Discovering that your car has been stolen is one of the worst scenarios that a driver can experience. Fortunately, a comprehensive insurance policy can help minimize the stress and financial burden you might experience from such an unfortunate event.

When your car is stolen, there’s a chance that it might be recovered by the police. What happens when your stolen car is recovered? Does your car insurance policy cover theft? What steps should you take to minimize the risk of your car getting stolen? Read on to learn about car theft and recovery in Ontario.

How Much Does Car Theft Affect Canadians?

Having your car stolen in Canada is an unfortunate circumstance that plagues thousands of Canadians per year, causing a huge financial and social burden. According to the Canadian Financial & Leasing Association, one car is stolen every six minutes in Canada, with only 50% of stolen vehicles being recovered on average.

Vehicle theft costs Canadians close to $1 billion a year, with over half of that amount being the cost for insurers to repair or replace vehicles. Around $250 million is spent on the police, court system, and health care costs, and the rest is spent on correctional services.

Since 2015, the number of car thefts in Canada has increased yearly. In 2021, Toronto alone reported over 6,000 vehicle thefts, which increased in 2022 to over 9,000. In just the first three months of 2024, Toronto police reported doubling of last year’s carjacking cases.

Car theft is usually a crime of opportunity and can take as little as 30 seconds to commit. While the public commonly associates vehicle thefts with broken windows and jimmied locks, most criminals nowadays tend to use methods that minimize damage to the vehicle. Many vehicle thefts occur when a driver leaves a running car unattended for a few seconds, just long enough for a thief to get in the driver’s seat and speed away.

Even with car manufacturers coming up with more sophisticated anti-theft systems, thieves have similarly come up with more advanced ways of jacking a car. Some criminals can use high-tech methods to copy a driver’s electronic key fob, which can then override a car’s onboard system.

Once a car is stolen, criminals can then chop it up for parts, sell them as used cars to clueless buyers, or even export them to other countries illegally. However, if a vehicle is stolen to be used as a getaway vehicle, to joyride, or for another purpose, there is a higher likelihood of it being recovered by authorities.

Does Car Insurance Cover Stolen Cars?

Yes, your car insurance can cover stolen cars, but you need to have a certain type of coverage to have that protection. There are three coverage options that give you protection against car theft:

- Specified Perils Coverage: This type of coverage is also known as upset coverage, and protects your car from specific perils named in the insurance policy. These can include fire, hailstorms, lightning, windstorms, and theft. If something that isn’t specified in the policy happens to your car, you won’t be able to file an insurance claim.

- Comprehensive Coverage: This kind of coverage insures your vehicle against all risks that may require repair or replacement, with the exception of collisions. This allows you to file an insurance claim when your car is stolen, set on fire, vandalized, or otherwise damaged by forces beyond your control.

- All Perils Coverage: The most extensive of all coverage types, all perils coverage will insure your car against all risks, except for those specifically excluded in your specific policy. This is typically the most expensive form of coverage due to its all-encompassing nature.

Additionally, collision coverage is another type of insurance coverage that you can get, though it only protects your vehicle from collisions involving another car or object and doesn’t include theft protection. Depending on your specific policy, your insurance provider may reimburse you the cost of renting another vehicle while your vehicle isn’t available.

What Happens When Your Car is Stolen then Found?

