Even if you’re a safe driver, it helps to know what to do when an accident happens. Around 33% of Canadians have or will be involved in an accident at some point, so accidents are more common than you might think.

It’s not enough to avoid being distracted and drive carefully – you must also know how to deal with accidents. Accidents are highly stressful and anxiety-inducing, so it’s easy to freeze up and not know what to do next. Fortunately, we’re here to help. Read on to learn what to do following a car accident in Ontario and how to report it to the relevant parties.

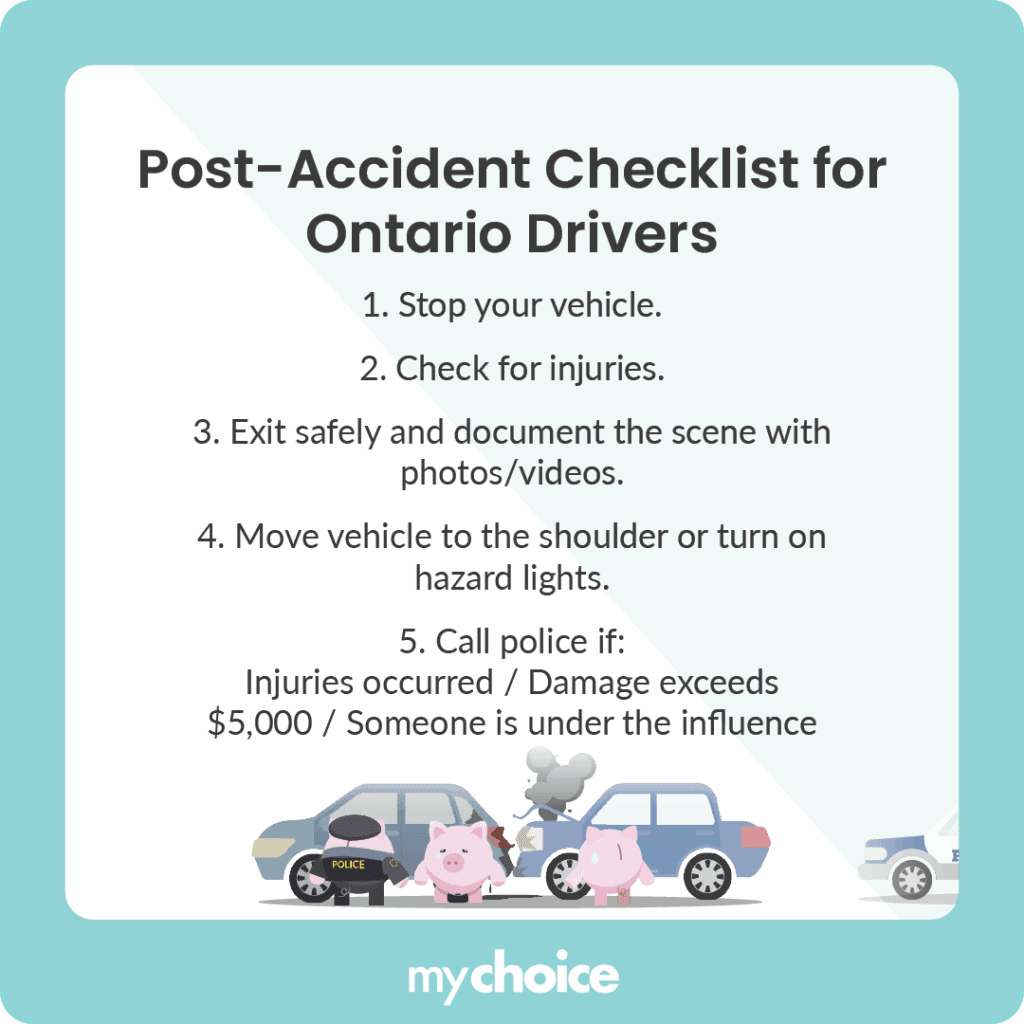

Post-Accident Checklist for Ontario Drivers

Some things must be done right after the accident to ensure you and everybody involved are as safe as possible. So, here’s a short post-accident checklist that you can either memorize or print out in case you ever get into an accident:

- Stop your vehicle.

- Check to see if anybody is injured.

- Exit your vehicle if it’s safe to do so. Take photos and videos of the scene if possible.

- Move your vehicle onto the shoulder of the road or turn on hazard lights.

- Call the police if people are injured, you estimate more than $5,000 worth of damage, or any of the parties involved are under the influence of drugs or alcohol.

