Different cars come with different premiums, so when it comes to buying a car in Ontario, finding the cheapest cars to insure can become rather tedious. Luckily, there are plenty of excellent cars available with very reasonable average insurance quotes, that’s why we’ve put together the following list of the 10 cheapest cars to insure in Ontario in 2026.

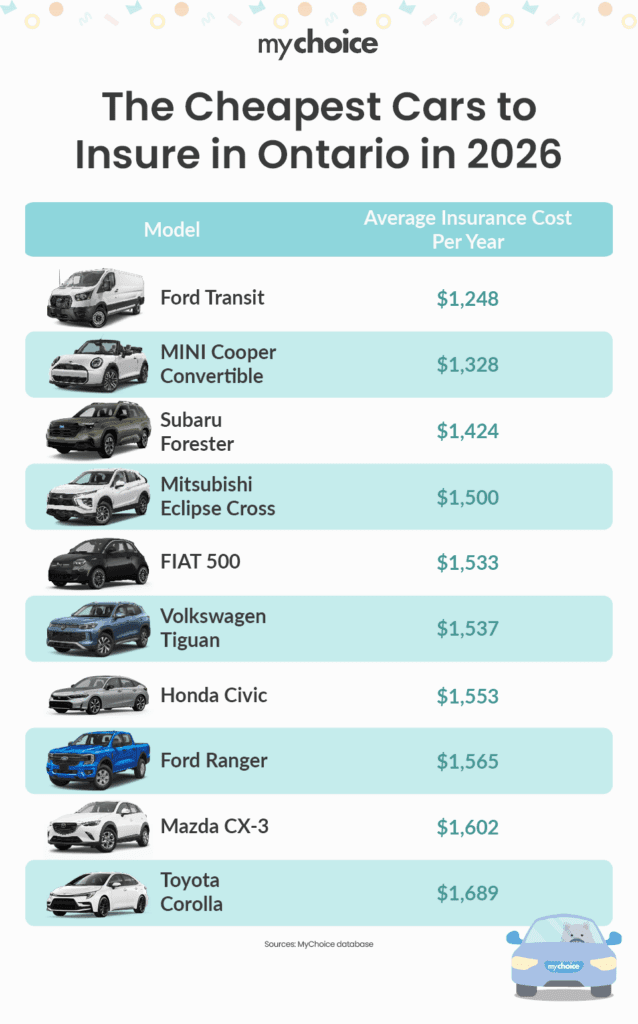

Top 10 Cheapest Vehicles to Insure in Ontario in 2026

| Car Model | Car Type | Average Annual Insurance Premium | Average Monthly Insurance Premium |

|---|---|---|---|

| Ford Transit | Van | $1,248 | $104 |

| MINI Cooper Convertible | Convertible | $1,328 | $111 |

| Subaru Forester | SUV | $1,424 | $119 |

| Mitsubishi Eclipse Cross | SUV | $1,500 | $125 |

| FIAT 500 | Small Car | $1,533 | $128 |

| Volkswagen Tiguan | SUV | $1,537 | $128 |

| Honda Civic | Small Car | $1,553 | $129 |

| Ford Ranger | Truck | $1,565 | $130 |

| Mazda CX-3 | SUV | $1,602 | $133 |

| Toyota Corolla | Small Car | $1,689 | $141 |

The insurance premiums in the table above and the infographic below are based on the thousands of quotes we collected through our platform in 2025.

Our Methodology for Choosing the Cheapest Vehicles to Insure in Ontario

We wanted to know which vehicles are truly the cheapest to insure in Ontario for 2026, so we went straight to the source and looked at the real insurance quotes from Ontario drivers. This helps paint an accurate picture of what people are actually paying for coverage today.

Here’s how we did it:

- We analyzed over 60,000 Ontario auto insurance quotes collected through MyChoice.ca in 2025 – our online comparison platform.

- Each quote was grouped by vehicle make, model, and year to calculate the average annual and monthly premiums for each car.

- To ensure a fair and consistent comparison, we focused on a standard driver profile across all vehicles: a 35-year-old married driver (male or female), fully licensed, with a clean driving record.

