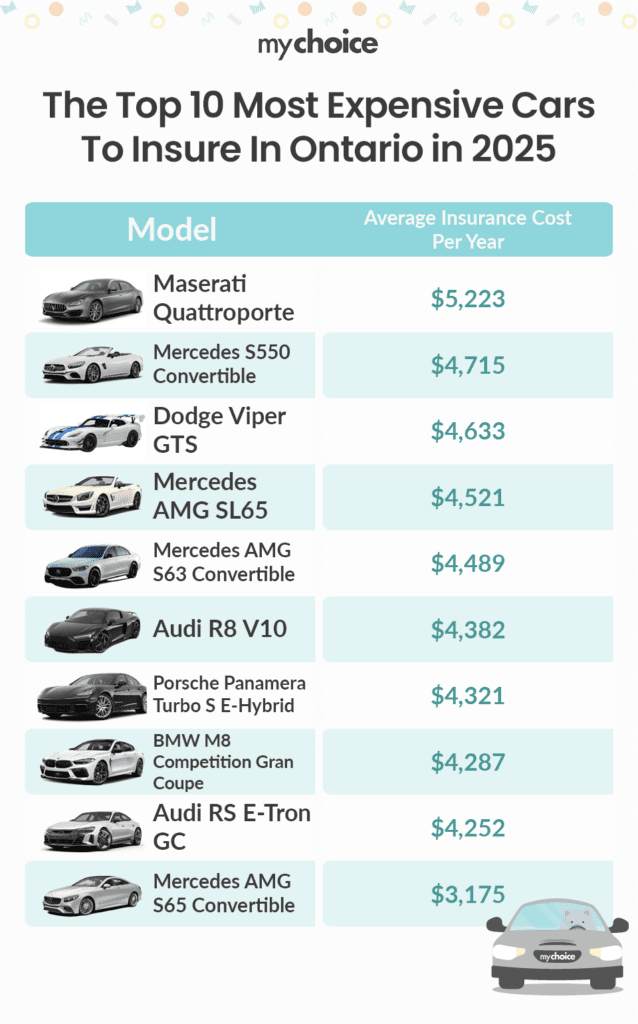

Top 10 Most Expensive Cars to Insure in Ontario in 2025

If you prefer newer upscale rides, expect a higher insurance premium. After all, you’re paying for aesthetics, comfort, and potential risks. Below are the top 10 most expensive cars to insure in Ontario in 2025.

If you’re on a budget and want to go the opposite way, you may want to visit our list of the cheapest cars to insure in Ontario.

Maserati Quattroporte

Average insurance cost per year: $5,223

Despite its impressive horsepower capabilities, the Maserati Quattroporte isn’t very fuel efficient, making it expensive to insure. It is currently the most expensive car in Canada to insure.

Because of its high price tag, Maserati Quattroporte parts are equally as expensive to replace. Expect customizations to bump your insurance rates up as well.

Mercedes S550 Convertible

Average insurance cost per year: $4,715

Mercedes S550 Convertible is slowly becoming a rare car with its discontinuation in 2017, which means spare parts are hard to come by. Like all of its cousins, the Mercedes S550 is also a popular target for car thieves, meaning insurance premiums are bound to be higher.

Dodge Viper GTS

Average insurance cost per year: $4,633

The high-performance Dodge Viper GTS is popular among sports car enthusiasts due to its motorsport pedigree and pop culture relevance. However, the car model is comparatively rare, meaning spare parts are harder to find. Therefore, Dodge Viper GTS drivers usually pay more to insure their car.

Mercedes AMG SL65

Average insurance cost per year: $4,521

The popular Mercedes AMG SL65 roadster was discontinued in 2018, meaning spare parts are going to be tougher to come by. Unfortunately, this also means your insurance premiums will rise.

Mercedes AMG S63 Convertible

Average insurance cost per year: $4,489

While Mercedes cars generally have lots of effective anti-theft measures, they’re still prone to being stolen. Rapper and actor Ludacris famously got his Mercedes AMG S63 stolen (and subsequently recovered) in 2021. Combined with its expensive spare parts, you may need to pay more to insure a Mercedes AMG S63 Convertible.

Audi R8 V10

Average insurance cost per year: $4,382

Famously driven by Tony Stark in the Iron Man movies, the Audi R8 is popular with car thieves thanks to its futuristic design and great performance. Toronto news famously reported an Audi R8 V10 was stolen in the city centre in November 2022.

Porsche Panamera Turbo S E-Hybrid Executive

Average insurance cost per year: $4,321

Thanks to premium features like a hybrid gas-electric engine, electronic stability control, traction control, night vision, and a stunning finish, the Porsche Panamera Turbo S E-Hybrid Executive typically runs over $4,000 in insurance per year.

Despite its promise of more meticulous safety features, Porsche is not an insurance company favourite, and most insurers don’t want to insure high-risk vehicles.

BMW M8 Competition Gran Coupe

Average insurance cost per year: $4,287

Equipped with a V-8 engine boasting 617 horsepower, an advanced cooling system, and a dual oil pan, it’s no wonder purchasing insurance for the BMW M8 Competition Gran Coupe costs an arm and a leg.

For a custom variant, the M8 can cost over $170,000, with parts that can be difficult to find. The hefty price tag and obscure parts make it more expensive to insure.

Audi RS E-Tron GC

Average insurance cost per year: $4,252

With the Audi RS E-Tron GC, you can go from 0 to 60 mpg in just 3.1 seconds, which is precisely why insurance costs over $4,000. Repair costs for this Audi model are also higher because of its electric-only parts.

Mercedes AMG S65 Convertible

Average insurance cost per year: $3,175

With their sleek designs and top-notch performance, Mercedes cars are a favourite among luxury car enthusiasts. Unfortunately, they’re also popular among car thieves, which means you need to pay more to insure your Mercedes AMG S65 Convertible.

Just How Expensive Is A Luxury Car to Insure?

Many Canadian drivers underestimate the cost of a premium vehicle. On top of the price of the car itself, there’s also the cost of insurance.

While insurance in Ontario is notoriously expensive, the list of costliest cars to insure might surprise you! If you want to get insurance for your vehicle, this guide will list the most expensive cars to insure in Ontario and what factors affect these rates.

The Average Cost Of Car Insurance In Ontario

The average cost of car insurance in Ontario is $1,686, with rates steadily increasing due to rate increases, insurance fraud, and vehicle theft.

However, this rate can vary depending on location, with rates in Vaughan reaching as high as $2,466. Meanwhile, compared to other territories like Quebec and Alberta, Ontario boasts one of the highest average car insurance costs in Canada.

What Factors Affect Insurance Rates For an Expensive Vehicle?

The Bottom Line

While Ontario is one of the most expensive Canadian provinces for purchasing car insurance, there are many ways to save on your premiums. For one, you can refer to the list above and avoid buying a luxury car but if you’re still wanting to make that sort of purchase then make sure you compare your insurance options.

You can do that here at MyChoice, we make it easy to compare rates and pick policies tailored to your driving needs. Just enter your postal code, and you can get the best insurance policy for you in under three minutes!