If you’re a student at an Ontario college or university and plan to use your parents’ car, or maybe a young driver who just got their G1 license and can’t wait to start operating a vehicle, this article is for you. Navigating the roads of Ontario comes with its own set of rules and regulations, especially when it comes to auto insurance in the province. A common question among young or occasional drivers is: “Can I drive my parents’ car without insurance in Ontario?” Let’s delve into this topic, providing clarity and guidance for those in similar situations.

Can You Drive Your Parents’ Car Without Insurance in Ontario?

The short answer is no, you can’t. In Ontario, the law is clear: every vehicle on the road must be insured. The fine for driving without insurance can range from as low as $5,000 to as high as $50,000. This means if you’re planning to drive your parents’ car, the vehicle itself needs to be covered by a valid insurance policy. You need to be one of the people included in the policy.

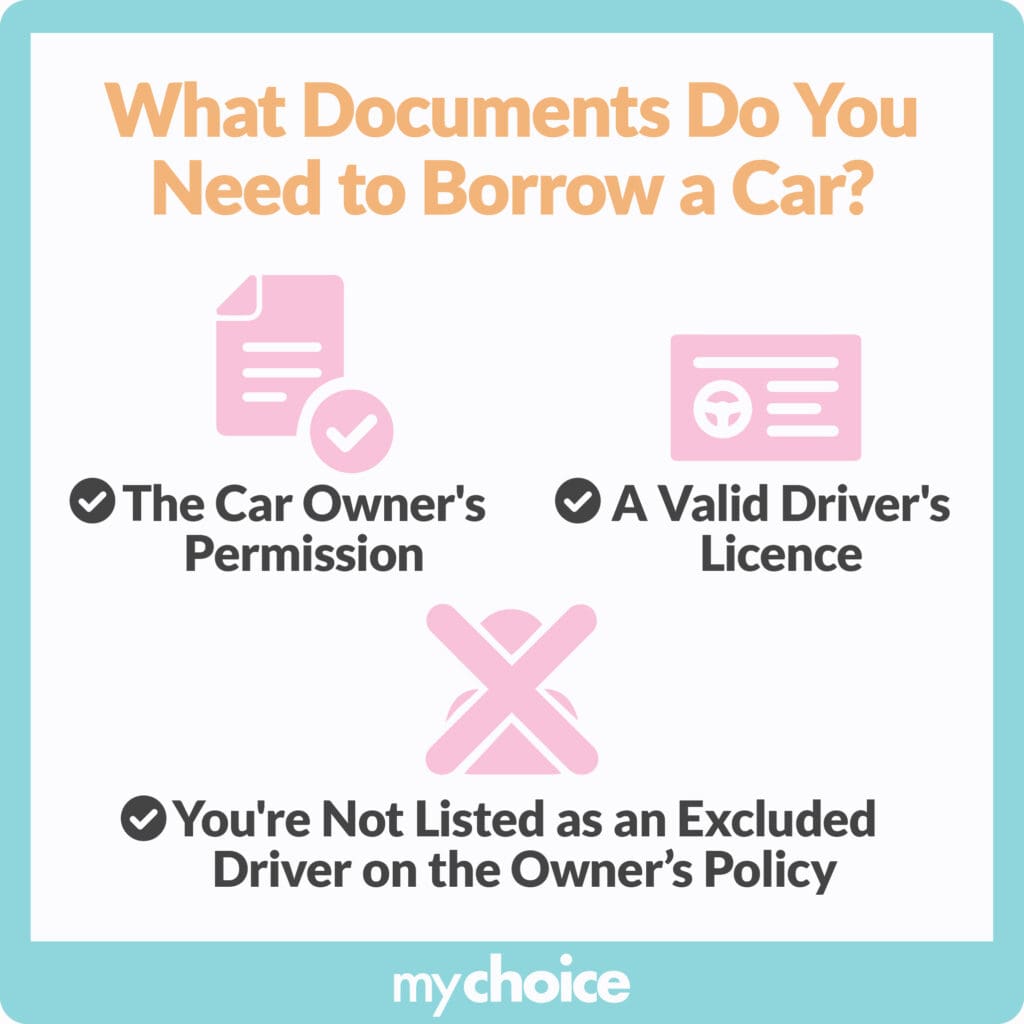

If you want to borrow someone else’s car and have no issues with insurance, you need to have the following in check:

- The car owner’s (your parents’) permission

- A valid driver’s licence

- You’re not listed as an excluded driver on their policy

Now, let’s look at the options to be legally allowed to drive your parents’ car.

