Car insurance premiums can be costly, and having someone with a spotty driving record on your insurance policy might make premiums more expensive. OPCF 28 and 28A can help you reduce premiums by limiting (or even excluding) that person’s access to car insurance coverage.

How OPCF 28/28A Works

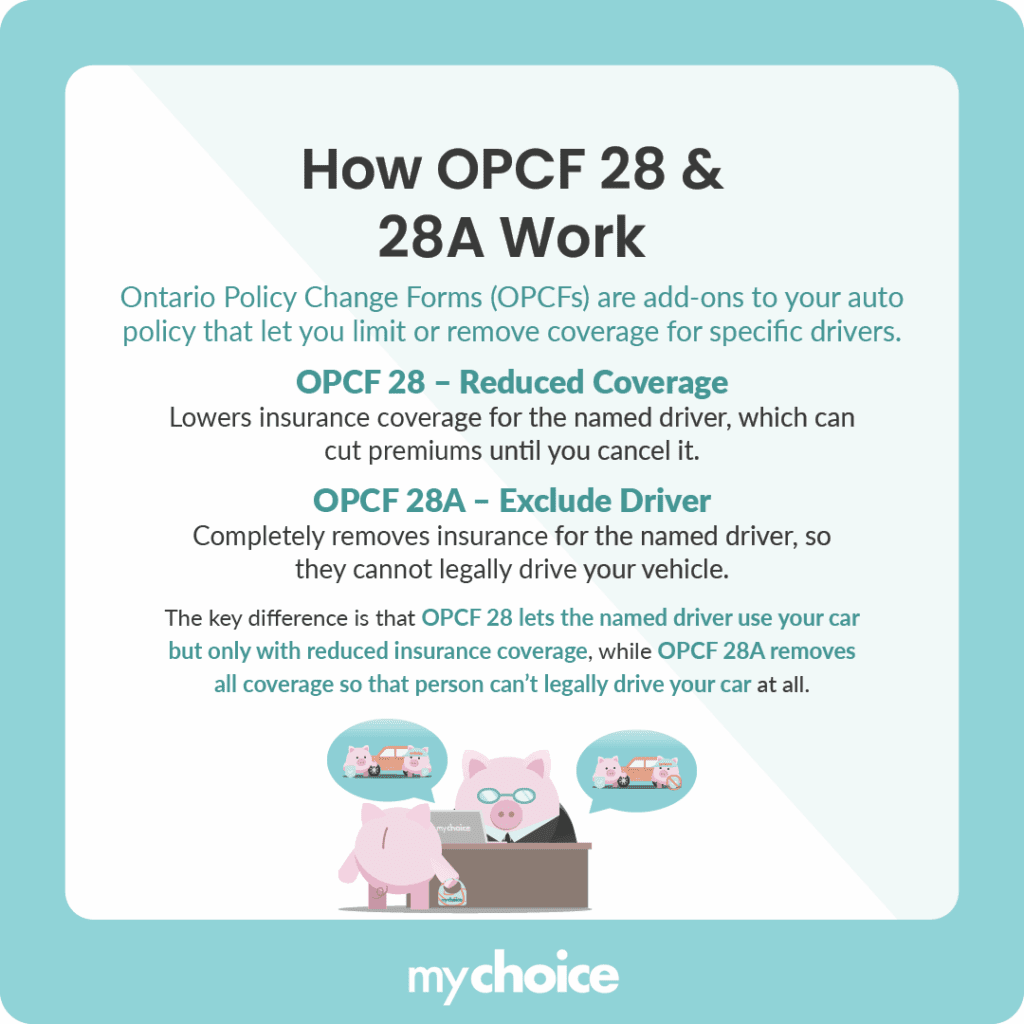

Ontario Policy Change Forms (OPCFs) are add-ons to your existing car insurance policy. OPCF 28 and 28A are two separate endorsements with similar end goals. Let’s break each of them down to see how they work:

The Difference Between OPCF 28 vs. OPCF 28A

The main difference between OPCF 28 and 28A is the scope of the driver exclusion. OPCF 28 reduces the coverage for your named driver, meaning they can still drive your car but receive some insurance protection. Meanwhile, OPCF 28A completely removes all insurance protection from the driver, meaning they won’t be able to drive your car legally.

Reasons to Exclude a Driver From Your Policy

There are many reasons to exclude a driver from your car insurance policy. Here are some common reasons why you might want to do that:

- Someone in your household has an accident on their record, and you don’t want to be penalized with increased premiums because you let them drive your car.

- You have a young child or family member whom you believe isn’t yet mature enough to drive.

- A member of your household is accident-prone, and you don’t want to take chances by allowing them to drive your car.

- You simply want to determine which household members can drive your car.

What Happens if an Excluded Driver Uses the Car Anyway?

Your insurer may cancel your policy if it discovers that the excluded driver uses the car anyway, as this constitutes a breach of contract. If this happens, it may be harder for you to get a new insurance policy.

Things could get even more dire if your excluded driver uses the car and gets into an accident. Your insurer may refuse to provide coverage, especially if this happened with your knowledge. Additionally, anybody injured in the accident can sue both you and the driver in question.

Alternatives to OPCF 28/28A

Using OPCF 28/28A is the most common way to limit the access a household member has to your car. However, there are some alternative options if you don’t want to use either of those change forms to deal with a high-risk driver in your household:

- Have the person you want excluded from your policy get their own car insurance policy. A high-risk auto insurance policy may be a good choice if they have a spotty driving record.

- Find a new car insurance company willing to shoulder the added risk without a big jump in insurance costs.

- Have the high-risk driver take defensive driving courses and negotiate a premium reduction with your insurer.

While it’s likely to be a very extreme solution, removing the high-risk driver from your household means they’re not listed on your policy anymore. omprehensive coverage.

Key Advice from MyChoice

- Use OPCF 28 if you only want to limit a person’s car insurance coverage, while OPCF 28A is used to completely block a high-risk driver’s access to your car.

- If you have an OPCF 28A in effect, be vigilant and don’t let the excluded driver use your car because you may face insurance penalties if the insurer finds out.

- Consider getting the high-risk driver their own insurance policy if you don’t want to file an OPCF.ded protection from traffic incidents and non-traffic hazards, consider taking all-perils insurance.