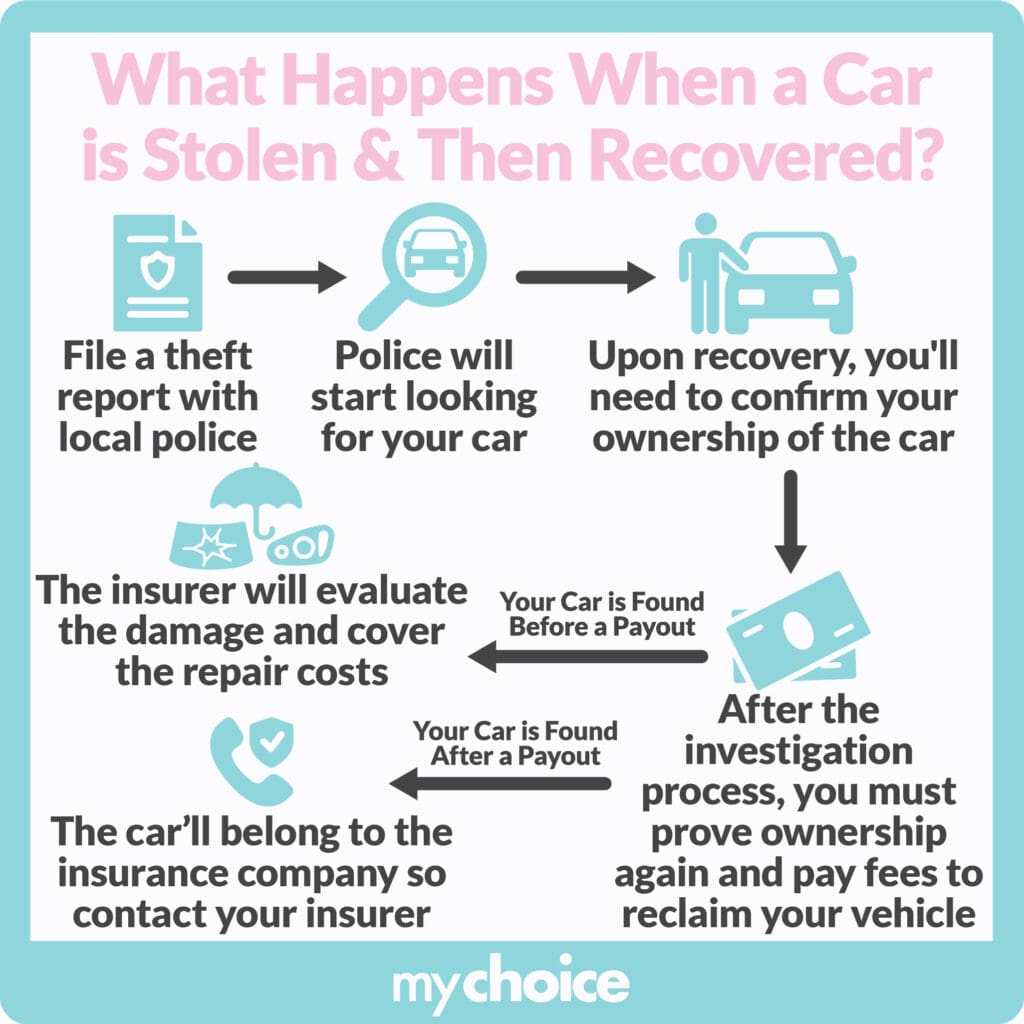

When your car is stolen and subsequently found, there is a legal process that local law enforcement will follow to ensure that your vehicle is properly recovered. There is also a process that insurance companies follow to make sure that

When you first notice that your vehicle is stolen, you need to file a police report ASAP. Include as many details in your report as possible, such as the make, model, license plate, and any identifying marks or stickers. Also, include the time and place of the theft if possible so that the authorities can look through any available surveillance footage of the area.

Many vehicles these days have a GPS or Tag tracking system that can greatly increase the chances of recovering stolen cars. In these cases, let the police handle the recovery of your vehicle and avoid putting yourself in harm’s way.

If and when the authorities are able to recover your stolen vehicle, they’ll document the car’s overall condition, obvious damage, and the date and place of recovery, before impounding the vehicle to preserve any evidence of the crime. They’ll then investigate the theft of your vehicle, which could take some time. In the event that the authorities find a suspect, you should be prepared to go through a lengthy court case.

Whether or not a case goes to court, you are required to legally prove that the vehicle belongs to you before it can be returned to your possession. This process may take some time, so you can ask your insurance provider if they’ll cover the cost of renting another vehicle for you to use in the meantime.

Once your vehicle is in the police’s possession, it’s important to contact your insurance provider immediately to let them know that your vehicle has been recovered. Insurance companies will have a waiting period to see if your vehicle turns up before offering a settlement. There are different outcomes depending on whether your vehicle is recovered before or after your payout is settled.

What Happens if a Stolen Car is Found Before an Insurance Payout?

If your stolen car is found before an insurance payout is distributed, your insurance provider will first assess the condition of the vehicle and document any damage sustained. Should your car be deemed fixable, your insurer will cover the costs of repairs before your vehicle is returned to you.

However, if the car is damaged beyond repair, your insurance company will declare it a total loss and compensate you with the fair market value of your vehicle. Depending on your specific policy, your insurance company may also cover the cash value of items left inside the vehicle and subsequently lost during the theft.

What Happens if a Stolen Car is Found After an Insurance Payout?

If your stolen car is found after an insurance payout is made, your vehicle will now belong to the insurance company. Since they’ve already paid you for the vehicle’s fair market value, the car now legally belongs to your insurers. It’s important to contact your insurance provider as soon as your vehicle is recovered, ideally before they pay out the insurance claim.

Tips to Prevent Car Theft

While you can’t completely eliminate the risk of car theft, you can reduce it significantly by making it hard for aspiring thieves to target your car.

- Never leave your car unlocked and unattended, especially when it’s running.

- Use physical deterrents such as steering wheel locks in addition to your car’s built-in anti-theft system.

- Keep your key fob in a signal-blocking container to deter electronic copying of your car’s key code.

- Park your car in a well-lit public parking space, preferably within sight of a surveillance camera. Consider taking out parking insurance to further protect your car when it’s not in use.

- Utilize an electronic locking system on your onboard diagnostic ports to stop thieves from reprogramming your car’s systems.

- Keep a tracking system inside your car so you can determine its location in the event of theft.

By making it inconvenient for thieves to steal your car, you drastically lower the risk of your vehicle getting stolen. Some insurance companies will even lower your insurance premiums if you have certain anti-theft systems installed on your vehicle.

Key Advice From MyChoice

- Take extra steps to ensure that your vehicle is not an easy target for thieves.

- Make sure that your insurance policy protects you from theft.

- Be ready with any documents that can prove your ownership of a vehicle in case the police are able to recover your vehicle.

- Call your insurance provider immediately once you find out that your car has been recovered.

- Ask your insurance provider if your policy covers the cost of renting a vehicle to drive while your car is missing.

- Your insurance provider may charge you lower premiums if you have multiple anti-theft systems installed on your car.