Do You Have to Get Your Own Car Insurance Policy?

While nothing is stopping you from getting your own policy, you might want to hold that off for a bit for your insurance rate to go down. If you’re a young driver under 25, staying on your parents’ car insurance is often more affordable than getting your own policy. This is because new drivers, considered at higher risk due to their limited experience and higher accident likelihood, face higher premiums. In the 2019 study, for example, regarding driver fatalities, the percentage of deaths was higher than their representation in the Canadian population for individuals aged 16 to 24 years and those 80 years and older. Additional research shows that crash risk is highest shortly after obtaining a driver’s license. Furthermore, a 2019 Statistics Canada survey found that young drivers aged 20 to 34 comprised 44% of those charged with alcohol or drug impairment.

You can stay on your parents’ policy indefinitely as long as you live at home and maintain a good driving record. Many insurers even cover young adults who temporarily move out of school. The decision to get your personal policy should come when you permanently move out or demonstrate enough driving experience to secure lower rates independently.

Occasional vs Secondary Driver in Ontario

Occasional Driver

If you’re an occasional driver who drives the car infrequently, perhaps once a month, then you’re generally covered under your parents’ car insurance policy. This is because, in Ontario, car insurance follows the vehicle, not just the policyholder. The insurance company won’t have a problem with you occasionally borrowing your parents’ vehicle.

Secondary Driver

If you regularly drive your parents’ car, say every week, you must be added as a secondary driver on their insurance policy. Note that it doesn’t happen automatically. Your parents must inform their insurance provider about adding a new driver to their vehicle’s policy. When your parents add you as a secondary driver, the insurer will assess your driving history and might adjust the premium based on the risk you present. Although this may raise the policy’s cost slightly, it’s still more affordable than purchasing separate coverage.

Is It Possible to Remain on My Parents’ Car Insurance Once I Move Out?

After moving out, you might still be covered under your parents’ car insurance. Still, updating the insurer about any driver or address changes is essential. If you relocate, like for school, and use their car less, switching from a secondary to an occasional driver on the policy could be more appropriate.

The Impact of G1 and G2 Diving License

Ontario’s graduated licensing system adds another layer to consider. If you’re a G1 or G2 driver, there are restrictions on when and how you can drive, and violating these can affect insurance coverage. For instance, G1 drivers can’t drive alone and have time restrictions to follow, while G2 drivers face fewer restrictions but still have limitations, such as zero blood alcohol level. If a violation of license restrictions leads to reckless driving and an accident with your parents’ car, your insurance claim will probably be rejected.

What If You Cause an Accident While Driving Your Parents’ Car?

If you’re at fault in an accident while driving your parents’ car, it impacts both your driving record and their insurance premiums. Being a listed driver on their policy means their rates could rise. When you get your own policy, they’ll need to ask their insurer to transfer the accident record to your policy.

Adding Accident Forgiveness to their policy can protect against a premium hike for your first at-fault accident, though it’ll still be on your record. If you switch insurers before the record clears (typically 3-6 years), your new insurer may increase your rates based on your past accident.

Whose Insurance Covers When Driving Your Parents’ Car in Ontario?

