessary to have the financial means to repay the loan.

- You will pay for the cost, interest and other fees of the vehicle, regardless of the kilometres you travel. The monthly payments are higher than a car lease.

What Is The Difference Between Leasing And Financing A Car?

If you are still undecided between financing or renting a vehicle, we leave you this table, to help you make a better decision:

| FINANCING | LEASING | |

|---|---|---|

| Ownership | You are the owner of the vehicle, and you keep it as long as you want. | Lease payments are almost always less than loan payments since you’ll only be paying for the depreciation of the vehicle over the term of the leas,e plus interest, taxes, and fees. |

| Anticipated Costs | It includes the cash or down payment price, taxes, registration, and other fees. | It may include the first monthly payment, a refundable security deposit, acquisition charges, taxes, registration, and other fees. |

| Monthly Payment | Loan payments are usually higher than lease payments because you will be paying for the entire purchase of your vehicle, plus interest and other financing charges, taxes and fees. | You can sell or trade in your vehicle at any time. If you need it, you can use the money from the sale to pay off any remaining loans. |

| Anticipated Termination | You can sell or trade-in your vehicle at any time. If you need it, you can use the money from the sale to pay off any remaining loans. | If you choose to end the lease early, the fees could cost you as much as if you had continued the lease. Occasionally, a dealer might be willing to buy the car. |

| Vehicle Return | You’ll have to deal with the sale or trade-in of your vehicle when you decide you want to trade it in. | You return the vehicle at the end of your lease, pay all costs associated with closing, and you’re done. |

| Future Value | The vehicle will depreciate, but its monetary value will be at your disposal. | The good thing is that its future value will not affect you financially. The bad thing is that you will not have any capital for the vehicle. |

| Mileage | You have the freedom to drive as many miles as you want. But keep in mind that the trade-in or resale value of the vehicle decreases as you increase the mileage. | Most leases limit the number of miles you can drive, typically between 12,000 and 15,000 per year. (You can negotiate a higher mileage limit). You will have to pay fees for exceeding the pre-established limits. |

| Excessive Wear | You won’t have to worry about wear and tear, although they can reduce the vehicle’s trade-in or resale value. | In most leases, you will have to pay supplemental fees for exceeding any wear that is considered natural. |

| End of the Term | At the end of the loan term, you will have met all your payments and will have accumulated the capital to be able to pay for your next vehicle. | At the end of the lease (usually two or three years), you can finance the purchase of the car, or lease or buy another. |

| Personalization | Since the vehicle belongs to you, you can modify or personalize it to your liking, although doing so could invalidate your warranty. | Since you’ll need to return the vehicle in resalable condition, you’ll need to remove any custom modifications or parts you’ve implemented. You will have to pay for any residual damage and have it repaired, or you will have to file a claim with your insurance and pay the deductible. |

Which One Is Better?

Key Advice from MyChoice

- Leasing a car generally has a cheaper monthly cost, but availability hinges on your credit history.

- Financing a car gives you freedom since you own the car, but monthly payments are usually higher.

- You can use OPCF 43 or gap insurance to protect your car in case of theft or an accident that causes it to be totalled.