- Finally, we ranked each model from lowest to highest average insurance premium to identify which vehicles consistently offer the best value for Ontario drivers.

This approach gives a realistic view of what you can expect to pay, helping you choose a vehicle that’s not only smooth to drive but also affordable to insure.

1. Ford Transit

The Ford Transit takes the crown as the cheapest vehicle to insure in Ontario for 2026. This dependable van is a favourite for business owners, families, and anyone who needs extra space. Its strong safety record, low theft rate, and durable build make it affordable to insure.

Estimated Annual Fuel Cost: $3,675/year

Estimated Average Annual Insurance: $1,248/year

Whether you’re running a small delivery service or packing for a cottage weekend, the Transit offers value and peace of mind.

2. MINI Cooper Convertible

The MINI Cooper Convertible is stylish and surprisingly affordable to insure. Despite being a convertible, its small size, strong safety systems, and excellent visibility keep premiums low.

Estimated Annual Fuel Cost: $2,050/year

Estimated Average Annual Insurance: $1,328/year

Perfect for city cruising or Sunday drives along Lake Ontario, the MINI brings personality and practicality together.

3. Subaru Forester

Known for its all-wheel drive and top safety ratings, the Subaru Forester continues to be one of Canada’s most reliable SUVs. This compact crossover is renowned for its standard all-wheel drive, exceptional visibility, and high safety ratings, which all translate to lower insurance costs.

Estimated Annual Fuel Cost: $2,050/year

Estimated Average Annual Insurance: $1,424/year

The Forester is often praised for its durability, making it a favourite among families, commuters, and outdoor enthusiasts alike.

4. Mitsubishi Eclipse Cross

The Mitsubishi Eclipse Cross has steadily gained popularity among Ontario drivers for its mix of modern style, fuel efficiency, and reliability. It features advanced safety technologies, including forward-collision mitigation and lane-departure warning. These reduce accident rates and keep insurance premiums low.

Estimated Annual Fuel Cost: $2,325/year

Estimated Average Annual Insurance: $1,500/year

This car also benefits from Mitsubishi’s 10-year powertrain warranty, which signals to insurers that owners are likely maintaining their vehicles properly.

5. FIAT 500

The Fiat’s compact design makes it easy to maneuver and park in busy cities, and its low-cost parts help keep repair and insurance expenses minimal. While it’s no powerhouse, the 500 boasts a low theft rate and solid safety ratings that make it more affordable to insure.

Estimated Annual Fuel Cost: $2,175/year

Estimated Average Annual Insurance: $1,532/year

This small, affordable car is a great option for students, first-time car owners, or anyone who spends most of their time in the city.

6. Volkswagen Tiguan

The Volkswagen Tiguan is roomy enough for families but compact enough for urban driving. It also has a comprehensive suite of driver-assistance features that lowers accident risks, such as adaptive cruise control, forward collision warning, and pedestrian monitoring.

Estimated Annual Fuel Cost: $2,350/year

Estimated Average Annual Insurance: $1,536/year

Generally, the Tiguan’s reputation for safety and strong European build quality helps keep insurance costs reasonable.

7. Honda Civic

Affordable, reliable, and easy to insure, the Honda Civic has long been one of the most insurance-friendly cars in Canada. Its strong safety record, inexpensive repair costs, and massive availability of replacement parts keep claim severity low, which is exactly what insurers like to see. Add to that excellent fuel efficiency and high resale stability, and the Civic becomes one of the most economical cars to own overall.

Estimated Annual Fuel Cost: $1,650/year

Estimated Average Annual Insurance: $1,553/year

Because Civics are driven by a wide range of cautious, everyday commuters and families, insurers tend to associate them with predictable driving patterns and lower-risk claims. It’s one of the rare cars that is cheap to buy, cheap to run, and cheap to insure.

8. Ford Ranger

Smaller and more fuel-efficient than full-size trucks, the Ranger offers great value for drivers who want the utility of a pickup without excessive operating costs. Its strong towing and payload capabilities make it versatile for both work and leisure.

