One-way car insurance is the most basic form of auto insurance coverage. Instead of covering the policyholder, one-way insurance protects others in the event of an accident.

One-way Car Insurance Article at a Glance

- One-way insurance can be beneficial to drivers who are on a tight budget, as it only offers the bare minimum coverage needed to drive in Canada legally.

- Without two-way insurance, you’re responsible for covering the cost of damages sustained by your car.

- There are some ways to make the most of one-way car insurance, including setting up an emergency fund and practicing safe driving.

Read on to learn more about what one-way car insurance covers, how it differs from other forms of auto insurance, and whether this kind of policy is right for you.

Understanding One-way Car Insurance

Also known as liability-only insurance, one-way insurance is a type of policy that covers the costs if a policyholder injures someone or damages someone else’s car in an accident. Think of it as a safety net that allows the policyholder to meet their legal responsibilities towards others without breaking the bank.

In most provinces, including (but not limited to) Alberta, British Columbia, Nova Scotia, Manitoba, and Ontario, one-way insurance is the bare minimum coverage needed to drive legally. This is because driving without insurance is illegal in Canada. So, if you don’t want to pay a hefty premium for auto insurance, one-way insurance is your best bet.

One-way insurance includes the following coverage:

- Third-party liability coverage: This is what covers the cost of damaging another person’s car or property, or injuring another person in an accident. Third-party liability covers medical treatments, repairs to someone’s property or vehicle, and any legal costs you may incur.

- Accident benefits coverage: This covers the driver and anyone in the car in the event of an accident — regardless of who caused it. Accident benefits covers medical costs, income lost if you can’t work due to your injuries, and funeral costs in case anyone passes away from the accident.

- Uninsured automobile coverage: This protects the other driver in an accident if they don’t have insurance, or if it’s a hit-and-run.

- Direct compensation-property damage (DCPD) coverage: This covers damage to your vehicle and the contents of your vehicle if you’re not deemed at fault in an accident.

One-way vs Two-way Car Insurance

Unlike one-way insurance, two-way insurance is more comprehensive, as it covers everything that one-way insurance does, plus provides protection for the policyholder and their car.

Two-way insurance includes all the basic coverage offered by one-way insurance, plus additional endorsements such as:

- Collision coverage: This covers the cost of repairing or replacing your vehicle after an accident. If the cost to repair is higher than the value of your car, your insurer may pay enough to cover the cost of replacing the vehicle.

- Comprehensive coverage: This covers almost anything outside of accidents, like damage from natural disasters such as floods, earthquakes, and hailstorms, as well as theft, vandalism, and collisions with animals.

- Accident forgiveness coverage: Think of this as a free pass for your first accident. Usually, insurers increase premiums the more claims you’ve made. But with accident forgiveness, the first claim won’t count.

- Loss of use coverage: This covers the cost of renting a vehicle or taking public transportation if your car is damaged and needs to be taken in for repairs.

Who Can Benefit from One-way Car Insurance?

