Canadians have to pay Retail Services Tax (RST) when buying a used vehicle in Ontario. This includes both the federal Goods and Services Tax (GST) and the Ontario provincial tax (PST). The tax is calculated based on either the purchase or wholesale price of the used car.

Ontario Used Vehicle Tax Rules at a Glance

- The tax on buying a used vehicle in Ontario is 13%, which includes the 5% GST and 8% PST.

- You don’t have to pay taxes on used vehicles that are gifted by family or friends.

- While you can’t avoid paying taxes when buying a second-hand car, you can lower the rate in several ways, such as reappraising your vehicle or trading it in for a new one.

Canadians have to pay taxes on every purchase, and used vehicles are no exception. These additional fees are important to keep in mind when buying a used car. Keep reading to learn more about how the tax is calculated, when you’re exempt from it, and what you can do to lower it.

Overview of Taxes on Used Vehicles in the Province

The Ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. When combined, these taxes are called an RST or Harmonised Sales Tax (HST).

Used vehicle taxes in Ontario are lower than in Quebec, which has a sales tax rate of 9.975%. However, it’s higher than in Saskatchewan and Manitoba, where used vehicles are taxed at 6% and 7% respectively.

Types of Used Vehicles Subject to Tax

This tax rate covers the purchase of all specified vehicles that are permitted to be on the road. Aside from cars, this also includes:

