Before we go further, take a look at the top 10 car insurance questions Canadian drivers often ask.

Average Car Insurance Rates for New & Young Drivers in Canada

New and young drivers pay more for car insurance because insurers consider them higher risk. Most accidents happen in the first few years of driving, but the risk drops as drivers gain experience.

Here is a quick look at average yearly car insurance premiums by age, based on data from Ontario and Alberta.

| Age | Average Annual Car Insurance Premium for a New Driver in Ontario | Average Annual Car Insurance Premium for a New Driver in Alberta |

|---|---|---|

| 18–20 | $5,437 | $5,015 |

| 21–24 | $2,804 | $2,569 |

| 25–34 | $2,159 | $2,056 |

Insurance premiums usually drop in your early 20s and keep going down through your 30s, then level off later in life. Although the exact price depends on your province, car, and driving record, this pattern is the same across Canada.

What Coverages Should I get as a New Driver?

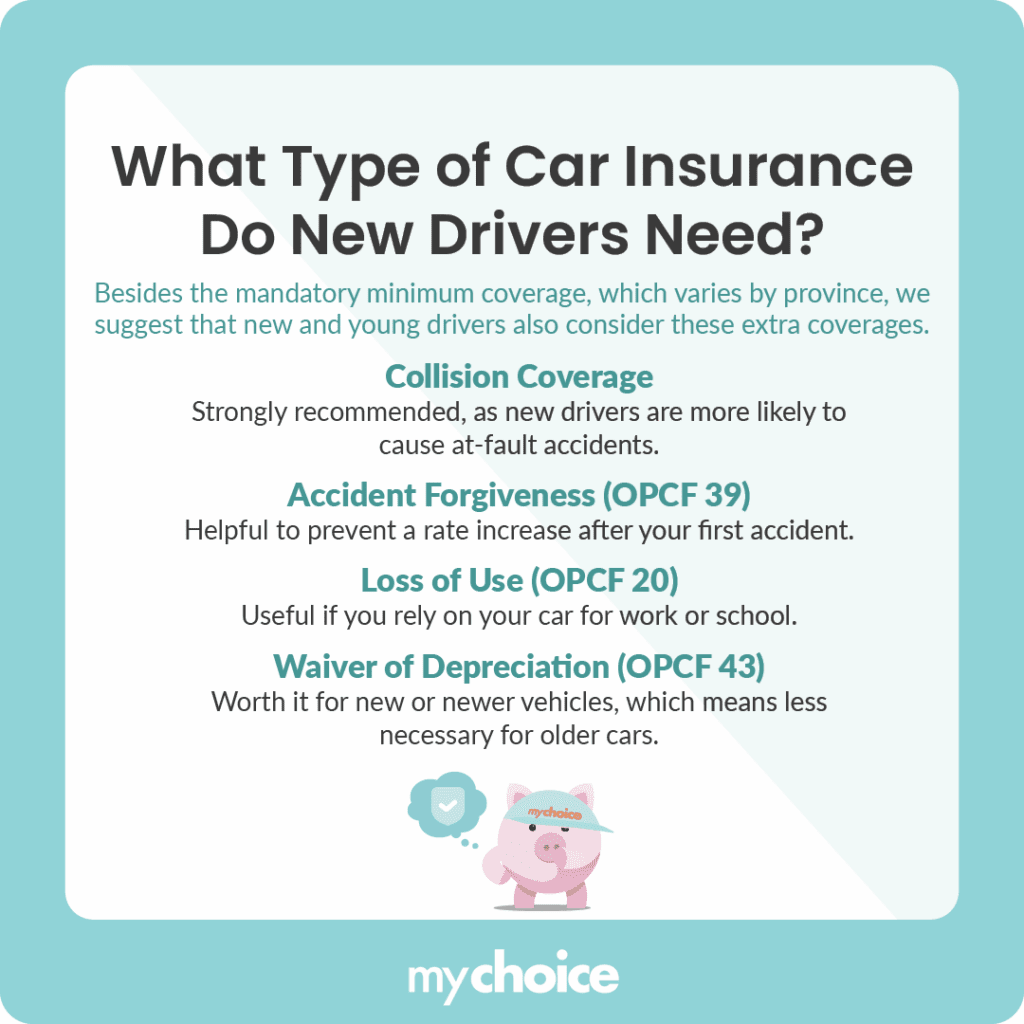

Besides the mandatory minimum coverage, which varies by province, we suggest that new and young drivers also consider these extra coverages.

How You Can Lower Your Rates

- Try to avoid making claims when you’re just starting out. An accident at 19 will raise your rates more than one at 39.

- Consider telematics or usage-based insurance. Safe driving can earn you discounts.

- Pick a practical car. Insurance costs are based on repair expenses and theft risk, not how exciting the car is to drive.

- If you can, stay listed as an occasional driver. This helps you build your driving history before you take on full responsibility.

- Shop around and compare insurance companies every year. Rates change as you get older, and being loyal doesn’t always help new drivers.

Which Insurance Company is Best for New & Young Drivers?

Based on our latest analysis, Belairdirect is a good choice for first-time insurance buyers who want a simple, fully online process. TD Insurance also has competitive rates for new drivers, especially if you qualify for group or affinity discounts.

Key Advice from MyChoice

- Review our car insurance tips for young drivers.

- Protect yourself from your first mistake with the right coverage.

- Choose a car that is cheaper to insure.

- Shop for new insurance quotes every year as you gain more driving experience.

- Use MyChoice to compare real offers and see how coverage choices affect your price.