The Top 10 Cheapest SUVs to Insure In Canada in 2026

When picking which SUV to buy, don’t just consider its features and price. You should also consider how much the specific make and model costs to insure. This can have a significant impact on how much you spend on your vehicle each month.

In this guide, we’ll reveal the cheapest SUVs to insure in Ontario and the rest of Canada. We’ll also share some of the factors that determine your SUV insurance premiums.

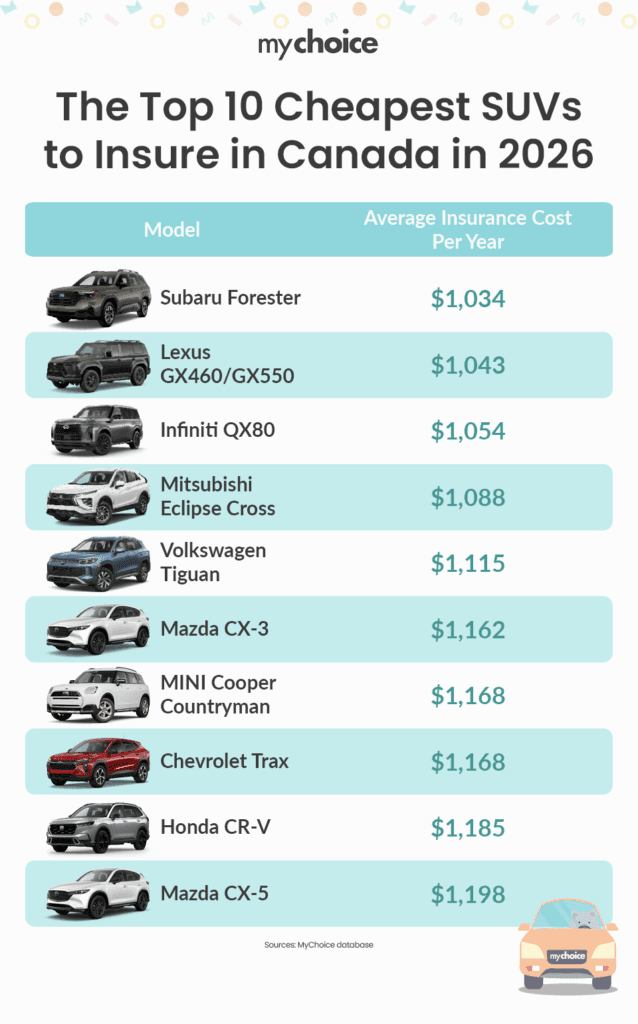

Below is a list containing our picks for the cheapest SUVs to insure in Canada in 2026.

| Car Model | Average Annual Premium | Average Monthly Premium |

|---|---|---|

| Subaru Forester | $1,033 | $86 |

| Lexus GX460/GX550 | $1,043 | $87 |

| Infiniti QX80 | $1,054 | $88 |

| Mitsubishi Eclipse Cross | $1,088 | $91 |

| Volkswagen Tiguan | $1,115 | $93 |

| Mazda CX-3 | $1,162 | $97 |

| MINI Cooper Countryman | $1,168 | $97 |

| Chevrolet Trax | $1,168 | $97 |

| Honda CR-V | $1,185 | $99 |

| Mazda CX-5 | $1,197 | $100 |

The insurance premiums in the infographic below and the table above are based on the thousands of quotes we collected through our platform in 2025.

Our Methodology for Choosing the Cheapest SUVs to Insure in Canada

To build this 2026 list, we used our internal data from over 80,000 auto insurance quotes collected through MyChoice.ca in 2025 across Canada. These quotes represent real people shopping for coverage, so the data reflects what Canadians are actually paying.

Here’s how we did it:

- We grouped quotes by make, model, and year to calculate each SUV’s average annual and monthly premiums.

- To ensure a fair and consistent comparison, we focused on a standard driver profile across all vehicles: a 35-year-old married driver (male or female), fully licensed, with a clean driving record.

- SUVs were then ranked from lowest to highest average annual premium to pinpoint which ones consistently offered the most affordable insurance costs.

Insurance premiums can vary depending on personal factors like age, province, and driving record, but when you look at tens of thousands of quotes, clear patterns emerged that helped us pinpoint our top 10 cheapest SUVs to insure.

1. Subaru Forester

This compact SUV combines practicality, comfort, and safety in a neat package that’s built for both city commutes and snowy adventures. Subaru’s Symmetrical All-Wheel Drive system comes standard, giving you great traction in harsh weather conditions.

What’s more, the Forester’s strong safety record and excellent crash-test ratings keep it among the lowest-cost SUVs to insure year after year.

Estimated Average Insurance Cost: $1,033/year

2. Lexus GX460/GX550

Luxury and affordability don’t always go hand in hand, but the Lexus GX460 (and the new GX550) break that rule. Despite being a premium SUV, the GX line is known for reliability and durability, which translates to lower repair costs and, surprisingly, lower insurance rates.

The 2025–2026 GX models feature a rugged body-on-frame design, advanced safety systems, and off-road capability that appeals to adventurous Canadian drivers. The GX’s solid safety reputation helps keep insurance costs in check despite its higher-end badge.

Estimated Average Insurance Cost: $1,043/year

3. Infiniti QX80

The Infiniti QX80 proves that size doesn’t always mean sky-high insurance premiums. Its excellent crash safety ratings and dependable performance help make it one of the most affordable full-size luxury SUVs to insure in Canada.

Powered by a 5.6L V8, the QX80 offers smooth highway driving and plenty of towing power for families or those with trailers. The model’s strong safety tech, including predictive forward collision warning and blind-spot intervention, contributes to its lower-than-expected insurance rates.