- Motorcycles

- Scooters

- Vans

- Buses

- Light trucks

- Camping trailers

- Motor homes

How to Calculate Your Used Vehicle Taxes

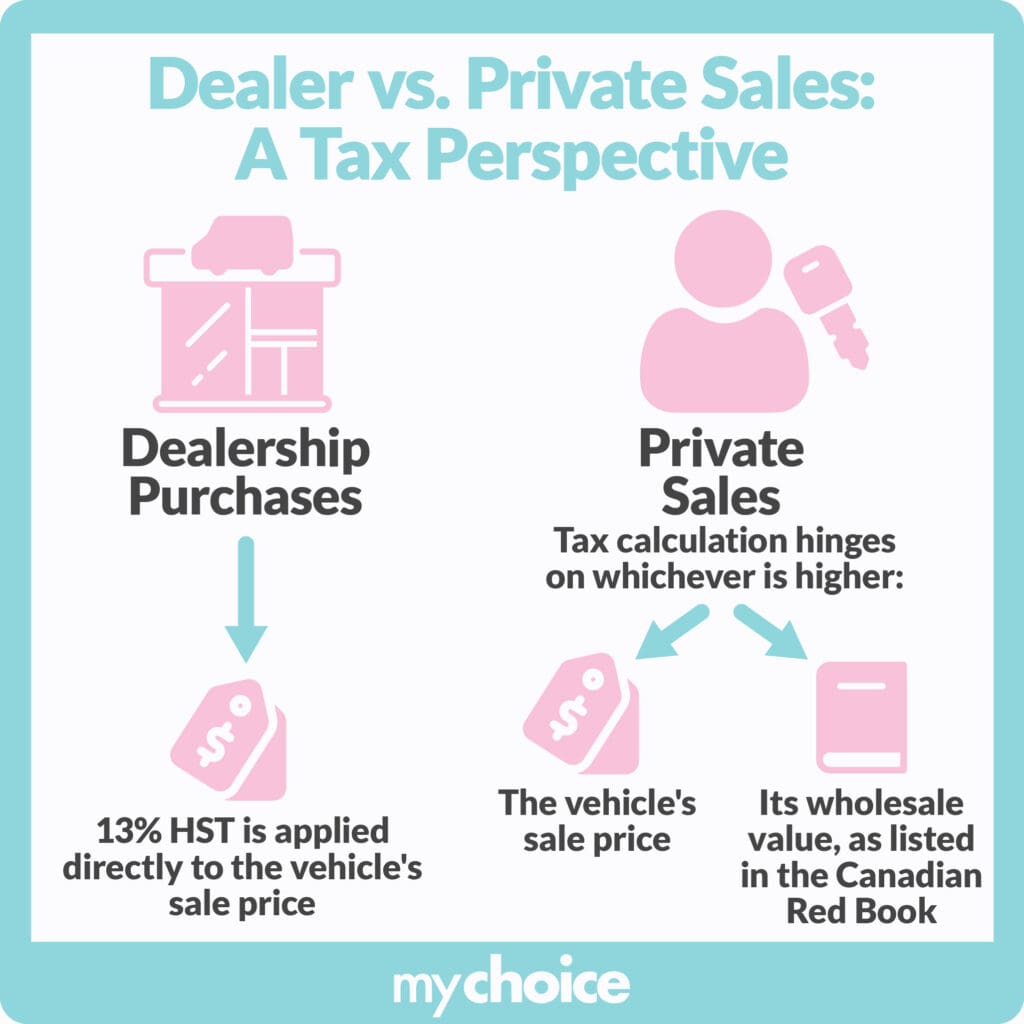

The sales tax is computed based on either the purchase price or the wholesale value of the used car, whichever is higher:

- Purchase price: How much you spent on the second-hand vehicle

- Wholesale price: Based on value provided by Canadian Red Book, with data from CARFAX Canada. Factors like make, model, and year affect the wholesale price, while condition, optional equipment, and mileage do not. You can also find the wholesale value on the used vehicle information package.

Example #1

For example, let’s say you buy a used car for $20,000, and it has a wholesale value of $15,000. You will be taxed 13% of $20,000 (the greater value) or $2,600.

Appraising Your Vehicle

It may be worth it to have your used car appraised if you paid less than the wholesale price for the vehicle and think the Red Book valuation is too high.

If the car is found to be worth less than the wholesale price, the tax will be calculated based on the higher of the appraised and wholesale values.

We highly recommend getting your car appraised if it’s heavily used or damaged and priced over $1,000.

Example #4

You buy a used car for $15,000, and the Red Book value is $20,000. Normally, you’d be taxed $2,600 (13% of $20,000).

You get your car appraised, and it is valued at $13,000—less than the purchase price. Your new tax, based on the higher amount, will be $1,950 (13% of $15,000).

Special Tax Rules

While it’s generally the same across cases, how taxes work with the purchase of used vehicles varies slightly depending on the circumstance. Below are some scenarios where the process may differ:

In Ontario, you have to pay tax whether you buy a used car from a dealership or a private seller. The main difference is in when and who you pay the tax to:

- If you buy from a dealership: The tax is usually bundled into the bill of sale. You pay the tax to the dealership when you buy the car, and they remit it to the government.

- If you buy from a private seller: You pay the tax when registering your vehicle at ServiceOntario. The seller does not collect the sales tax.

While the federal GST is generally the same across provinces, the provincial tax rates may differ. That said, you have to pay the rate of your home state or where you’re registering the vehicle.

If you’re purchasing the car in another province and move it to Ontario, the sales tax is still 13%. The final amount is calculated based on the purchase price.

Cars that are valued at less than $1,000 by Red Book are taxed based on the purchase price.

The RST on used vehicles applies to luxury and antique vehicles as well. However, if the car is older than 20 years old, the Ministry of Finance requires you to get your car appraised.

Luxury tax does not apply to used vehicles with a retail price over $100,000, as it’s typically paid when the car is first registered with the government.