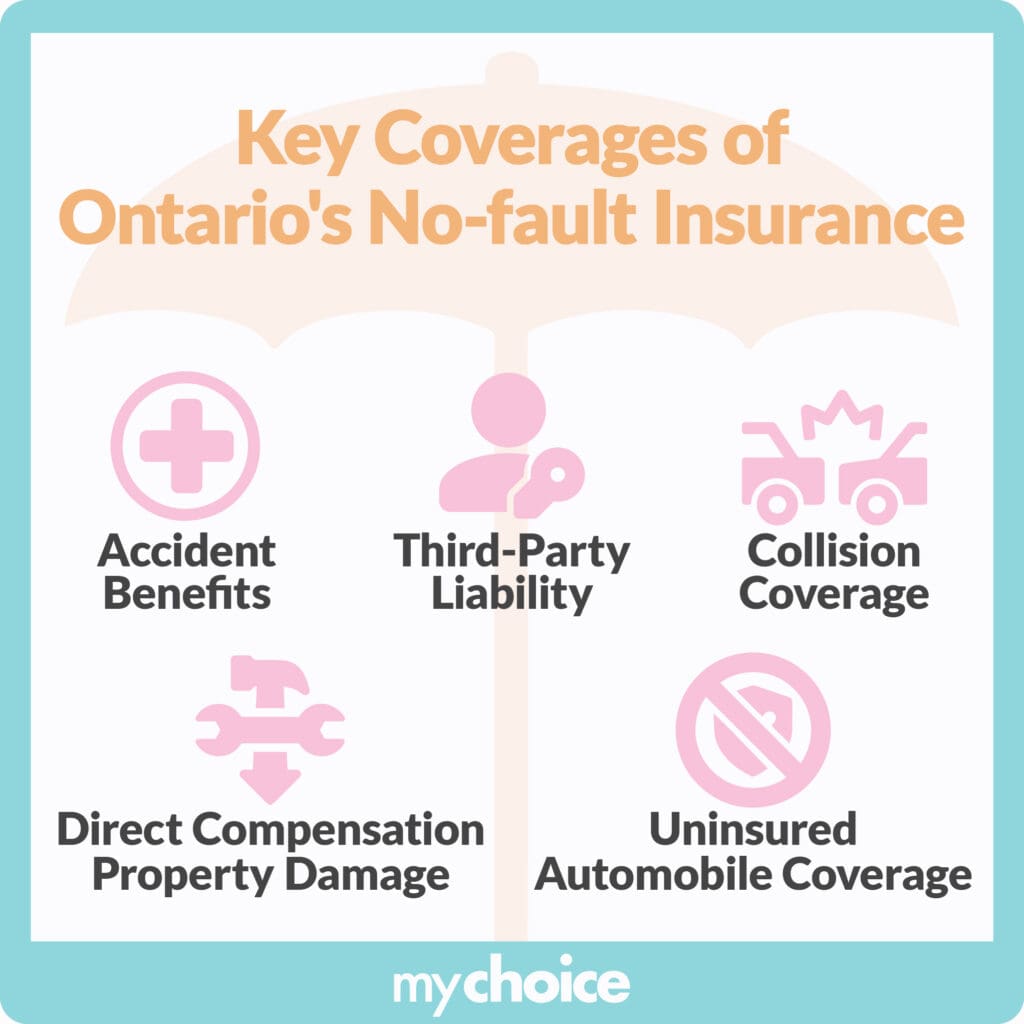

In accidents, fault and damage determine whether the car owner’s or the other party’s insurer pays. Ontario’s no-fault insurance means policyholders typically deal with their own insurers for damage claims. Key coverages include:

- Accident Benefits: Covers medical expenses for the driver and passengers of the borrowed car.

- Direct Compensation-Property Damage: Pays for repair costs, regardless of fault.

- Uninsured Automobile Coverage: Helps with costs in hit-and-run or uninsured driver incidents.

- Third-Party Liability: This coverage pays liability costs if the borrower causes the accident.

- Collision Coverage: Optional collision insurance covers repairs outside direct compensation claims within policy limits.

What Happens If You Receive a Ticket?

This differs from the consequences of an accident. If the police stop you and receive a ticket, you are personally accountable for paying the fine, and demerit points will be added to your license.

The Bottom Line

Driving your parents’ car without your own insurance policy in Ontario is possible but with conditions. If you’re an occasional driver, you’re generally covered. However, regular drivers should be listed on the policy to avoid complications. Always adhere to the rules of your license class and drive responsibly.

Remember, insurance protects you, your family, and other road users. It’s always better to be safe and informed than to deal with the consequences.