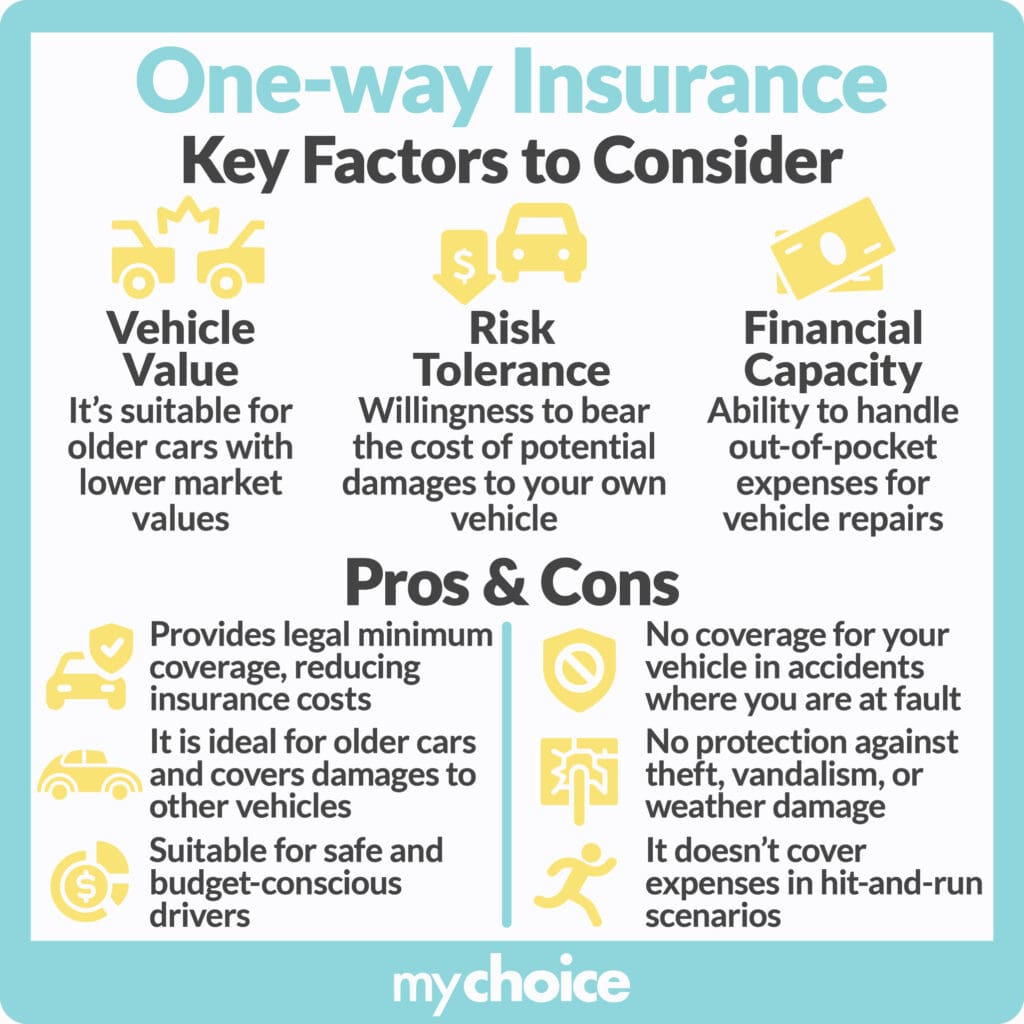

One-way car insurance isn’t for everyone, but it can be a great option for the following people:

Drivers on a Budget

Because one-way insurance provides minimal coverage, it’s much cheaper than two-way insurance. If you’re trying to save money and you’re willing to accept the risk of damage or theft, one-way insurance may be a good option.

Drivers with Older Cars

If you have an older car, it may not be worth spending two-way insurance on. Insurance premiums can set you back hundreds of dollars a year. If the cost of two-way insurance is higher than the replacement value of your vehicle, you’re probably better off getting one-way insurance and saving up for a new car.

Drivers Who Rarely Use Their Cars

By spending less time on the road, you also lower your risk of being involved in an accident. This minimizes your chances of needing to make a claim for an accident or damages from natural disasters.

Drivers Who are Willing to Cover Repair Costs

If you feel like the cost of two-way insurance outweighs the cost of repairing your vehicle after an accident, you might want to consider just getting one-way insurance. You’ll save money this way in the long run.

Drivers Who Can Accept the Risks

People have different degrees of risk tolerance, or the ability and willingness to accept an outcome and its consequences. With one-way insurance, you’re essentially weighing your chances of being involved in an accident and your ability to pay for the damages with the cost of buying a more expensive policy.

Financial and Legal Implications of One-way Car Insurance

As discussed, there are some risks involved with getting only one-way insurance. Firstly, one-way insurance won’t cover any injuries and damages you and your vehicle endure in an untoward incident. The cost of medical bills, repairs, and alternative transport options will all have to come out of pocket.

Secondly, you will have trouble finding a lender who will finance a vehicle without collision or comprehensive coverage. Most lenders require financed vehicles to have these two types of coverage and impose a minimum limit as well.

Can I Get Sued if I Only Have one-way Insurance?

You can get sued for a car accident whether you have one-way or two-way insurance. You can get sued even if you have insurance for four reasons:

- The claimant and your insurer can’t agree on who was at fault and whether you should bear any responsibility for the accident. In this case, a court may have to determine the percentage of fault that each party should bear.

- The claimant and your insurer don’t meet eye-to-eye on the settlement amount.

- The statute of limitations is nearing and the involved parties don’t have time to negotiate.

- The value of the case exceeds your coverage limit and you have assets.

Note that one-way insurance is the bare minimum coverage, so it’s possible that your insurance won’t cover the cost of damages in a major accident. This is when one-way insurance could land you in court. The claimant’s legal team could assess whether you can cover the remaining costs with your personal assets.

In any case, to avoid legal repercussions, make sure to report a car accident as soon as it happens.

How to Manage the Risks Associated with One-way Car Insurance

If you don’t want to purchase two-way insurance but are worried about the risks, the following tips may help give you some protection:

- Set up emergency funds: make sure you have enough funds to cover yourself in case an accident happens. Have enough stashed for medical bills, repairs, lost income, and the cost of finding another mode of transportation while your vehicle is out of commission.

- Drive less: The less you drive, the lower your risk of being involved in an accident.

- Drive safely: Follow traffic rules, maintain a safe distance between you and the vehicle ahead of you, and make sure you’re always visible to other drivers.

- Install a theft-deterrent system: To minimize the risk of theft, purchase anti-theft devices like brake and wheel locks, GPS trackers, and Faraday bags.

- Consider getting usage-based insurance (UBI): Also known as pay-as-you-go insurance, this uses telematics to log data on your driving habits. With this data, your insurer will provide a rate based on your performance.

- Try temporary or short-term insurance: Some insurance providers offer temporary insurance that lasts anywhere from a few days to a few months. Not all provinces allow temporary options.

Key Advice From MyChoice

- While it’s a budget-friendly option, getting one-way insurance is a risky decision.

- Be prepared for the possibility of accidents, natural disasters, and theft, as you will have to cover any damages and injuries caused to your vehicle and yourself.

- If you’re looking for affordable options with more coverage, use MyChoice to shop around and find the best rates for you.