For minor accidents (no injuries, damage to vehicles less than $2,000), like if you accidentally bump into a car in the parking lot, report to the nearest collision reporting centre within 24 hours. You also have seven days to call your insurer and make a claim.

What Happens If You Don’t Report an Accident Within 24 Hours in Ontario?

If you fail to report an accident within 24 hours, you may face legal consequences, including fines and licence demerits.

If you neglect to report an accident that must be reported to the police, you may be in breach of Ontario laws. The legal consequences include, but aren’t limited to:

- Jail

- Fines

- Licence suspensions

How Long Do You Have to Report a Car Accident in Ontario?

If somebody is injured and the total damage to all vehicles involved exceeds $2,000, you must report it to the police immediately. If nobody is injured and the damage is below the threshold, you must call a Collision Reporting Centre within 24 hours.

How Soon Should You Inform Your Insurance Company?

If you’re making an insurance claim, most companies accept car accident claims within seven days of the accident.

How to Report a Car Accident in Ontario?

You’re required by law to report a car accident in Ontario if it fulfills at least one of these criteria:

- All vehicles suffered over $2,000 in damage.

- Somebody is injured or killed.

- A government vehicle is involved.

- The accident involves someone driving without insurance.

- Somebody performs a criminal act like DUI.

- A pedestrian is affected by the accident

- There is private or municipal property damage, like hitting a pole or somebody’s home fence.

Generally, you need to report to three parties when an accident happens in Ontario:

- The police

- The closest Collision Reporting Centre

- Your insurer

What You Need to Report a Car Accident in Ontario

When reporting a car accident in Ontario, you need as much information about the incident as possible. This helps your insurer, the police, and the collision Reporting Centre to get the best picture of your incident.

Here’s the essential information you need when reporting car accidents in Ontario:

- Your insurance information

- Your car make, year, and model

- Details about the incident

- Notes about the weather, road conditions, time, and place of the accident

- The other driver’s licence, registration, and insurance details

How to Report a Car Accident in Ontario

Now that you know why reporting accidents is important, it’s time to learn how to do so. Here’s a quick guide to reporting car accidents in Ontario:

Things to Avoid After a Car Accident

Emotions tend to run high after a car accident, and rash decisions are easy to make. If you’re involved in a car accident, remember not to:

- Panic

- Argue with other parties

- Move anybody who’s injured without the help of a medical professional

- Assume full responsibility or blame the other party for the crash

What to Do If You Were Driving Someone Else’s Car

If you’re driving someone else’s car and get into an accident, follow the above checklist and notify the owner. The owner’s insurance will cover the damage if you’re permitted to drive the car and aren’t driving impaired.

Risks of Not Reporting a Car Accident

Ontario laws require you to report a car accident if it fulfills certain criteria. However, sometimes it isn’t as simple as that. Sometimes, you don’t want to report an accident because you made an agreement with the other driver and can pay the expenses out of pocket. People often do this because they don’t want insurance premiums to rise.

However, this isn’t a good idea. Here are some things that might happen if you don’t report a car accident to the police or insurers:

- The other driver can file a police report, which makes it look like you’re running away from the accident.

- The other driver can change their mind and report to their insurer, meaning your insurance company will know and deny your coverage.

- The accident caused over $2,000 in damages, making it a must-report incident.

- You could be injured and not know it, meaning you must pay medical bills to treat them out of pocket.

Do I Have to Report Accidents in a Parking Lot?

You have to report accidents in a parking lot because it still counts as a road accident. Follow the steps outlined in this guide to report parking lot accidents properly.

What Happens if I Get Involved in a Hit-and-Run?

You can still make an insurance claim if your car is involved in a hit-and-run. Additionally, the escaping driver may be subject to criminal charges.

Do I Have to Report Minor Car Accidents in Ontario?

You still have to report minor car accidents in Ontario to the Collision Reporting Centre, even if it’s just a small fender-bender. For larger accidents, you must call the police.

Many car insurance policies in Ontario require you to report all accidents, regardless of damage. If you neglect to do so, you may be denied future coverage.

If the tree sap damages your car, you should check to see if your car insurance covers it. You can find out by reading your policy or calling your provider.

Key Advice from MyChoice

- Take pictures or video of the accident scene if possible to ensure a detailed accident report.

- Report the accident to your insurer within seven days.

- Failing to report an accident after 24 hours may result in legal consequences.