Estimated Average Insurance Cost: $1,054/year

4. Mitsubishi Eclipse Cross

The Eclipse Cross has distinctive styling, standard safety features, and an efficient 1.5L turbo engine, making it ideal for Canadian drivers looking for a dependable and budget-friendly ride.

The Eclipse Cross also benefits from Mitsubishi’s excellent warranty coverage, which can indirectly help lower insurance rates due to reduced long-term repair risk. Its smaller size, lower horsepower, and strong safety suite with lane-departure warning and forward collision mitigation all contribute to low premiums.

Estimated Average Insurance Cost: $1,088/year

5. Volkswagen Tiguan

The Volkswagen Tiguan blends European styling with practicality, boasting midsize dimensions that make it easy to handle, as well as available third-row seating for versatility for growing families.

Its insurance-friendly reputation comes from its strong crash test performance and moderate repair costs compared to other European vehicles. Plus, its available all-wheel drive and comprehensive safety technology make it a reliable year-round companion across Canada.

Estimated Average Insurance Cost: $1,115/year

6. Mazda CX-3

Small, sporty, and surprisingly upscale for its price, the Mazda CX-3 continues to rank among the most affordable SUVs to insure. With nimble handling, sleek design, and Mazda’s reputation for reliability, it appeals to both new and experienced drivers.

Insurance companies often view the CX-3 favourably due to its compact size, advanced safety features, and low repair costs. While it’s no longer in production after the 2021 model year, many Canadians still drive and insure CX-3s, keeping it on this list for 2026.

Estimated Average Insurance Cost: $1,162/year

7. MINI Cooper Countryman

Despite this SUV’s quirky design and premium feel, it remains relatively inexpensive to insure in Canada. The Countryman’s small footprint, strong safety record, and efficient turbocharged engine all help keep premiums manageable.

With optional all-wheel drive (ALL4) and a surprisingly spacious cabin, this MINI combines style with practicality. For urban drivers who want something a bit different, the Countryman offers low insurance costs without sacrificing charm.

Estimated Average Insurance Cost: $1,168/year

8. Chevrolet Trax

Compact, affordable, and built for city life, the Chevrolet Trax has been redesigned for 2025, offering more space and modern tech while staying easy on the wallet. It’s one of the cheapest SUVs to insure across most provinces thanks to its simple design, inexpensive parts, and strong safety systems.

For young drivers or those on a budget, it’s a top pick that delivers affordability in both purchase price and insurance costs.

Estimated Average Insurance Cost: $1,168/year

9. Honda CR-V

The Honda CR-V continues to offer unbeatable reliability, excellent fuel economy, and top-tier safety. Its wide availability and abundance of parts help keep repair costs down, which directly influences insurance premiums.

The 2025 CR-V comes standard with Honda Sensing, which is a suite of safety technologies including lane-keeping assist, adaptive cruise control, and collision mitigation braking. Its strong resale value and proven record on Canadian roads make it a favourite among insurers and drivers alike.

Estimated Average Insurance Cost: $1,185/year

10. Mazda CX-5

The Mazda CX-5 consistently earns high marks for safety, driving dynamics, and build quality. This is largely due to its strong safety ratings, modest repair costs, and relatively low theft rates. With features like blind-spot monitoring, rear cross-traffic alert, and a refined cabin, it’s no surprise this SUV remains one of Canada’s most affordable to insure for 2026.

Estimated Average Insurance Cost: $1,197/year

How to Get Affordable SUV Insurance

Even if you choose one of these low-cost SUVs, there’s still more you can do to reduce your insurance premiums. Here are some practical tips for Canadian drivers:

- Compare quotes: Insurance prices vary widely between companies. Shop around annually or when your policy renews to ensure you’re getting the best rate.

- Bundle policies: Combine your auto and home insurance with the same provider to unlock multi-policy discounts.

- Increase your deductible: Choosing a higher deductible can lower your monthly premium. Just make sure it’s an amount you can comfortably afford if you need to file a claim.

- Maintain a clean driving record: Safe driving habits lead to lower rates over time, especially in provinces with private insurance systems like Ontario and Alberta.

- Install anti-theft devices: SUVs with built-in or added security features often qualify for discounts.

What Factors Determine SUV Insurance Premiums?

Insurance companies use a range of factors to calculate your SUV’s premium, including:

- Vehicle make and model: Some SUVs cost more to repair or replace than others.

- Safety ratings: Models with advanced safety features and strong crash-test results typically have lower premiums.

- Theft rates: SUVs that are frequently targeted by thieves cost more to insure.

- Repair costs: Expensive parts or specialized repairs can raise premiums.

- Driver profile: Age, driving experience, and accident history all affect your perceived risk profile and the quotes you get.

- Location: Your province and postal code can affect your rates due to traffic density and claim frequency.

How Can You Lower Your SUV Insurance Premiums?

Have your insurance premiums gone up? Here are strategic ways to make your SUV insurance affordable:

- Choose your trim wisely: Higher trims packed with luxury features or performance upgrades can drive up insurance costs. Sticking with a mid-range or base model often means lower premiums without losing out on essential features.

- Drive fewer kilometres: If you don’t rack up a lot of mileage each year, let your insurer know. Many companies offer low-mileage discounts.

- Take a defensive driving course: Completing an approved defensive driving program can earn you a discount with many insurers.

- Stay loyal, but shop around: Some insurers reward long-term customers with loyalty discounts, but rates can change every year. Compare quotes on MyChoice to make sure you’re still getting the best deal.