If you’ve ever opened your car insurance renewal notice and wondered why your rate went up despite making no claims, you’re not the only one. Your insurance renewal time can surprise you with an increased premium, but it’s also an opportunity to reevaluate your options and try to save money.

Smart drivers use renewal season to shop around, review coverage, and negotiate better rates. Let’s break down what you can do ahead of the renewal to reduce your insurance premiums.

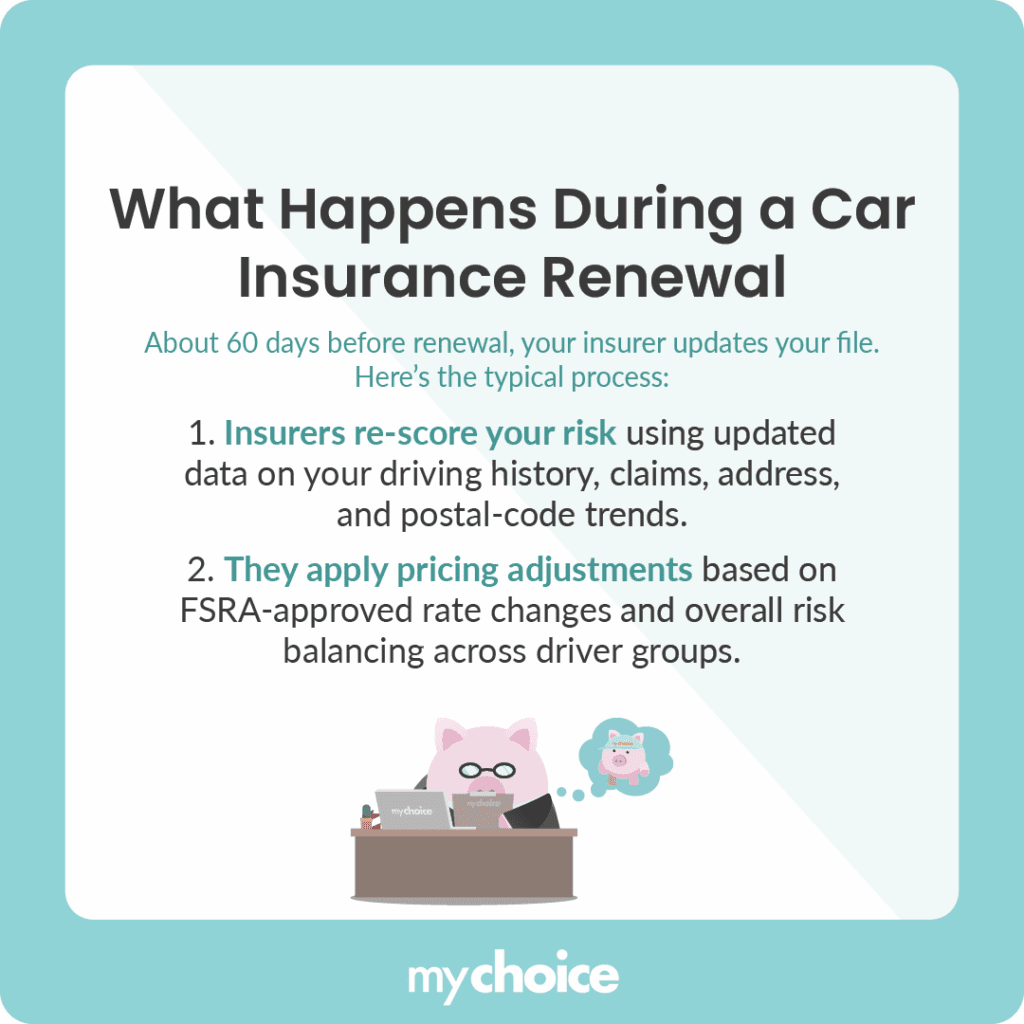

What Actually Happens Behind the Scenes at Renewal Time

About 60 days before your renewal date, most insurers start to do the following:

The Smart Driver’s Renewal Routine (Step-by-Step)

Staying ahead of renewal time means being proactive. Here’s a simple timeline to follow:

| Step | What to Do | Why It Matters |

|---|---|---|

| 45–60 days before expiry | Start comparing quotes with MyChoice or your insurer. | You’ll see if your current insurer is still competitive before your renewal is processed. |

| 30 days before expiry | Review your coverage and discounts. | You may qualify for lower rates if your driving habits or lifestyle have changed. |

| 15 days before expiry | Contact your insurer or broker with questions. | Your insurer may re-rate your policy or reapply available discounts, depending on their underwriting rules. |

| Renewal day | Confirm your final policy details. | Make sure your policy reflects correct drivers, mileage, and coverages. |

| Post–renewal | Review your documents and save proof of insurance. | Verify your payment schedule and coverage start date to avoid lapses. |

The Renewal “Audit” Checklist

The renewal checklist below should help you navigate the process and make sure you’re not leaving money on the table:

Why Your Renewal Price Can Change Even With a Clean Driving Record

Your insurer is not re-evaluating your driving behaviour in isolation. They are applying newly approved pricing rules across their entire portfolio.

Auto insurance prices are set based on rate manuals that must be filed with and approved by regulators before they’re ever applied to a policy. When a renewal occurs, insurers may apply updated versions of those approved rates, even if nothing about you personally has changed.

These updates typically reflect higher expected costs across the insurer’s book, such as vehicle repair inflation, regional loss experience, or changes in legally mandated benefits.

That’s why a clean driving record can still result in a higher renewal premium, not because your risk increased, but because the cost of insuring similar drivers has changed province-wide.

How to Negotiate Your Car Insurance Renewal Like a Pro

Are you unsure about how to start negotiating with your insurer for a lower rate? Here’s how to approach it:

When to Switch and When to Stay Put

Once you receive your new rate and have tried negotiating with your auto insurer, how do you know when it’s time to stay and when it’s time to go? These are some signs you should note:

Key Advice from MyChoice

- Start comparing rates 60 days before your renewal. Insurers often finalize renewal pricing around that time, so you’ll know if it’s worth switching before you’re locked in.

- Always open your renewal notice and confirm all the details before your payment goes through.

- Your lifestyle impacts your rate. If you’ve started working remotely, moved to a new area, or installed an anti-theft device, you should tell your insurer.