Estimated Annual Fuel Cost: $2,750/year

Estimated Average Annual Insurance: $1,564/year

Its manageable size and impressive safety ratings contribute to lower insurance rates for such a versatile vehicle.

9. Mazda CX-3

The CX-3 is one of the most affordable Mazda models to insure, thanks to its smaller engine, lightweight design, and solid safety record. Its advanced safety suite, including Smart City Brake Support and blind-spot monitoring, reduces collision risks and insurance claims.

Estimated Annual Fuel Cost: $1,925/year

Estimated Average Annual Insurance: $1,601/year

For budget-conscious drivers who don’t want to sacrifice style or driving enjoyment, the CX-3 is a great all-rounder.

10. Toyota Corolla

The Toyota Corolla is practically an insurance industry favourite. It consistently ranks among the lowest-risk vehicles thanks to its legendary reliability, excellent safety ratings, and extremely low repair and replacement costs. For insurers, the Corolla represents stability and low volatility in claims.

Estimated Annual Fuel Cost: $1,575/year

Estimated Average Annual Insurance: $1,689/year

With advanced safety systems standard across most trims and a long track record of low claim frequency, the Corolla is often one of the cheapest vehicles to insure in its class. It’s the definition of “boringly smart” from an insurance perspective — and that boring is exactly what keeps premiums down.

Cheapest SUVs to Insure in Ontario in 2026

| Car Model | Average Annual Premium | Average Monthly Premium |

|---|---|---|

| Subaru Forester | $1,424 | $119 |

| Lexus GX460/GX550 | $1,438 | $120 |

| Infiniti QX80 | $1,452 | $121 |

| Mitsubishi Eclipse Cross | $1,500 | $125 |

| Volkswagen Tiguan | $1,537 | $128 |

| Mazda CX-3 | $1,602 | $133 |

| MINI Cooper Countryman | $1,609 | $134 |

| Volvo XC40 | $1,621 | $135 |

| GMC Yukon | $1,634 | $136 |

| Land Rover Range Rover Evoque | $1,644 | $137 |

Cheapest Small Cars to Insure in Ontario in 2026

| Car Model | Average Annual Premium | Average Monthly Premium |

|---|---|---|

| MINI Cooper Convertible | $1,328 | $111 |

| Honda Civic | $1,465 | $122 |

| Toyota Corolla | $1,489 | $124 |

| FIAT 500 | $1,533 | $128 |

| Kia Soul | $1,588 | $132 |

| Subaru Legacy | $1,600 | $133 |

| Kia Rio | $1,652 | $138 |

| Subaru Impreza | $1,653 | $138 |

| MINI Cooper S | $1,673 | $139 |

| Volkswagen Passat | $1,715 | $143 |

Cheapest Electric Cars to Insure in Ontario in 2026

| Car Model | Average Annual Premium | Average Monthly Premium |

|---|---|---|

| Tesla Model Y | $1,746 | $145 |

| Tesla Model 3 | $1,776 | $148 |

| Hyundai Ioniq | $1,808 | $151 |

| Tesla Model S | $1,841 | $153 |

| Tesla Model X | $1,963 | $164 |

| BMW i3/i4/i5 | $2,207 | $184 |

| Tesla Model X | $2,263 | $189 |

| Audi Q8 e-Tron | $3,114 | $259 |

Cheapest Trucks to Insure in Ontario in 2026

| Car Model | Average Annual Premium | Average Monthly Premium |

|---|---|---|

| Ford Ranger | $1,565 | $130 |

| GMC Canyon | $1,639 | $137 |

| Dodge/RAM 1500 | $1,644 | $137 |

| GMC Sierra 1500 | $1,678 | $140 |

| Ford F150 XL | $1,788 | $149 |

| Honda Ridgeline | $1,788 | $149 |

| Chevrolet Silverado 1500 | $1,818 | $152 |

| Ford F150 Lariat Supercrew | $1,878 | $157 |

What Factors Determine How Cheap It Is to Insure Your Car?

Several factors influence how much you’ll pay for car insurance in Ontario. While some of them aren’t within your control, others are, and planning ahead will help you save on your coverage. Here’s what insurers typically look at: