Your car insurance is affected depending on whether your car is financed or owned. A financed car may have stricter insurance coverage requirements, while owned cars generally have more relaxed requirements.

Are you thinking of buying or financing a car? Read this guide first to learn the difference between a financed vs. an owned car, as well as the insurance implications of each option.

How Do You Pay for a Car in Canada?

You can pay for a car in Canada in one of three ways:

- Leasing: Leasing is like long-term rent. You borrow a car, make monthly payments, and return the vehicle once your lease is over. Sometimes, you can buy a leased car at the end of your loan period, but that isn’t always the case.

- Financing: Financing a car is like a mortgage. You sign a loan contract with a bank or other financial institution to get the money to buy your car. Then, you make regular payments to repay the loan’s principal and interest. Unlike leasing, financing a car means you can fully own the car once the loan is completely paid.

- Buying outright: This method is usually the simplest – you buy the car in full, and you own it the second the dealership agrees to the purchase. Not everyone has enough cash to buy a car outright sitting around, but, sometimes, it’s a good idea. Many dealerships have cash incentives, and you won’t be bogged down by loan interest.

Leasing and financing a car both involve loans, but they’re very different things. Read our comparison between leasing and financing a car to learn more.

What’s the Difference Between an Owned and Financed Car?

The main differences between an owned and financed car are your payment obligations and ownership status.

With an owned car, you don’t have to pay anything else besides the initial purchase price, and you fully own the vehicle. With a financed car, you still need to make regular loan payments, and you don’t really “own” the car until the loan’s fully paid off.

There are also other differences between owned and financed cars, like their insurance implications. Many lenders want you to get full coverage on a financed car because they want to protect their investments. Meanwhile, you’re only required to get mandatory coverage for an owned car because the only person with insurable interest is you.

Owned vs Financed Car: How Should You Pay for Your Vehicle?

You should pay for your vehicle with the method that best suits your needs.

Financing your car is the more viable way to pay if you don’t have enough cash to make an outright purchase. However, the loan payments may end up costing more because the lender includes expenses and interest.

Meanwhile, buying a car outright is the most direct way to pay for your vehicle. You don’t need to deal with interest, and some dealerships even offer special prices for cash buyers.

That said, not everybody has enough idle money to buy a car with cash. Plus, you may miss out on money-making investments and projects if you use most of your cash to buy a car.

There are more benefits and drawbacks to either vehicle payment method. Let’s break them down here:

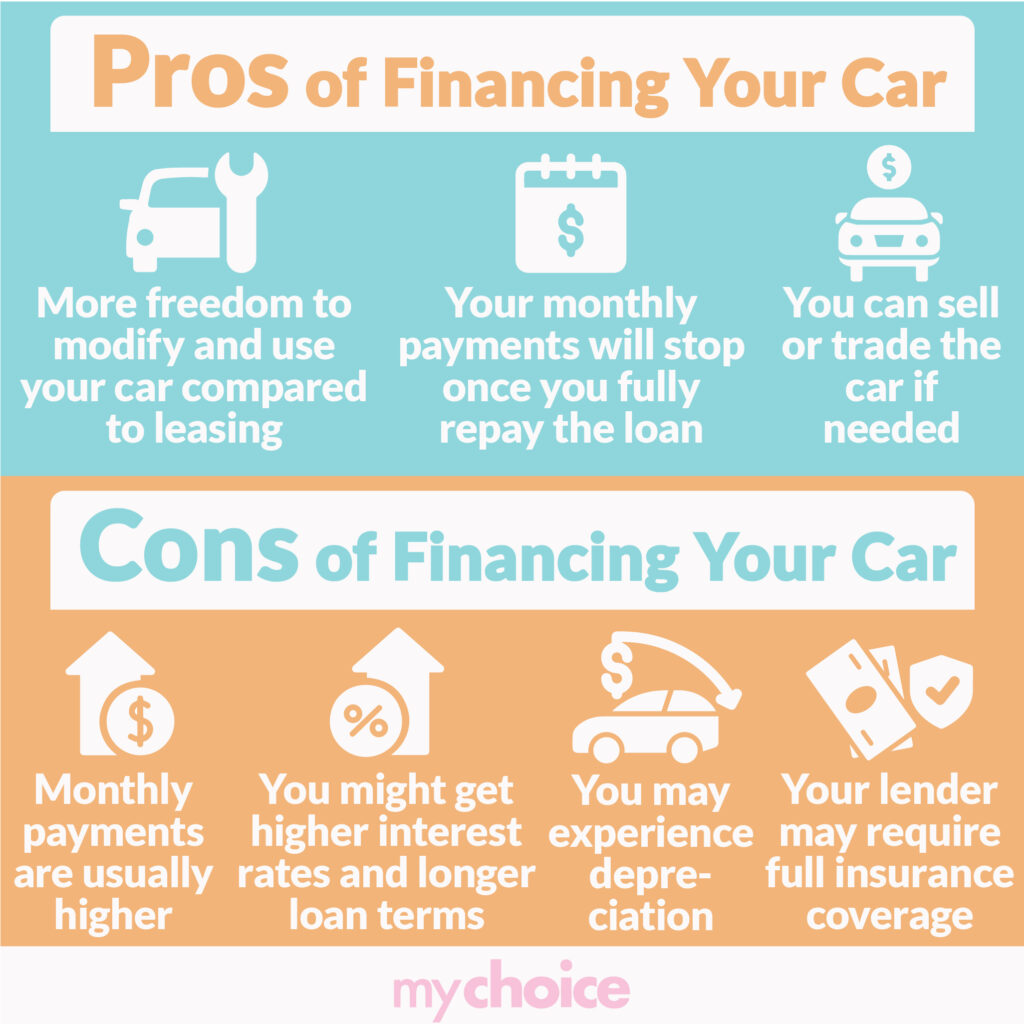

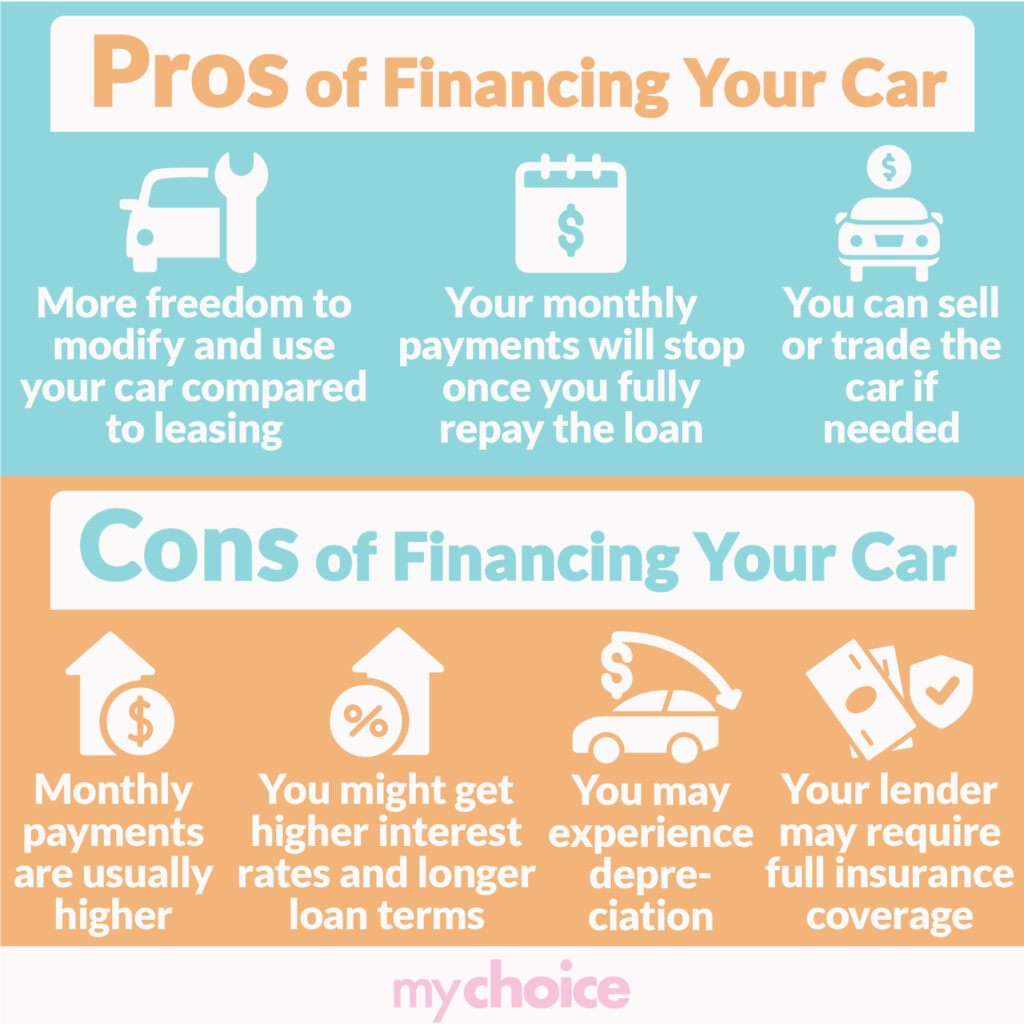

Pros of Financing Your Car

- You have more freedom to modify and use your car compared to leasing.

- Your monthly payments will stop once you fully repay the loan.

- You don’t have to commit lots of cash for the initial payment.

- You can sell or trade the car if needed.

Cons of Financing Your Car

- Your monthly payments are usually high because they include interest.

- You might get higher interest rates with longer loan terms.

- You may experience depreciation because the car’s value diminishes over time.

- Your lender may require full insurance coverage, which is more expensive.

Pros of Owning Your Car

- You can save money by skipping interest payments.

- You don’t have to worry about monthly loan payments.

- You can get dealership discounts and special incentives.

- You don’t have to go through loan qualifications.

Cons of Owning Your Car

- You might stretch your finances too thin.

- You might miss out on alternative investments that may make you money.

- You can’t build your credit rating.

Car Insurance: Financed vs Owned

How you buy your car has insurance implications. Financed and owned cars have different insurance requirements because the number of people with an insurable interest in them differs.

On an outright owned car, you’re usually the only person who has an insurable interest in it. This means you can dictate what kind of insurance coverage your car should have. As long as you have the mandatory Canadian auto insurance coverage, you can add extra coverage or skip them altogether, depending on your budget and needs.

With financed cars, your lender also has an insurable interest in the vehicle. Most auto loan lenders require full coverage insurance, which includes comprehensive and collision protection. This ensures that even if you get in an accident, the lender won’t experience a total loss on its investment.

Insurance Coverage for Financed Cars

You need full insurance coverage on a financed car if your lender requires it. Different lenders have different insurance coverage requirements.

Check with your auto finance provider for more details. You can also have the lender get car insurance on your behalf, but that might be more expensive than shopping for a policy yourself.

Do Financed Cars Come With Insurance?

Financed cars don’t come with insurance by default. Some lenders might offer car insurance as an add-on but don’t include that in your auto loan. That means you need to pay extra to get an insurance policy from the lender.

In most cases, you need to get a policy that meets the lender’s requirements by yourself. Lenders usually require mandatory, comprehensive, and collision coverage. Lenders require the latter two because they need to protect their investment in case of an accident.

How to Deal With Accidents When Driving a Financed Car

The steps of dealing with accidents when driving a financed car are generally the same as when driving an owned car. However, you need to inform the lender before making repairs or getting a replacement because it might have specific conditions and requirements.

Here’s a quick step-by-step guide to dealing with accidents when driving a financed car:

- Check yourself, your passengers, and the other drivers.

- Call the local authorities and help them file an accident report.

- Contact your insurer to learn what’s needed to make an insurance claim.

- Check with your lender and follow their instructions, if any.

- Repair your vehicle according to the lender’s requirements.

- Pay your insurance deductibles, if any.

Read our article on what to do after a car accident to ensure you’re prepared.

Does Having a Financed Car Affect My Premiums?

Having a financed car might raise your premiums because you usually need extra insurance coverage. You might also need a higher coverage limit because the lender requires it, raising your auto insurance rates.

What Happens to My Policy if I Don’t Make Payments on My Car?

If you don’t make payments on your car, your insurer usually cancels your policy. This happens because the lender will repossess your car, leaving you without an insurable interest in the car.

Can I Modify My Policy Once I Repay My Auto Loan?

You can modify your insurance policy once you repay your auto loan. The lender no longer has any say in your insurance coverage, so you can reduce or add insurance coverage according to your needs and budget.

Insurance Coverage for Owned Cars

There’s a lot more leeway when you’re looking for insurance coverage for owned cars. You’re typically the only party with an insurable interest in the vehicle, so you can choose whichever policy add-ons that fit your needs – as long as you have mandatory coverage.

Does Buying a Car Outright Affect My Premiums?

Buying a car outright doesn’t directly affect your premiums. However, you might land cheaper premiums than people with financed cars because the insurance coverage requirement is more relaxed. This means you can only take the mandatory insurance coverage and get lower rates than those who pay for full insurance coverage.

Do I Need Full Coverage Insurance on an Owned Vehicle?

You don’t need full coverage insurance on an owned vehicle if you don’t want it. You’re the only one with an insurable interest in the car, so you can dictate what type of coverage you should and shouldn’t get.

Finding Affordable Car Insurance for Financed and Owned Cars

Car insurance for financed vehicles is typically more expensive because you need to have full coverage. Meanwhile, you can get cheaper rates for owned cars because you can just get mandatory coverage and nothing else.

Are you looking for the best insurance rates for your financed or owned car? MyChoice is here to help. Visit our rate calculator pages for Toronto and Alberta to find the cheapest car insurance policies for you.

When you need to dispose of old insurance documents, be sure to do so thoroughly by burning, shredding, or pulping. Improper document disposal might lead to identity theft or other unwanted consequences.