Your car insurance rates are determined by how risky you are to insure. Therefore, you might feel the urge to present yourself as low-risk as possible when applying for car insurance to secure the lowest rates. However, some people take that as a reason to bend the truth on their car insurance applications, misrepresenting their risk profile to get lower rates.

Unfortunately, lying on your car insurance application won’t just put you at risk. You also risk affecting other drivers.

How Lies Affect the System and Honest Drivers

Lying on your insurance application doesn’t just affect you. It affects other drivers, including honest ones. Every invalid car insurance claim drives up the insurance company’s loss ratio. The loss ratio measures the amount of money the insurance company spends on paying out car accident claims compared to the money it earns from premiums.

When the insurance company spends more on claims payouts than what it earns from premiums, then the company is operating at a loss. To stay profitable, the insurance company offsets the loss by increasing its earnings, namely by increasing the premiums it charges.

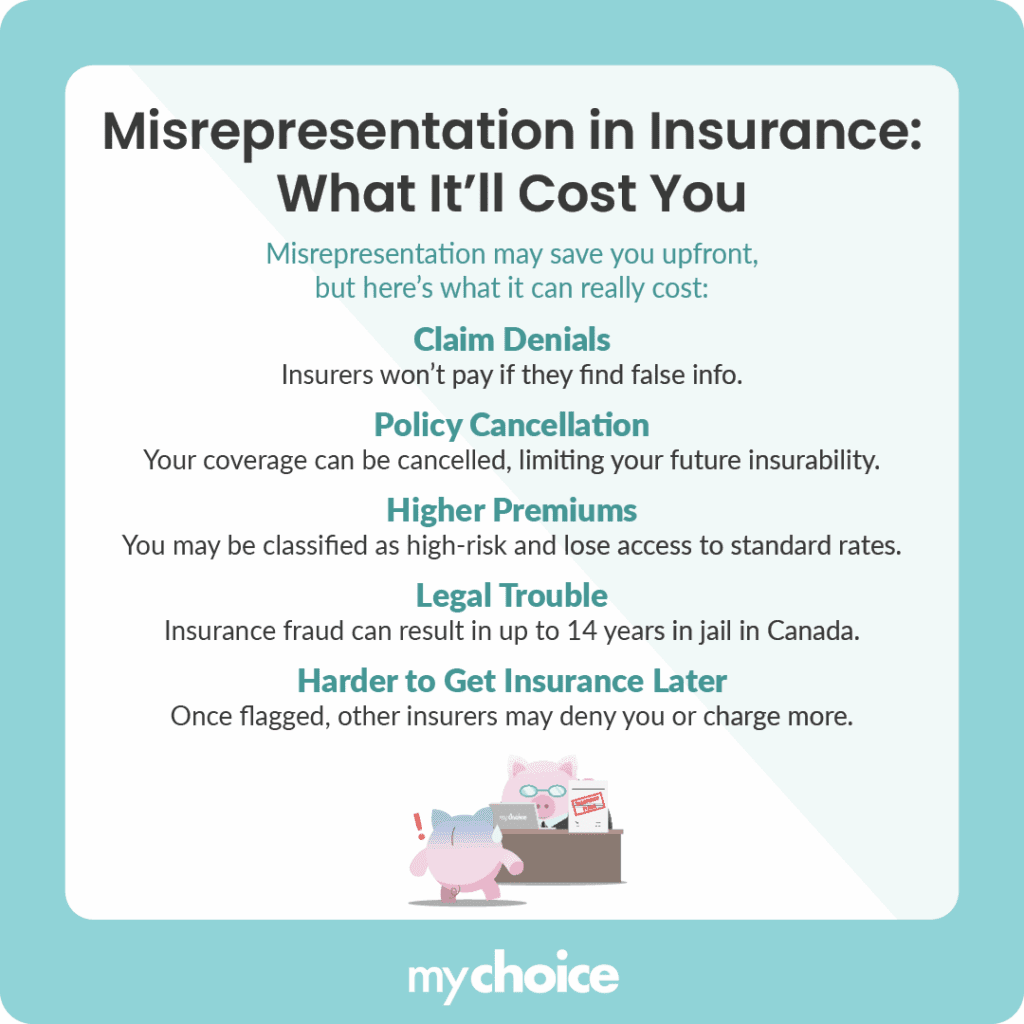

How Misrepresentation Will Cost You More in the Long Run

You may think that intentionally presenting yourself as a low-risk policyholder can result in reduced premiums, saving you money. However, that isn’t accurate because misrepresentation may cost you more. Let’s take a look at some ways misrepresentation may harm you down the line:

Most Common Misrepresentations on Insurance Applications

There are many things an irresponsible applicant can lie about or misrepresent on their application. Here are some of them:

- Number of miles driven

- Who drives their vehicle

- Past accidents and driving infractions

- Home address

Insurers can generally find out when you’re misrepresenting yourself on an insurance application and penalize you for these omissions or lies, so it’s best to always tell the truth.

How to Avoid Unintentional Misrepresentation

Sometimes, mistakes happen, and you can accidentally misrepresent yourself on your insurance application. Unintentional misrepresentation can happen by forgetting your first licence date, unintentionally neglecting to mention traffic tickets or accidents, or forgetting to pay a past insurance charge.

Generally, unintentional misrepresentation can be avoided by double-checking your information and making sure everything is in order before submitting your application.

Key Advice from MyChoice

- Insurance fraud can harm both the offender and other insurance customers because invalid claims affect the company’s loss ratio.

- Common misrepresentations on car insurance applications include past accidents and infractions, miles driven, and details about the car’s drivers.

- To avoid unintentional misrepresentation, it’s a good idea to double-check your information and ensure all information given is accurate before submitting.