Electric vehicles (EVs) are becoming a regular sight on Canadian roads. But as more drivers make the switch, insurers are noticing a new trend – rising claim frequency and higher repair costs for EVs compared to gas-powered cars. Let’s break down what’s driving the increase in EV claims and how drivers can keep their car insurance costs under control.

What are the Main Drivers of Rising EV Claim Frequency?

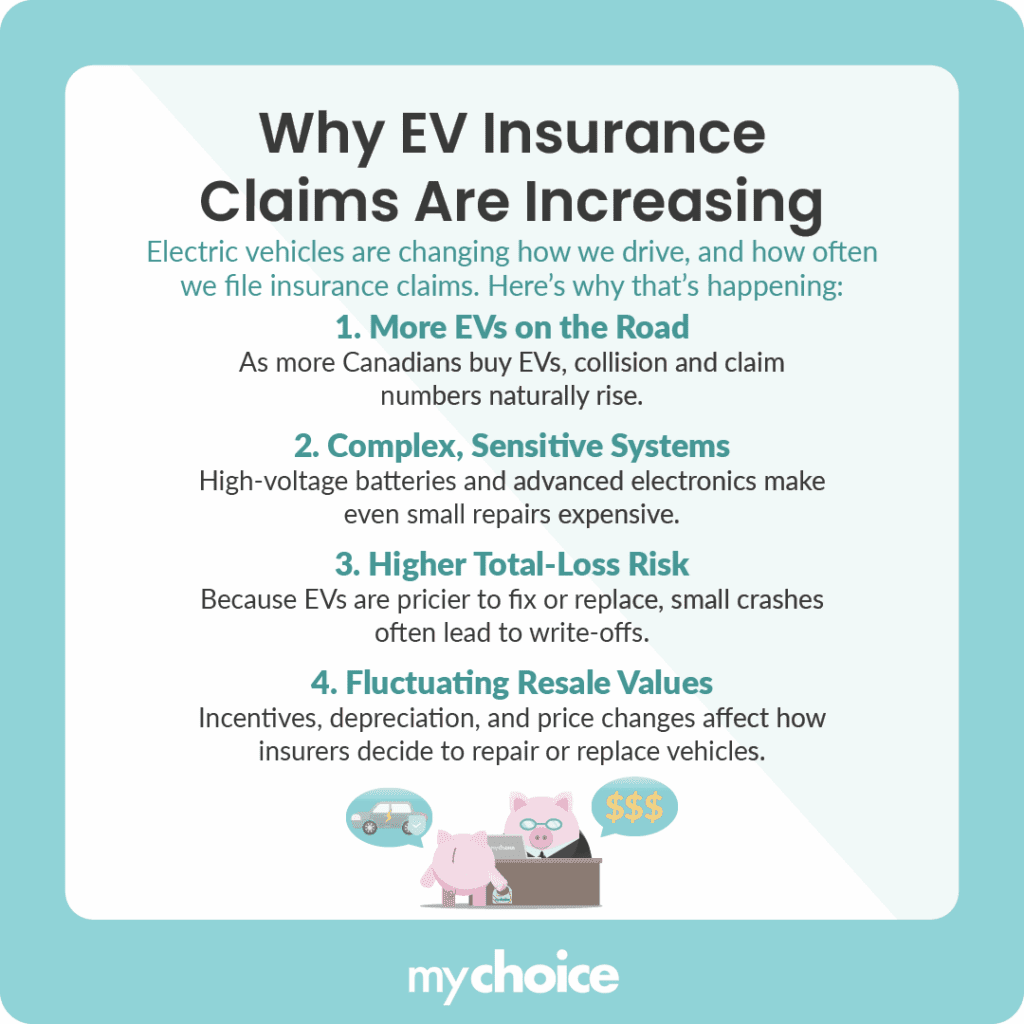

EV claims are rising, and that’s largely due to a mix of adoption trends, technological complexity, and market dynamics all playing a role. Let’s look at the biggest factors behind the rise.

Why EVs Are So Expensive to Repair

The heart of the issue for insurers isn’t just how often EVs are being damaged, but how much it costs to fix them. From specialized parts to high-voltage safety protocols, EV repairs can quickly add up. Here’s why those costs tend to be higher:

What This Means for Drivers and Insurers

Rising EV claim frequency and cost ripple through the entire insurance ecosystem. For drivers, it can mean higher premiums. For insurers, it means rethinking how risk is measured and priced. Here’s how the landscape is shifting:

How to Keep EV Insurance Costs Down

Here are practical steps for drivers to manage or reduce insurance costs:

- Choose EVs with strong safety, repairability, and parts support: Some models are easier and cheaper to fix. Check reviews or get advice before purchase.

- Increase deductibles: A higher deductible reduces what the insurer pays, often lowering your premium.

- Bundle your policies or negotiate with your insurer: If you have home, renters, or other insurance, bundling may yield discounts.

- Ask about EV-friendly discounts or green incentives: Some insurers give credits for eco-friendly vehicles, low mileage, or safety features.

- Drive carefully and maintain a clean record: Claims frequency will always factor in driving history. Having no accidents or traffic violations on your record helps.

- Consider telematics or usage-based programs: If available, these programs let you earn discounts based on your driving behaviour and mileage.

Key Advice from MyChoice

- Ask prospective insurers how they price EVs and what discounts or penalties they apply.

- When you select an EV, think about how easy it is to repair, parts availability, past claim history, and battery warranty, as these will affect your insurance cost.

- Watch incentives and local rules. Provincial incentive programs, trade‐policy changes, or parts tariffs can affect residual values and repair costs