In some cases, your car just can’t come back from an accident. When the cost to repair a vehicle exceeds its actual cash value, it will generally be written off as a “total loss,” sometimes referred to as “totalled.” What happens from an insurance standpoint after your car has been totalled? Keep reading to find out.

Why Total Loss Situations Are More Common Than You Think

While writing off cars as a total loss means the damage is considerable, the situation is more likely than you think. Modern cars are often expensive to repair, so even moderate collisions sometimes result in your vehicle being totalled.

Whether or not your car is written off as a total loss depends on your insurer. The actual total loss trigger, according to the industry standard, is around 70 to 80 percent. Once the cost of repairs passes that threshold, your insurer will begin to view the car as a potential write-off.

What Happens When Your Car is Declared a Total Loss?

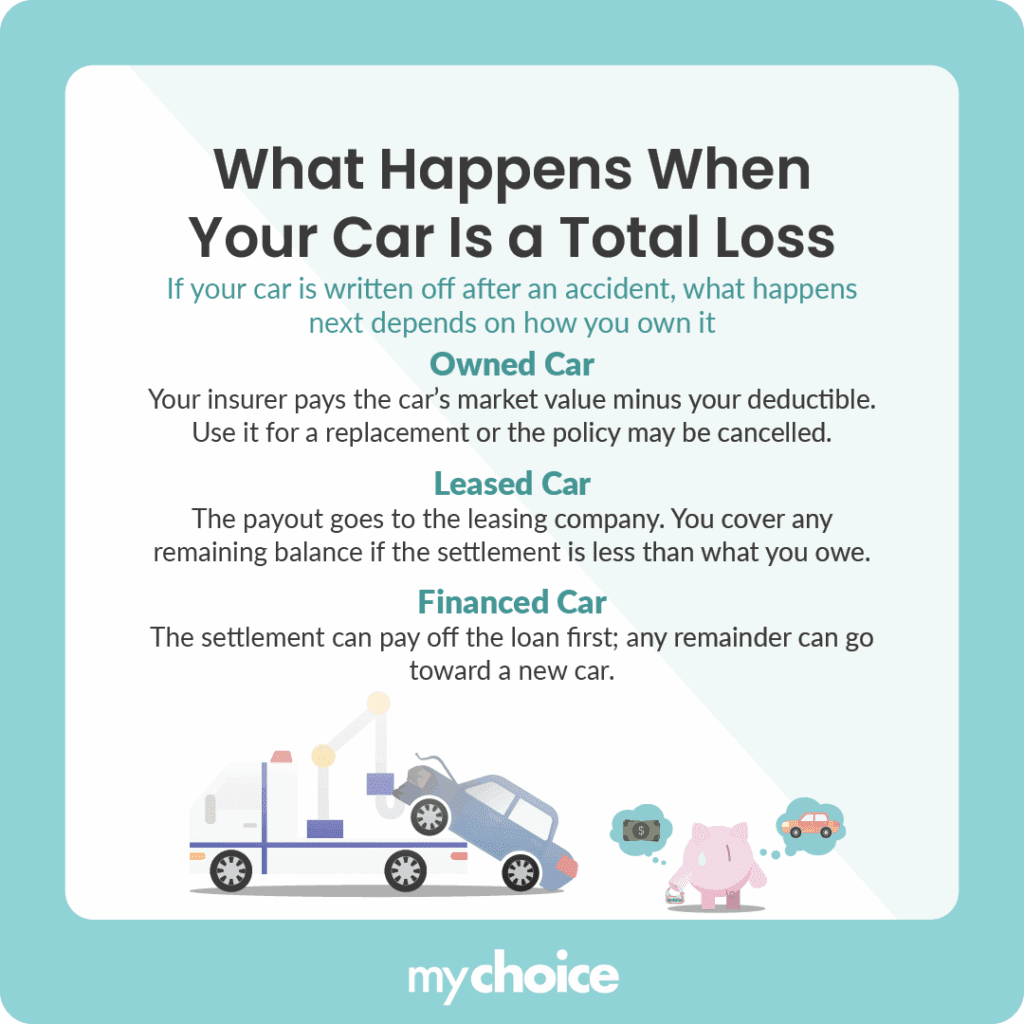

What happens when your car is declared a total loss depends on whether you own, lease, or finance the car. Let’s take a look:

How Insurers Decide When to Declare a Car a Total Loss?

Insurers determine when to declare a car a total loss by evaluating the estimated repair cost and comparing it to the car’s market value. If the repair costs exceed the car’s value, then they’ll write it off as a total loss.

Your car’s monetary value is calculated according to the kilometres it’s been driven as well as the results of a market evaluation related to the car’s year, make, model, and depreciation.

That said, in some cases, the repair costs don’t need to match or exceed the car’s value to get your car written off. Once the repair costs reach around 70 to 80 percent of your car’s value, the insurer will begin to view your car as a potential total loss.

Is My Car Declared a Total Loss When It’s Stolen?

If your car is stolen and not recovered, your insurer will typically declare it a total loss and pay out a settlement based on its actual cash value. Even if the vehicle is recovered but severely damaged — such as being stripped for parts or re-registered with a different VIN — it may still be written off. In fact, the Équité Association’s First Half 2025 Auto Theft Trend Report recorded 23,094 private passenger vehicles stolen in Canada in the first six months of 2025, with many of these cases linked to organized crime tactics like chop shops and re-VIN operations, which reduce recovery chances and increase the likelihood that insurers classify the vehicles as total losses.

What Insurance Coverage Do I Need to Be Protected Against a Total Loss?

To be protected against a total loss, you need both comprehensive and collision coverage. Both types of coverage cover vehicle repairs or replacements up to the vehicle’s actual cash value in the case of collisions with vehicles or objects, as well as other unexpected situations. You can also bundle both of these insurance protection packages into all-perils coverage.

Coverage Add-Ons That Can Make a Huge Difference

In addition to collision and comprehensive coverage, there are two add-on insurance protection options that can soften the blow of your car getting totalled:

Key Advice from MyChoice

- You don’t have to accept the insurer’s first cash settlement offer, since you can still negotiate for a larger settlement.

- Consider purchasing a new vehicle quickly after your car gets totalled because you can move the existing insurance policy to your new car.

- Think about getting OPCF 43 or gap insurance to get extra protection from your car being totalled.