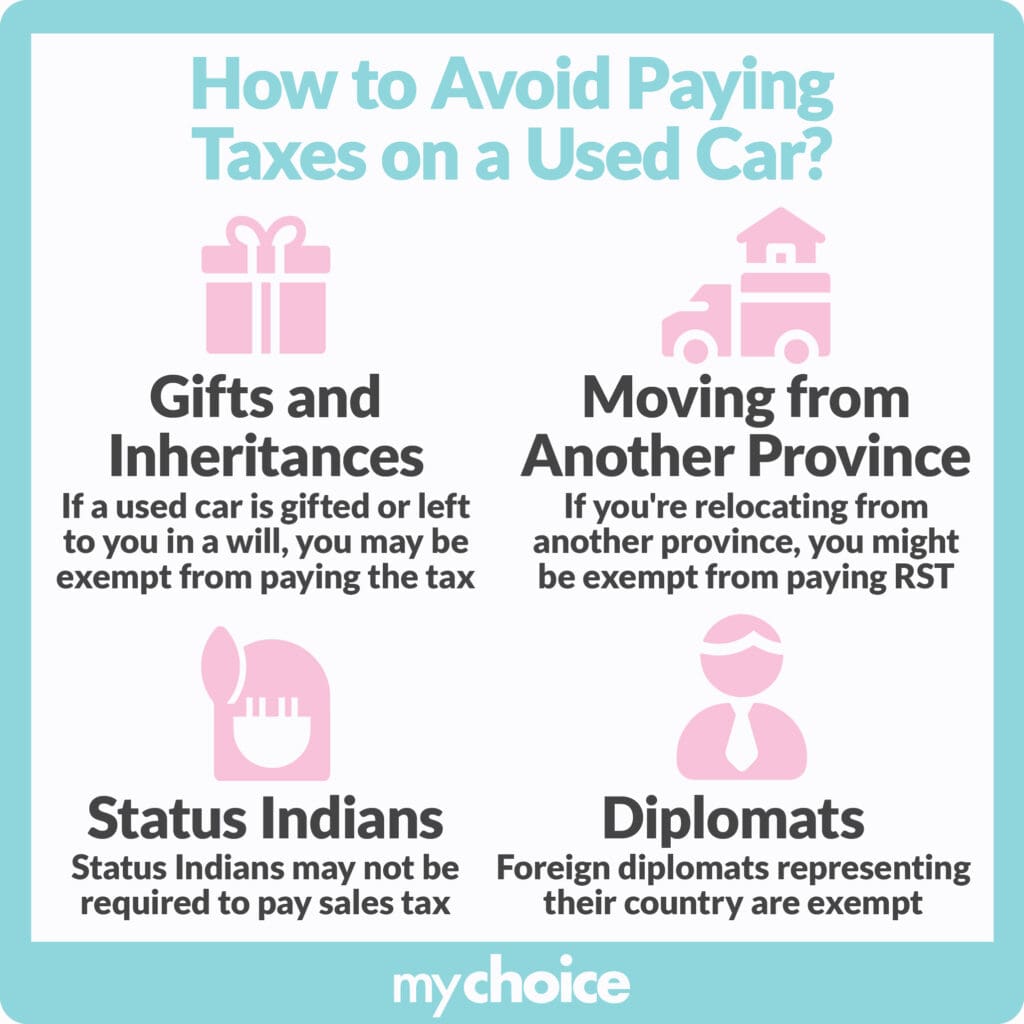

Tax Exemptions: When You Don’t Have to Pay RST

The 13% tax applies when buying used vehicles in Ontario in most cases, but there are a few in which tax isn’t required:

- A friend or family member gifts you the used vehicle. You have to submit a Sworn Statement for Family Gift of a Used Motor Vehicle.

- You inherit the car from someone else’s estate. These may be subject to other taxes, however.

- You are a Status Indian buying a used car from a private seller.

- You’ve previously registered the vehicle in another province and are moving it to Ontario.

- You’re a foreign diplomat buying a second-hand car for use in the country.

There are also no retail service taxes on auto insurance in Ontario or the rest of Canada.

Tips on Lowering the Taxable Value of Your Used Car in Ontario

Between taxes, fees, insurance, and maintenance, the total cost of owning a car can get very expensive. As such, it’s important to save money where you can.

Here’s how to avoid paying taxes on your used car, or at least lower them:

- Get the vehicle as a gift. Keep in mind that this only applies if the current owner is a family member or friend.

- If you already own a car, consider trading it in for a used vehicle. You still have to pay tax, but only the difference between the value of the used car and your existing one. However, this is only recommended if your car doesn’t have negative equity.

- Have your car appraised, especially if it’s been damaged or used heavily. Its actual value may be significantly less than its wholesale price, which can lower the taxes you’ll have to pay.

- Take advantage of tax refunds and rebates for eco-friendly cars and persons with disabilities.

Key Advice From MyChoice

Now that we’ve learned more about used vehicle taxation in Ontario, let’s review some top tips:

- Used cars in Ontario are taxed at 13% of the purchase price or wholesale value, whichever is greater. Make sure to account for this when buying a second-hand vehicle.

- You can get your vehicle appraised if you think the wholesale price is overvalued. It’s especially recommended for vehicles that are damaged, heavily used, or older than 20 years.

- Gifted vehicles are exempt from retail sales tax. If the current owner is a family member, consider getting it as a gift instead to avoid paying the tax.